Consulting firm Wazir Advisors hasconducted a detailed study on the impact on selling price and taxes paid to thegovernment before and after GST. Sumit Parmar of Wazir looks at the completetextile value chain and finds that GST has failed to resolve the issue ofdifferential duty structure in the industry as well as the issue of fibreneutrality.

The Goods & Services Tax (GST)rolled out on July 1, 2017 heralding a new era of economic reforms in thecountry. GST subsumed all the central as well as state taxes, and brought thecountry under one single regime, thus replacing the complex multiple indirecttax structure. This reform is intended to transform India into a single marketfor manufacturing and selling of goods, bring in greater tax compliance and efficientresource allocation which in turn will help in improving manufacturingproductivity.

GST has now replaced central taxesand duties such as excise duty, service tax, counter vailing duty (CVD),special additional duty of customs (SAD), central charges and cesses and localstate taxes, i.e., value added tax (VAT), central sales tax (CST), octroi,entry tax, purchase tax, luxury tax, state cesses and surcharges andentertainment tax (other than the tax levied by the local bodies). GST is adestination-based tax structure, and it is levied only at the consumptionpoint. Under this structure, a merchant has to pay tax only on the valueaddition of its product and allows manufacturers and retailers to reclaim inputtax credit paid during the purchase of raw material, thus setting off theindirect tax. This feature eliminates the cascading effect of taxes which usedto trickle down to the end consumers. The GST council has approved five baserates i.e. 0 per cent, 5 per cent, 12 per cent, 18 per cent and 28 per cent ondifferent goods and services.

GST andthe textiles industry

Under the new GST regime, textilecommodities will fall under the 0-18 per cent tax cloud. Table 1 illustratesthe change in the tax structure at different segments in the textiles industry.

Table 1:Tax Structure in Textile Value Chain

On comparison between the two dutystructures, the cotton value chain which was exempt of any excise duty(exclusive of VAT/CST) will now have to pay a minimum of 5 per cent duty acrossdifferent segments. While in case of MMF value chain, which was earlier paying12.5 per cent excise duty on fibre and yarn level (exclusive of VAT/CST) willnow pay now pay 18 per cent GST for the same. This indicates that the textilesindustry will be paying higher taxes overall.

The textiles industry faces a

unique issue in the presence of a differential duty structure both in different

fibre value chains and within specific value chains too. This situation was

prevalent in the earlier tax regime and is still relevant for the new GST

regime. The result of such a structure is the accumulation of duty at a certain

point in the value chain wherein the duty paid on the input is higher while the

duty on the output is comparatively lower. This accumulated duty is embedded in

the cost of the final product by the seller as he/she is unable to set off the

input duty which in turn leads to higher prices.

Now, with the onset of higher

duties, the quantum of duty accumulation will increase which will lead to

further increase of prices. To analyse these implications, four basic value

chains have been considered which encompasses the majority of textiles

production in India:

a) 100 per cent cotton value

chain;

b) MMF rich blended value chain -

PC (65/35);

c) Cotton rich blended value chain

- PC (48/52);

d) 100 per cent MMF value chain -

PV (50/50).

Implications

on 100 per cent cotton value chain

Cotton textile value chain

attracts a singular rate of 5 per cent across the value chain except on cotton

garments with retail value of more than? 1,000 per piece. Due to a constant

duty rate being charged on subsequent products (with higher value addition)

across the value chain, there will be no duty accumulation. At each stage of

this chain, manufacturer will be able to avail input credit on the purchase of

raw material and will only pay duty for the value addition.

Due to the balanced tax structure,

prices of intermediate products (i.e. fibre, yarn and fabric) are not expected

to increase. However, on the retail end of the chain, prices of cotton garments

(value more than ? 1,000) will rise due to higher duty paid by the retailer.

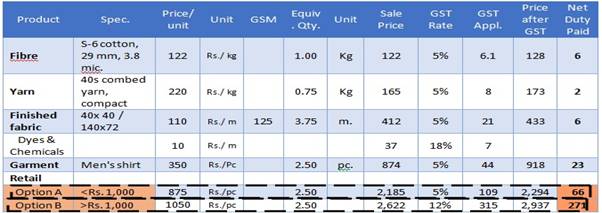

Table 2:

Scenario for 100% Cotton Value Chain

Table 2 represents duty flow in a

100 per cent cotton value chain, taking 1kg of cotton fibre and further converting

it into subsequent products. At retail level, retailers keeping price points above?

1,000 per garment will have to pay approximately 4 times higher net duty to

government as compared to garments sold at price points below? 1,000.

This will lead to the following

two scenarios:

a) Dip in prices of low cost

garments below? 1,000 per garment so that they are subjected to 5 per cent

rate;

b) Increase in prices of high cost

garments above? 1,000 per garment as they will attract significantly higher

duty rate of 12 per cent.

