RBI announces additional measures to aid economy

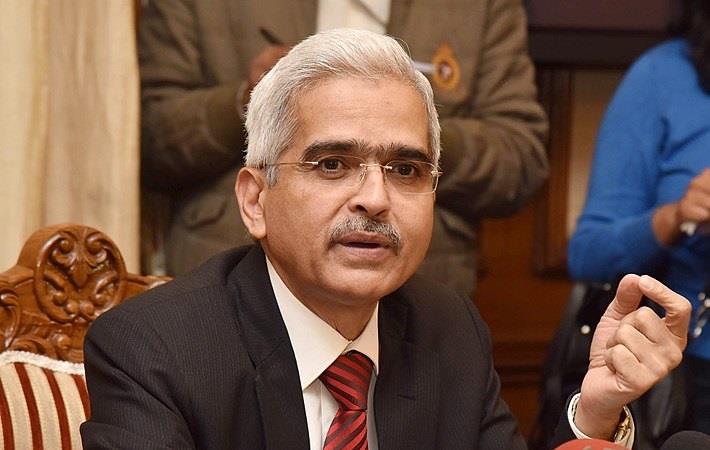

"The policy actions complement and strengthen each other in intent and reach," RBI Governor Shaktikanta Das said in a statement.

The policy measures announced today are:

(A) Measures to Improve the Functioning of Markets

Refinancing Facility for Small Industries Development Bank of India (SIDBI)

The RBI had earlier announced a special refinance facility of ₹15,000 crore to SIDBI at RBI’s policy repo rate for a period of 90 days for onlending/refinancing. In order to provide greater flexibility to SIDBI, it has been decided to roll over the facility at the end of the 90th day for another period of 90 days.

Investments by Foreign Portfolio Investors (FPIs) under the Voluntary Retention Route (VRR)

Since its introduction, the VRR scheme has evinced strong investor participation, with investments exceeding 90 per cent of the limits allotted under the scheme. In view of difficulties expressed by FPIs and their custodians on account of COVID-19 related disruptions in adhering to the condition that at least 75 per cent of allotted limits be invested within three months, it has been decided that an additional three months time will be allowed to FPIs to fulfil this requirement.

(B) Measures to Support Exports and Imports

The deepening of the contraction in global activity and trade, accentuated by the rapid spread of COVID-19, has crippled external demand. In turn, this has impacted India’s exports and imports, both of which have contracted sharply in recent months. In view of the importance of exports and imports to the economy certain measures are being taken to support the foreign trade sector.

Export Credit

In order to alleviate genuine difficulties being faced by exporters in their production and realisation cycles, it has been decided to increase the maximum permissible period of pre-shipment and post-shipment export credit sanctioned by banks from the existing one year to 15 months, for disbursements made up to July 31, 2020.

Liquidity Facility for Exim Bank of India

In order to enable EXIM bank to meet its foreign currency resource requirements, it has been decided to extend a line of credit of ` 15,000 crore to the EXIM Bank for a period of 90 days (with rollover up to one year) so as to enable it to avail a US dollar swap facility. Extension of Time for Payment for Imports 22. With a view to providing greater flexibility to importers in managing their operating cycles in a COVID-19 environment, it has been decided to extend the time period for completion of outward remittances against normal imports (i.e. excluding import of gold/diamonds and precious stones/jewellery) into India from six months to twelve months from the date of shipment for such imports made on or before July 31, 2020.

(C) Measures to Ease Financial Stress

The RBI had earlier, on two separate occasions (March 27 and April 17, 2020), announced certain regulatory measures pertaining to (a) granting of 3 months moratorium on term loan installments; (b) deferment of interest for 3 months on working capital facilities; (c) easing of working capital financing requirements by reducing margins or reassessment of working capital cycle; (d) exemption from being classified as ‘defaulter’ in supervisory reporting and reporting to credit information companies; (e) extension of resolution timelines for stressed assets; and (f) asset classification standstill by excluding the moratorium period of 3 months, etc by lending institutions.

In view of the extension of the lockdown and continuing disruptions on account of COVID-19, the above measures are being extended by another three months from June 1, 2020 till August 31, 2020 taking the total period of applicability of the measures to six months (i.e. from March 1, 2020 to August 31, 2020). The lending institutions are being permitted to restore the margins for working capital to their original levels by March 31, 2021. Similarly, the measures pertaining to reassessment of working capital cycle are being extended up to March 31, 2021.

Additionally, it has been decided to permit lending institutions to convert the accumulated interest on working capital facilities over the total deferment period of 6 months (i.e. March 1, 2020 up to August 31, 2020) into a funded interest term loan which shall be fully repaid during the course of the current financial year, ending March 31, 2021.

In view of the current difficulty in raising resources from capital markets, the group exposure limit of banks is being increased from 25 per cent to 30 per cent of eligible capital base, for enabling corporates to meet their funding requirements from banks. The increased limit will be applicable up to June 30, 2021.

(D) Measures to ease financial constraints faced by State Governments

Consolidated Sinking Fund (CSF) of State Governments - Relaxation of Guidelines

In order to ease the bond redemption pressure on states, it has been decided to relax the rules governing withdrawal from the CSF, while at the same time ensuring that depletion of the Fund balance is done prudently. Together with the normally permissible withdrawal, this measure will enable the states to meet about 45 per cent of the redemptions of their market borrowings, due in 2020-21. This change in withdrawal norms will come into force with immediate effect and will remain valid till March 31, 2021.

Fibre2Fashion News Desk (RKS)

-Ltd..jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)