I enjoy analysing patterns of motivation, connecting the dots that will impact on new trends. Where are we coming from? Having the ability to track and analyse will prevent the next black swan effect. Last December, Streetwear was declared dead by Virgil Abloh but it’s not. These are some of the factors that shaped this still growing trend.

Nownership and the experience economy. In US and Europe, Millennials are prioritising relationships and experiences over things. “By the end of the 1950s, 87 per cent of all US families owned at least one television, 75 per cent owned a car, and 60 per cent owned a home” (Forbes 2019). New generations are changing their shopping patterns in regards to some categories. But, a report from MIT, found little difference in preferences for vehicle ownership between Millennials and prior generations. In contrast to the anecdotes, it finds higher usage in terms of vehicle miles travelled (VMT) compared to Baby Boomers. Life is not always black and white. There is always an exception. Owning a car is still important, maybe because it’s a symbol of autonomy and provides the opportunity of traveling (another experience). What if some clothes are a symbol too?

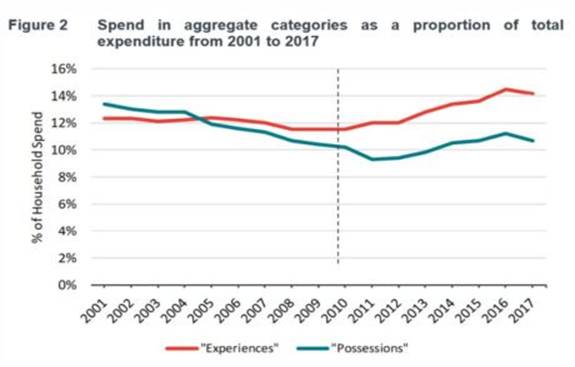

The UK Living Costs and Food Survey (LCFS) shows how households spend their money, broken down by age, income and region.

In this case, since 2005, the average household spending on “experience categories” is growing at a higher level compared to “possession categories”.

Other factors could influence this change. New generations values are impacted by changes in consumer perception, prices (eg if car prices drop, sales will rise), and service-oriented business models (eg Uber or electric scooter rental). Understanding customer needs and expectations will help us to avoid hasty generalisation fallacies. A customer looking to commute will take a different decision compared to a customer that is looking forward driving experiences or considers cars as a status symbol.

Technology and new types of communication are transforming new generations shopping habits. The experience economy is represented by Netflix, Spotify or Uber. Many product or product-categories aren’t owned any more or are obsolete, like DVD players. Do you remember the song “Video Killed The Radio Star”, from The Buggles? Technology platforms are making customers shift from ownership to access or on-demand services (eg subscriptions).

Globally, a majority of Gen Z and Millennials (65 per cent) communicate with each other more often digitally than in person (LivePerson Inc). New generations communicate in a new way. Instagram (1 billion monthly active users), WhatsApp, TikTok or Wechat (1.2 billion monthly active users) success is based on how millennials and Gen Z are using digital platforms to socialize, shop, engage, experience. It’s the race for likes and self-esteem is in their pockets.

The digital era is connecting friends, tribes and communities. Influencers are inspiring millennials and Gen Z, that are spending more time on video and social. And, how influencers are dressing? Casual and urban/streetwear. Covid-19 is also changing the shopping habits and preferences, boosting casualwear and sportswear brands sales. Gym-goers are discovering outdoor exercise and are investing in new materials or updating their closet, as commented in the fashion of cycling (bikes are the new toilet paper or cycling is the new golf). Fashion is evolving to a “cool-but-comfortable” style. And, what is the hottest fashion trend? Streetwear… and it’s not dead.

From Niche to Chic. Streetwear gained notoriety when partnering with luxury houses (eg Louis Vuitton x Supreme). Capsule collections are a way to create a fad, alternative to fast-fashion micro-collections. Since the early 2000s, fashion brands, from luxury to mass-market have been launching collaborations with streetwear brands, designers or counter-culture icons: Adidas x Yeezy, Raf Simons x Sterling Ruby, Nike x Off-White, Fenty x Puma or UGG x …Everyone.

Did you visit 5th Avenue, Bond Street, Rodeo Drive, Champs-Elysees, Ginza, Myeong-dong… or any other High Street? There’s lack of authenticity. Sometimes, the only difference is their building facades. Then, if you visit a department store, you feel like being in a clean and tidy warehouse. But, did you visit Kith, Dover Street Market or Supreme? You will always find fans in lines. Customers are waiting in lines like in the Louvre or Moma museums. What is the secret of their success? A combination of customer experience and limited collections: scarcity and uniqueness. You will get exclusive items you won’t find anywhere else.

Streetwear clothes are considered “artworks” by new generations. There’s a huge market for reselling Supreme products because of the extremely high demand. Within minutes of going on sale, the most popular products can end up on eBay for many times the original price. One of the most popular items from week one of the season a Madonna t-shirt cost $48 at Supreme, and within hours of the in-store drop, it was listed on eBay at a starting price of $250 (Business Insider 2018).

In 2019, Farfetch acquired New Guards Group, a brand platform that provides infrastructure, production and distribution capabilities to nine international urban, casual brands including Off-white or Opening Ceremony. According to Farfetch 2019 Annual Report, in aggregate, the New Guards portfolio of brands sold more than any specific brand on Farfetch in 2019.

Carlyle group, an American multinational private equity, valued Supreme (skateboard and streetwear brand founded in 1994 by James Jebbia) at $1 billion in 2017 and acquired 50 per cent stake. Then, in November 2020, VF Group (The North Face, Timberland, Vans) acquired Supreme in a $2.1 billion deal. Supreme provides VF with deeper access to attractive consumer segments that apply to many of VF’s existing brands.

In 2017, I wrote Sports, Fashion and Society: A sociological approach. The article describes evolution of sports in human history, from a social and individual perspective and how brands adapted to changing trends. Sport has a cultural and experiential significance. Lifestyle sport is a status symbol and collaborations between sportswear brands and streetwear is the culmination of aesthetics experience.

Covid-19 environment of casualisation is shaking the fashion industry up. Fashion and Sportswear brands are evolving at the pace of innovation, technology and customer trends. The lifestyle era is a consequence of a hyper-competitive society where aesthetics is the basis of self-identity (individuals promote their brands on social media). Social media is a thermometer of success and sport is a way to disconnect from this liquid society.

Streetwear is not dead and is not a trend. Owning streetwear clothes is like owning a car: a symbol of status and a way to present yourself. Streetwear is considered as art (emotional power) by many Millennials and GenZs. It’s an important piece in the self-identity puzzle for teens and young adults too. Streetwear is an “experience” too and new generations love it. This is the power of Goodwill…

This article has not been edited by Fibre2Fashion staff and is re-published with permission from fashionretail.com

Comments