Textile mills must make efforts to understand the changing global context and consider macroeconomic indicators while formulating operations strategies. This article is an effort to highlight the source and kind of economic indicators that must be observed to gain insights in to the evolving market context.

Foreword

Most of the textile mills, being privately held, are managed by equity stakeholders and are not subject to any public scrutiny. The pressure to produce short term results on scores of financial and non-financial indicators hardly exists.

Though, this absence of constant scrutiny enabled some responsible management to excel, most others failed to adapt to the rapid market changes. Traditionally, managements ride the growth wave of ‘good times’ while sitting-out the ‘bad times’. This strategy while good enough during economic boom-bust cycles is certainly inadequate to deal with severe economic conditions as a result of the COVID-19 pandemic.

The sources cited in the article include; IMF world economic outlook report, JP Morgan PMI, WTO trade statistics and European CDC for COVID-19 current status.

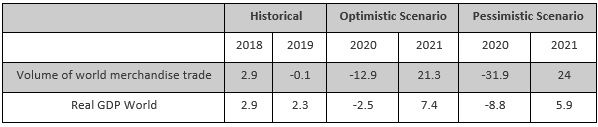

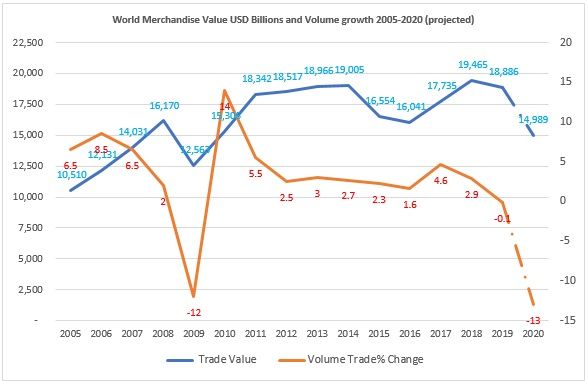

The global economy is projected to witness a negative growth of 3 per cent in 2020 and experience a sharp recovery of 5.8 per cent in 2021. With respect to international trade, the world merchandise trade volume is set to decline by 13 per cent in 2020 and stage a sharp recovery of 21.3 per cent in 2021.

Industry strategists must constantly monitor following two indicators:

• European CDC data (worldindata.org) to understand which countries are ‘flattening the curve’

• PMI (Purchasing Managers Index) monthly data to gain insights regarding level of economic activity.

Spotting these trends early on will enable companies to plan for demand upswings, if any.

‘The great lockdown’ (a term coined by the IMF) while detrimental to the economy also offers opportunity for textile mills leadership to plan, restructure organisation, implement smart factory architecture, develop management skills, reduce finance cost and adapt flexible production lines. The most productive asset, ‘management time’ must be spent in planning and developing new skills.

1.0 Pandemics so far

The sudden emergence of COVID-19 pandemic has had a dramatic impact on lives and livelihood and has taken everyone by surprise. The measures taken to contain the spread and casualty has dented otherwise normal economic conditions. The virus, after having emerged in China, has spread globally within a short span of time. Within three months of its first appearance, it has brought the global economy to a standstill. The uncertainty of the real extent and duration of this pandemic is causing wide spread despair. This has led to section of population fearing outright economic collapse and ultimately industrial activity.

While plagues and other widespread illness have affected humanity from time to time causing widespread death and economic destruction (See box on Spanish Flu), this is the first major outbreak of the globalised world.

SPANISH FLU (1918-20)

A research was conducted to study the economic impact of the worst pandemic to affect US between 1918-1920, the Spanish flu. It infected 500 million people and claimed lives of 50 million globally. The flu pandemic killed 550,000 to 675,000 people in the United States. The researchers quoted that “paper yields two main insights. First, areas that were more severely affected by the 1918 Flu Pandemic saw a sharp and persistent decline in real economic activity. Second, cities that implemented early and extensive NPIs (Non-Pharmaceutical Interventions such as Social distancing) suffered no adverse economic effects over the medium term. On the contrary, cities that intervened earlier and more aggressively experienced a relative increase in real economic activity after the pandemic subsided. Altogether, our findings suggest that pandemics can have substantial economic costs, and NPIs can lead to both better economic outcomes and lower mortality rates” (Federal Reserve Board’s Sergio Correia, the New York Fed’s Stephan Luck, and Emil Verner of the Massachusetts Institute of Technology, March 2020).

