The 2020 pandemic saw demand for Egyptian cotton fall due to cancellation of shipments, both for domestic and global markets. The Egyptian government took a number of steps to revive the cotton industry. A report.

Challenges

1. Export Drop

According to the Egyptian Cotton Exporters Association (ECEA), Egyptian cotton exports suddenly dropped between March 2020 and July 2020 due to disruptions from the spread of COVID-19 pandemic. India is Egypt's main cotton market. But the shipments of some 10,000 metric tonnes (MT) of cotton have been cancelled with reduced capacity of spinning mills in India. Demand for textiles and cotton products have declined both domestically and internationally. Hence the cotton prices moved down, and the cotton harvested area need to be reduced to accommodate the situation.

Egypt had planned an export of 2,20,000 bales of cotton, majorly to India and Pakistan in Market Year (MY) 2019/20. But the Egyptian cotton exports to India got suspended for approximately three months with disruptions in port operations and spinning capacity in India due to COVID-19 pandemic. The country's cotton exports had gained momentum from July 2020 but again they had to cancel orders of approximately 45,000 bales. This makes up around 20 per cent of expected exports for the MY 2019/20. To date, only 80 per cent of the total contracts have been exported according to the Alexandria Cotton Export Association (ALCOTEXA).

2.Price Drop

The prices of imported cotton prices were upto 15 per cent down depending on the variety. High stocks and competitively priced imports, including US Pima, contributed to the low prices. Although the situation was challenging, Egyptian cotton producers and traders expected a normal season in MY 2020/21. It was expected that harvested area may drop to accommodate the stocks and ease the pressure on prices in next season. However, the prices remained lower than average due to high stocks and lower demand.

The trend of reduced cotton prices was expected to continue into next season as the government had reformed the system of providing cash payments to the textile industry, which allowed them to pay government-announced price for Egyptian cotton.

The government announced an indicative price before the planting season commenced. The indicative price was a subtle attempt to urge the textile industry to buy cotton from farmers at the indicative price; however, it was not a price support or commitment from the government to buy the crop.

In MY 2019/20, for the first time the government had not announced indicative prices which affected the cultivation in MY 2020/21.

Government Initiatives

1. Government Intervention to Reinstitute Cotton Quality

Since 2017, the Egyptian government has taken control of the production and distribution of cottonseed to restore seed purity and cotton quality. The government was forced to intervene as the seed companies' lack of effective quality assurance systems gave inferior and mixed variety output. Analysis released by the Cotton Arbitration & Testing General Organization (CATGO) on the physical fibre properties of Egyptian cotton varieties confirms this improvement. The length, strength, firmness, colour, trash count and maturity have all improved in cotton produced in MY 2019/20 compared to cotton produced in MY 2018/19.

2. Medium and Short Staple Upland Cotton

The Egyptian government has been conducting a research project in Sharq El-Owainat (East Owainat) to cultivate trials of medium and short staple upland cotton. Ministry of Agriculture leadership chose the area due to its remoteness and isolation from existing cotton cultivation to avoid seed mixing.

3. Better Cotton Pilot Project of Egypt

The United Nations Industrial Development Organization (UNIDO) has launched a multi-stakeholder pilot project in Egypt to train cotton farmers on the Better Cotton Initiative's holistic approach to sustainable cotton production.

Funded by the Italian Agency for Development Cooperation, the project is implemented by UNIDO in collaboration with the Ministry of Trade and Industry, the Ministry of Agriculture and Land Reclamation as well as with local and international textile private sector stakeholders. The Better Cotton Initiative (BCI), in coordination with selected Implementing Partners, supported UNIDO on the activation of the pilot in select areas in Egypt during the MY 2018/19 cotton season.

BCI provided guidance, shared knowledge, developed materials and provided relevant agricultural and cotton experts. Approximately 5,000 smallholder cotton farmers would be involved in the initial pilot project, receiving training on the Better Cotton Principles and Criteria. By adhering to these principles, existing (licensed) BCI Farmers around the world will produce cotton in a way that is measurably better for the environment and farming communities. Once the pilot is complete, and in coordination with relevant Egyptian governmental entities and private sector stakeholders, UNIDO and BCI would explore the possibility of supporting the start-up of a direct BCI Program in Egypt.

4. Formation of Egypt Cotton Association

The Egyptian Ministry of Industry and Trade (MoIT) and the Alexandria Cotton Exporters' Association (ALCOTEXA), owners of the Egyptian Cotton trademark logo together formed the Cotton Egypt Association (CEA) in order to improve the marketing and image of Egyptian cotton through the licensing of their logo.

