The Indian domestic intimatewear market is sizeable, and its potential is reckoned to be enormous. The prospects of exports too are substantial-a Fibre2Fashion report anchored by Subir Ghosh, with base inputs from Sanjay Arora, Anubha Sehgal and Barnaa Dekaa.

Those were once perceived as only functional elementary necessities that no one needed to talk about or give second thoughts to. But today, they are used to assert style statements. That's how much the sheer concept of intimatewear itself has changed. These days, the term 'intimatewear' connotes one of those handful of product ranges that are both a necessity and luxury. The once-traditional intimatewear market that was underlined by abysmal production quality and desultory promotions is now seeing experimentation of untold scale in terms of product design, style, colours, fabrics and what-have-you. The insipid, anaemic market of yesterday is now bustling with life. Some indicators: ad spends by intimatewear brands have grown exponentially; there are fashion weeks dedicated specifically to intimatewear, and the intimatewear market is expanding at a stunning rate.

Innumerable international brands have hurtled into the segment, rightly fathoming its immense potential in the Indian scenario. Intimatewear is now a talking point; intimatewear is something that an Indian cannot do without. The market needs to talk about it too-it can't be all hush hush anymore.

Intimate goes Indian

Intimatewear is an integral segment of apparel manufacturing; it also lies at the core of any individual's set of garment requirements. Even conservative estimates put the share of intimatewear in the average consumer's garment expenditure to be as much as ten per cent. Although-globally speaking-intimatewear manufacturing is consistently scaling new heights, Indian intimatewear manufacturing is arguably still in a nascent stage. India is a long way off from realising its-well-potential.

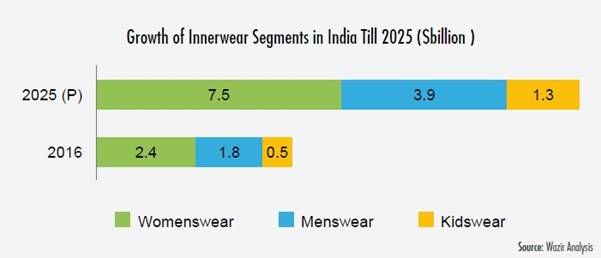

The current state of affairs is not a State secret-the Indian Intimatewear market has been growing rapidly over the last few years. The current market size is estimated to be $4.8 billion, which marks an 11 per cent increase over 2014; and, the share of intimatewear is roughly 8 per cent of the total domestic apparel market. The segment is expected to grow at a healthy pace in the coming years-by 2025, the market will be worth a whopping $13 billion.

Very broadly speaking-in terms of product segmentation at least, intimatewear in India can be safely categorised into three major segments: women's innerwear, men's innerwear and kids' innerwear. The market is dominated and also being driven by women's innerwear which holds sways over 50 per cent of the landscape. The value of women's innerwear alone is estimated to be around $2.4 billion. Men's innerwear accounts for 38 per cent with an estimated market value of $1.8 billion, and the kids' constituent is surprisingly low in terms of value ($0.5 billion). The women's innerwear component is the fastest-growing among the three and is expected to wrap up 60 per cent of the market share by 2025.

Hela manufactures for an array of brands and retailers. Its top brands / groups are PVH (Calvin Klein, Warner's, Tommy Hilfiger and Izod), Michael Kors and MGF group of brands; for casualwear arm VF Corporation, Tesco, Marks & Spencer; and Speedo in sportswear. Paranamana continues, "Five out of the nine factories we have in Sri Lanka have been awarded Gold WRAP certification, and we are currently the only PVH Green-rated plant in Africa, which speaks for itself in terms of where Hela places its benchmark for quality. In terms of design, since we manufacture end-to-end designs, we always follow a customer-price architecture which is designed to suit the demand for fashion products, which in turn allows the customer to market the product at the right price."

He also outlines something that Indian manufacturers would want to take note of, "Most brands turn to Sri Lanka for innerwear due to the high standard in quality and end-to-end solutions. All leading manufacturers in Sri Lanka boast of very high standards in compliance for their factories as well as employees. This has become part of the overall country's offering. Hela Clothing, like most leaders in the industry, provides more than just manufacturing solutions for brands. An end-to-end approach for design & innovation is a key offering that differentiates us from Asian counterparts."

That's how Sri Lanka has gone on to becoming one of the biggest players in the global intimatewear market, and possibly why Amant too is one of the biggest players on Indian turf.

