In Bangladesh, the readymade garments (RMG) industry acts as a catalyst for the prosperity of the nation and its competitiveness in international RMG market. Any brand with the 'Made in Bangladesh' tag, is considered as a high value brand across the world.

Bangladesh has maintained a 6 per cent average of annual GDP growth rate with its limited resources. The RMG industry, with the biggest export earning capacity, has become a significant industry of the country. This sector accounted for 83 per cent of total export earnings of the country in MY 2017/18 which reached over $30.61 billion of exports in 2017/18 financial year.

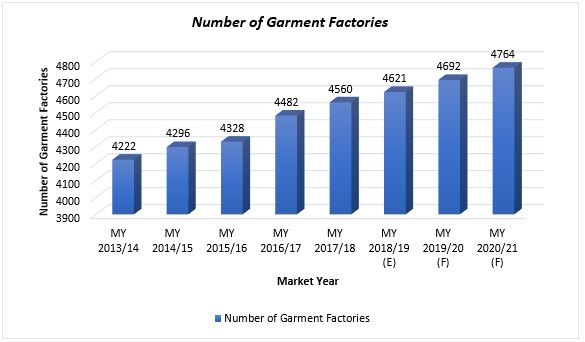

Number of garment Factories in Bangladesh

SOURCE: - BGMEA

The number of garment factories in the country is also increasing continuously with stable to high growth rate. In MY 2016/17, the number of factories in Bangladesh were 4482 and increased by 3.10 per cent to 4621 in MY 2018/19. It is expected to increase by CAGR of 1.53 per cent to 4764 in MY 2020/21 from MY 2018/19.

As a supply hub of the world, the Bangladesh garment industry is focusing on compliance and environmental sustainability. The count of green factories in Bangladesh is continuously increasing and has already exceeded the number 100. The cost of garment production has increased by 30 per cent in the country between 2014 and 2018. Also, the minimum wage of the garment workers has increased by 51 per cent since December 2018.

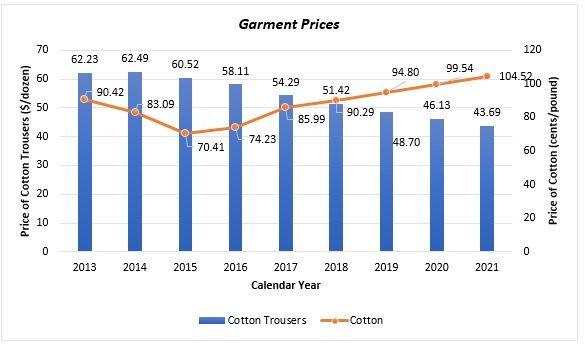

Garment Price Movements in Bangladesh

Despite the increase in the price of cotton, the main raw material for fabrics, the prices of Bangladeshi garments have started falling since the Rana Plaza disaster in April 2013.

A dozen of cotton trousers manufactured in Bangladesh sold for $62.23 in 2013 and dropped by 12.80 per cent to $54.29 per dozen in 2017, according to a finding by Worker Driven Social Responsibility Network (WSR). The price of cotton was 90.42 per cent per pound in 2013, it decreased to 83.09 in 2014 and 70.41 per cent in 2015. The prices of cotton continued to recover since 2016 and reached 85.99 per cent in 2017, according to the findings.

The prices of Bangladeshi garments are still following a downward trend with increased cotton prices because the international retailers are not ready to pay a fair price to local manufacturers and exporters.

In Bangladesh, the prices of the cotton play a very significant role in the industry as the production of cotton garments is still high compared to production of garments by man-made fibre or viscose fibre. Approximately 90 per cent of the total Bangladeshi garment exports are cotton based.

Garment Prices

SOURCE: - WORKER DRIVEN SOCIAL RESPONSIBILITY NETWORK

According to Bangladesh Garment Manufacturers and Exporters Association (BGMEA), the prices for EU and US have fallen by 3.64 per cent and 7 per cent respectively due to constant price pressure from brands and retailers as a result of volatile global consumption.

