Interviews

FICCI seeks rationalisation of duty for MMF

03 Aug '15

5 min read

Courtesy: FICCI

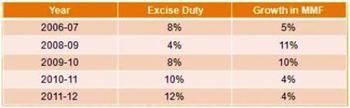

One of the concerns raised by industry is that MMF being a high technology and high investment area requires an enabling and better fiscal environment. At present, India also does not have the complete value chain in MMF i.e. fabric, processing and apparel making. Reduction in excise duty on MMF will stimulate the growth of the industry by attracting investments leading to completing the value chain and higher production and exports and thereby generate additional employment. Historically, lower excise on manmade fibres have triggered tremendous growth as can be seen from data (see chart). Since 2012-13, industry is continuously under contraction.

New Textiles Policy: The FICCI representation asked Jaitley to immediately announce the draft of the new Textiles Policy as given by Ajay Shankar Expert Committee. It would require adequate allocation of resources under the new and existing schemes as suggested in the Draft Vision Document.

“Against the total outlay proposal of Rs 7,818 crore by the Ministry of Textiles for the year 2015-16, the allocation has been restricted to Rs 3,523 crore only which will adversely affect vital schemes like TUFS, ISDS, SITP, etc,” the committee said.

Interest Subvention: The committee suggested that export finance should be provided at seven per cent per annum to increase the competitiveness and accelerate export growth. “The interest subvention scheme has played an instrumental role in enhancing the competitiveness of the industry and exports. Restoration of interest subvention will provide boost to the fragile export growth of textile sector.”

Technology Upgradation Fund Scheme (TUFS): In its representation submitted to Jaitley, the FICCI Textiles Committee requested for adequate allocation of funds under the TUFS, consideration of sanctioned loans under the existing TUFS and not the proposed new scheme of TUFS.

The committee said exports of textiles and apparel from India have increased steadily over the last few years though, India’s export performance has been below expectations in the post-quota period. However, looking at the global scenario now where China is vacating space in manufacturing, there is no reason why India, provided it takes the necessary steps, cannot achieve 20 per cent growth in exports over the next decade.

It said TUFS has been very helpful in promoting investments in the sector, and it is the only support for the Indian textile industry after export incentives been rationalised. The budget allocation for TUFS for the current year has been reduced vis-à-vis last year from Rs 1,840 crore to Rs 1,520 crore.

“This is grossly inadequate for the sector given the pending and future demands of the industry,” it said and requested the minister to consider increasing the allocation under the scheme to Rs 5,000 crore.

TUFS – Proposed New Scheme: The committee said the industry is apprehensive that under the current review of the TUFS, term loans already sanctioned would be considered in the new scheme. This would affect the projects that are in pipeline. Therefore, it requested that the new scheme whenever formulated and ready for launch should be applicable for new proposals received by the banks thereafter and all sanctioned term loans should be considered under the guidelines of existing TUFS scheme.

The committee also raised the question of capping subsidy under the proposed new TUFS. It said, “Capping under the scheme will discourage large investments in the domestic industry and derail competitiveness of Indian manufacturer.”

Fibre2Fashion News Desk – India

Popular News

Leave your Comments

Editor’s Pick

C Devarajan & P Raajashekar

Texvalley

Rajesh Mittal

Cedaar Textile Private Limited

Andrea pompilio

Label - Andrea pompilio

-Ltd..jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)