Lingering On

Despite the continual growth and the potential growth factor, intimatewear for inexplicable reasons remains under the cover. Perhaps some taboo, some of that introverted veneer still remain. Till, hopefully, those are ripped to shreds by that ever-burgeoning market.

In terms of manufacturing too, the market can be broken down into three, but not along the same lines.

The first are the indigenous small-scale manufacturers. For long, most of the Indian intimatewear manufacturing has been taking place in the ubiquitous small-scale industry (SSI) units across the country and catering primarily to local market requirements. These units are typically proprietary firms, with an average size per unit not exceeding 15-20 machines, and churning out simple, inexpensive products.

Next come the indigenous large-scale manufacturers without foreign tie-ups or collaborations. In fact, a number of such manufacturers have been remarkably successful in their own right. They make products using different types of raw materials, and notable players include Groversons, Rupa, Amul, Lux, Bodycare, TT, Maxwell Industries, Pratibha Syntex, Juliet Apparel and Sonari Lingerie.

Then, there are the large-scale manufacturers with their respective foreign tie-ups / collaborations. Quite a few Indian companies in recent years have entered into the manufacturing, marketing or brand licensing tie-ups with international players with a focus on both domestic and export markets. Examples of this category include Page Industries, which has a brand licensing arrangement with Jockey (US).

Fast-changing society

The innerwear market is being driven by a few key factors or trends. All spell good news for the current manufacturers of innerwear in the country and also for those wanting to enter the market.

At the heart lies the demographics factor. India is seeing rapid growth in its urban population not only in the big cities, but in smaller towns and cities too. While on the one hand people are shifting base to cities and metros for better livelihood opportunities, on the other the rural population too is becoming infused with urban patterns and cultures through-what is referred to as-r-urbanisation. Besides, demographics of the country are changing just as swiftly with an increase in the working age population, better male-female ratios, increasing female literacy rates, and narrowing birth and death rates.

This triggers growth elsewhere, and therefore the booming growth of the innerwear segment is rooted in fast-changing consumer profiles. New-age consumers are well-educated, fashion and quality conscious, and also well-dressed with that better spending capacity owing to higher disposable incomes-combined with a sense of clarity over needs and wants. The most dynamic of the demographic segments is the aspirational working class who today have the money that they are willing to splurge on intimatewear. Being associated with distinguished brand names and that innate need for a sense of belonging to the upper segments of the society is shaping the average consumer's need for such apparel items. Moreover, the average customer has also been equally aware of the functional properties of good quality innerwear for support and protection of the body.

This triggers growth elsewhere, and therefore the booming growth of the innerwear segment is rooted in fast-changing consumer profiles. New-age consumers are well-educated, fashion and quality conscious, and also well-dressed with that better spending capacity owing to higher disposable incomes-combined with a sense of clarity over needs and wants. The most dynamic of the demographic segments is the aspirational working class who today have the money that they are willing to splurge on intimatewear. Being associated with distinguished brand names and that innate need for a sense of belonging to the upper segments of the society is shaping the average consumer's need for such apparel items. Moreover, the average customer has also been equally aware of the functional properties of good quality innerwear for support and protection of the body.

Karan Behal, founder and chief executive of top-selling brand PrettySecrets, points out, "Over the past decade, the average woman in India has gained exposure from social media, the ways of the West and similar sources. This has led innerwear and intimatewear to no longer remaining a hush-hush discussion, but rather one wherein women openly have a say in their choices and preferences. Women no longer accept lingerie as casual innerwear-they make time to try, select and make the purchase. Innerwear and intimatewear are now seen as fashion accessories instead as necessities.

"For example, women make calculated purchases of innerwear with an event, activity or occasion in mind. This has been driven by the media, product innovations within the industry and an increased awareness of fashion orientation and health trends. The sector has also witnessed a rise in the number of working women, a rise in disposable incomes, and a thriving youth population. Bringing together these factors, the innerwear / intimatewear sector has experienced drastic changes over the past decade and is poised to experience unprecedented growth."

At the same time, the population of working women-especially in the urban agglomerations- has grown tremendously in the last few years. The tastes and styles of working women are ever evolving coupled with the freedom and luxury to spend more. The lingerie basket of women has graduated from hopelessly-mismatched bras and panties to impeccably matching sets, bikinis, swimwear, shapewear, sportswear, loungewear and nightwear. The lines between athleisure and casual sportswear has been blurring with the growing popularity of sports bras, while crop tops have been turning into forms of outerwear. In a similar fashion, the men's innerwear hamper too is expanding. Men are better-groomed than earlier and take special care in choosing the right products for their needs.