Implications

on MMF rich blended value chain

This situation is particularly

complex for 100 per cent MMF and MMF blended value chain as there is

significant variation in the tax rates at fibres/yarn (18 per cent) and fabric

level (5 per cent). This duty differential will create a higher tax incidence

on fibre and yarn level than on the successive value chain segment i.e. fabric

which will lead to duty accumulation at the weaving stage.

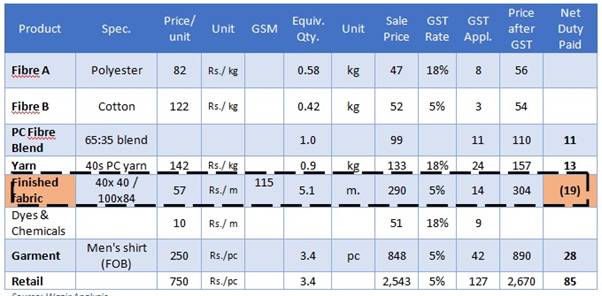

Table 3:

Scenario for MMF Rich Blended Value Chain

Table 3 represents duty flow in

polyester cotton (65/35). The applicable duty at finished fabric level is

smaller than the cumulative duty paid on the input raw materials i.e. fibre and

yarn, resulting in a net negative duty. This means that weaver will not be able

to reclaim full input credit on purchase of yarn, and hence the weaver will

increase the price of fabric in order to mitigate the loss. This increase in

fabric prices will further reflect in the increased prices of MMF blended

garments.

Implications

on cotton rich blended value chain

The duty structure under this

chain will be such that duty accumulation will occur at both yarn and fabric

stage. As mentioned earlier, a cotton rich value chain will attract 5 per cent

duty rates at all levels (i.e. fibre, yarn, fabric, etc). However, due to

addition of MMF at the fibre stage, the net duty at that level will become

greater than at the subsequent yarn stage which will trickle down to fabric as

well.

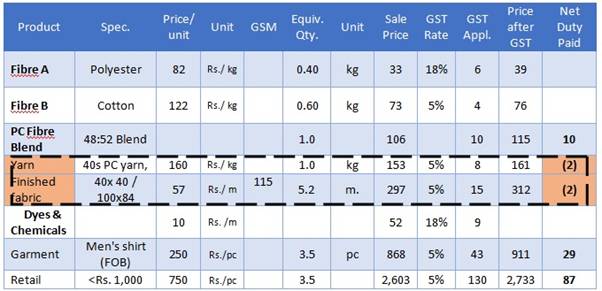

Table 4:

Scenario for Cotton Rich Blended Value Chain

This situation will result in

blended yarn manufacturers keeping the MMF component on the higher side in the

blend composition as compared to the cotton component in order to avoid duty

accumulation at this stage. This might also result in an increase in both yarn

and fabric prices to offset the accumulated duty loss.

Implications

on 100 per cent MMF value chain

A 100 per cent MMF value chain

will face the implication as that of MMF rich value chain, wherein there will

be a duty accumulation at the fabric stage.

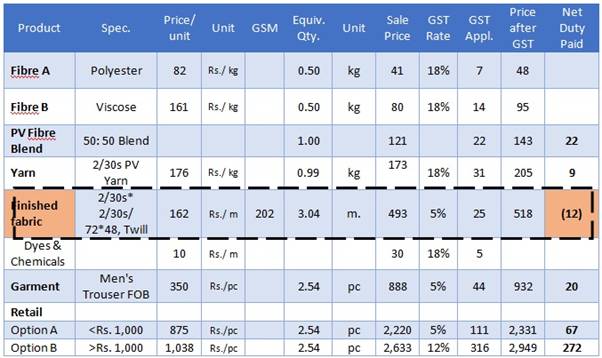

Table 5:

Scenario for 100% MMF Value Chain

To set off the higher duty paid on

raw material i.e. yarn, weavers will increase the prices of fabric which will

further result in increased garment prices.

Conclusion

As per its defined objectives, GST

will have a positive influence on the textiles industry in terms of eliminating

distortions in the tax system, reducing compliance for industry, facilitation

of input tax credit etc. However, GST has failed to resolve the issue of

differential duty structure in the industry as well as the issue of fibre

neutrality. Duty accumulation was an issue for the MMF industry earlier also,

however, with the increase in the duty rates, it will become more prominent and

it will lead to a likely increase in the prices of finished goods.

About

author:

Sumit Parmar is a research associate at Wasir Advisors. He has completed his BTech in textile technology from Technological Institute of Textile & Science, Bhiwani in Haryana.

Comments