CEA has established a monitoring system to cover the entire supply chain of their licensees. The organisation monitors the quantities purchased and sold by each licensee, mapping their sales and establishing a traceability system. They verify and ensure that quality and standards in using the logo are met, conduct random audits to licensee premises. Moreover, CEA checks websites that promote Egyptian cotton products and works to notify them of their proper usage. CEA regularly collects samples of products that are promoted as Egyptian cotton from retailers, tests them, and follow-ups with the manufacturers and retailers if issues arise.

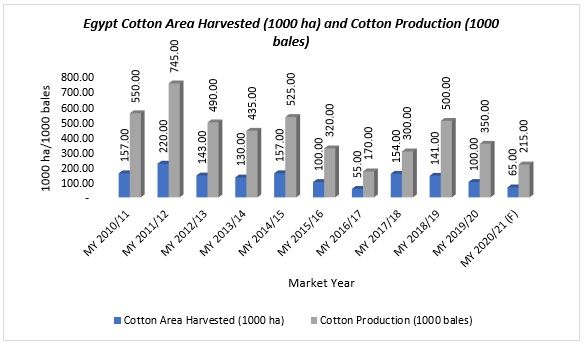

Cotton Area Harvested, Production and Consumption

In market year (MY) 2020/21, cotton area harvested is expected to decline by approximately 35 per cent to 65,000 hectares (ha), from 100,000 ha in MY 2019/20. In MY 2020/21, FAS/Cairo (Post) has predicted the production to 215,000 bales with a decline of 90,000 bales (approximately 30 per cent) as compared to the production in MY 2019/20.

The Office of Agricultural Affairs accepted the drop in price of cotton in 2020. High stocks of the previous seasons lowered prices and discouraged farmers from planting cotton in 2019. In MY 2020/21, imports are expected to increase by 23 per cent to 6,30,000 bales, up by 1,18,000 bales from MY 2019/20 imports.

Egypt Cotton Area Harvested (1000 ha) and Cotton Production (1000 bales)

Source: FAS/PSD, F = FAS Forecast

This season, farmers and industry experts reduced production to raise cotton prices to preserve the industry's reputation as a supplier of high-quality cotton. The harvested area and yields decreased in MY 2019/20, however the prices remained low. Price averages were $133 per 50 kg of lint cotton to $146 per 50 kg of lint cotton for extra-long varieties and $120 per 50 kg of lint cotton to $133 per 50 kg of lint cotton for long-medium staple cotton.

In MY 2020/21, cotton consumption of Egypt is expected to plunge by 5,000 bales to 6,25,000 bales, a drop of 1 per cent over last year attributed to lower domestic demand due to decrease in demand from public spinners. The local consumption usually focuses on long staple varieties, whether Giza 90 and 95 produced locally or imported from Greece, Burkina Faso, Benin, and Sudan. Some spinners use Egyptian extra-long and long staple varieties, while others depend on imported US Pima cotton as requested from their international buyers.

Egyptian Cotton Varieties

Only 3 per cent of the total world cotton production is Extra Long Staple (ELS) cotton. Egypt, US, Israel, and Turkmenistan are the only ELS producers in the world. Egypt produces ELS and long staple cotton.

The Cotton Arbitration and Testing General Organization (CATGO) which is affiliated with the Egyptian government, identifies ten different varieties of cotton that come under two categories such as extra-long staple cotton and long staple cotton.

Long staple cotton is divided into lower-long staple varieties that grow in the Delta region and upper-long staple varieties that grow in Upper Egypt. However, traders and industry players identify and market the upper-long staple cotton as medium staple cotton, as it is used to produce the same type of yarns.

Egyptian Cotton Varieties

Source: FAS, Cairo

In MY 2019/20, Giza 96 was the dominant variety planted on 7,369 Ha or 96 per cent of the total ELS cultivation. Giza 45 and Giza 87 have been cultivated on only 207 Ha and 79 Ha land, respectively.

Of the lower long-staple varieties grown in the Delta region, Giza 94 is the most widely grown on 365,714 ha land (approximately 63 per cent). Giza 86 was cultivated on approximately 18 per cent of Egypt's total cotton production area (102,420 ha) and it was the second most produced in the country.

Of the upper-long staple varieties grown in Upper Egypt, medium staple cotton, Giza 95, the most widely cultivated, accounted for 12 per cent of Egypt's total cotton production with total cultivation area of 68,388 ha, followed by Giza 90 which accounted for 1 per cent of Egypt's total production with area of 7,958 ha.