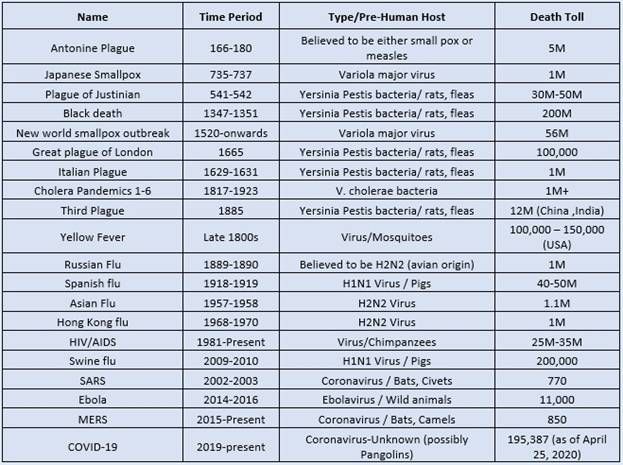

Major Historical Pandemics

Source: World Economic Forum

2.0 Global Textile & Clothing Industry

Global textile & clothing industry employs the largest number of people, next only to agriculture and produced USD 847 billion worth of yarns and fabrics (important to note that this value reflects yarn & fabric produced) in 2019 at manufactured prices (Shenglu Fashion).

In response to the developing situation, governments across the world have resorted to lockdowns and shuttered factories. Any prolonged production shutdown will a have serious negative impact on the workforce and health of the textile companies.

PMI (Purchasing Managers Index) published monthly by JP Morgan closely monitors manufacturing and service activity (See section on Global PMI – Interpretation and Implications at end of the article).The Global Composite PMI1 for March 2020 dropped to 39.42 indicating the sharpest decline in manufacturing and services activity, while China’s Composite PMI recovered in March 2020 to 46.7 from a February 2020 low of 27.5. China’s PMI recovery in March 2020 offers a glimmer of hope for the countries flattening the COVID-19 curve, Refer Exhibit 1.

Source: TTS Database

Exhibit 1: China PMI

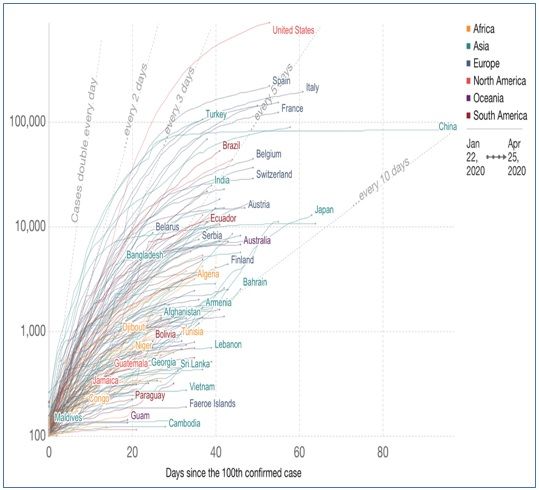

The remarkable recovery of China’s PMI is attributed to stringent NPI (Non Pharmaceutical Interventions) measures taken to control the spread of the Coronavirus. China’s confirmed cases curve started flattening from 50th day after first 100 confirmed cases, refer Exhibit 2.

Exhibit 2: COVID-19 Confirmed cases (as of April 25, 2020)

Source: European CDC – ourworldindata.org/coronavirus

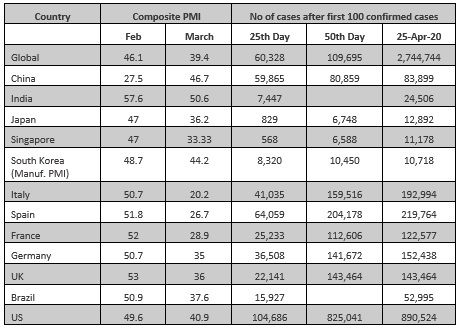

Of the seriously affected countries, only few have clocked 50 days after having confirmed the first 100 cases (all have crossed 25 days and will soon cross 50). If right measures are taken, these countries should also be able to flatten the curve by end of May 2020. However, much depends on government’s ability to impose and manage the NPI and affected cases through medical interventions. The May/June 2020 composite PMI will shed light on the developing situation. Refer Exhibit 3 for indications on the situation at different stages after confirmed first 100 cases

Source: TTS data base /worldindata.org

Exhibit 3: Country composite PMI & COVI-19 Trend

3.0 Global Economic growth during and after COVID-19 Pandemic

The uncertainty surrounding the extent of spread and duration of the pandemic has made economic prediction harder. The prediction for global GDP growth from many leading institutions range from -2 per cent to -8 to -10 per cent. No government or business firm can plan with any certainty the policy support or cash cushioning needed to sail through the situation. Two of the leading and reliable global institutions World Bank and IMF have come up with forecast for global growth during 2020. Both institutions predict a rebound in economic activity during the second half of 2020 assuming countries would have managed to contain the pandemic and NPI’s would have relaxed. Worst-case scenario of a prolonged pandemic well in to the next financial year has also been considered.

