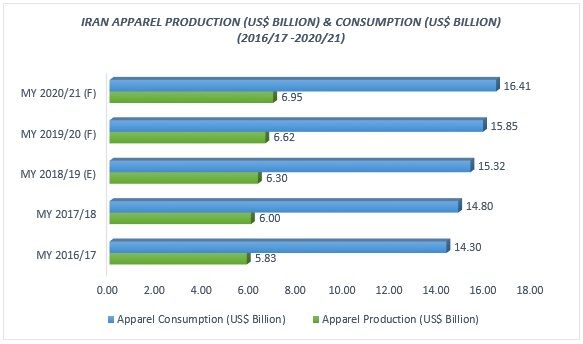

The apparel industry in Iran is flourishing. A Market Intelligence (MI) report from Fibre2Fashion finds that the production and consumption of apparel have been increasing since the marketing year (MY) 2016-17.

For a country where the production volume in the apparel industry is half the nominal capacity, there is considerable scope for expanding operations as well as search for markets. It is with this backdrop in mind that the government of Iran is planning to revamp garment manufacturing across the country-there are some 8,000 units of varying size in all.

Things look promising: apparel production in Iran is expected to grow to $6.95 billion in MY 2020-21 with a CAGR (compounded annual growth rate) of 5 per cent over MY 2017-18. With most of export destinations being the nearby former Soviet republics, export prospects look bright too-apparel exports are expected to reach $97 million in 2021 with a CAGR of 16.20 per cent over 2018.

Apparel Production

The apparel production of Iran in value terms was $5.83 billion in MY 2016-17 (March to February). It increased to $6 billion in MY 2017-18 with a growth rate of 3 per cent. The figure is expected to increase to $6.95 billion in 2020-21 with a CAGR of 5 per cent over MY 2017-18. The classic apparel manufacturing accounts for 60 per cent of domestic apparel production. Consumption of casualwear is widespread, but the production of apparel in the country is not enough to meet domestic needs.

According to Iran's Ministry of Cooperatives, Labour and Social Welfare, the production volume of Iran's apparel industry is half of its nominal capacity. Hence, the country is planning to revamp its garment manufacturing units. There are about 8,000 production units across the country, and the current year has been named as the "year of pickup in production."

Source: TexPro

Apparel consumption in Iran was $14.30 billion in MY 2016-17. It increased to $14.80 billion in MY 2017-18 with a growth rate of 3.50 per cent. Apparel consumption is expected to increase to $16.41 billion in 2020-21 with a CAGR of 3.50 per cent over MY 2017-18. The deficit between consumption and production remains high. Hence, apparel imports too are high.

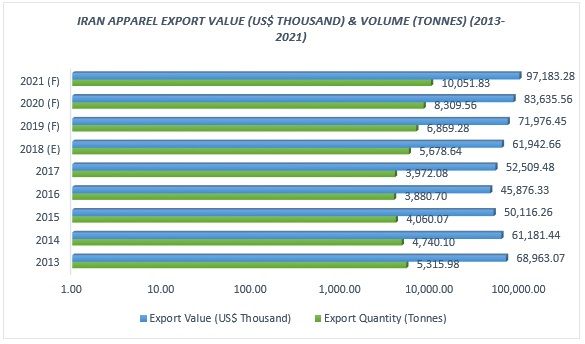

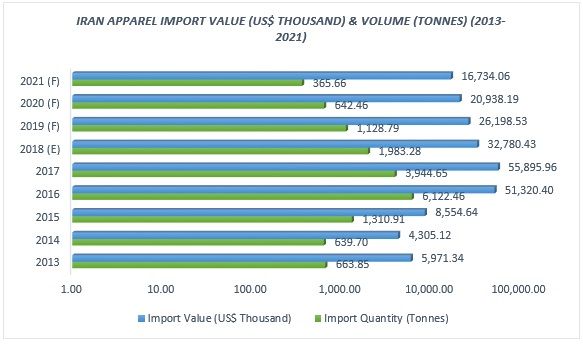

Apparel Trade

After the decline from 2013 to 2016, Iran's apparel trade has been growing with a high CAGR. In terms of value, Iran's apparel trade was $97,196.73 thousand in 2016 with a tremendous rise of 65.66 per cent over the previous year, reaching $94,723.08 thousand in 2018 with a drop of 2.54 per cent. The total trade declined by 12.62 per cent in 2018 over the previous year. It is expected to reach $113,917.34 thousand in 2021 with a growth rate of 20.26 per cent over 2018.