Bangladesh RMG Trade

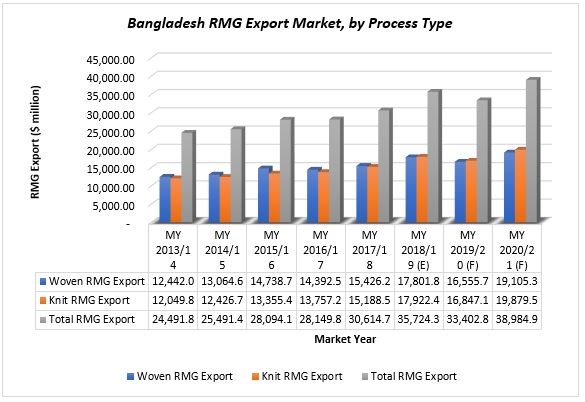

Bangladesh RMG Export Market, by Process Type

The total Bangladesh RMG export was $28,149.84 million in MY 2016/17 and increased by 26.90 per cent to $35,724.33 million in MY 2018/19. Total exports moved up by 16.69 per cent in MY 2018/19 over the previous year and is expected to reach $38,984.92 million in MY 2020/21 with a CAGR of 12.65 per cent from MY 2018/19.

SOURCE: - BGMEA

The total woven RMG export was $14,392.59 million in MY 2016/17 and increased by 23.69 per cent to $17,801.89 million in MY 2018/19. Total exports moved up by 15.40 per cent in MY 2018/19 over the previous year and is expected to reach $19,105.35 million in MY 2020/21 with a CAGR of 11.22 per cent from MY 2018/19. The total knit RMG export was $13,757.25 million in MY 2016/17 and increased by 30.28 per cent to $17,922.44 million in MY 2018/19. Total exports moved up by 18 per cent in MY 2018/19 over the previous year and is expected to reach $19,879.57 million in MY 2020/21 with a CAGR of 14.14 per cent from MY 2018/19.

The major export destinations for Bangladesh garments are the US and the EU. But currently neither of these markets are in recession. However, the exports are expected to decline in MY 2019/20. The major reasons for decline in exports are falling global consumption and devalued currencies in major competitor countries.

Presently, non-traditional markets contribute approximately 15 to 16 per cent of total RMG export earnings. The RMG export in MY 2019/20 showed negative growth in non traditional markets due to trade tensions between China and US, and declining price trend of raw materials, especially cotton and yarn.

The markets other than US, Canada and EU are considered as non-traditional markets. It includes Chile, China, Japan, India, Australia, Brazil, Mexico, Turkey, South-Africa, Russia.

According to Export Promotion Bureau (EPB), in the early months of current fiscal year, China started importing from Bangladesh as the Chinese government has allowed duty-free access to over 5,000 Bangladeshi products. In case of India, Bangladeshi garment exports showed positive growth with international brands such as Zara and H&M. Also, the domestic market of India has grown with growth in number of fashion-conscious consumers. Bangladesh imports raw materials for garments such as cotton and machinery from India. The RMG exports to Chile also showed negative growth.

The ongoing US-China trade conflict has strongly supported garment exports from Bangladesh. The Chinese manufacturers have started shifting their business to other regions due to rise in wages and tariff rise by the US government. Bangladesh offers quality products at a lucrative price, hence global retailers landed there to take the advantage.

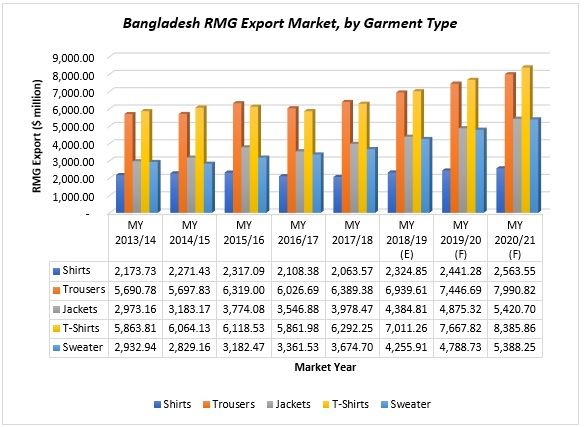

Bangladesh RMG Export Market, by Garment Type

Shirts, trousers, jackets, t-shirts and sweaters have made significant contribution to the Bangladesh RMG exports. Trousers and t-shirts contributed for the major part of the total exports. Trousers and t-shirts contributed 27.85 per cent and 28.14 per cent respectively in the total Bangladesh RMG exports for MY 2018/19. Out of all the above garment categories, export of sweaters and jackets have increased with a high growth rate of 26.60 per cent and 23.62 per cent respectively from MY 2016/17 to MY 2018/19.