Recently, World Bank conducted a preliminary research and presented a working paper on “The potential impact of COVID-19 on global GDP and trade”. The study models four different shocks that will impact the global economy due to the loss of lives and containment measures:

-

Underutilisation of labour and capital, a decline in employment(3 per cent below baseline)

-

Increase in international trade costs, transport andtransaction costs up to 25 per cent

-

Drop in travel services activity i.e. decline in export oftourism services at global level 20 to 32 per cent

- Redirection of demand from activities that require close human interaction, such as mass transport, local tourism, restaurants and recreational activities anticipated to drop by 15 per cent

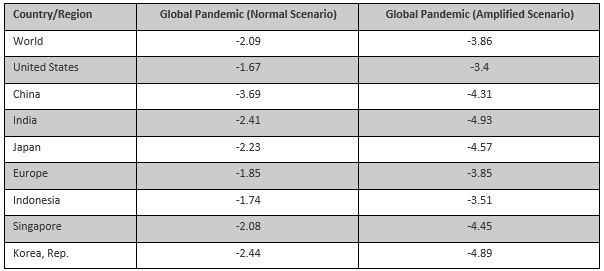

The results for normal and amplified conditions are presented in Exhibit 4.

Source: World Bank group/Policy research working paper 9211

Exhibit 4: GDP projection under normal and amplified scenario 2020 (percent)

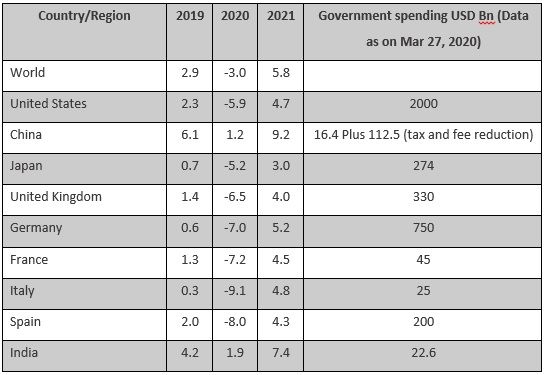

IMF’s World Economic Outlook Report 2020 projects, that the pandemic would cause a total global GDP loss of USD 9 trillion, which is greater than the combined GDPs of Japan and Germany, over 2020 and 2021. The economy will not recover to pre-virus level even at the end of financial year 2021. The paper underscores that the response from the governments across the globe is unprecedented in providing policy support through fiscal and monetary intervention. The combined fiscal and monetary intervention will exceed USD 7 trillion (CNN, March 27,2020).

Such measures and fading of pandemic in the second half of 2020 should cushion the severe decline in economic activity and return to above normal growth in 2021, Exhibit 5.

Source: IMF World Economic Outlook 2020/CNN, Business March 27, 2020

Exhibit 5: Real GDP growth Leading economies (percent)

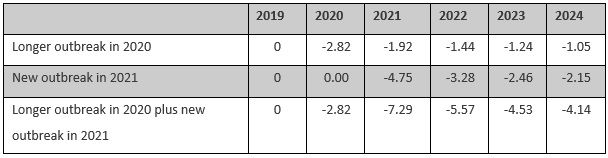

IMF also modeled three different scenarios and projected GDP growth under amplified conditions i.e. (i) the outbreak is longer than baseline assumption, (ii) new outbreak in 2021 and (iii) a combined longer outbreak in 2020 and new outbreak in 2021, Exhibit 6.

Exhibit 6: Real GDP growth under amplified global pandemic

4.0 Global Textile and Clothing Trade

Non Pharmaceutical Interventions planned to contain the pandemic include factory shutdown apart from other activities, travel, tourism, restaurants, education and recreational. China’s manufacturing PMI a key measure of industrial activity fell from 50 in Jan 2020 to 35.7 in Feb 2020 and since then recovered to 52.3 in March 2020. All advanced economies experienced a drop in industrial activity in March 2020. The decline in industrial activity due to lockdown will impact exports and imports of merchandise. The world merchandise trade volume expected to decline by 13 per cent in 2000 and recover to 21.3 per cent in 2021.

