Indonesian textiles and clothing exports is growing at a rate marginally faster than that of the country's GDP, but the overall downward trend continues. A Market Intelligence (MI) report from Fibre2Fashion.

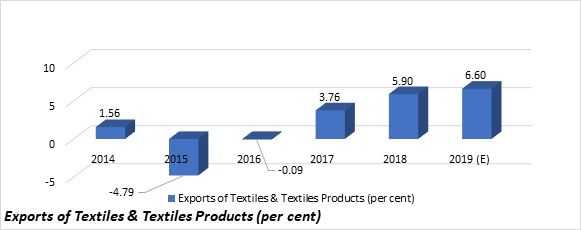

The export value of Indonesian textiles and clothing products increased to $13.28 billion in CY (calendar year) 2018 from $12.54 billion in CY 2017 with a growth rate of 5.90 per cent, according to textile association Asosiasi Pertekstilan Indonesia (API). The growth rate of the Indonesian textiles and clothing industry was higher than the country's GDP growth rate of 5.17 per cent in 2018.

Exports of cotton and cotton products have been showing a consistent downward trend due to the continued fall of the Indonesian rupiah, fierce competition among yarn spinners in both domestic and overseas markets, shutdown of some major retail markets, uncompetitive cotton yarn prices for exports, and weak demand from export destinations. This also affected growth in cotton use in MY (market year which starts on August 1) 2018-19. Consequently, cotton imports have shown a slight increase and reached 772,929 metric tonnes in MY 2018-19.

Growth in Exports of Textiles and Textile Products

There has been a consistent increase in exports of textiles and textile products from Indonesia since CY 2017. During this period, an Indonesian trade delegation visited the US in July 2018 and committed to the predominant use of US cotton. US-China trade tensions too have resulted in more Indonesian garments being exported to the US and more cotton imported from the US. American cotton is still preferred over other varieties as it is of higher quality and more consistent. Now, with the conclusion of the Indonesia-European Comprehensive Economic Partnership Agreement (IEU-CEPA) in 2019 textile exports to the European market is expected to increase.

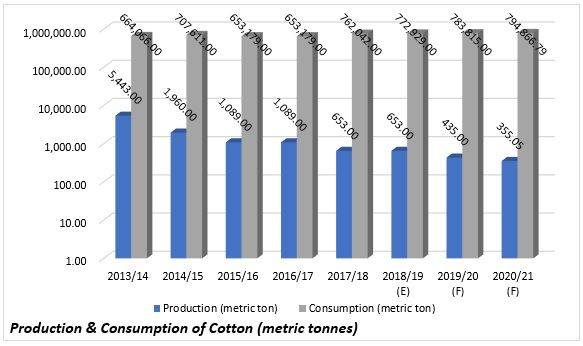

Production of Cotton

Cotton production in Indonesia is not significant due to the preference for non-agricultural produce and production of higher margin crops such as rice and corn. In fact, cotton production has been declining since MY 2013-14. That year, Indonesian cotton production was 5,443 metric tonnes, which plunged to 653 metric tonnes in MY 2018-19-registering a huge drop of 4,790 metric tonnes. This is expected to drop further to 355.05 metric tonnes in MY 2020-21.

According to reports, the margins of smaller millers have reduced, who are now unable to increase yarn prices. Therefore, some have temporarily halted production. Moreover, domestic players are competing with imports from Vietnam and Bangladesh. According to the ministry of agriculture, the cotton production reported in MY 2018-19 was 51 per cent in South Sulawesi region, 25 per cent in East Nusa Tenggara and 8 per cent each in East Java and West Nusa Tenggara.

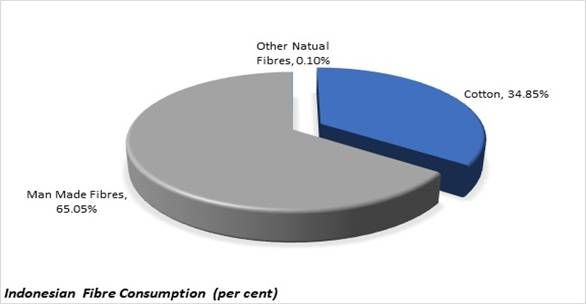

Consumption of Cotton and Fibres

Cotton consumption of Indonesia in MY 2018-19 remained at 772,929 metric tonnes. It is expected to rise to 794,866.79 metric tonnes in MY 2020-21 with a growth rate of 2.84 per cent following expansion by larger mills and increased global production and demand.

Out of the total fibre consumption in Indonesia, cotton accounts for 35.85 per cent which is fulfilled by US cotton imports. Manmade fibres make up for an overwhelming 64.05 per cent, while other natural fibres contribute just 0.10 per cent to the total fibre consumption.

