Speculation has been rife on how and to what extent the ongoing coronavirus pandemic will affect the global factories of tomorrow. A dispassionate look.

The covid-19 pandemic and the consequent lockdowns, be they long-drawn or intermittent, have turned out to be heaven-sent. It has been a good time to sit back and ruminate, introspect, and plan corrective/mitigation measures for a world that was already in a mess. This has taken many forms and shapes—from animated discussions about the need for the textiles-apparel-fashion industry to do things only from a sustainability point of view henceforth to what will happen to supply chains and the impact that the pandemic has so far had on workers and livelihoods the world over.

Whether these have been sheer figments of speculative fiction or will turn out to be dire predictive exercises in futility, only time can tell. There are many ways of looking at the past-present-future of an industry, and none can claim to be the only or the definitive way of looking at things. For sure, many of the discussions have either overwhelmingly hovered around or at least touched one elementary question: where will the global factories of tomorrow be located?

But when there are far too many factors at play, many of them either at conflict with one another or rooted in shaky ground, the debate quickly degenerates into being one of my prediction is better than yours. While it is true that many things are uncertain, taking shape even as you are reading this, it would make sense to simply look at certain things as they are.

The way things stand

As stores keep downing shutters and losses across the industry mount by the day across the globe, it becomes increasingly difficult to ascertain where one stands. A just-released report, however, does provide a starting point. The World Trade Statistical Review (WTSR) 2020 of the World Trade Organization (WTO) provides the numbers for 2019—roughly the point when the SARS-CoV-2, the virus that causes covid-19, was beginning to spread beyond Wuhan, the sprawling capital of Central China’s Hubei province where it had originated.

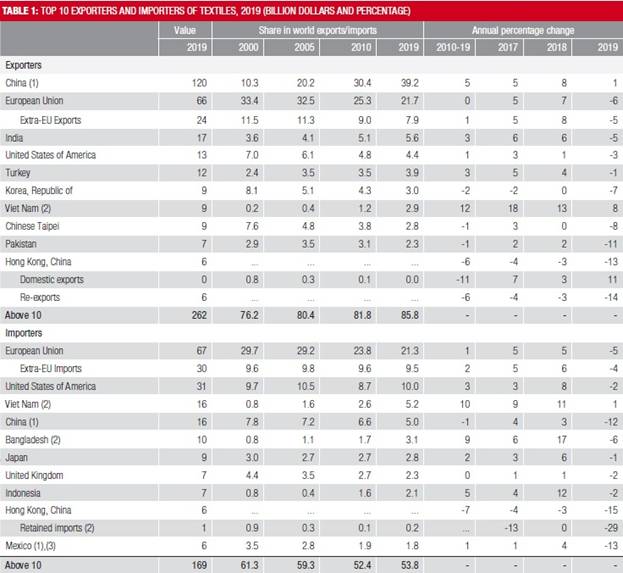

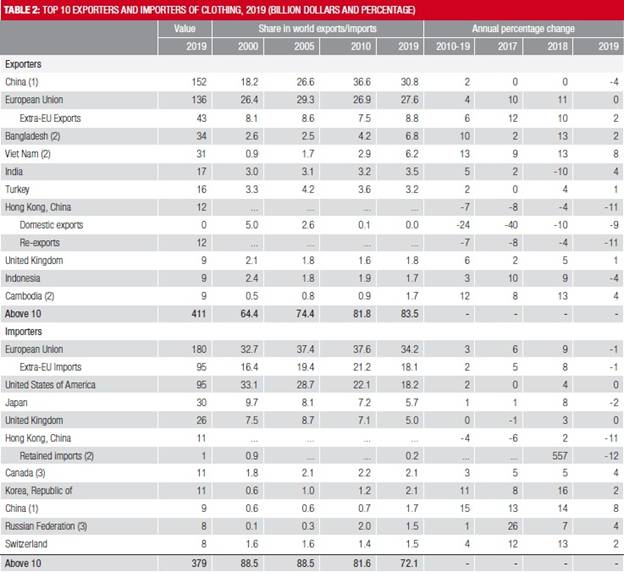

The WTSR 2020 is only a confirmation of fears. The volume of world textiles and apparel trade dropped in 2019, with the value of the textiles and apparel exports of $305 billion and $492 billion respectively decreasing by 2.4 per cent and 0.4 per cent from a year ago. The world merchandise trade dropped by 3 per cent measured by value and 0.1 per cent by volume in 2018-19, compared to a 2.8 per cent growth by volume in 2017–18. This is the first time that world merchandise trade has dropped since the 2008 global financial crisis, even before the Wuhan epidemic had been able to trickle out of China in December 2019 to eventually becoming a global pandemic. The reason for the drop is a no-brainer: “persistent trade tensions,” as the WTSR 2020 put it.

