Interviews

2010 cotton crop forecast higher in September

18 Sep '10

6 min read

India's policy to limit exports, the flood effects in Pakistan, and China's anticipated need for cotton imports are likely to benefit U.S. shipments of cotton this season. With foreign import demand and mill use rising to its highest in 3 years, foreign ending stocks are forecast at their lowest level since 2002/03. At 15.5 million bales, the current U.S. export forecast would be second only to 2005/06's record estimate of nearly 17.7 million bales.

As a result of this month's adjustments, the 2010/11 ending stock estimate is 2.7 million bales, 300,000 bales below last season. In addition, the stocks-to-use ratio is forecast to fall from 19 percent to 14 percent by season's end. Both the stock level and ratio are their lowest since 1995/96. As a result, cotton prices have remained relatively high. The 2010/11 average upland cotton farm price is now forecast to range between 63 and 77 cents per pound. The midpoint of 70 cents would represent a 12-percent increase from last season.

U.S. Textile Trade and Trade Deficit expand in First Half of 2010

U.S. textile trade grew during the first half of 2010, compared with a year ago. Total imports during the first 6 months of 2010 reached nearly 8.4 billion (raw-fiber equivalent) pounds, 15 percent above a year ago. During the same period, textile exports expanded 21 percent to 1.8 billion pounds. As a result, the textile trade deficit for January-June 2010 increased to nearly 6.6 billion pounds or 14 percent above the corresponding period in 2009.

Cotton products continue to account for the majority of U.S. textile and apparel trade. During the first half of 2010, cotton product imports approached 4.6 billion pounds, up from 4.0 billion during the first half of 2009. Similarly, cotton textile exports increased to 870 million pounds through June 2010, compared with 736 million pounds a year earlier. Consequently, the cotton product trade deficit for the first 6 months of 2010 totaled 3.7 billion pounds, or 14 percent more than in 2009.

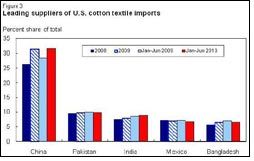

Meanwhile, the leading trading partners with the United States continue to account for an increased share of the U.S. cotton textile and apparel market during the first half of 2010. For U.S. imports, the top five suppliers combined for nearly 64 percent of the total during January-June 2010, compared with 61 percent a year earlier and 62 percent for calendar year 2009 (fig. 3). While each of the top five suppliers' volume grew, their shares were mixed with only China showing appreciable growth during the first half of 2010.

For U.S. cotton product exports, the top five destinations through the first 6 months of 2010 accounted for over 85 percent of the total, slightly below the corresponding period in 2009 but similar to the entire calendar year. Of the top five export destinations, quantity increases were noted for Honduras, Mexico, and the Dominican Republic versus a year ago.

As a result of this month's adjustments, the 2010/11 ending stock estimate is 2.7 million bales, 300,000 bales below last season. In addition, the stocks-to-use ratio is forecast to fall from 19 percent to 14 percent by season's end. Both the stock level and ratio are their lowest since 1995/96. As a result, cotton prices have remained relatively high. The 2010/11 average upland cotton farm price is now forecast to range between 63 and 77 cents per pound. The midpoint of 70 cents would represent a 12-percent increase from last season.

U.S. Textile Trade and Trade Deficit expand in First Half of 2010

U.S. textile trade grew during the first half of 2010, compared with a year ago. Total imports during the first 6 months of 2010 reached nearly 8.4 billion (raw-fiber equivalent) pounds, 15 percent above a year ago. During the same period, textile exports expanded 21 percent to 1.8 billion pounds. As a result, the textile trade deficit for January-June 2010 increased to nearly 6.6 billion pounds or 14 percent above the corresponding period in 2009.

Cotton products continue to account for the majority of U.S. textile and apparel trade. During the first half of 2010, cotton product imports approached 4.6 billion pounds, up from 4.0 billion during the first half of 2009. Similarly, cotton textile exports increased to 870 million pounds through June 2010, compared with 736 million pounds a year earlier. Consequently, the cotton product trade deficit for the first 6 months of 2010 totaled 3.7 billion pounds, or 14 percent more than in 2009.

Meanwhile, the leading trading partners with the United States continue to account for an increased share of the U.S. cotton textile and apparel market during the first half of 2010. For U.S. imports, the top five suppliers combined for nearly 64 percent of the total during January-June 2010, compared with 61 percent a year earlier and 62 percent for calendar year 2009 (fig. 3). While each of the top five suppliers' volume grew, their shares were mixed with only China showing appreciable growth during the first half of 2010.

For U.S. cotton product exports, the top five destinations through the first 6 months of 2010 accounted for over 85 percent of the total, slightly below the corresponding period in 2009 but similar to the entire calendar year. Of the top five export destinations, quantity increases were noted for Honduras, Mexico, and the Dominican Republic versus a year ago.

U.S. Department of Agriculture (USDA)

Popular News

Leave your Comments

Editor’s Pick

-Ltd..jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)