The ongoing pandemic has resulted in buyers moving out of China for more reason than one. This SWOT analysis looks at Bangladesh and Vietnam from India’s perspective.

The covid-19 pandemic brought about several changes in the apparel manufacturing industry across the world, with the year 2020 being majorly characterised by lockdowns and work from home, affecting apparel production, trade and consumption patterns. Several buyers changed their sourcing strategies, and on the other hand, various suppliers diversified to new product segments. These adaptations by both buyers and suppliers to some of the fast-paced trends helped them sustain the anticipated changes that are expected to stay for a year or two.

A major change that was hastened during the pandemic is the buyers across the globe moving out of China and sourcing from other countries instead. The buyers are looking for new destinations that appear reliable and portray other advantages in terms of cheap labour and duty-free access to major markets. This has given newfound hope in smaller garment manufacturing nations, each trying its best to grab the attention of the various buyers by showing their respective strengths.

These nations have not only taken up China’s share, but also possess a strong threat to India’s share as well. It is not hidden that these nations have various advantages over the Indian textiles industry. Therefore, it has become a necessity to understand the working of these nations and improve India’s in order to retain its share in the world.

Bangladesh has earned popularity for its big capacity and ability to manufacture low-end items at the cheapest rate of the world with an acceptable quality, whereas Vietnam is more value-oriented with a strong backward linkage and a more educated skilled workforce.

Let us explore further, how small nations such as Bangladesh and Vietnam have grown so much in just a short span of time and what limitations do they have.

#Strength

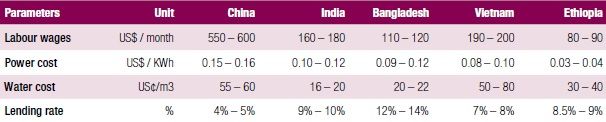

One of the most aggressive advantages that these small nations have over the traditional ones is their low cost of production. The cost of labour in Bangladesh ranges between $110 to $120 which is ~80 per cent less than China’s and ~40 per cent less than India’s. Other costs such as power, water, and lending rates are also significantly less as compared to China which makes them an attractive sourcing hub for buyers.

Another reason for their rapid growth is the free trade agreements (FTAs) and preferential duty treatments. Bangladesh, as an LDC (least developed country), gets European Union’s (EU’s) preferential duty treatment accorded to its garments. Vietnam has the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Vietnam-EU FTA (EVFTA), which came into effect from August 1. On the other hand, apparel supplies from India to major markets are taxed at 9.6 per cent. This further hardens the challenge for India to even hold on to its market share in garment exports, let alone grab the space being gradually vacated by China.

As a consequence of preferential access and FTAs, there has been a large number of investments in these countries that have boosted the growth of the textiles industry. Due to the US-China trade war, many companies from China have expanded their operations in Vietnam. In the past five years, the textiles industry of Vietnam has continuously grown at an average rate of 17 per cent annually. According to the United Nations Conference on Trade and Development (UNCTAD), in the first 11 months of 2019, Vietnam attracted FDI (foreign direct investment) totalling nearly $1.55 billion for 184 projects in the garment and textiles industry. Investments were led by Hong Kong ($447 million), Singapore ($370 million), China ($270 million) and South Korea ($165 million). Bangladesh also received FDI of $500 million in FY2018–19 in the textiles and apparel sector.

It has also been observed that despite being paid less, the workforce is highly productive in Bangladesh and Vietnam. On an average, a garment factory in Bangladesh operates at an efficiency level of 60–65 per cent whereas in India the factory operates at 40–45 per cent. There is also an increased focus on compliance factories; with 67 LEED (Leadership in Energy and Environmental Design)-certified factories, Bangladesh has the highest in the world. The BGMEA has said that over 220 more garment manufacturers have applied for LEED certification.

The biggest advantage Vietnam has over others is the skill of labour. The industry has an abundant supply of skilled workers. The assembly work is extremely competitive; so, the resulting product is always of the best quality. Each manufacturing company employs up to 2,500 workers, who produce millions of garments annually. The smallest factories in Vietnam hire around 500 and still have the capacity to produce 300,000 items each year. Vietnam also has one of the world’s highest speed-to-market rates in the clothing and fashion industry.

