India has the second largest population in the world. Even if a brand is able to tap 25 per cent of the total population, it can become a market leader. Most studies term the Indian retail market an upcoming one for both consumers and sellers. It is a market that is creating space for all textile industry stakeholders to try new concepts and innovative ideas in designing and marketing.

For the success of any project or market, a few factors and trends play an important role and this article maps ten such key factors or drivers of the Indian retail market for its future growth. However, before discussing the drivers, let us take a look at the following statement by Fab India managing director William Bissell, which very well defines today's consumer and his requirements:

"Customers are moving to one of two responses to retail. Either they are responding to products as commodities, or investing in curated products and experiences. We will continue to focus on the quality of our design and curation."

Figure 1: Stakeholders of Indian retail market

Key Trends in Industrial Economy

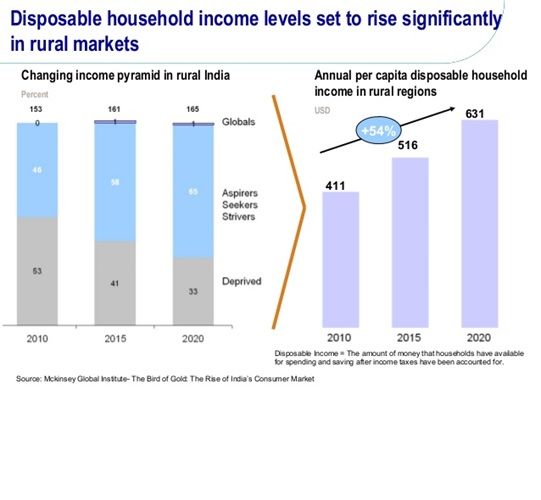

Increase in disposable income and global consumption: The income of an average Indian has increased manifold, leading to a rise in spending capability. This has led to an increase in demand and supply of products. It is predicted that an average Indian's annual income which is supposed to be $18,500 by 2020 would rise up to $6,400 by 2015. The Indian consumer's spending capacity is being projected to be $3.6 trillion by 2020, with maximum annual expenditure on food, household items, transport and communication. According to various studies and reports, India's global consumption share is expected to double to 5.8 per cent by 2020 and the retail sector could also double to $1.1-1.2 trillion by 2020 from $630 billion in 2015. The retail sector accounts for over 10 per cent of the country's gross domestic product (GDP) and around 8 per cent of employment. It is quite evident that disposable income is going to affect the Indian retail

industry in a major way in the next five years. The retail industry is now going to be more consumer-centric. Giving priority to consumers and their needs would generate business for any retail industry.

Rapid automation: The Indian retail sector is expanding to suffice the requirement of a rising population, which has led to rapid industrialisation of the textile sector. To maintain a balance between demand and supply chain, the sector is moving away from traditional products and is working to manufacture technically superior materials that can be quickly supplied in huge quantities.

India is being seen as the most desirable retail destination in the world by many foreign brands in different segments. However, with the 15-20 per cent growth observed in this industry, a major problem is its low organised retail penetration of 8 per cent. According to Neilson report, the Indian consumer confidence index is on a positive trajectory and the household consumption per capita expenditure, according to a World Bank report, is growing at 5 per cent, which is next to China. All this foretells well for India's retail growth story.

Key trends in consumer behaviour

Spontaneous buying behaviour: Today's consumers are impulsive shoppers and they want to buy things quickly. The sudden demonetisation in 2016-end made digital payments more popular and acted as a catalyst for consumer spending. This trend will rise with the increase in popularity of credit and monthly installment schemes. Companies like Bajaj Finserv and private and government banks are working in a big way to offer installment schemes and other benefits with hassle-free documentation to consumers for buying products. With these easy loan options, consumers can increase their expenditure budget to a considerable extent. Bajaj[D1] Finance says loans for apparel, footwear and accessories are a bigger opportunity than for consumer durables or mobiles.

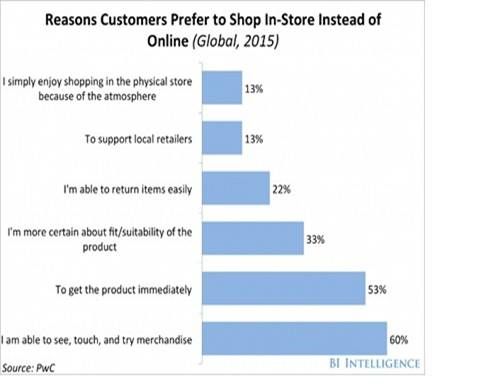

E-commerce: Shopping through e-commerce has become exceptionally trouble-free for consumers using smart phones and Internet. This section is well tapped in both rural and urban areas by omni channels. Promotions of new products on Internet, mobile apps and social network tools are expected to take over print media in future. However, brick and mortar retailers are also strengthening their presence as the presence of such stores along with the online option offers the seller the advantage of better understanding consumer psyche.