The natural outcome of these inter-related socio-economic factors is that retail gets the chance to first grow, and then boom. Retailing is one of the most important sectors of the economy, contributing 20 per cent to the gross domestic product (GDP) of the country. The Indian retail market is among the top five in the world and is expected to touch $2 trillion by 2025. The Union government's decision to allow 100 per cent foreign direct investment (FDI) in single-brand retail has been a much-needed boost for the sector with several international players rushing headlong into the beguiling Indian market. Apart from the conventional brick-and-mortar retail, the clickand- mortar retail more commonly known as online retail, or e-tail, is also on a high-growth trajectory courtesy the ongoing digital revolution in the country. India is expected to become the fastest growing e-commerce market in the world with robust investment being its backbone. And, intimatewear will be a key component.

Emerging Categories

Indian consumers are becoming increasingly aware of ensembles that they want to buy for any specific occasion or a particular purpose. This has led to an increase in demand for special categories such as shapewear, sleepwear, swimwear and athleisure. Among these, sleepwear has already seen unprecedented growth in both branded and unbranded segments. However, other categories such as shapewear and swimwear still present a lot of possibilities. Herein, there are three promising categories.

Sleepwear:

The demand for sleepwear is continuously expanding with sleepwear emerging as an essential clothing item and a fashion statement. Organised players have entered the segment over the last few years with heavy investments in R&D seeking to augment their respective product ranges and have since then come up with either new or better functionalities altogether. Trendy sleepwear is now a mix of t-shirts, shorts, capris, pajamas and nightgowns along with the conventional kurta-pajamas. Fabrics used for sleepwear are mainly of the cotton-blended type (usually with prints). Still enough, a large part of the segment remains unorganised, which can be tapped into by manufacturers and brands.

Loungewear: Loungewear now is nightwear which can be easily converted into multi-purpose daywear. For example, taking a morning walk in glam pajamas or wearing chic yet comfortable capris / shorts and tee for a run. There is unexploited and unexplored potential in this segment due to the sheer multi-functionality of products. This in turn provides an opportunity to manufacturers to experiment with fabrics, prints and designs. Growth in man-made fibres such as modal is also a contributing factor to the growth of loungewear. Global brands such as GAP, Marks & Spencers and Calvin Klein have already made headway into this category.

Loungewear: Loungewear now is nightwear which can be easily converted into multi-purpose daywear. For example, taking a morning walk in glam pajamas or wearing chic yet comfortable capris / shorts and tee for a run. There is unexploited and unexplored potential in this segment due to the sheer multi-functionality of products. This in turn provides an opportunity to manufacturers to experiment with fabrics, prints and designs. Growth in man-made fibres such as modal is also a contributing factor to the growth of loungewear. Global brands such as GAP, Marks & Spencers and Calvin Klein have already made headway into this category.

Thermals: Another booming category is that of thermals, with many domestic and international brands already diversifying into this hitherto-ignored bracket. Some of the key players in thermals are Monte Carlo, Jockey, Rupa, Hanes and Dixcy. Van Heusen and other premium brands have also launched thermals and men's innerwear, and are actively promoting it on digital and in print media. Small players too exist, but only cater to local area requirements. Sleepwear could well turn out to be the jack in the box. That's certainly what the founder of PrettySecrets indicates, "We are currently experiencing enormous growth in the sleepwear segment. Our sleepwear collection is unique compared to any other product in the market. Our collection consists of distinctive prints that are fun and quirky. These are developed in-house by a highly experienced design team. We offer the widest catalogue of sleepwear in the market; our products are available at affordable price points and are value for money. We also offer products for all sizes, XS to XXL."

Next to skin

The very essence of intimatewear has been changing, particularly over the last two decades. Even in the late 1990s, an overwhelming 90 per cent of innerwear would be made from 100 per cent cotton-woven non-stretch fabrics. The market was highly fragmented and dominated by relatively inconsequential brands from the unorganised sector. Countless multibrand outlets dotted the rugged innerwear terrain till even the late 1990s. And then came the influx of premium international brands, and growth of their indigenous cousins. The inevitable shift in fabrics too started early this century, and in the first five years itself the mix was almost equal: between innerwear made from cotton-woven non-stretch fabrics and those produced from cotton-knit fabrics. At the end of the first decade, the mix was approximately this: 10 per cent made from 100 per cent cotton-woven fabrics, 50 per cent from 100 per cent cotton-knit fabrics, and the rest from polyester or cotton-mix fabrics.

