What is Brexit?

Brexit, the term referring to the isolation of the United Kingdom (UK) from European Union (EU), was carried out at midnight of January 31, 2020 at 23:00 GMT. The transition period which began as a result, will end on December 31, 2020. In the transition period, all the rules and regulations of the EU will be applicable to the UK. This transition period might be extended once by two years if both UK and the EU agree to do so. It could remain in place till December 31, 2022.

The Withdrawal Agreement (November 12, 2019)

It covers multiple issues including the rights of the EU citizens in the UK and British nationals in the EU, the amount UK will contribute to the EU budget (and for how long) and the border between Ireland and Northern Ireland.

Now, the UK and the EU will also have negotiations on citizens' rights and cooperation on security. Any new agreement will come into force only after the transition period. These new agreements will have to be approved by the UK and the European parliaments. If both fail to reach a new agreement, then there will be a 'no deal' Brexit after the transition period.

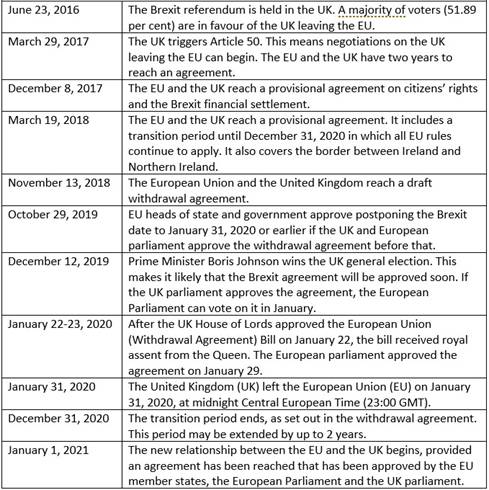

Brexit Schedule

What is "No deal Brexit"?

In case of "No Deal Brexit", there is no transition period. The UK businesses will have to apply customs, excise and VAT procedures to goods traded with the EU in the same way that already applies for goods traded outside the EU.

Import Tariffs

• Around 80 fashion lines will face import tariff of 8-12 per cent. Yarns and fabrics will be duty free for a year.

• Customs has the legal right to seize, destroy and even sell the goods that are not properly imported.

Export Tariffs

• The tariff of 6 per cent and 12 per cent will be applied on exported products.

• Customs can demand to inspect paperwork from the past 7 years.

• The export of goods from the UK to the EU without an EU EORI number will not be possible. There are several ways given below to apply for an EU EORI number.

Value Added Tax

You will still be able to use the EU VAT registration number validation service, but UK VAT registration numbers will no longer feature on it.

In addition to the major rules and regulations given above, the different guidelines and procedures have been set for moving samples internationally. It includes contracts and incoterms, immigration, intellectual property and financial management.

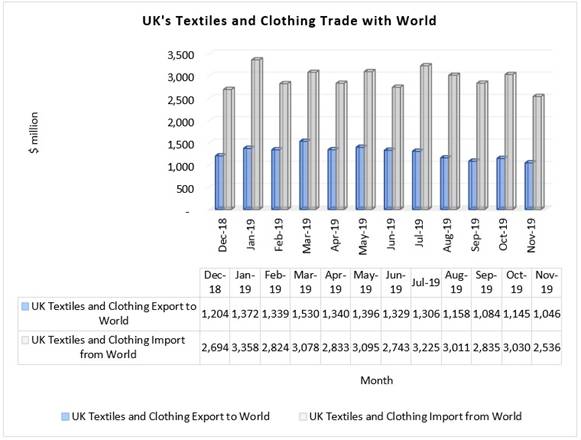

Trade between UK and EU 2019

UNCTAD opinion on No Deal Brexit/Standard Free Trade Agreement

According to the UN Conference on Trade, Investment and Development (UNCTAD), the UK may lose up to 14 per cent of its exports to the EU under "No Deal Brexit". The losses related to tariffs are estimated at $11.40 billion to $16 billion of current exports. According to the new study, non-tariff measures (NTM) may double the above-mentioned losses.

As per the estimation of export figures from 2018 by British Fashion Council (BFC), acceptance of the World Trade Organisation (WTO) rules would cost to the UK fashion industry up to $1 billion. According to UNCTAD, the UK's exports may drop by 9 per cent if both the regions move ahead with the new standard free trade agreement. The EU is a major export destination for UK's export and contributed to 46 per cent of total exports of the UK. The increasing costs due to NTM and rise of actual tariffs are the adverse economic effects of Brexit for the UK, the EU and developing countries. NTM includes regulatory measures protecting health and environment and traditional trade policies such as quotas.

Boon to developing countries

The trade barriers between the UK and the EU may give benefits to the suppliers from a third country. According to the UNCTAD's post-Brexit analysis on NTMs, chemicals and textiles sectors will face negative impact and agriculture will face positive impact.

