Developing countries like Japan and the US have a higher potential of growth as compared to developed countries considering that the former have experienced historically low growth margins that are increasing, while the latter have already witnessed historically high margins, which are now on the decline. Companies in emerging markets can generate greater profits by returning to normal levels of productivity, even without any increase in revenue growth. This translates into earnings expectations that are rising faster for emerging market companies than those in developed markets, analyses Market Intelligence, Fibre2Fashion.

Brazil, Russia, India and China, or the BRIC countries as they are referred to as, are the top emerging countries by either nominal or PPP (purchasing power parity)-adjusted GDP (gross domestic product). The other emerging countries include Mexico, Saudi Arabia, Indonesia, South Korea and Turkey.

The potential for growth in emerging economies is greater than in developed countries. Margins in developed countries like Japan and the US have reached historic highs and are now declining, and are at average levels in Europe, while in emerging countries they are close to historic lows and increasing. Companies in emerging markets can generate greater profits by returning to normal levels of productivity, even without any increase in revenue growth. This translates into earnings expectations that are rising faster for emerging market companies, as compared to developed market companies.

Few favourable factors to invest in emerging markets:

Firmer Chinese growth

Product goldilocks

Growth gap returning

Profit growth in sight

A dovish fed

Brazil

The Brazilian real was very strong in 2016, mainly due to favourable external factors such as a weaker US dollar and higher commodity prices. The economy on the other hand, seemed to have rebounded off its lows. The manufacturing sector has recovered in the last year, but from very low levels. The inflation rate probably topped out at 10.5 per cent in early 2016 and since then has fallen to below 9 per cent, making it easier for the central bank to cut rates later in the last year. The country's economy has probably become more vulnerable to financial shocks as the current account deficit has decreased from 4.5 per cent in 2015, and currency reserves are equivalent to nearly two years of imports. In 2016, yearly currency average increased as compared to previous year.

Find comprehensive analysis & detailed reporting on related subjects here.

Indonesia

The economy is developing positively in Indonesia as compared with most other high-yield emerging countries. Despite this, the rupiah is sensitive to the dollar's appreciation. Still, it is financially less susceptible now, than in 2013 with currency assets covering about 10 months of imports and improved terms of trade. The economy bottomed out in 2015, and GDP grew to 5.2 per cent on a yearly basis in the second quarter. Growth is extensive with strong expansions in manufacturing. Investment has improved after a dip in 2015. Nowadays, Indonesia is essentially stronger than during the currency crises of 2013. The current account deficit has stabilised at around 2.1 per cent of the GDP, as compared with a deficit of about 3.5 per cent in 2013. The yearly average of currency slightly declined in 2016 when compared with 2015.

South Korea

The economic drive in South Korea was positive in the first half of 2016 with the GDP growing at 3.2 per cent in annual terms. Industrial production recovered later in 2016 after a slide to the start of the year. There are some doubts about the strength of the recovery, and growth appears to be slowing and short-term interest rates are very low in comparison with other emerging countries. Inflation has been very low in 2016 and rose only 0.5 per cent versus 2015. The export market growth has been observed negative since 2015 and would benefit from a weaker won. Credit growth has risen in 2016 from an annualised rate of 9 per cent to 13 per cent. Property prices rose only about 2 per cent at an annualised rate. On the other hand, retail activity is stronger and new car sales have been the highest in 10 years. South Korean won improved in 2016 as compared to last year.

Ethiopia

The Ethiopian economy has witnessed a strong growth over the past decade, averaging 11 per cent per year from 2003-04 to 2014-15 compared to the regional average of 5.4 per cent. The country has failed to match the double-digit growth in 2016 due to a drought that affected the harvest in most parts of the country, and the ongoing socio-political conflict. Expansion of the services and agricultural sectors contributed to most of this growth, while the manufacturing sector witnessed a modest performance. Economic growth in the country led to a reduction in poverty in both urban and rural areas. About 55 per cent of Ethiopians lived in poverty in 2000, which reduced to 35 per cent in 2016. The government pursues to reach middle income status over the next decade and has estimated 7 per cent economic growth in 2017. In 2016, the average Ethiopian birr increased over 2015.

