Challenges for apparel retailers will vary depending on brand positioning, style, customer segment, product categories and life cycle. The pandemic-induced crisis will accelerate adoption of new digital capabilities across the value chain

The year 2020 is probably the worst ever for many: COVID-19, social movements, terrorism, populism, hurricanes and wildfires. You may have lost a close friend or a family member, or lost your job or closed your business while fundamental freedoms were limited. This is a different crisis and socioeconomic consequences are still uncertain. COVID-19 cannot be compared to the flu pandemic of 1918. It has changed our world: the way we work, socialise, learn, shop and dress.

It is the year of retail purgatory. Some will survive, others will not. This is not about what business strategy to implement but how to run a business in a new era; a new way of facing existing and coming challenges. Vaccines give us light at the end of the tunnel and retailers will have to adapt to a new ecosystem.

Sorry, we're closed

Retailers keep shutting a large number of stores. A record 9,500 stores went out of business in 2019 in the United States, but as many as 25,000 could shut down permanently in 2020, mostly in malls, says an estimate from Coresight Research. Store closure will hit the United States the hardest as there are 8.5 billion square feet of retail space, which equates to 24.5 square feet of retail space per capita, or five times Europe's average of 4.5 square feet per capita, according to the Lincoln Institute of Land Policy.

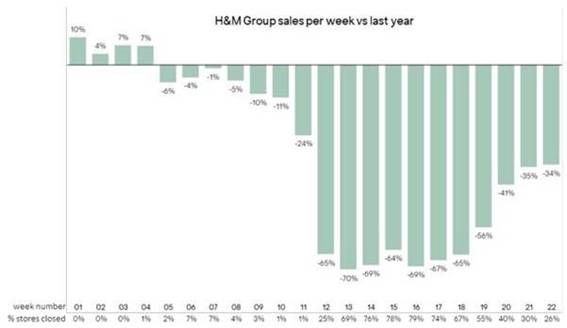

Retailers closing stores include GAP, Barneys, Victoria’s Secret, Guess, Macy’s, PVH and Michael Kors. Zara owner Inditex said in June it will close 1,000 to 1,200 stores over the next two years. Inditex reported a 37 per cent decrease in sales from February to July this year and a 74 per cent rise in online sales. H&M net sales decreased by 50 per cent in their second quarter (1 March 2020 to 31 May 2020) with 80 per cent of stores closed, while online sales increased by 36 per cent compared to 2019. The following chart shows the impact of the pandemic on H&M sales by week. Signs of recovery are observed, but consumption remains subdued.

Source: H&M Six-month report 2020

Cash flow oxygen

Cash is king in retail and managing cash flows during the pandemic is a major challenge. "Based on analysis from the past three years, typically, around 3 per cent to 4 per cent of struggling retail businesses will fail each year. The economic impact of coronavirus will see this rate of failure rise substantially, well into double figures," according to business intelligence firm Red Flag Alert. In 2020, several fashion retail companies, such as Ascena Group, Brooks Brothers, John Varvatos, Aldo Group, Forever 21, J. Crew, Tailored Brands, JCPenney and Lord & Taylor have filed for bankruptcy or liquidation.

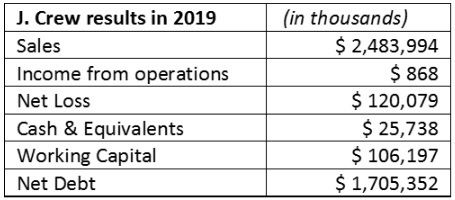

It is worth to notice that the pandemic has not made most of these companies insolvent or caused a number of retailers to file for bankruptcy. It probably accelerated the process. J. Crew, for example was highly leveraged in 2019 with significant lease obligations. Its annual rental obligations under long-term operating leases were $146 million in 2019 and $146 million in 2020, while paying interests of approximately $125 million in fiscal 2019.

Source: Based on JCrew 2019 Annual Report

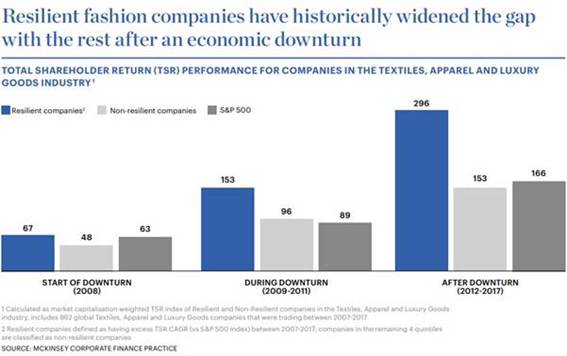

Uncertainty is the new normal and companies have been forced to rethink their business models and operational strategies, from design to retailing. In every crisis, there are winners and losers, and as McKinsey reports, "Resilient fashion companies have historically widened the gap with the rest after an economic downturn".

