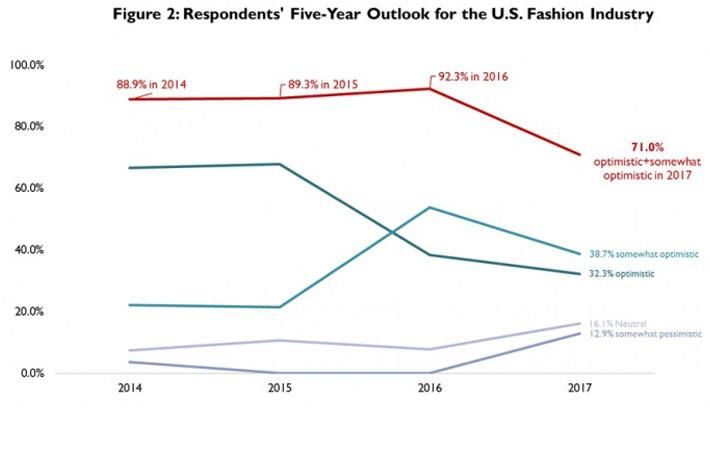

Optimism for fashion sector's 5-year outlook drops: USFIA

The USFIA released the fourth annual Fashion Industry Benchmarking Study, which is a survey of 34 executives from the leading fashion and apparel brands, retailers, importers, and wholesalers.

The decline in the optimism for the outlook could be explained by the rise of new challenges for the industry—specifically, the ‘protectionist trade policy agenda in the US,’ which executives rank as their top challenge this year, up from being ranked the number 10 challenge last year.

Conducted in conjunction with Dr Sheng Lu, Assistant Professor at University of Delaware Department of Fashion & Apparel Studies, the survey asked respondents about the business outlook, sourcing practices, utilisation of Free Trade Agreements and preference programmes, and views on trade policy.

Executives are more concerned about trade protectionism, market competition from e-commerce, and supply chain risk than they are about cost; ‘increasing production or sourcing cost’ dropped from the number 2 concern in 2016 to the number 7 concern in 2017, according to the study.

Only 36 per cent of executives expect to increase sourcing from Vietnam, compared to 56 per cent last year; this is likely due to the US’ withdrawal from the Trans-Pacific Partnership. The study also says that among all sourcing destinations examined this year, Bangladesh is considered the most competitive in terms of price—but also the riskiest in terms of trade compliance.

Free trade agreements remain underutilised; only the North American Free Trade Agreement (NAFTA) is utilised by more than 50 per cent of companies surveyed. Ethical sourcing and sustainability are given more weight in sourcing decisions, with 87.5 per cent saying these issues have become more important in sourcing decisions today versus five years ago; 100 per cent of companies surveyed audit their suppliers, notes the study. All respondents unanimously opposed the US border adjustment tax (BAT) proposal.

The survey was conducted between April 2017 and May 2017. In terms of business size, 68 per cent have more than 1,000 employees, including 58 per cent with more than 3,000 employees; an additional 19 per cent have 101-500 employees. This suggests the findings well reflect the views of the most influential players in the US fashion industry. (KD)

Fibre2Fashion News Desk – India

-Ltd..jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)