Find comprehensive analysis & detailed reporting on related subjects here.

Myanmar

Myanmar, one of the largest countries in mainland Southeast Asia, has a low population density along with fertile lands, potential to increase production, yields and profits in agriculture, as well as abundant natural resources. The country witnessed an economic growth of 7 per cent in 2016 due to a supply shock from heavy flooding, a challenging external environment and a slowdown in new investment flows. Medium term growth is likely to average 8.2 per cent per year. The yearly average of currency increased sharply in 2016 when compared with the previous year.

Cambodia

After more than two decades of strong economic growth, Cambodia has achieved lower-middle income status as of 2016. The garment sector, construction, and services have been the main drivers of the economy. Poverty continues to fall in Cambodia, although more slowly than in the past. Growth is expected to remain strong in the future as improving internal demand and dynamic garment exports slow growth in agriculture and facilitate construction and tourism activity. In 2016, an average of currency remained almost same as compared to 2015.

Find comprehensive analysis & detailed reporting on related subjects here.

Vietnam

Since 1990, Vietnam's GDP per capita growth has been among the fastest in the world, averaging 6.4 per cent annually. Vietnam's economic activity moderated in the first half of 2016, with GDP expanding by 5.5 per cent, compared to 6.6 per cent over the same period in 2015. This slowdown is considered a result of severe drought affecting agricultural production and slower industrial growth. In 2016, the yearly average of currency improved as compared to the last year.

Bangladesh

In the past decade, the economy has grown nearly 6 per cent annually. More than 15 million Bangladeshis have moved out of poverty since 1992. The government aspires to be a middle-income country by 2020. The yearly average of Bangladeshi taka increased in 2016 as compared to 2015.

Find comprehensive analysis & detailed reporting on related subjects here.

Thailand

Thailand received the status of an upper-middle income economy in 2011. In the last four decades, Thailand has made a considerable progress in economic and social development, becoming an upper-income economy, from a low-income country. Thailand's economy grew at an annual rate of 5 per cent on an average following the Asian crises during 1995-2005, creating millions of jobs, which pulled millions of people out of poverty. Poverty declined to 12 per cent in 2016 during the period of high growth and rising agricultural prices. However, GDP grew by less than 2 per cent annually in 2014 and 2015. Economic growth of 2.5 per cent to 3.5 per cent has been projected for 2017-18. In 2016, the yearly average of currency in Thailand improved as compared to the previous year.

Sri Lanka

Sri Lanka is a lower middle-income country, whose economy grew at an average of 6.5 per cent between 2010 and 2015. A strong growth in the economy in the last 10 years has led to a decline in poverty and improved shared prosperity. Its growth in the last five years was substantial, thanks to a 'Peace Dividend'. The country's government aspires to become a higher middle-income country by 2020. In 2016, the yearly average of currency increased sharply by 7 per cent when compared to 2015.

Find comprehensive analysis & detailed reporting on related subjects here.

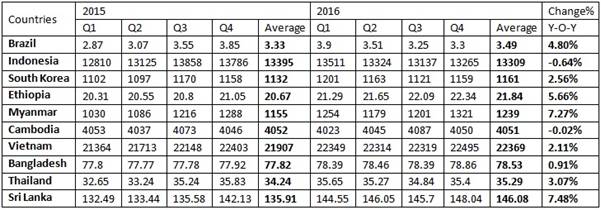

Table 1: Emerging Market Currencies per 1 US Dollar

As shown in Table 1, Sri Lanka showed the maximum growth in 2016 followed by Myanmar, Ethiopia and Brazil. Indonesia is the only country observing a negative growth of 0.64 per cent. Cambodia has shown steady growth in 2016 as compared to 2015. Thailand, South Korea and Vietnam are the largest emerging countries. Emerging countries' stocks were among the outperformers in 2016. There was a false failure early in 2016 followed by a strong bounce later. One of the most significant drivers of emerging markets stocks is the US dollar. For 2017, emerging markets stocks depend on what the dollar does at current price levels.

Find comprehensive analysis & detailed reporting on related subjects here.

Comments