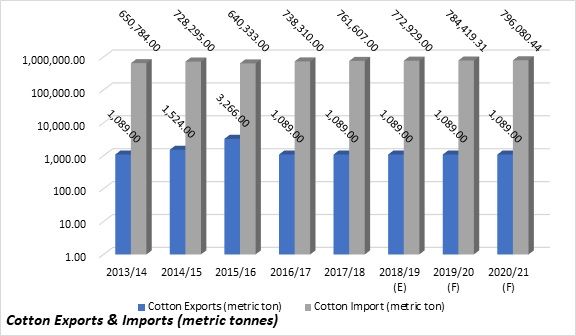

Cotton Exports and Imports

Indonesia's cotton exports in MY 2013-14 was 1,089 metric tonnes, which increased till MY 2015-16 and then dropped again in MY 2018-19 to 1,089 metric tonnes. It is expected to remain stable in MY 2020-21 at the same number. On the other hand, cotton imports are very high as compared to the exports and continue to increase. Cotton imports are expected to grow by 3 per cent in MY 2020-21 to 796,080.44 metric tonnes from 772,929.00 metric tonnes in MY 2018-19. Cotton imports are expected to increase in MY 2019-20 at a rate of 1.48 per cent to 784,419.31 metric tonnes.

Trade Partners

The major export destinations for Indonesian textile products are US (32.87 per cent), Japan (10.08 per cent), China (5.7 per cent), and South Korea (4.7 per cent). The domestic demand of textiles in Indonesia, however, continues to drop in the face of competition from low-cost imports.

Indonesia is now a major cotton importing country with no growth expectations in exports. The demand for US cotton remains high as domestic players favour American cotton and the Indonesian government has been promoting it in order to boost the country's bilateral trade with the US. Cotton imports are expected to increase in the event of expansion of mill infrastructures with higher production capacities. Meanwhile, cotton imports from the US reached a record $602 million in 2018 which allowed the US to regain its position in becoming the leading supplier of cotton to the country with a market share of 35.3 per cent followed by Brazil (25.2 per cent) and Australia (9.3 per cent).

Major Cotton Tariffs in Indonesia and Trade Agreements

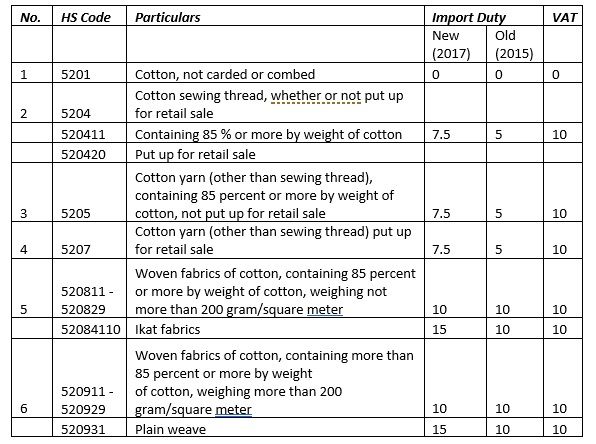

Tariffs

Trade Agreements

Cotton Yarn Exports and Imports

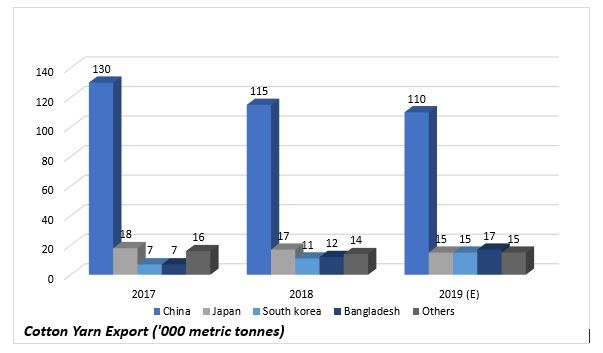

Indonesia's cotton yarn exports in CY 2017 was 178,000 metric tonnes, which dropped by 5.05 per cent to 169,000 metric tonnes in CY 2018. It is expected to increase slightly by 1.78 per cent to 172,000 metric tonnes in CY 2019. China, Japan, South Korea and Bangladesh are the major cotton yarn export destinations for Indonesia with China accounting for 65-70 per cent over the years.

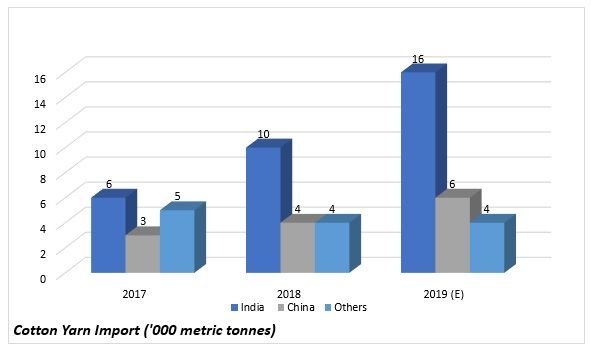

Indonesia's cotton yarn imports in CY 2017 was 14,000 metric tonnes, which rose by 22.22 per cent to 18,000 metric tonnes in CY 2018. It is expected to increase to 26,000 metric tonnes in CY 2019. India and China are the major cotton yarn suppliers for Indonesia, with India accounting for 42.85 per cent, 55.56 per cent and 61.53 per cent in CY 2017, CY 2018 and CY 2019 respectively.

Usually, raw cotton accounts for 50 per cent of cotton yarn production costs. Competitiveness of Indonesian cotton yarn has reduced in the export market due to rising production costs as compared to other cotton exporting nations. Increasing production costs have resulted in closure of some small-scale spinning mills, while others are struggling with cash flow problems. Prominent large-scale cotton mills with strong capital flows have been buying these mills. With rising production costs, textile manufacturers are now seeking to increase exports as a proportion of total production.

Comments