Source: TexPro

In terms of volume, Iran's apparel trade was 10,003.16 tonnes in 2016 with a recorded growth of 86.24 per cent over the previous year, reaching 7,661.92 tonnes in 2018 with a decline of 23.40 per cent. The total trade volume plunged by 3.22 per cent in 2018 compared to the total trade in 2017. It is expected to reach 10,417.49 tonnes in 2021 with a surge of 35.96 per cent over 2018.

Apparel exports in terms of value was $45,876.33 thousand in 2016 and reached $61,942.66 thousand in 2018 with a growth rate of 35.02 per cent. The overall apparel exports moved up by 17.96 per cent in 2018 over the previous year. It is expected to reach $97,183.28 thousand in 2021 with a CAGR of 16.20 per cent over 2018. In terms of volume, Iran's apparel export was 3,880.70 tonnes in 2016 and increased to 5,678.64 tonnes in 2018 by 46.33 per cent.

The Iranian government has planned to double its exports to neighbouring countries by the Iranian calendar year of 1400 (which starts in March 2021).The major apparel exporting destinations of Iran are the former CIS (Commonwealth of Independent States) countries including Azerbaijan, Armenia, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Uzbekistan and Ukraine. Out of these, Azerbaijan is at the top of the list.

Source: TexPro

Apparel imports in value terms was $51,320.40 thousand in 2016 with a high growth of 400 per cent and dropped to $32,780.43 thousand in 2018 by 36.13 per cent. The overall apparel import declined by 41.35 per cent in 2018 over the previous year. It is expected to reach $16,734.06 thousand in 2021 with a drop of 48.95 per cent from 2018. In terms of volume, the apparel imports were 6,122.46 tonnes in 2016, going down to 1,983.28 tonnes in 2018 with a fall of 67.60 per cent. The overall apparel imports of the country dropped by 49.72 per cent in 2018 over 2017. It is expected to go down further to 365.66 tonnes in 2021.

Government Initiatives

The government of Iran has introduced policies, rules and regulations which are aimed at revamping the country's garment manufacturing industry in order to compete in international markets. This initiative has also led to the imposition of very high tariffs on imports of apparel.

The measures taken by the government include:

-

Foreign representatives,branches and distributors of apparel companies in Iran who seek business licenses have been mandated to produce goods worth 20 per cent of their import value inside Iran and to export at least 50 per cent of this domestic production. This initiative has been taken to boost domestic production, create jobs and revive Iran's apparel industry. It has been observed that public interest in domestic products has dramatically increased in recent months.

-

Import restrictions have been imposed on garments, footwear and textile products.

-

Iran's Ministry of Industry,Mines and Trade is focused on boosting production and generating new employmen t opportunities. In order to achieve the given objectives, the ministry would cooperate with the private sector.

-

The country is focused on increasing on-oil exports (garments as a major product) to neighbouring countries such as Afghanistan, Iraq, Russia and Yemen. According to data published by the Trade Promotion Organization (TPO), the value of trade of Iran with neighbouring countries was over $36.5 billion in the past Iranian calendar year which was approximately 41 per cent of the country's total non-oil trade over the same time span.

-

Iran is going to sign a preferential tariff agreement with India soon which will slash tariffs on many traded goods. A lot of important items will be made zero duty as part of the deal and the tariffs on many others will be significantly reduced. Along with the trade deal, a bilateral investment protection agreement and a double taxation avoidance agreement are also under progress and expected to be signed by the end of 2019.

US Sanctions

Meanwhile, the first set of sanctions imposed by the US in August 2018 restricted Iran's purchase of US currency, while the second in November restricted sales of oil and petrochemical products from Iran. India was one of the eight countries given a six-month waiver to continue its oil trade with Iran, but with the caveat that it should lower its imports.

In addition to the above, the difficulties such as rising shipping costs, unavailability of insurance cover and uncertainty on exchange of documents need to be sorted out immediately. Both governments are said to be working towards it.

Comments