To mitigate the negative impact on textiles and clothing industry, the formation of custom unions and trade blocs with NTMs must be done in a more comprehensive way as compared to the standard free trade agreements (FTAs).

Impact of Brexit

Cambodia

The UK's textile imports from Cambodia was worth $311.64 million in 2017. On February 12, 2019, the EU announced a partial suspension of the Kingdom's Everything but Arms (EBA) trade preferences. It resulted in higher tariffs of 12 per cent to apparel imports to the EU of around $1.1 billion. As per the policy announced in December by the UK, Cambodia's preferential trade status will be maintained after Brexit. As per the UK officials, the new trade deals will be done preferably with higher-value trading partners such as the EU, US, Japan, Canada and Australia. The already existing EU-Singapore and EU-Vietnam FTAs with bilateral deals will take some time. The EU-Singapore agreement is already effective, these benefits will be lost after the transition period.

Rest of Southeast Asia

Southeast Asian countries are very interested in signing trade deals with UK and EU in light of trade tensions between the US and China. The UK may face local political obstacles from Indonesia over the impact of an FTA on its industrial competitiveness, to well established grassroots opposition to FTAs in Malaysia and Thailand inspired by nationalist sentiment. Recently, the trade and diplomatic relations between the EU and Southeast Asian countries have been worsening as the EU is emphasising more on human rights and the environment in its trade policy. The improvements in EU-ASEAN

relations took place as the US has developed an erratic foreign policy with the region. The direct confrontation took place with Beijing in the South China Sea, with an aggressive and punitive response to trade imbalances with traditional Southeast Asian allies. The major impact on Southeast Asia from Brexit is the reduction of future European development assistance as the UK was the 3rd largest contributor to the EU's development assistance budget. It may reduce with a shortfall of $2.22 billion after Brexit.

Pakistan

Pakistan is one of the biggest exporters of textiles and clothing in the world, but the exports have been declining from recent years. The country is the eighth largest exporter of textile products in Asia. Textile sector of the country contributed to 8.50 per cent of its total gross domestic product (GSP) and provided employment to approximately 15 million personnel. According to the UK, the GSP plus status of the Pakistan will remain after the Brexit as Pakistan is a major trade partner of the UK.

Bangladesh

Brexit is a very significant matter for Bangladesh as the UK is its top export destination. Bangladesh total exports to the UK remained at $4.16 billion in 2018/19, which was 10.29 per cent of the country's total exports. But the UK has already announced that the trade facilities after Brexit will remain the same as was the case when it was a member of the European Union.

According to Export Promotion Bureau (EPB) data, Bangladesh's exports to the UK in the first six months of the current fiscal year has slightly declined by 0.84 per cent to 2.03 billion, which was 2.04 per cent in the previous year. According to Centre for Policy Dialogue (CPD) Research, global apparel retailers have become uncertain due to Brexit and have become conservative in placing work orders. Also, this uncertainty reduced the consumers spending which led to slight fall of apparel exports of Bangladesh to the UK. It may show positive growth by the end of the current fiscal year as the UK announced to provide duty-free market access to the country under the EU's Generalized Scheme of Preferences (GSP), namely the Everything but Arms (EBA) arrangement. EBA grants duty-free and quota-free access to the EU for exports of all products, except arms and ammunition to 48 LDCs including Bangladesh.

Impact on UK's Fashion Industry

Market uncertainty has been created in the global fashion industry due to Brexit and the US-China trade war. The fluctuations in the exchange rate have put a pressure on prices. The replacement of trade deals may increase administration and resource costs and put further pressure on prices.

According to the UK Fashion and Textile Association (UKFT), the textile and apparel suppliers of the UK may experience some difficulties while trading with the EU during the transition period. Hence, they advised to allow extra time for shipping goods and be prepared to face some delays at customs. The difficulties can be submitted to or communicated with UKFT.

UK's Drive for New Trade Deals

The 'Ready to Trade' campaign was launched by the UK on February 1 in 18 cities including Mumbai across 13 countries outside the EU, as the UK readies to deepen its relationships with future global partners. Besides Mumbai, the other cities in the list include Perth, Melbourne, Sydney from Australia, Sao Paulo from Brazil, Toronto from Canada, Shanghai from China, Hong Kong, Tokyo from Japan, Mexico City, Singapore, Johannesburg, Seoul from South Korea, Istanbul from Turkey, Dubai and New York, Los Angeles, Chicago and the US. The performance of the textile export-oriented sectors will be influenced by the UK's decisions on the new trade deals. Now the UK is looking towards the US and Australia to start negotiations on new agreements. To increase the trade of the region despite Brexit, the UK government has initiated the ASEAN Economic Reform and ASEAN Low Carbon projects in 2019 with the help of its Prosperity Fund.

Comments