The new Garment & Apparel Policy 2017 of the Gujarat government willenhance cost-competitiveness as well as ease of doing business in the state,say Varun Vaid and Disha Acharya

The Gujarat government hasannounced its new Garment & Apparel Policy 2017. The policy aims atcreating one lakh new jobs, generating an additional Rs3,000 crore of exports,and attracting Rs1,600 crore of investment in the apparel sector over the nextfive years. The fiscal and non-fiscal support announced under this policy are aimedat enhancing the cost-competitiveness as well as ease of doing business throughapparel manufacturing units in the state.

Gujarat has the presence of theentire textiles and apparel (T&A) value chain, starting from availabilityof raw material, yarn production, fabric production, up to apparel and made-upsmanufacturing units. Gujarat contributes to 27 per cent to India's cotton fibreproduction (1,600 million kg), and in case of manmade fibre production, thestate's share is nearly 50 per cent. Almost 30 per cent of India's mill sectorproduction of fabric (640 million sq m) comes from Gujarat. The state has 14sanctioned textile parks, which is second highest in number among all thestates.

It also has the highest number ofmedium and large textile processing houses and is home to more than 50 per centof India's processing machinery manufacturers and 90 per cent of weavingmachinery manufacturers. Moreover, it contributes around 25 per cent to thecountry's technical textiles output. The T&A exports from the state accountfor around 12 per cent of total T&A exports from India. Gujarat has a hugeinstalled capacity for T&A production with Rajkot, Ahmedabad, Navsari andVapi as major spinning clusters and Anjar, Ahmedabad, Surat, Vapi and Mehsanabeing major weaving clusters. Due to these key strengths, Gujarat is home toleading textile sector companies such as Arvind Mills, Welspun, AlokIndustries, Raymond, Mafatlal, Aditya Birla Nuvo, among others.

Table 1: Installed Capacities in Gujarat Textile Sector

Source: Office of TextileCommissioner

The Gujarat government hadlaunched its textile policy in 2012 to promote investment and employment in theT&A sector which offered investment incentives such as interest subsidy,power subsidy, stamp duty exemption, support for establishing textile parks,building skill development centre, etc. It helped attract significantinvestments worth Rs20,000 crore into the state and created 2.5 million jobs,mainly in the segments of ginning & pressing, yarn manufacturing, fewtechnical textile categories, training centres and textile parks. In order toprovide a further thrust to the sector and attract investment in the downstreamvalue chain, the state government has now identified apparel manufacturing asthe engine for growth and released a dedicated incentive package under Garment& Apparel Policy 2017.