The exports of shirts, trousers, jackets, t-shirts and sweaters are expected to increase by CAGR of 5 per cent, 7.31 per cent, 11.18 per cent, 9.36 per cent and 12.51 per cent to $2,563.55 million, $7,990.82 million, $5,420.70 million, $8,385.86 million and $5,388.25 million respectively in MY 2020/21 from MY 2018/19.

SOURCE: - BGMEA

According to BGMEA, the technological upgradation and extended winter due to western climate change, has promoted the export earnings of sweater. Installation of new technology has improved quality of products as well as capacity which led to increase in work orders by global buyers.

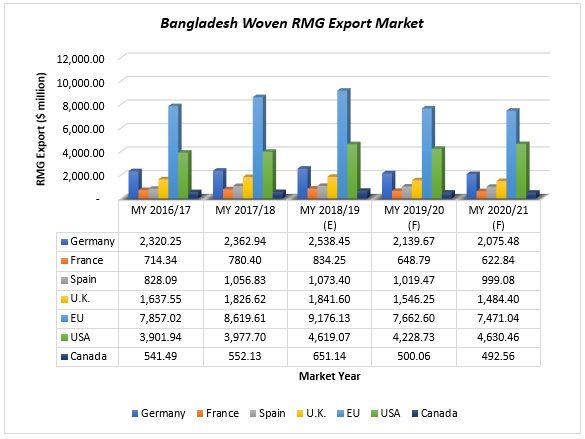

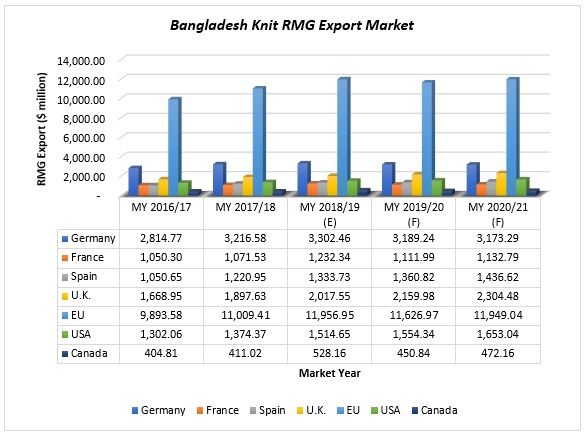

Bangladesh Woven and Knit RMG Export Market, by Countries

SOURCE: - BGMEA

SOURCE: - BGMEA

Government Initiatives to boost the RMG Export

1). Training programme for Skill Development

-

Government has initiated training programme forapproximately 15 lakh RMG workers in order to ensure sustainable development ofthe sector with the challenges of automation.

-

A "Training Conducting Committee" hasbeen appointed with 8 members, headed by the director general of EPB. The othermembers of the committee are from the textile cell of the Commerce Ministry,the Department of Labour, Labour and Employment Ministry, Department ofTextile, BEPZA, BGMEA, BKMEA, and deputy director (compliance and monitoringcell) of the EPB.

-

Approximately, there are 40-lakh workers inBangladesh's RMG sector and there is immense scope to employ more skilledworkforce. According to industry insiders, the skill enhancement of theworkforce can enable the sector to reach the targeted revenue of $50 billion.

-

According to the Centre for Policy Dialogue (CPD)- a leading institution for in-depth research and dialogue to promote inclusivepolicymaking in Bangladesh, and strengthen regional and global economic integration),around 13 per cent of the country's garment factories hired experts fromoverseas in the top-level management who remit over $500 crore from Bangladeshevery year. In merchandising, design, marketing and operation of sophisticatedmachines, the country needs experts from outside to fill in the gap.

2). Multi-modal Transport System

-

In order to solve the problems in transportation,government has planned a multi-modal transport system which is yet to beimplemented.

-

Multimodal Transport is the combination ofdifferent means of transport to facilitate the cargo movement.