Trade

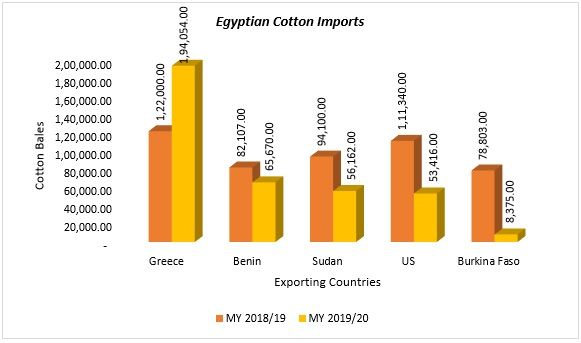

In MY 2020/21, cotton imports of the country are expected to increase by 23 per cent to 6,30,000 bales, up by 1,18,000 bales from MY 2019/20 imports attributed to the steady domestic use and lower yields.

As per the contracts reported this season, cotton traders and yarn manufacturers prefer to source their needs from abroad even with lower domestic prices. Yarn manufacturers who are dependent on medium staple varieties would maintain their import levels to meet their domestic and international needs. In MY 2019/20, Greece, Benin, Sudan, the US and Burkina Faso were Egypt's main cotton suppliers and are expected to remain so in MY 2020/21.

Imports

Local traders and yarn manufacturers also have been demanding the US Pima and upland cotton. Big yarn manufacturers also preferred imported Pima cotton even with the high prices as the customers from Europe demand Pima cotton and can pay extra cost for its high quality. However, for upland cotton, the high shipping costs of this US variety has led traders and yarn manufacturers to source it from countries such as Greece, Sudan, and other African countries.

Egyptian Cotton Imports (bales)

Source: CAPQ

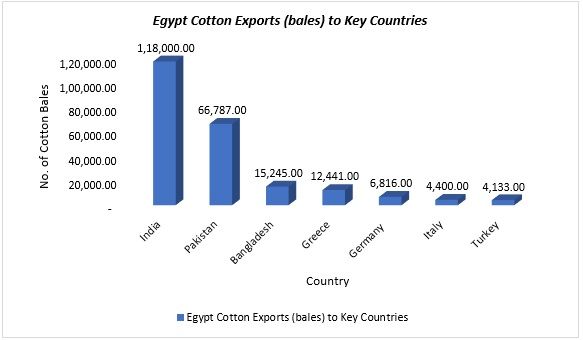

Exports

Egypt Cotton Exports (bales) to Key Countries (September 2019 to March 2020)

Source: ALCOTEXA

Egypt's total lint cotton exports in MY 2020/21 is expected to increase by 14 per cent or 30,000 bales to reach 2,50,000 bales with low prices and reduced domestic consumption.

In MY 2019/20, India remains the main importer of Egyptian cotton. Pakistan, Bangladesh, Greece, Germany and Italy are also Egypt's top export destination. India and Pakistan are expected to remain the same in MY 2020/21.

In MY 2019/20, Egypt's major export was long staple varieties grown in lower Egypt. Giza 94 and Giza 86 were the majorly grown cotton products with share of 75 per cent and 19 per cent respectively. Four per cent of the total exports were extra-long staple such as Giza 92 and Giza 96.

Trade Policy

1. Importers must apply for an import permit from the MALR's Central Administration for Plant Quarantine (CAPQ), which is valid for a year.

2. Egypt imposes zero import tariffs on raw cotton or cotton lint with HS code 520100 and 5 per cent import tariffs on carded or combed cotton with HS code 520300.

3. According to CAPQ regulations, importers should request import permits before importation, identifying the port of entry and date of arrival to reserve the equipment required for fumigation. In addition, the shipment must be accompanied by a fumigation certificate from the quarantine authorities at the port of origin and less than three months should have elapsed from the date of issuance to the date of arrival. If the three-month validity period is exceeded, the shipment must be returned to its origin, and the fumigation should be repeated, or the product may be re-exported to a third destination.

4. Egypt's cotton import regulations stipulate that imported cotton should be free from whole or broken seeds or foreign materials. When a shipment is found to have whole or broken seeds, even if one seed is found in baled cotton, it will not be released. The importer can either destroy it under the supervision of CAPQ, re-export it to another destination, or return it to the country of origin. If the importer decides to re-export, CAPQ issues to the importer a certificate stipulating the reason for its rejection, which would need to be presented to authorities at final port of destination.

5. Egypt also requires that cotton exported to Egypt be fumigated at the country of origin using methyl bromide, magtoxin or phostoxin at specified concentrations found in the import permit.

6. Fumigating the shipment at country of origin does not exclude it from being fumigated at Egyptian ports.

7. The following statement must be in the certificate: "The cotton is free from boll weevil - Anthonomus grandis". The government also recommends an optional pre-shipment inspection at origin. If this is elected, two plant quarantine inspectors travel and inspect the shipment and supervise fumigation prior to its departure from the port of origin. Although pre-shipment inspection is optional, some importers prefer to bear the cost, which serves as an insurance policy of sorts, to avoid delays at the port of entry.

Comments