Source: The State of Fashion 2021 (McKinsey & Business of Fashion)

A 'resilient' company has a strong financial health, is adapted to omni-channel retail and implements digitalisation across the value chain. Digital is not a department (e.g. digital marketing), but everything from a front-end and back-end perspective. Inditex is an example of a resilient company that took rapid action and its flexible business model allowed it to reduce its inventory by 19 per cent. Furthermore, Inditex has a negative net financial debt (- €8.067 million). Unlike Inditex, J.Crew was highly leveraged as previously mentioned. A high debt capacity is probably one of the greatest retail vaccines for the pandemic. Cash is oxygen.

Economic and retail industry outlook

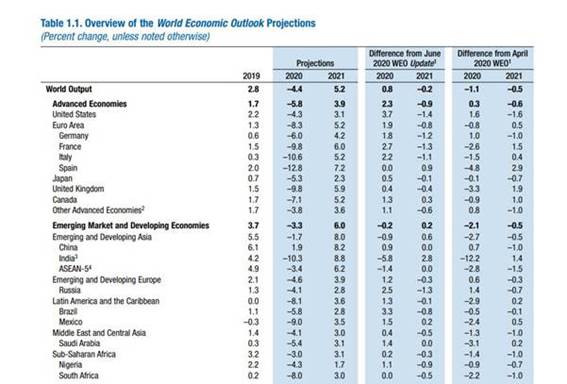

The International Monetary Fund's (IMF) World Economic Outlook says global growth is projected at -4.4 per cent in 2020 and 5.2 per cent in 2021. The growth projections imply wide negative output gaps and elevated unemployment rates this year and in 2021 across both advanced and emerging market economies.

Source: World Economic Outlook, October 2020: A Long and Difficult Ascent

According to the latest The State of Fashion report (BoF & McKinsey. 2021), fashion sales in China are expected to recover in 2020, while recovery in the United States and Europe lags. If we stay positive and take the earlier recovery scenario from McKinsey, recovery would be achieved by the third quarter of 2022. China sales growth are expected to grow by 5-10 per cent compared to 2019, while Europe would see lower sales down to 2-7 per cent compared to 2019 as well. The United States will experience a similar trajectory with sales down 7-12 per cent in 2021 compared to 2019.

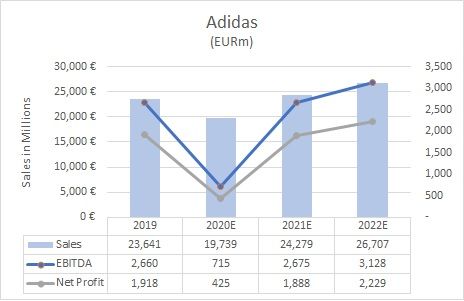

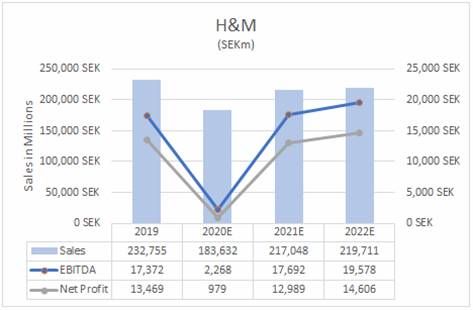

As mentioned, the global economy is projected to recover in 2022 and most fashion retailers are expected to recover in 2022-23. These are some examples from equity research firms that show the impact of the novel coronavirus on sales, earnings before interest, taxes, depreciation and amortisation (EBITDA) and net profit as well as its 2020-22 period forecast:

Source: based on Equity Research Kepler Cheuvreux. December 2020

Source: based on JP Morgan Cazenove. Europe Equity Research. November 2020

Source: based on Santander Corporate & Investment Banking.

European Equity Research. November 2020

Retail sales crashed during the lockdown. Retail Sales, EBITDA, net profit and other financial ratios are expected to shrink. As shown, Adidas (2020 vs 2019: -17 per cent, -73 per cent and -78 per cent respectively), H&M (2020 vs 2019: -21 per cent, -87 per cent and -93 per cent respectively) or Inditex (2020 vs 2019: -27 per cent, -37 per cent and -66 per cent respectively) will recover in 2022 or later.