-

It will be the centralisation of theresponsibility to one transport operator. It will increase the economies ofscale in transport negotiations. It will ensure better use of availableinfrastructure and reduction of indirect costs.

3). The government provides 4 per cent cash incentive to garment manufacturers which was set in 2018. Henceforth they have started to explore new destinations and markets.

Challenges in Logistics Industry

As per the World Bank (WB) report, the high transportation cost in Bangladesh is a major cause of compromise for the competitiveness of the country's RMG sector. The price of garments in the country have increased by 35 per cent due to transportation mess. It includes congestion on roads and seaports, high logistics costs, inadequate infrastructure, one-sided logistics service markets, and fragmented governance.

The carrying costs accounted for 17 per cent to 56 per cent of logistic costs. About 53 per cent to 75 per cent of the additional inventory were created due to inconsistent deliveries and congestion. Bangladesh was positioned at 105th rank among 141 countries in World Economic Forum (WEF) Global Competitiveness Index 2019 and at 100th rank among 161 countries in the World Bank Logistics Performance Index 2018.

The road transport accounted for 84 per cent in Bangladesh transport industry. Usually, seven-tonne trucks are used for transportation. The average cost of carrying per tonne per kilometre is $0.095, which is much higher than many other developing and developed countries such as US, France, Australia, India, and Pakistan.

The average dwell times at Chattogram Port is four days for an export container and 11 days for an import container. The social cost of annual carbon dioxide emission from road freight transport in Bangladesh is equivalent to 1.2 per cent of the GDP, with is almost 60 per cent of the emission caused by congestion.

Bangladesh RMG industry and 'Apparel 4.0'

The RMG industry in Bangladesh is adopting the 'Apparel 4.0' and undergoing a revolution which includes the digitisation of apparel production processes ranging from concept to post-retail. This revolution will enable the manufacturers to monitor and automate the entire production process with complete supply chain transparency.

Apparel 4.0 has major applications in smart clothing, robotics, simulation, industrial IOT, augmented reality, Machine-to-Machine (M2M) communication in knitting machines, smart factory, 3D printing, smart fabrics and AI-infused Industrial ERP (enterprise resource planning) etc.

Neighbouring countries of Bangladesh such as India, China and Vietnam are also rapidly implementing the Apparel 4.0 technologies in their factories. Raymond from India has started using the sewbot technology. Chinese garment manufacturers are introducing the smart clothing, augmented reality, and 3D printing in their factories. Vietnam has significantly developed Radio Frequency Identification Device (RFID), additive manufacturing and ERP.

This technology will enable the country to make the garment production cost effective and efficient. But it may cause a heavy job loss in the future as humans will be replaced by machines. According to the McKinsey Global Institute, approximately 800 million jobs could be lost worldwide due to automation by 2030. The garment sector of Bangladesh will be the most affected by Industry 4.0. A study by Government of Bangladesh predicts that around 60 per cent (5 million) of jobs will be lost in the next 15 years.

Possible Number of Job Loss by 2041 in RMG Sector

|

Occupations |

Possible Number of Job Loss by 2041 |

|

Sewing operators who operate single needle lockstitch machine, double needle lockstitch machine, single and double needle chain stitch machine, Sewing Machine Mechanic |

500,000 |

|

Floor Supervisor, Pattern Maker |

10,000 |

|

Pattern Making for Knitwear, Quality Control, Production Planner, Merchandiser |

10,000 |

|

Fashion Designer, CAD-CAM Operator, Portfolio Developer, Production Planner and Controller |

5,000 |

SOURCE: - A2I PROGRAMME, GOVERNMENT OF BANGLADESH, 2019

Many garment manufacturers in Bangladesh have already implemented Industry 4.0. Mohammadi Group has installed automated knitting machines, Envoy Textiles Ltd has employed robotic autoconers, DBL Group has made their dyes and chemical dispensing system automated and Beximco Group is using AI-infused ThreadSol software offering integrated planning process which will reduce material wastage by using effective concepts of fabric utilisation.

But as automation is majorly implemented by the big giants and as Bangladeshi RMG sector is majorly made up of small and medium-sized enterprises (SMEs), the SMEs are being worst hit by automation. For this reason, the government of Bangladesh is arranging for training and upskilling initiatives, especially for small factories.

Comments