As the economy of these countries is majorly dependent on the textiles industry, the government provides full support in the development of the industry. Bangladesh, for instance, offers up to 100 per cent foreign equity, especially in the economic zones (EZs). Additionally, as per the government policy, an investor has the right to pull out the full investment, which is further transferrable with a full profit sum. The country also allows up to 10 years of 100 per cent tax holiday to investors. Tax holidays are often given to reduce sales taxes by local governments and are now being commonly given as a stimulus for foreign investment.

The government of Vietnam is no less. The Vietnamese government is working actively to reduce raw material dependency on other nations. Recently, in order to fight the pandemic, the government cantered its support for the textiles industry by expanding industrial parks for textiles and stimulating the domestic supporting industries. The plan is to increase the supporting industry’s contribution to 18 per cent of production in the local manufacturing and processing sector by the end of 2020. Local governments are also encouraged to assist firms in research and development activities, technology transfer and innovation.

The government and various textile manufacturers’ associations in these nations organise several business-to-business exhibitions and international shows, which gives suppliers and producers a platform to meet clients and showcase their products. In turn, it provides companies with a variety of options to identify makers who can cater to their specific requirements.

#Weakness

It is no doubt that Bangladesh and Vietnam have advantages that no other nation can match up to, but it is also true that these nations have their own challenges which also cost them potential buyers. One is the inability to meet compliance norms. Factories in Bangladesh and Vietnam are often found to be implementing longer working hours and forced labour to meet short deadlines.

The Rana Plaza tragedy in Bangladesh leaving over 1,100 people dead, shook the entire world, and buyers began to question whether they should quit sourcing from Bangladesh. The incident resulted in the shutting down of over 1200 RMG (readymade garment) units. Till today, Bangladesh struggles a lot to portray the “safe” image for its RMG units. In 2012, the US Department of Labour added garments from Vietnam to its official list of products made with forced and child labour, making Vietnam one of only seven countries in the world whose apparel received this designation. Although both the nations have worked hard to improve their image over the years, until they build complete trust, this will always be regarded as their weakness.

Another big issue is the absence of a complete value chain due to which they have to rely heavily on other nations for raw materials. Though Bangladesh has emerged as a leading supplier of RMG to the world, it grows only 2 per cent of its annual cotton requirement and imports the remaining 98 per cent of raw materials in the form of cotton, yarn, fibre, filament and fabric.

Due to the size, weather conditions and lack of integration, Vietnam too doesn’t grow a lot of cotton, and has to import a big quantity. Vietnamese garment manufacturers predominantly focus on the simplest cut-make-trim (CMT) model in which buyers control and own all the pre- and post-production processes. CMT production contributes over 60 per cent of Vietnam’s total exports, while the more advanced business models (considered more profitable) like original equipment manufacturer (OEM) and original design manufacturer (ODM) account for the rest.

In January this year when the pandemic broke out, China suspended production thereby disrupting fabric supply to Vietnam—leaving the country high and dry. This made it realise the importance of a complete value chain in the country. In 2019, Vietnam imported 89 per cent of fabrics, of which 55 per cent were from China, 16 per cent South Korea, 12 per cent Taiwan and 6 per cent Japan.

Unlike India and China which have a growing domestic market to cater to as well, the growing nations are dependent only on exports for their survival. The nearly absent domestic consumption of the goods is a major drawback for them. Although the market is growing, it would be still years before it can be seen as a potential place for investment.

#Opportunity

As growing nations, Bangladesh and Vietnam both have a lot of opportunities that are enough to draw the attention of anyone—whether it’s a buyer or an investor. One of the opportunities that draw the most attention is product diversification. These nations are highly capable of modifying products as per the buyer requirements, irrespective of the quantity. The textiles and apparel industries of Vietnam and Bangladesh have upheld the principles of quality, timely delivery and product diversification, which have made it easier to maintain impressive growth momentum. Product diversification also helps them to build a long-term relationship with buyers as well.

Another opportunity is the focus on research & development to explore new products, technologies and machinery to make the process fast and efficient. Most factories are equipped with new and state-of-the-art technologies. Technological upgradation has contributed a lot to increase the export earnings of small nations. Installation of new technology has improved the quality of products as well as capacity. As a result, global buyers place more work orders, which has pushed up export earnings. The reason why Bangladesh and Vietnam have profited from the ongoing trade conflict between the US and China, and India hasn’t, is because these nations have better technologies to match with the quality provided by their Chinese counterparts.