In short, cotton has been losing its status as the fabric of choice among consumers, and that has been directly reflected in the product mix of both brands and unorganised small players. Over time, there was an increasing proclivity towards spandex, and then lycra brought in that stretch element that subsequently reshaped the market altogether. The perfect fit became 'in', and additional features were being talked about: from anti-odour and anti-sweat properties to anti-microbial elements. It was no more a question of that functional, basic garment anymore- innerwear needed its own features.

The plethora of new fibres that hit the market had its cascading effect on intimatewear as well. To name just a few: DuPont Sorona, Lenzing Modal, Lycra, Inviya, Freshsil, Birla Cellulose and Creora. But all this happened towards the higher end of the market mix. Down below, small-time manufacturers stuck to the basic cotton-oriented fabrics- some by design, others by default. The market therefore remained varied and polarised, with one end of the spectrum swathed in the new and exciting, and the other unceremoniously bereft of either invention or innovation.

But what's past, is past for sure. It's the set of trends of the future that one will henceforth need to keep in mind. As Behal, who has been keeping a close eye on trends and changing consumer behaviour, indicates, "Consumer preference will shift towards practical choices in innerwear and companies will cater to functional requirements. The majority Indian female body type is one with a heavy bust; they require high-support full-coverage bras. Full-coverage bras will not only remain simple and functional, but also come in several style options and trim additions. Similarly, plunge bras that are bought for deeper necklines are currently among the (hot) trends in the market.

"Owing to the trend that suggests consumers take notice of the colour palette in their wardrobe while shopping for lingerie, more women seek to match their lingerie sets. Even as per different skin tones, we have added three different nude shades to cater to these specific needs. Likewise, we added neon colours to the PrettySecrets 2017 collection when neon outerwear was hitting the market."

The inclination towards certain fabrics too is bound to set in, sooner than later. Behal underlines, "Preference for natural fabrics will see a rise as consumers become increasingly conscious about their purchases. Bamboo-based fibres such as modal viscose will gain popularity. Our Breathe collection consists of all natural 100 per cent cotton bras and we keep adding more options in solids and prints. Our Super Soft Essentials in modal are an all-time favourite among our customers. Natural fibres are super-absorbent and perfect for Indian weather, and hence it will work well in the market."

The inclination towards certain fabrics too is bound to set in, sooner than later. Behal underlines, "Preference for natural fabrics will see a rise as consumers become increasingly conscious about their purchases. Bamboo-based fibres such as modal viscose will gain popularity. Our Breathe collection consists of all natural 100 per cent cotton bras and we keep adding more options in solids and prints. Our Super Soft Essentials in modal are an all-time favourite among our customers. Natural fibres are super-absorbent and perfect for Indian weather, and hence it will work well in the market."

Key Challenges

Yes, the market is booming, and the potential is phenomenal. But that doesn't mean that there are no hitches or drawbacks. In fact, there are one too many. A snapshot:

-

Lack of economies of scale;

-

Lack of skilled manpower;

-

Lack of sophistication to manufacture high-end women's intimatewear;

-

Unavailability of quality inputs within the country;

-

Intense competition and low margins in economy to mid-segment;

-

Lack of professional fashion and design schools that impart training specifically in intimatewear;

-

Lack of R&D focus unlike countries such as Sri Lanka.

There's, of course, a context here. The intimatewear demand is moving from plain cotton white sets to designers sets with advanced fabrics. Product development in terms of design is also gaining ground with products like weighted vests, biker vests, and cowboy vests becoming popular among customers. As a spin-off, the focus on product development and innovation becomes key to sustain in this market. Joint venture options can also be explored by the industry to bring in the requisite technology to the country. Such collaborations will help industry upgrade in terms of skillsets, manufacturing capacities, and design and operational efficiencies as they gain access to the partner company's invaluable resources.

True, the Indian consumer is still evolving. Hence, the onus of educating customers about their latent needs and new product innovation lies completely with the brands. They need to invest in marketing and communications to realise long-term gains of the potential Indian intimatewear market. Manufacturers, for their part, should invest in large plants to reap the benefits of economies of scale.

Organised retailers should grant due consideration to the intimatewear category in their merchandise mix. Retailers should focus on building a comprehensive range of right brands and products around the needs of their target consumers. Emphasis should be given on visual merchandising, as this will help in maximising the per square foot yield from the promising intimatewear category.