Source: WTO April 8, 2020

Exhibit 7: World Merchandise trade volume

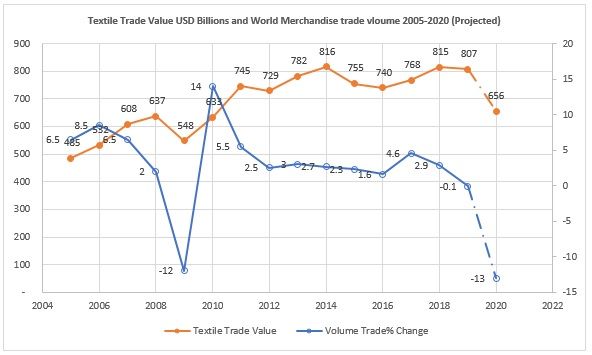

Textile and Clothing (T&C) global trade has grown at a CAGR of 5.1 per cent in value terms between 2001-2019 and World merchandise trade value also has grown at a CAGR of 6.4 per cent for the same period. T&A trade in value terms increased from USD 327 billion to 807 between 2001-2019 and the world merchandise trade value increased from USD 6.2 trillion to 18.9 trillion. The T&A trade value averaged 4.5 per cent of the world merchandise trade value.

The world merchandise trade volume is projected to decline by 13 per cent for 2020 under optimistic scenario. Such steep drop (12 per cent) occurred in 2009 during great financial crisis and the trade value declined from USD 16.2 trillion in 2008 to USD 12.6 trillion in 2009. The world merchandise trade value stood at USD 18.9 trillion in 2019. The simple linear model predicts the world merchandise trade value to drop to USD 15 trillion, Exhibit 8.

T&C world trade value is projected to decline to USD 656 billion in 2020 from USD 807 billion in the previous year. The drop projected mirrors the decline in T&C trade value during great financial crisis. The simple linear models projects the trend based on historical data and don’t consider changes in real economic and non-economic variables then and now. The projections are to be seen only as an indicator of a developing trend and any planning must take into account the anticipated sharp decline in exports, Exhibit 9.

Exhibit 8: World Merchandise trade volume

Exhibit 9: T&A world trade value and world merchandise trade volume

5.0 Global Textile Mills Market

Globally, the textile mills operating partially are forced to carry stocks as downstream operations, retailers have had to shut shop and consumers stay away from visiting brick and mortar stores.

China exports majority of its textile produce to US, Europe and Japan. While China has reopened its production units, Europe and US remain shut. It is uncertain when these economies will open to business. It remains to be seen how Chinese textile production units dependent on exports to sustain production, if the west is to remain closed for business longer than anticipated.

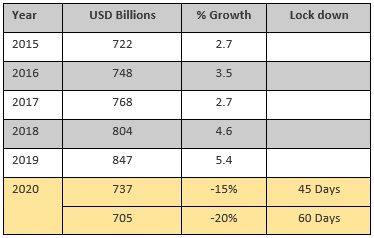

Textile mills produced USD 805 billion worth of Yarns and fabrics in 2018 and estimated to produce USD 847billion and USD 899 billion in 2019 and 2020 respectively. The shutdown of production units will reduce the estimated value sharply for 2020.The reduction in textile mills market value may vary from -15 per cent to -20 per cent depending on the extent of lockdown, Exhibit 10.

The textile mills are expected to see a sharp recovery along with economic recovery 5.8 per cent and merchandise trade volume 21.3 per cent in 2021.

Source: Shenglu Fashion

Exhibit 10: Textile mills market value at manufactured prices (Yarns and Fabrics)

6.0 Specific strategic priorities during lockdown

The uncertainty about the duration and severity of the pandemic makes any prediction difficult, textile mills have hard time planning for the resource requirement during and after the lockdown. Textile mills are to be aware of external developments to organize better, but they have very little control over these developments. Efforts can be made to manage things under their control. The lockdown also provides an opportunity to streamline or restructure operations at various levels as it has freed up ample time for the management team to discuss and plan functions or activities needing restructuring, learning new skills and preparing for the upturn expected after the lockdown.

• Organisation restructure

Textile mills have undertaken scores of initiatives to restructure production activities; from reducing workforce through full automation, real time feedback (both online and offline) to improve productivity and continuous improvement systems to increase shop floor effectiveness. But, much less is done to improve management effectiveness at Marketing, R&D, procurement, finance management and customer management. Identifying and adopting best practices would improve result orientation and accountability.

• Smart Factory Architecture

Every function and activity performed by man, machine and interactions among men and group of machines performing dependent activities can be measured in real time and corrective actions taken or interrupted, to maintain consistency in process and people management. Big data analytics, machine learning and Artificial Intelligence has made this possible. Textile mills can choose and customize specific functions needed to be measured and monitored to improve overall business effectiveness.