Figure 3: The advantage of Brick and Mortar Retailers over Online retailers

Source: National Association of Retailers: Information Services / Blog

The e-commerce market is expected to reach $125 billion in terms of its gross merchandise value, growing at the rate of 31 per cent, by 2020. Around 250 million Indians are expected to be shopping online, spending more than $50 billion annually by 2020, according to a 2016 study published by Price Waterhouse Coopers (PWC).

Competition in the textile sector is going to rise manifold in the next three years and it will be tough for companies to carve out a niche model to engage customers.

BI Intelligence in 2015 reported the following six factors influencing the strategy of US brick-and-mortar retailers to win back shoppers. These now apply to the Indian scenario as well.

|

(1) Modernisation: About 68 per cent of Indian population resides in rural areas. This big consumer segment plays an important role. According to a 2014 Nielson report, the rural market contributes 35 per cent of the total sales of consumer packaged goods in India. Another report by the Indian Brand Equity Foundation said India's per capita GDP in rural areas has grown at a compounded annual growth rate of 6.2 per cent since 2000. The fast moving consumer goods (FMCG) sector in rural and semi-urban India is expected to cross $20 billion mark by 2018 and reach $ 100 billion by 2025. Retail brands like Lifestyle, Shoppers Stop and Westside are gradually focusing more on tier-II and tier-III cities as incomes are rising there along with brand awareness.

(2) Private labels: Many designers and multi-brand retailers are launching their private labels customised for different age and income groups. As in a demographically shifting India, where, according to a PWC study, about 64 per cent of the population will be in the 15-59 age group by 2021, leading retail chains are fuelling growth by increasing the reach of their private label range and offering contemporary ethnic styling. The indutvas or ethnicwear segment is also seeing a lot of aggressive expansion from newer players.

(3) Convenient and experiential shopping: Specialty stores, where products are showcased to highlight their utility offering sensory experience, will be a big hit in future. For example, the Van Heusen Style Studio in Bengaluru offers a virtual trial mirror where shirts, tees or trousers can be virtually previewed by customers on themselves without stepping into a physical trial room. An infra-red scanning device is available to take body measurements without hassles. Bengaluru-based Revxx Hardware Accelerator has reportedly worked on making a smart Airflash retail store using technology based on Internet of Things (IoT) the interconnection via the Internet of computing devices embedded in everyday objects where customers can experience products unboxed. Other possible solutions include sensor-ridden smart systems that can track facial expressions and eyeball movements of buyers while they look at products and analytical models to enable retailers to understand the co-relation between products purchased together.

(4) Development of new consumer segments: Consumers today are aware of the pros and cons of most products they use. Therefore, designers and manufacturers are

working on creating eco-friendly products in almost all categories. Pottery using terracotta, glass and ceramics are now high-end products. There is also a shift in Indian consumer preference to indigenous apparel brands like Manyavar, Fabindia Overseas, Anokhi and Sabhyata. As economies grow, retailers also need to identify newer consumer segments, such as high aspirational trendsetters, time-starved and rurban, who have strong local preferences.

(5) Customised products: There is hardly any brand in India that offers customised goods as per individual requirements on a large scale. Indians depend on small boutiques or tailors for that need. With rise in varying personal tastes and design requirements, brands will have to work on customised products. At present, brands offer options to the consumer to choose from their fixed product menu, which many a times forces a consumer to buy a product which he may not be wholly interested in. Bakery and chocolate brands offer customised products. In textiles, Raymond offers tailoring garments as per the requirements of customer and has succeeded in achieving growth in the apparel sector.

(6) Shopping with learning: This new concept, in which a seller offers its service along with workshops for consumer knowledge and awareness, is yet to take off in India. These workshops can attract consumers even if they don't buy any product.

The Indian shopping scene is changing and the noticeable transformation is being driven by expanding livelihoods, young demographic profile of buyers, Internet and smart phones, health and environment awareness, technical advancements and the increasing intricacy of making choices owing to an expanded product range. These drivers are reshaping where, what and how buyers purchase and how they need to be served.

India's overall retail prospect is considerably high and a rise in e-commerce is backed by the government's 'Make in India', Digital India and Start-up India initiatives. India's textiles and apparel sector have come forward to adapt and implement Western ecological and environmental standards which is a boon for retailers.

About the authors: Fauzia Jamal is senior guest faculty at National Institute of Fashion Technology, New Delhi, and Anu Sharma is an assistant professor at the same institute.

Comments