Interviews

Cotton production forecast up slightly in August

16 Aug '10

6 min read

In the West, upland cotton area rose for the first time since 2004. The higher area and an above-average yield are projected to push the crop there above 1 million bales once again after 2 consecutive seasons below that level. The extra-long staple (ELS) crop remains concentrated in the West—particularly California.

Larger area is contributing to the latest production forecast of 498,000 bales, about 25 percent above last season and the highest in 3 years. However, a below-average yield of 1,154 pounds per harvested acre is expected to keep the crop from rising further this season, a year in which ELS stocks are forecast to remain at historically low levels.

U.S. cotton crop development in early August indicates that the crop is running ahead of last season. As of August 8th, 84 percent of the cotton area was setting bolls, compared with 73 percent in 2009. While a handful of States were running behind last season, most were above a year ago and their respective 5-year averages.

In addition, a number of States were reporting bolls opening. As of August 8th, 9 percent of the U.S. area had bolls opening, similar to both last season and the 2005-2009 average. Arizona and Louisiana lead the way, with 25 percent and 18 percent of the respective area reporting bolls opening.

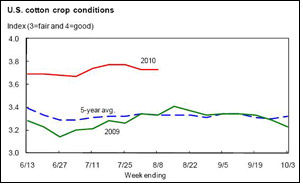

Meanwhile, U.S. cotton crop conditions in 2010 continue to outpace both last season and the 5-year average. In early August, 65 percent of the area was rated “good” or “excellent,” compared with 50 percent in 2009. In contrast, only 10 percent of the 2010 cotton area was rated “poor” or “very poor,” compared with 19 percent a year ago. Dry conditions have developed in parts of the Cotton Belt this season, but generally favorable conditions have been maintained.

Demand and Stock Revisions

In August, U.S. cotton demand revisions were limited to the export estimates. For 2010/11, the U.S. export projection was raised 700,000 bales to 15 million bales as a result of increased expectations for foreign import demand and a larger U.S. crop. This season's forecast is the second highest behind 2005/06's 17.5 million bales. While U.S. mill use is unchanged at 3.4 million bales, total cotton demand in 2010/11 is now projected at 18.4 million bales, the highest in 5 years.

With forecasts for U.S. cotton production slightly higher than demand, ending stocks for 2010/11 are projected marginally higher at 3.2 million bales, but still one of the lowest since the mid-1990s. Based on the current estimates, the stocks-to-use ratio is slightly lower in 2010/11 at 17 percent, similar to 2003/04. As a result, U.S. farm prices were raised a penny on each end of the range and are now forecast between 61 and 75 cents per pound in 2010/11.

Although the 2009/10 season has ended, estimates will be finalized over the next several months as additional end-of-year data become available. In August, U.S. exports for last season were reduced based on cumulative shipment data in the latest Export Sales report. After adjustments based on data in the “exports for own account” category, U.S. cotton exports in 2009/10 were placed at 12 million bales, 250,000 bales lower than estimated in July.

With U.S. mill use unchanged at 3.4 million bales, total cotton demand in 2009/10 was estimated at a decade low of 15.4 million bales.

Larger area is contributing to the latest production forecast of 498,000 bales, about 25 percent above last season and the highest in 3 years. However, a below-average yield of 1,154 pounds per harvested acre is expected to keep the crop from rising further this season, a year in which ELS stocks are forecast to remain at historically low levels.

U.S. cotton crop development in early August indicates that the crop is running ahead of last season. As of August 8th, 84 percent of the cotton area was setting bolls, compared with 73 percent in 2009. While a handful of States were running behind last season, most were above a year ago and their respective 5-year averages.

In addition, a number of States were reporting bolls opening. As of August 8th, 9 percent of the U.S. area had bolls opening, similar to both last season and the 2005-2009 average. Arizona and Louisiana lead the way, with 25 percent and 18 percent of the respective area reporting bolls opening.

Meanwhile, U.S. cotton crop conditions in 2010 continue to outpace both last season and the 5-year average. In early August, 65 percent of the area was rated “good” or “excellent,” compared with 50 percent in 2009. In contrast, only 10 percent of the 2010 cotton area was rated “poor” or “very poor,” compared with 19 percent a year ago. Dry conditions have developed in parts of the Cotton Belt this season, but generally favorable conditions have been maintained.

Demand and Stock Revisions

In August, U.S. cotton demand revisions were limited to the export estimates. For 2010/11, the U.S. export projection was raised 700,000 bales to 15 million bales as a result of increased expectations for foreign import demand and a larger U.S. crop. This season's forecast is the second highest behind 2005/06's 17.5 million bales. While U.S. mill use is unchanged at 3.4 million bales, total cotton demand in 2010/11 is now projected at 18.4 million bales, the highest in 5 years.

With forecasts for U.S. cotton production slightly higher than demand, ending stocks for 2010/11 are projected marginally higher at 3.2 million bales, but still one of the lowest since the mid-1990s. Based on the current estimates, the stocks-to-use ratio is slightly lower in 2010/11 at 17 percent, similar to 2003/04. As a result, U.S. farm prices were raised a penny on each end of the range and are now forecast between 61 and 75 cents per pound in 2010/11.

Although the 2009/10 season has ended, estimates will be finalized over the next several months as additional end-of-year data become available. In August, U.S. exports for last season were reduced based on cumulative shipment data in the latest Export Sales report. After adjustments based on data in the “exports for own account” category, U.S. cotton exports in 2009/10 were placed at 12 million bales, 250,000 bales lower than estimated in July.

With U.S. mill use unchanged at 3.4 million bales, total cotton demand in 2009/10 was estimated at a decade low of 15.4 million bales.

U.S. Department of Agriculture (USDA)

Popular News

Leave your Comments

Editor’s Pick

-Ltd..jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)