Fashion sustainability is the new cool

Last week, during a talk with investors, suppliers and retailers, I was asked if fast fashion can really be sustainable. We could include other business segments like luxury in this question. Fashion sustainability is the new cool and is going mainstream, but some brands are still destroying products as a way to maintain exclusivity. In the meanwhile, more and more companies are filing their annual reports with sustainability statements. Greenwashing?

Is fashion intrinsically ephemeral? (therefore, non-environmentally friendly)

Fashion is a way to present yourself to the world. Fashion is an aesthetic expression, factor of segmentation and cause of discrimination. Fashion consumer motivation goes from physiological (i.e. clothes can insulate against cold or hot conditions) to self-actualisation needs (ie lifestyle, status), as described on the fashion pyramid. Depending on the need, renewing your “old” clothes will be more or less “urgent”. Shopping clothes makes people happier, releasing serotonin.

In my opinion, and as described in Fashion Goes Tech, fast fashion sustainability is probably an oxymoron. How do companies that base their business model on product freshness and inventory turnover, while selling thousands of garments globally (Inditex, for example, placed 545.036 tons of garments in the market in 2019), call themselves sustainable? Renewing its closet every season is not “sustainable”, but fashion is about launching New collections on a regular (eg every season) basis.

In fashion though, all products or categories are not short-term oriented. Luxury “icons” (eg iconic bags) or basics (eg white shirt) have a longer lifetime. While luxury icons don’t lose their appeal, basics’ neutral styles don’t become obsolete. Consequently, there are many factors when considering sustainability in fashion. For instance, Patagonia is more oriented to sustainability from a “business model/ fashion offering” perspective than Zara (the reasons include usability but also quality).

It is widely accepted that outdoor and sportswear brands are not selling fashion. I don’t fully agree because many of these brands (eg The North Face, Adidas, Nike) are launching limited editions and capsules targeting streetwear lovers. Streetwear cult is based on the same principles than modern art: innovation and experimentation. It is also important to remember that VF Group (Napapijri, Jansport, Eastpak, Timberland, Dickies, Vans, The North Face, etc) acquired Supreme… Today, most apparel, luxury and accessories brands are looking to accelerate product freshness by releasing more styles/colours or increase the assortment through capsules or collaborations. Seasonal collections and runaways are adapting to volatile times (including weather uncertainty). It’s not the only cause of change, but climate change affects the seasons…

Fashion, water and marketing

What about denim and sustainability? This is probably the most “discriminated” product category in the Fashion industry. United Nations Sustainability report says that 10,000 litres of water are needed to make a single pair of jeans. In 2010, Levi’s launched the Better Cotton Initiative, which trains farmers to use less water, pesticides, insecticides, and synthetic fertilisers when growing cotton plants. Other brands that make sustainable jeans using eco-friendly materials and production methods are Everlane, Warp Weft or Frank And Oak. But, do you know it takes around 2,400 litres of water (around 5,000 litres in a Big Mac) to make a single burger? How many burgers to you eat every week or month? How many jeans do you “eat” every month. From the demand side, we must be consistent with our values. In fact, sustainability is linked to health and wellness (e.g. preferences for sugar-free products, vegan food, yoga or mindfulness, just to mention a few).

“ESG in General Retail – who’s faring well in a changing climate?”, an RBC Capital Markets report, says that increasingly a number of retailers and distributors are focussing on reducing the impact of their operations on the environment and are also influencing partners in the industry to reduce their own impact… Approximately 70 per cent of a garment’s climate impact comes from the manufacturing stage, which is energy-intensive, and so retailers are needing to make changes to the way they produce and source garments in order to reduce negative impacts on the planet. In relation to water usage, the report highlights the following initiatives: (all three are fast-fashion/ low-cost apparel groups)

• H&M is working to reduce negative water impacts through the use of its 5-step water stewardship strategy which includes improving the use of water in store and warehouses and requiring suppliers to comply with its sustainability commitment. It has also started using new water recycling solutions for textile and apparel production and it aims to recycle 15 per cent of wastewater by 2022.

• Inditex’s Global Water Management Strategy also aims to use water more sustainably, by following the guidelines of the CEO Water Mandate, which is part of the UN Global Compact. In 2015, Inditex partnered with water.org in a 4-year partnership to provide clean water and better sanitation for communities in Bangladesh and Cambodia.

• Primark has partnered with Solidaridad and the IFC on its partnership for cleaner textile initiative in Bangladesh and its Better Mills programme in China which has invested in technologies to reduce water usage.

Brands incorporate environmental and sustainability business practices but consumers are also changing their shopping behaviours. Sustainability should be analysed from a “closet” perspective: How sustainable is your wardrobe?

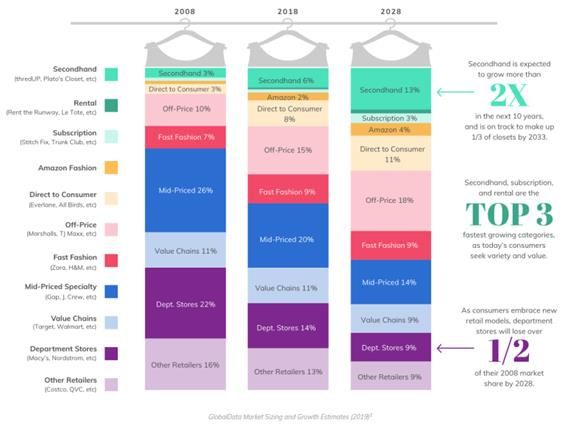

The Closet of the Future from Thred Up Resale Report (2019)

According to the above report, fast-fashion won’t decrease its “closet share” but will grow from 7 to 9 per cent while other segments (categories, distribution channels…) like department stores will decrease from 22 per cent to 9 per cent. Thred Up latest reports shows that with consumers seeking bargains from home, online secondhand is set to grow 69 per cent between 2019 and 2021, while the broader retail sector is projected to shrink 15 per cent. Secondhand market set to hit $64 billion in the next 5 years. Secondhand, Amazon, and off-price are the only sectors expected to gain customers while Gen Z is powering the growth of resale shopping.