• Management Skill development

Skills needed to navigate tough times and beyond; change management, innovation (product & process), external orientation, coordination and control and motivation to be assessed and instilled among key management executives. Lockdown makes it possible for the company leaders to spend quality time skilling the management team.

• Finance cost

Textile operations are capital intensive, the very high initial investment and working capital requirements demand use of equity and debt capital. Most of the textile mills are privately held and local banks are the major source of debt capital. The cost of finance for privately held textile mills is over 6 per cent of the turnover while the benchmark cost of finance is less than 2 per cent of turnover. Excess finance cost incurred reduces companies savings and hence capacity to sail through tough times. Companies can reduce inventories, explore alternative means of finance to reduce finance cost to benchmark level.

• Flexible production line

Textile mills producing yarns and fabrics are designed to produce selected products at maximum volume to achieve economies of scale. Minimum order quantities are norms in the industry. Retail stores closures and uncertainty about the return of the customers to procure mass produced goods, and change in product demand to hygienic textiles and frequent changes required to produce custom designed items need flexible production lines capable of meeting demands. Textile mills should partner with and outsource products that can’t be produced in a given setup. Collaboration with suppliers, customers and other textile production units will ensure mills meet the demand until the situation is normalized.

The most productive asset, ‘management time’ should be spent readying different plans, including the suggestions pointed out and other priorities. The leadership should divide teams and tasks should be assigned with specific objectives. While plans made by the team needing resources might be scheduled for appropriate time, plans that need little or no investment must be executed right away.

7.0 Conclusion

-

IMF, world economic outlook April, 2020 report estimates acombined economic output loss of USD 9 trillion for the forecast period 2020& 2021 due to the COVID-19 pandemic. The real GDP output has been reviseddown to -3 per cent in 2020 and improved 5.8 per cent output for 2021.

-

Countries/regions which have implemented NPI (NonPharmaceutical interventions) ahead of time to contain the spread of COVID-19,will achieve economic recovery faster.

-

Monitoring closely, the European CDC data for countriesflattening the curve and PMI monthly data will provide valuable insights aboutthe state of economic recovery.

-

China’s composite PMI dropped to 27.5 in February 2020 dueto lockdown, however, China flattened the curve and reopened the economy andits PMI recovered to 51.5. Countries flattening the curve will experiencequicker recovery than those that do not,making it the most important indicator to focus and spot early to planreopening.

-

The recovery will be far quicker than anticipated given thefiscal and monetary stimulus worth of USD 7 trillion committed by variousgovernments and central banks.

-

WTO April 2020 brief projects world merchandise trade byvolume to decline to -13 per cent under optimistic scenario and set to recoverto 21.3 per cent growth in 2021. Textile trade averaged 4.5 per cent of worldmerchandise trade value during 2001-19. Textile trade is expected to mirror thetrend in world merchandise trade.

-

Textile mills producing yarn and fabrics are expected tolose 15 to 20 per cent of output value (at manufactured prices) depending onthe extent of lockdown. While year 2020 will experience negative growth ratesYOY, the year 2021 will see a sharp recovery.

- Textile mills must plan for the effective use of ‘management time’ during the lockdown by assigning tasks to teams for readying action plan to be implemented to sustain and excel in performance.

Global PMI – Interpretation and Implication

The composite PMI (Purchasing Managers Index) published monthly, monitors global output activity by surveying purchase managers from economies around the globe. GDP (Gross Domestic Product) mirrors PMI output activity index.

Global business activity contracted in March due to measures taken to contain COVID-19 spread. The decline is steepest since global financial crisis of 2009. The output activity fell from 46.1 (Feb 2020) to 39.4 (Mar 2020). The latest reading indicates a second successive month of steeply declining business activity, comparable with global GDP falling at an annual rate of 1.5-2 per cent (at market prices), a far cry from a 3 per cent expansion signaled in January 2020; Figure 1.

Source: IHSMarkit

Figure 1: Global Composite PMI & GDP growth

The manufacturing and services PMI measures manufacturing and service output activities independently, while composite index is a measure of combined output activity.

The manufacturing PMI improved slightly from 47.1 (Feb 2020) to 47.6 (Mar 2020), the increase is solely due to China’s manufacturing PMI recovery from 40.3 to 50.1 for the same period. The Services PMI suffered its worst drop in the PMI recorded history of 22 years, Figure 2. The PMI, composite, services and manufacturing signal sharp slowdown in real economic activity. China’s rebound in all three components, if sustained, will lift global activity in the coming quarter.

Source: IHSMarkit

Figure 2: Global Manufacturing and Services PMI

About the Author:

Rajaguru Raja, Managing Director, Texcoms Textile Solutions, Singapore

Comments