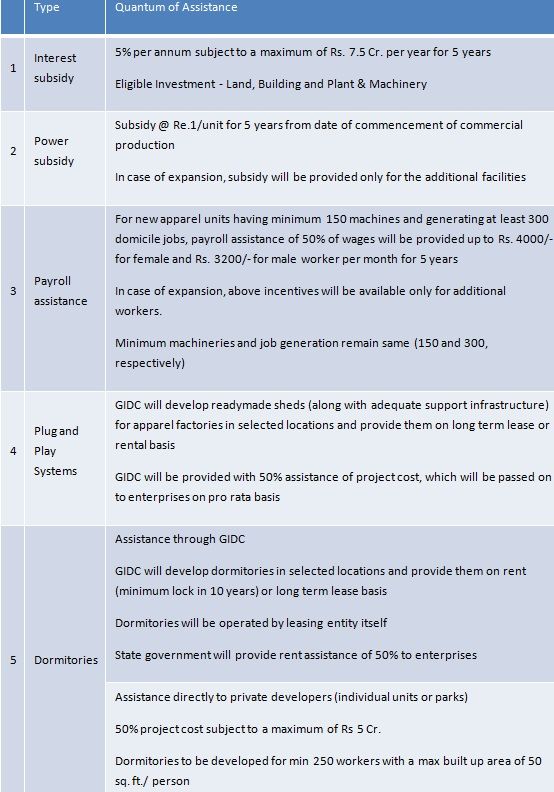

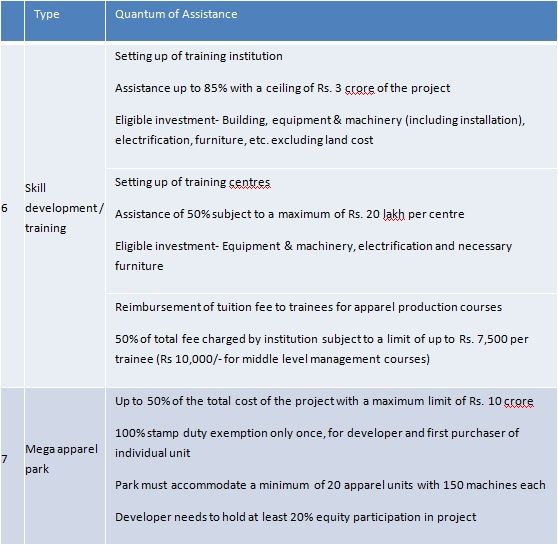

The key

highlights of the new policy are as under:

Out of the various incentives provided, there are three major attractions for apparel investors:

Payroll assistance: Current wages in apparel factories are in the range of Rs10,000-12,000 per month and wage contributes to about 30-35 per cent of cost of apparel manufacturing. The wage subsidy of Rs.4,000 per month (Rs3,200 for males) provided in this policy will have direct and positive impact on the cost-competitiveness of apparel manufacturers in the state.

Plug and play systems: The government has gone a step forward by providing infrastructure support to the industry which is first of its kind incentive in the country. The government will provide compliant and good, standard ready-to-move-in sheds to manufacturers at reasonable costs. Such incentivised readymade set-ups will reduce the cost of establishment and help investors come up with bigger units.

Assistance for dormitory construction: Though there is a huge availability of manpower in the state, retaining the workforce in the apparel sector is one of the key challenges that the industry is facing today. Availability of dormitories near factories will not only address this challenge, but also provide compliant and hygienic habitats to the workers.

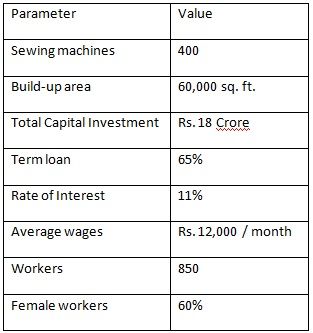

How much does one get under the policy? To understand the fiscal incentives available for establishing an apparel manufacturing unit under this policy, let us examine an illustrative project:

Based on industry ball park

figures and calculations, the yearly incentives work out as follows:

This means that over the five-year

period, the incentive made available will exceed the total capital investment.

If we consider the NPV value of incentives, at a discounting rate of 11 per

cent, they work to be almost 80 per cent of the total capital investment. An

extremely attractive proposition!

Payroll assistance is a major

fiscal support for apparel companies as wages have a major share in the cost of

manufacturing. In India, there is precedence of payroll assistance being

provided by few other states to the T&A sector. However, the infrastructure

support being provided by Gujarat in the form of readymade sheds and dormitories

is first of its kind. China had adopted this model in late 1980s when it was in

its initial phase of industrialisation. It established large industrial zones

which provided all types of support infrastructure to investors. Today,

Ethiopia is doing the same by providing such facilities in its industrial

parks. Gujarat has taken the lead in India to establish such infrastructure and

significantly reduce the associated risk for investors. By providing this

infrastructure support, the government of Gujarat has created a possibility for

investors to set up operations in expensive zones (with better connectivity,

manpower availability, etc) without creating their own infrastructure. This

also reduces the associated financial risks, which can actually enable investors

to plan much larger projects.

The new Garment & Apparel

Policy, with its multifold fiscal and non-fiscal incentives, is expected to

significantly enhance the attractiveness of Gujarat as an apparel manufacturing

destination. The key will be the timely implementation of infrastructural

support in line with the industry requirement, which needs to be the focus of

the state government.

Varun Vaid is Associate Director with Wazir Advisors, where Disha Acharya is a consultant.

Comments