While nothing is inherently new about selling used clothes, the projected growth rate of 15 per cent annually over the next five years announces a growing trend within the apparel industry. Clothing brands are turning to re-commerce partners to tap into secondary markets for apparels. International trade is not only about new products. A wide variety of used or refurbished consumer and capital goods are also sold on international markets in the clothing sector. The second-hand clothing market is growing and becoming bigger every year. More than 70 per cent of the world's population uses second hand clothing. The average lifetime of a cloth is approximately three years. And nearly 100 per cent of textiles and clothing are recyclable. There is more demand now for quality second hand clothes around the world. Given the significant environmental impact of fashion and apparel industry in general, and fast fashion in particular, the implications of these facts could be significant.

At present the second-hand apparel retail is a $20-billion industry globally and its significant growth will outpace traditional retail, which has only 2 per cent projected annual growth, according to ThredUp's 2018 Resale Report. Given that second hand clothing sales exist regardless of whether brands approve, the opportunity is obvious. Brands can make a margin on selling the same garment multiple times while maintaining brand and quality control. Hence the trend where many online stores offer platform for potential buyers of second-hand clothes will continue to exist.

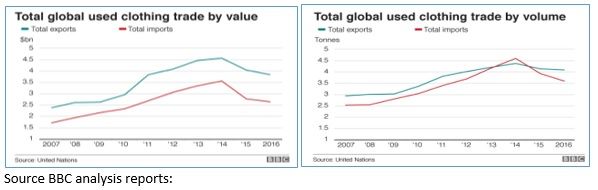

The consumption market of second-hand clothes touches 4 billion with major stakeholders coming from Asia (26 per cent), Africa (35 per cent) and Europe (27 per cent) and the rest of the world nations sharing the rest. As per a BBC analysis of data received from a United Nations report shown below, the global export market for worn and used clothing is about $4 billion and the import/export business of used clothing has not seen much improvement over the past few years, both in terms of volume and value.

The United States ($575.5 million) and Italy ($118.6 million) are among the leading exporters of used clothing globally whereas African nations like Uganda ($72.3 million) and a few Asian nations like Pakistan ($239.5 million) are among the leading importers of second-hand clothing.

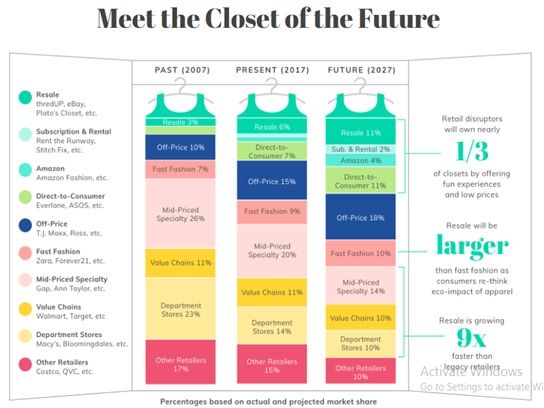

At present only apparel segment shares the pie part of whopping 41 per cent from the resale segment and it is expected to grow 24 times faster than fresh retail sale. Thus, resale is capturing market share and the global resale market for apparel will reach $41 billion by 2022, according to threadup.com.

Source: www.threadup.com

It is a win-win situation for both buyers and sellers. The buyer gets hefty discounts, better brands and purchase satisfaction, whereas the seller gets a good market, quick distribution and business. In this case, deeper discounts attract bargain hunters and companies also get profit margins covered. At present, big departmental stores contribute to sale of 14 per cent of the total share and it is expected to go down by 4 per cent by 2022. The share of resale directly to consumers is 7 per cent at present and it is expected to grow to 11 per cent, courtesy online resale. An expected number of 71 per cent more consumers plan to spend more on resale shopping than fresh purchase and that is a good indication of good days ahead for the second-hand apparel market.

Courtesy: www.thredup.com

The above graph from Thredup shows the expected nine-fold growth in retail sale of second hand clothes.

A few African nations like Rwanda have increased tariffs and are planning to ban the import of second hand clothes from big exporters like the United States and Europe by 2019 to reduce its negative impact on local manufacturers.

The second hand clothes sector now is a big employer in East Africa, both directly and indirectly, largely in sales and distribution. So, while second hand clothes imports do undercut local producers and traders, they also provide employment - and local textile producers are up against cheap, efficient producers in Asia and elsewhere.

Second hand clothing and accessory stores in Asian countries like Japan, Thailand, China are looking to expand into other neighbours where demand for used goods is rising. The companies plan to sell pre-owned Japanese apparel as well as domestically-sourced items, the market for which is growing, driven by the rise of the region's middle-income bracket. The notable fact is that since the beginning of fiscal 2018, sales in Thailand are up 20 per cent year on year. Similarly, with a combined annual sales target of over $18 million, another series of stores are planned in Malaysia and other nearby nations.

Almost 35 per cent of Europeans claim to have used second hand clothes. With awareness of environmental impact and online retail of used clothing, this number has significantly improved over the years. Among these, Italians (60 per cent), Hungarians (40 per cent) and Poles (35 per cent) have become more conscious about buying second hand goods. The earlier concept of charity is getting replaced by business owners and private operators who get exports from the United States, the United Kingdom, Germany and the Netherlands. The market is booming in Eastern European countries where the mushrooming of second hand stores in Poland, Bulgaria, Croatia and Hungary is a good indicator in the last six years.

More and more consumers are now driving an explosive growth in the fashion industry in Latin American countries like Brazil and Argentina. As the 2018 market was worth more than $160 billion, with 2018-2019 growth projected at up to 7.5 per cent, one can think of the potential that exists for second hand clothing in these markets. That makes it a much easier market to penetrate than the mature and slower-growing US and EU markets. And this means that it is a destination rich with potential for shipping clothing from US-based e-commerce retailers. The main countries where used clothes are welcome are Panama, El Salvador, Costa Rica, Guatemala, Honduras and Nicaragua. For thousands of people, the market's biggest attraction is the second hand section where donated clothes from United States, for example, gets sold through retailers who set up stalls in places like Bolivia's El Alto market.

The world has learnt that the main benefit of textile recycling activities is the opportunity to reuse clothing. Through the reuse of clothes and textiles, we can avoid pollution and energy-intensive production of new clothing. Additionally, clothing that cannot be reused may be repurposed into such products as rags or recycled into fabric or other material for reprocessing.

References:

1. Wikipedia.org

2. Bbc.com

3. Thredup.com

4. Africanews.com

5. Shenglufashion.com

About the author: Sulakshna Sharma writes on textile issues.

Comments