The Indian Textiles and Clothing (T&C) industry plays acrucial role in the Indian economy and contributes about 7 percent ofindustrial production and 2 percent of Gross Domestic Product (GDP) of thecountry.

Industryalso creates employment opportunities for about 45 million people andaccounts for 12.57 percent of the export of the country with a share of5.03 percent in textiles (HS Chapter 50 to 60) and 7.54 percent inclothing and made-ups (HS Chapter 61 to 63) in the global market during 2017.

The domesticdemand of textiles, which is characterised by demand from Household andNon-Household sector, plays a significant role in the overall growth andperformance of the

In orderto estimate the domestic demand for Textiles and Clothing in the Householdsector, the Textiles Committee has been publishing an Annual Report titled“Market for Textiles and Clothing (MTC)” since the year 1969.

The reportestimates the per capita and aggregate demand of textiles & clothing in thecountry by region, gender, area, income group etc. besides estimating thepreference pattern by fibre, product groups viz. woven apparels, knittedapparels, home textiles, etc. in the Household sector of the country. This isthe only authenticated report available in the country, which provides domesticmarket size of textiles at dis-aggregated level.

The reportis published on the basis of the textile purchase data collected bi-monthlyfrom selected panel Household across the country. The data base generated fromthe collected data is analyzed and findings of the report are published in theform of an annual Report. The latest annual report “Market for Textiles and Clothing (MTC): NationalHousehold Survey 2017” has been prepared by the TextilesCommittee. Besides, estimating the domestic demand for 2015 & 2016, thereport has also

The key findings of the “Market for Textiles and Clothing (MTC)”are as follows:

1. Domestic demand of Textiles in the Household sector:

Theoverall market size of

Thus, the Household sector contributed 53.39 percent to the overall market size of the Textiles and Clothing and the same has been analysed in detail in the MTC, 2017.

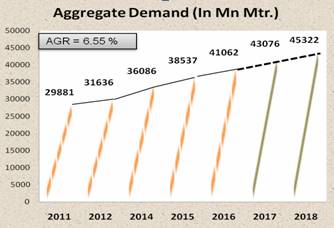

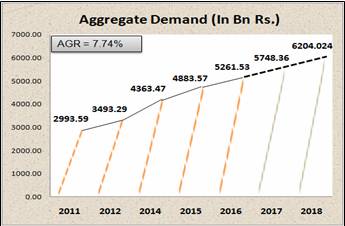

2. Aggregate demand for Textiles & Clothing in Household sector in terms of quantity and value:

The aggregate demand for Textiles & Clothing was 41.06 billion metres in 2016 as compared to 38.54 billion metres in 2015 and have experienced an annual growth rate of 6.55 percent and demand is expected to touch 45.32 billion. metres by 2018, growing at a Compound Annual Growth Rate (CAGR) of 5.34 per cent between 2011-2018.

In terms of value, the demand has increased to Rs.5261.53 billion in 2016 as compared to Rs.4883.57 billion in 2015 and has experienced an annual growth rate of 7.74 percent and demand is expected to touch Rs.6204.02 billion by 2018, with CAGR of 9.54 per cent between 2011-2018.

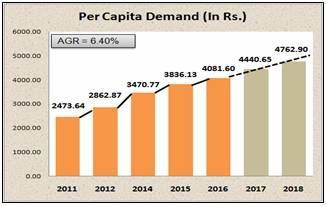

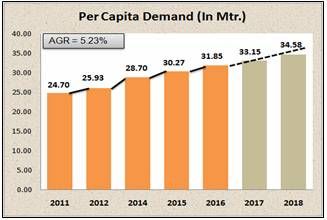

3. Per Capita Demand for Textiles & Clothing in the Household Sector:

The per capita demand for textiles was Rs. 4081.60 in 2016 as compared to Rs. 3836.13 in 2015 and has experienced a growth of 6.40 percent and the per capita demand is expected to touch Rs.4762.90 by 2018, with a CAGR of 8.53 per cent between 2011-2018.

On the other hand, the per capita demand for textile in terms of quantity has increased to 31.85 metres in 2016 as compared to 30.27 metres in 2015 with a growth of 5.23 percent during the period, and the per capita demand is expected to touch 34.58 mtrs. by 2018, with a CAGR of 4.30 per cent between 2011-2018..

The change in per capita demand indicates that an average person’s consumption of textile has increased by 1.58 metres during the period 2015-16. It is pertinent to mention that while the growth in demand was 6.91 percent in the urban area, it was 6.01 percent in the rural area during the same period.

Fibre wise Demand for Textiles:

The aggregate demand for cotton fibre based product was 17.22 billion metres in 2016 as compared to 16.51 billion metres in 2015 and has experienced an annual growth of 4.28 percent and aggregate demand is expected to touch 19.29 billion meters by 2018. The demand for manmade fibre based product was 23.34 billion metres in 2016 as against 21.60 billion metres in 2015

with a growth of 08.04 percent which is expected to touch 25.46 billion metres by 2018.