But that’s last year’s picture. The world has, as we all know it, changed since then, and a glimpse of what the picture for the current year might look like comes from the first two quarters of 2020. The WTSR 2020 noted: “The volume of world merchandise trade has fallen precipitously in the first half of 2020 as the covid-19 pandemic has disrupted the global economy. Leading indicators provide clues about the extent of the slowdown and how it compares with earlier crises.”

Source: The World Trade Statistical Review 2020

And, it will worsen over the coming days, as the document sounded out: “In April 2020, WTO economists estimated that world trade would fall between 13 per cent and 32 per cent in 2020 as the covid-19 pandemic disrupted normal economic activity and life around the world. Subsequent tracking of trade developments suggests that the decline may be closer to the optimistic scenario but worse outcomes are still possible if there is a resurgence of the virus.”

As production has slowed, global exports of manufacturing services fell by 2 per cent in 2019 compared to a 16 per cent rise in 2018. The report explained, “The economic slowdown, coupled with weaker demand, has taken a toll on the manufacturing of textiles and clothing, whose exports stagnated in 2019. These sectors are part of fashion value chains, in which the production of garments take place in various countries, thus affecting exports of manufacturing services.”

Also, disruption in global value chains and lower demand for many goods due to the covid-19 pandemic “is expected to have a negative impact on manufacturing services in 2020.” The WTSR 2020 pointed out, “Preliminary estimates show that global demand for clothing decreased by 37 per cent in April 2020, in year-on-year terms. Export orders of garments were cancelled, severely affecting providers of manufacturing services to the clothing industry. In Bangladesh, where clothing accounts for 83 per cent of total exports, cancellations amounted to $3.18 billion in April, with exports 81 per cent lower than in April 2019.”

Stagnancy in the big markets

What the WTSR 2020 tells us is that trade was already on a decline in 2019, implying that it would have been harder for the world to bounce back even under normal circumstances. But what the report also tells us is this: a shift in manufacturing was already taking place last year. China exported less apparel and more textiles to the world in 2019. China’s shares in apparel exports fell from its peak of 38.8 per cent in 2014 to a record low of 30.8 per cent in 2019 (which was 31.3 per cent in 2018). On the other hand, China’s share in textile exports scaled a new high of 39.2 per cent in 2019. What this means is that while the smaller Asian and Southeast Asian nations have increased their global apparel export share, the raw materials come from China.

Another significant point is that the main markets for apparel exporters do not show any promise. Imports by the European Union (EU) decreased by 1 per cent and Japan by 2 per cent last year. The United States (US) and the United Kingdom (UK) showed 0 per cent change. The maximum import growth of apparel, ironically, came from China with 8 per cent, though it was much lower than the previous year’s increase of 14 per cent. Even South Korea’s apparel import growth rate dropped from 16 per cent to a paltry 2 per cent. As of now, there is not enough data to show whether the major importers are starting to make their own apparel products. Maybe they will.

Source: The World Trade Statistical Review 2020

But, whether the global factories will shift depends a lot on buyers, the single largest of them being the US with a global import share of 18.2 per cent ($95 billion). [The EU was the largest bloc in 2019 with $180 billion and a share of 34.2 per cent.] The US sentiments have also just been revealed through the 2020 Fashion Industry Benchmarking Study by the United States Fashion Industry Association (USFIA). According to the study, it is the escalating US trade war with China, besides the pandemic, that has exerted significant impact on US fashion companies’ sourcing practices.

The study noted: “The ‘increasing production and sourcing cost’ is ranked as the 4th top business challenge facing respondents in 2020. Notably, for the second year in a row, respondents say “shipping and logistics” is their top cost concern in 2020. Further, as high as 90 per cent of respondents explicitly say, the US Section 301 action against China has increased their company’s sourcing cost in 2020, up from 63 per cent last year. [The] covid-19 and the trade war are pushing US fashion companies to reduce their “China exposure” further. While ‘China plus Vietnam plus Many’ remains the most popular sourcing model among respondents, around 29 per cent of respondents indicate that they source more from Vietnam than from China in 2020, up further from 25 per cent in 2019.” All respondents (100 per cent) to the study said they had “moved some sourcing orders from China to other Asian suppliers” this year, up from 77 per cent in 2019.