Consumer spending forecast

According to Deloitte's Global State of the Consumer Tracker, consumers have been deeply affected by COVID-19. On an average across all countries in the survey, 30 per cent respondents expressed concern about making upcoming payments. Only consumers in China, where lockdown measures were eased before the rest of the world, seem more inclined to increase their spending on discretionary goods, particularly apparel and clothing (26 per cent), according to Global Powers of Luxury Goods 2020.

In its latest report, consulting firm Bain & Company says the core personal luxury goods market fell by 23 per cent in 2020 to €217 billion worldwide. China was the only region globally to see an increase in sales ( plus 45 per cent) to reach €44B affected by the shift to local shopping. Chinese consumers are expected to make up nearly half the global luxury market by 2025. On the other hand, sales decreased in Japan (-24 per cent), Europe (-36 per cent), Americas (-27 per cent), Asia (-35 per cent) and the rest of the world (-21 per cent).

Retail consumer behavior has also changed. Rewards app Shopkick surveyed more than 14,000 Americans to gain insight into their buying patterns, and there are some notable generational trends. For one, 55 per cent of Gen Z consumers say they will shop more frequently at retailers or brands that align with their core values in 2021. On one hand, consumers are shopping with demand for local, sustainable and value brands rising, while on the other, more and more fashion brands are influencing in politics and culture while adapting its store formats to 'local shopping' (e.g. Nike Unite and Nike Rise).

Action Plan: 2020-2023

Fashion brands and new retail: how to adapt to demand uncertainty while maintaining positive cash flows

Apparel retailers will face different challenges depending on their brand positioning, style, customer segment, product categories and life cycle. The pandemic-induced crisis acts as an accelerator for brands to adopt new digital capabilities across the value chain. But it is not only about technology.

New retail requires a rethink on the operating model.

These are some of the strategies, from business processes to big data, that brands will have to implement to overcome the challenges retail might face:

Designing

• Offer freshness and quality: Launch micro-collections or limited editions to cut down on overstock while investing in quality as customers are looking for long-lasting items.

• Embrace sustainability: Use organic materials, recycling, upcycling

• Use 3D sizing powered by artificial intelligence (AI) to ensure a good fit and reduce returns (3D knitting manufacturing could support the mentioned process).

• Increase make-to-order and pre-paid offerings (e.g., customisation)

Planning

• Demand forecasting empowered by AI

• Implement attribute-based assortment, clustering and allocations

• Collect customer information (e.g., social sensing)

• Use virtual reality to allow virtual showrooming and virtual fashion shows

Supply Chain

• Embrace 'partnerships' or the platform economy:

• Vertical integration: take control of the end-to-end value chain

• Look for acquisitions or partnerships

• Balance off and near-shore manufacturing aligned to merchandise life cycle and uncertainty

• Support supplier collaboration and product/process traceability (e.g., RFID)

• Embrace sustainability through transparency and customer engagement (e.g., use blockchain to illustrate the story of a garment)

• Enhance omni-channel capabilities (e.g., BOPIS, click & collect, showrooming)

Optimise reverse logistics from a cost and experience perspective

• Set up a supply chain orchestration

Retailing

• New processes and digital training required at store level

• Diversify sales/distribution channels

• Develop curated, local stores; physical shopping is not about conversion but experience

• Integrate the customer journeys (online and offline)

• Foster customer loyalty (e.g. Adidas Creator Club has around 150 million members)

Sources:

1.https://coresight.com/research/weekly-us-and-uk-store-openings-and-closures-tracker-2019-week-43/

2.https://www.cnbc.com/2020/06/09/coresight-predicts-record-25000-retail-stores-will-close-in-2020.html

3. https://www.thefashionlaw.com/retail-woes-a-bankruptcy-timeline/

4.https://natwestbusinesshub.com/articles/retail-coronavirus-costs-and-cash-flow

5.https://www.lincolninst.edu/publications/articles/2019-12-unmalling-america-municipalities-navigating-changing-retail-landscape#:~:text=There%20are%208.5%20billion%20square,4.5%20square%20feet%20per%20capita.

6. Inditex Half Year report (2020)

7. H&M Six-month report (2020)

8.https://www.bain.com/insights/pandemic-spurs-transformation-of-luxury-market-infographic/

9.https://footwearnews.com/2020/business/retail/consumer-shopping-trends-2021-1203075181/

10.Santander Corporate & Investment Banking. European Equity Research. November 2020

11. Equity Research Kepler Cheuvreux. December 2020

12. JP Morgan Cazenove. Europe Equity Research. November 2020

13. JCrew 2019 Annual Report

14.https://www.vox.com/the-goods/2020/2/5/21113525/barneys-bankruptcy-closing-liquidation-sale

Comments