Similarly, the aggregate demand for pure silk and woolen fibre based product was 0.34 and 0.16 billion metres respectively in 2016 as against 0.27 and 0.15 billion metres in 2015, showing a positive growth of 25.18 percent and 8 percent respectively, which is expected to touch 0.37 and 0.20 billion metres respectively by 2018.

The survey reveals that out of the total aggregate consumption of 41.06 billion million metres (Per Capita 31.85 metres) of textiles in the year 2016, Manmade and Blended/Mixed textiles together have the largest share of 56.83 percent followed by Cotton textiles with 41.94 percent, Pure Silk textiles with 0.84 percent and Woolen textiles with 0.39 percent. Hence, the demand for manmade fibre based products has been growing and contributing significantly to the overall demand in the Household sector.

1.Demand for Textiles as per the Sector of Manufacturing:

The Mill/ Powerloom sector has contributed 33.97 billion metres (82.72 percent) to the overall demand for textiles in 2016 compared to 31.85 billion metres in 2015 (82.65 percent). Similarly, the Knitted sector has contributed 4.94 billion metres (12.04 percent) to the total basket in 2016 as against 4.77 billion metres (12.39 percent) in 2015.

At the same time, the handloom sector contributed 5.24 percent to the total demand for textiles in the Household sector. The aggregate demand for handloom textiles is 2.15 billion metres in 2016 as compared to 1.91 billion metres (4.96 percent) in 2015. The demand for handloom textiles has increased by 12.66 percent as compared to the previous year.

The projected aggregate demand for textiles by sector of manufacturing is estimated for Mill made/ Power loom, Knitted/Hosiery and Handloom sector to be 37.24 billion Metres, 5.56 billion Metres and 2.53 billion metres respectively for the year 2018.

2.Major Varieties demanded by the Household sector:

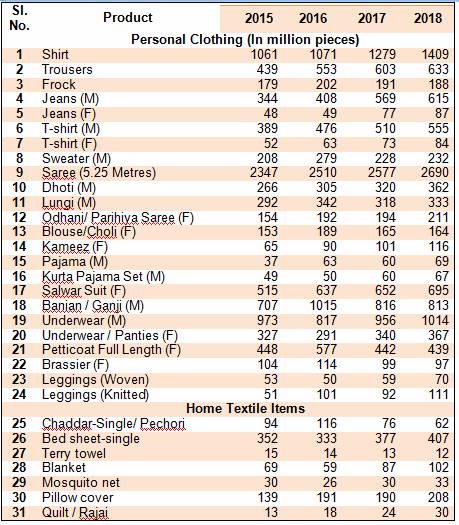

Some important varieties which are highly demanded in the Household sector pertains to (i) personal clothing and (ii) home textiles.

Among the personal clothing’s, products like shirt, trousers, frock, skirt midi, jeans (male and female), sweater, saree, kurta pyjama, leggings constitutes the major varieties in the reference period. Similarly, the inner wears like Banian, underwear, briefs, petticoat, panties, brassiere, are also contributing a major chunk of demand in the personal clothing categories.

The MTC 2017 report indicates that the market size of personal clothing items was 37.87 billion metres during 2016 as against 35.52 billion metres in 2015 and has experienced a growth of 6.60 percent during the reference period. The

market size of personal clothing items is expected to touch 39.64 billion metres during 2017 as against 41.66 billion metres in 2018 and experiencing a growth of 5.08 percent during this same period.

Demand for some major varieties from Personal Clothing & Home Textiles:

As regards Home textiles items, products like chaddar, bedsheets, towel and terry towels contributed significantly to this segment. In addition, the products like mosquito net, pillow cover or cushion cover, furnishing materials, blankets have also increased their presence in the product basket.

Conclusion

The demand for the Household sector is the major contributor to the overall growth of the sector with 53.39 percent (USD 78.28 billion) share in the total market size, which is expected to touch 54.90 percent (USD 89.88 billion) in 2018. While the export of T&C decreased at 4.66 percent and the demand in Household & non-Household sector grew by 2.82 and 1.51 percent respectively

during 2016. For the year 2018, is the exports are expected to increase by 12.79 percent, whereas the demand in Household & Non-Household sectors are expected to increase by 14.82 percent and 2.89 percent respectively.

It is worth mentioning that the growth in Household demand for textiles has brought about additional demand for 2.53 billion metres of fabrics in 2016, which is expected to touch 4.76 billion metres in 2018 from 2015, which is pointer towards required capacity expansion in the fabrics manufacturing in the country. Similarly, the growing demand for the newly emerged products like legging etc. provides an indication at the change in preference pattern of the consumers in the country during the period. Hence, the many findings in the report may provide authentic data & insights for informed decision making by the businesses, trade & industry, researchers & policy makers etc.

Source: Executive Summary of ‘Market for Textiles & Clothing report 2017’ by Textiles Committee

_Big.jpg)

Comments