A complete shopping experience should be offered to customers entering a shop to buy intimatewear. The elements should ideally include some of the following:

-

Ambience that enhances the privacy and pleasure in shopping of this category;

-

Aesthetic display of products in a way which facilitates easy browsing;

-

Clean and well-lit trial rooms;

-

Female staff and privacy for the women's section;

-

Personal counseling on correct size measurement, selection of correct styles based on usage and body types, trousseau collection and gifting.

It is noteworthy that the Indian intimatewear industry has reached a tipping point and is geared to take its next leap of growth. The time is ripe to reap the benefits of the massive growth potential in the sector. Manufacturers can adopt a mix of strategies such as product diversification, strategic tie-ups among domestic brands or with international brands. Also, the focus should be on better product designs and increased functionalities to make Indian products globally competitive and catapult Indian exports of intimatewear towards the top. Both organised and online retailers who have not yet included intimatewear in their merchandise assortment could well consider doing so to provide an all-inclusive shopping experience to customers as well as maximise their own profits.

A trade perspective

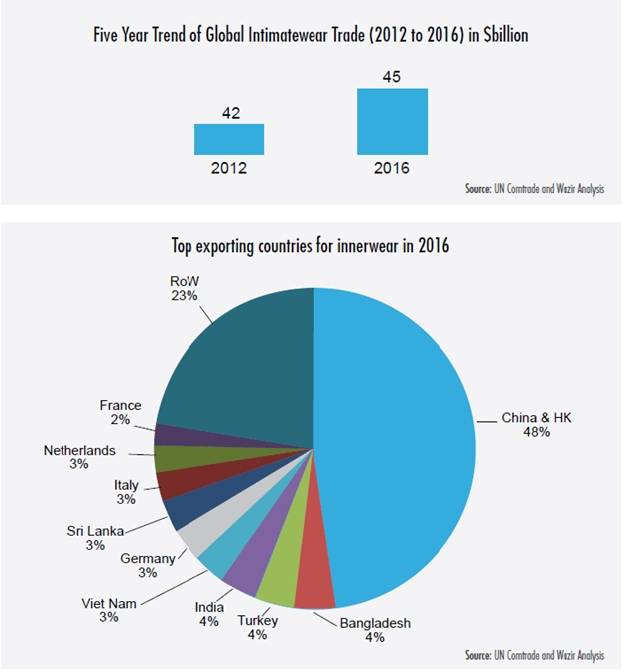

The global market for intimatewear is ever-expanding, fuelled by growing global demand, changing dynamics of the end-consumer and innovative technologies. A range of attractive and practically useful innerwear have flooded the markets from many global brands vying for the top spots, especially in the lucrative women's intimatewear category. Globally innerwear exports amounted to $45 billion in 2016. It is expected to reach $80 billion by 2025. China and Hong Kong are the major exporting nations of innerwear for men and women with a value of $21.3 billion which is a 47 per cent share in global exports. Following closely are Bangladesh, Turkey, India and Vietnam with 4.3 per cent, 4 per cent, 3.7 per cent and 3.4 per cent shares respectively. India held the fourth position with around 4 per cent share of global exports and approximately $1.7 billion exports value in 2016.

Countries such as Bangladesh, Sri Lanka and Vietnam have marched ahead in the innerwear trade mainly due to large manufacturing set-ups, economies of scale, huge investments, market access arrangements and strong focus on design and research and development (R&D) which are some areas in which India is still lacking in. For example, Sri Lankan brand Amant has been selling widely in India for over a decade through multi-brand retailers and e-commerce platforms. Witnessing their enviable success, owner company MAS Holdings has already sanctioned over 100 exclusive stores for their lingerie brand (Amant) all over India. The strategy being employed here is the need for privacy by the customer while going on a lingering-shopping spree. Similar strategies are being followed by other global brands such as Marks & Spencers, which conducted a pilot run of six standalone beauty and lingerie stores.

Indian manufacturers and exporters could well look at what their rivals or counterparts in the tiny island of Sri Lanka are doing. A tete-a-tete with one particular company reveals that their emphasis is quality. Buddhi Paranamana, general manager for innovation and strategy at the $200 million Hela Clothing, says, "Quality is embedded in our development and production process. Our quality assurance starts at the fabric mill, where fabric technologists develop and produce the fabric in collaboration with the mill adhering to our customers' quality levels. Quality assurance checks are carried out for all raw materials (fabric, trims, elastics, thread and all other components), when laying the fabric, after cutting the fabric, when sewing, after sewing, and just before the goods are shipped to the customer."

Comments