So, does that mean this shift will accelerate in the days to come? That would be difficult to predict, but the USFIA study does indicate that few are willing to rock the boat right now: “Sourcing diversification is slowing down, and more US fashion companies are switching to consolidate their existing sourcing base. Close to half of the respondents say they plan to ‘source from the same number of countries, but work with fewer vendors,’ up from 40 per cent in last year’s survey.”

This is reflected, perhaps even corroborated, in another finding: “For the first time since we launched the survey in 2014, NONE of the respondents plans to substantially increase sourcing volume from ANY particular country or region in the world. This extraordinary result reminds us of the severity of the current economic crisis facing US fashion companies and suggests the post- covid-19 economic recovery could be a long slow climb.” Any marginal shift will go to Vietnam and Bangladesh. Those expecting a tectonic shift might have to wait awhile.

Similar studies do not exist for other blocs/countries, but the underlying US sentiment that no one wants to upset the applecart right now might just as well be true for the EU, UK, Japan and Korea.

Coming out of the pandemic

While buyer/importer compulsions and sentiments in the backdrop of anti-China sentiments, political tension and trade wars are significant, what is just as important to keep in mind is the ability of the factory countries to emerge from the ongoing covid-19 pandemic, as unscathed as possible.

The most resilient apparel-producing countries—so far, at least—have been Vietnam and Cambodia. The first case to be reported in Vietnam was on January 23. Till July 31, the aggregate number of cases had been only 546. The number of deaths—touch wood—still stands at zero. Yes, zero. Ditto for Cambodia, which saw its first case on January 27. The total number of cases there has been 234 with zero deaths once again. Both countries, of course, have lost out huge amounts to cancelled orders and seeing job losses. Myanmar is close with 353 cases and six deaths. If they are able to keep the lid on the coronavirus, they could well emerge as top sourcing destinations.

Compare the numbers with three South Asian countries: India, Pakistan and Bangladesh. The cumulative number of cases in these countries (as on July 31) were 1,638,227, 278,305 and 237,661 respectively, and the death tolls have been 35,745 5,951 and 3,111 respectively. All three have been adversely hit by losses because of cancelled orders. Additionally, India saw one of the largest exodus of workers from the cities during the ongoing pandemic. These countries, therefore, will need to surmount innumerable challenges if they are to remain in the game.

The biggest player, China, has already made a comeback. Profits of industrial textile companies with annual revenues of more than 20 million yuan (about $2.86 million) skyrocketed 189.08 per cent year on year to 12.69 billion yuan from January to May this year, according to ministry data. China has made hay, particularly with exports of surgical/protective masks and personal protective equipment (PPE) kits all through the pandemic so far. In fact, when the SARS-CoV-2 infection was being described as a pandemic by the World Health Organization (WHO) towards the end of March, many apparel factories in China had already resumed work—albeit under restrictions and guidelines.

For the record, the lockdown was lifted from Wuhan on April 8 and the city is reported to be back on track, though retail is far from picking up. Incidentally, the number of cumulative cases in China moved up at a snail’s pace from 79,932 on March 1 to 87,610 on July 31. The corresponding deaths were 3,979 and 4,661 respectively. The country, therefore, is expected to do well. Whether that will happen depends on extraneous factors, though China is well placed both as an apparel exporter as well as producer of textiles to take on the same mantle as it did during the financial crisis.

A pointer to this (the uncertainty) comes an article in Nature magazine:

-

June 2021. The world has been in pandemic mode for a yearand a half. The virus continues to spread at a slow burn; intermittentlockdowns are the new normal. An approved vaccine offers six months ofprotection, but international deal-making has slowed its distribution. Anestimated 250 million people have been infected worldwide, and 1.75 million aredead.

-

Scenarios such as this one imagine how the covid-19 pandemic might play out. Around the world, epidemiologists are constructing short- and longterm projections as a way to prepare for, and potentially mitigate, the spread and impact of SARS-CoV-2, the virus that causes covid-19. Although their forecasts and timelines vary, modellers agree on two things: covid-19 is here to stay, and the future depends on a lot of unknowns, including whether people develop lasting immunity to the virus, whether seasonality affects its spread, and—perhaps most importantly—the choices made by governments and individuals.

It is the set of unknowns, together with everything else, that will determine where the global factories of tomorrow will be. Or, whether such a concept will exist at all.

This article was first published in the August 2020 edition of the print magazine

Comments