In recent times, the buyers’ focus has shifted to value-added high-end products. Bangladesh and Vietnam have quickly adapted to the shift in order to remain competitive in the global market. The countries are able to provide value-added and highend products at lucrative prices, giving them the opportunity to grab an even bigger market share.

As the sector is growing, Bangladesh and Vietnam are also focusing on self-sustenance. There is a huge opportunity for vertical integration in both nations. Having tasted success, both nations are now investing heavily in technology to upgrade their skills and develop a complete value chain. One of the biggest factors that has driven them towards integration is the decreasing lead times. In the case of imported fabrics, the companies are compelled to ask for at least 90 days’ lead times, but for products manufactured with local fabric, they can offer shorter lead times. In fact, vertical integration is used not just to streamline and control their supply chain, but also to present it as a marketing tool to the buyers who prefer working with integrated units.

#Threat

It requires a lot of hard work and effort to be on top of the game, but what’s more difficult is to maintain the top position. Every nation is a threat to the other. A decade ago, China had no competition but today even China is facing strong headwinds from growing nations. Similarly, growing nations are also facing a lot of threats.

One of the biggest threats is their dependency on other nations for sourcing raw materials. If the supplying nations increase the price of materials, it can cause them to lose their low-price bargain. Moreover, it is expected that Bangladesh will be graduated from the LDC status by 2024—meaning it will lose its duty-free access accorded to garments in the EU. If this happens, then apparel products from Bangladesh will be taxed at ~7 per cent. Hence, it is of outmost importance for them to develop their own supply chain in order to remain “the low cost” country.

Not able to meet compliance norms is also a growing threat to these nations. If not rectified soon, they may lose many major buyers. As developing nations, it is difficult for them to maintain rigorous environmental standards; but as the industry is exploiting natural resources, they are vulnerable to being pressured to enforce stricter standards or face less market access for their exports to developed countries. Apart from environmental issues, other issues like workplace safety and child labour have already proved as a sensitive issue in the western market. Compliance with the rules of origin may threaten future market access and performance of the RMG sector.

Some specific threats to the Bangladesh garment industry are the political unrest situation in the country and increasing environmental pollution, besides the rising prices of raw materials, poor ease of doing business and a complicated documentation process. Some specific threats to Vietnam are availability of similar articles of clothing at low prices from competitors and poor customer services.

India can also be a potential threat to growing nations, as it has the presence of a complete value chain along with large production capacities, which is enough to make it a better substitute for China than any growing nation. India is also increasing its focus on synthetic and regenerated fibre products to adapt to the change in the product trend and remain competitive in the global market.

Moreover, the Indian government is also working on drafting attractive reforms for the development of the industry. Till now, 74 textiles parks have been approved and are in various stages of implementation with 18 parks operational and 32 under implementation. Many international companies have already invested in the Indian textiles industry. Last year, South Korean textiles and apparel major Youngone Corporation signed the final agreement with the Telangana government to set up a unit in Warangal with an investment of about ₹900 crore.

#Wrapping Up

To summarise the scenario, both Bangladesh and Vietnam enjoy three huge advantages over India in the global apparel market. The first advantage is the cost of labour. The second is the preferential duty treatment from major markets and the third is a consequence of the first two—increasing FDI.

On a broad level, no hindrance could stop Bangladesh and Vietnam from achieving moderate economic growth through RMG exports. Although the garment and textiles industry of both nations has been significantly affected by the pandemic, optimistic prospects for fast and strong recovery is possible, given the industry’s response and government’s support policies. But such a well-built sector could not really grow as anticipated due to many reasons explained above—most of which are not abnormal for developing countries. The sector still managed to cope with the situation and keep the momentum going. Both nations have shown remarkable export rates.

For both the established and growing nations, in order to survive in the market, one must learn to quickly adapt to market trends, enlarge operations into new merchandise, and relocate into diverse territories. If necessary measures are not taken in time, the consecutive improvement which India has shown in world trade will become a thing of the past.

This article was first published in the December 2020 edition of the print magazine.

Comments