Another point I would like to make on the wardrobe’s structure is the decrease of “Mid-Priced Specialty” contribution. In my opinion, companies in the middle of the fashion pyramid will struggle to survive. Even more, if they don’t have sub-brands or product categories covering other price points (eg premium). Armani, for example, has a portfolio of brands or sub-brands that are positioned in many segments of the pyramid, from premium to luxury segments (eg Armani Privée, high-luxury, to Armani Exchange, affordable luxury). Then, brands at the bottom of the pyramid will face competition from Amazon’s private labels or supermarket clothing essentials (eg Carrefour or Lidl). For instance, Uniqlo is selling low-cost but high-quality essentials. But, if you are just a regular brand in the middle-low segment, with not a clear positioning nor loyal customers, competition from the bottom level will kill you. Make sure customers remember your brand.

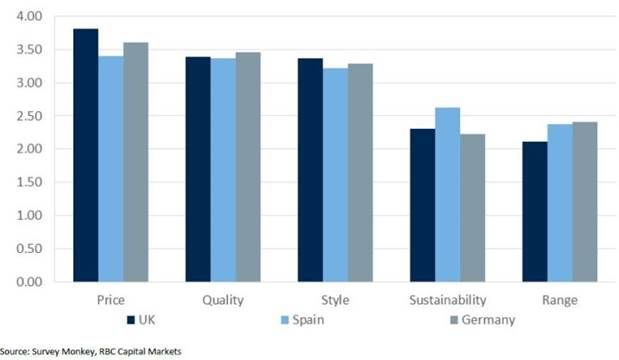

Price and Quality are the two most important factors for respondents

“ESG in General Retail – who’s faring well in a changing climate” report (RBC Capital Markets. Equity Research. June 2020) said that second hand clothing is becoming more popular, a threat to Fast Fashion. According to this report that surveyed 750 consumers from the UK, Spain and Germany, there appears to be a shift away from fast fashion, with over 60 per cent of respondents ‘likely’ or ‘very likely’ to buy higher quality items in lower volumes instead of high volumes of cheaper garments in the next year. We see this as a negative for Primark, as consumers move away from cheaper, mass produced items and look towards more sustainably, longer lasting clothing. Price and Quality remain the two most important factors that consumers consider when buying clothing, followed closely by Style. As I commented previously, brands in the mid and low segment will face many threats.

Sustainability is less of a focus point, although it is still particularly important for Spanish consumers. However we see the focus on Quality indicating that consumers are now more focussed on value for money items, and so this is less positive for the fast fashion market, the report said. Less Is More. Customers may buy less units but the average ticket size (eg upselling effect) could increase due to the preference for high-quality or quality over price items (more value).

More quality, more durability, more sustainability (but less fashion?)

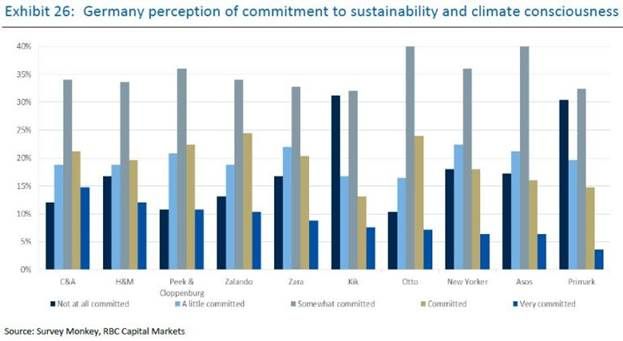

The chart above shows how in UK, Marks & Spencer (British brand) is perceived to be the most committed to sustainability and climate consciousness. In Spain, Zara, Bershka (Spanish brands) and H&M all score well, with over 30 per cent of respondents seeing these as either ‘Committed’ or ‘Very committed’ to climate consciousness. In Germany, C&A (German brand) is seen as the most climate conscious retailer, although both H&M and Zalando (also a German brand) score well, with over 30 per cent of respondents seeing them as ‘Committed’ or ‘Very committed’. So, brand’s perception vary depending on nationality. Why is that? Brands are selling the same products and qualities worldwide… Brands market presence (origin and made in) could explain the correlation between nationalist sentiment and preference for domestic brands. Differences arise also in regards how people perceive sustainability by country as shown above (eg Spanish consumers are more concerned about sustainability). Then, is sustainability a subjective notion?

Advertisements are one of the biggest factors that influence customer perception. But, this is not exhaustive nor objective. Understanding sustainability requires more than a marketing campaign. Pressure groups, academics, regulators, schools (eg teach sustainability to kids), influencers or celebrities, just to mention a few stakeholders, have an important role to play supporting circularity. Sustainability and its perception shouldn’t be based on a marketing campaign. We are more likely to remember content with images and just a few people check sources for validity.

Many brands are greenwashing or just mentioning how sustainable is a part or area of their business. Many times, sustainability is shown from a front-end side of the business, this is the customer-facing side of a company (eg marketing approach: recycled packaging). But are fashion companies taking care of the back-end business (anything hidden from the eyes of the customer like sourcing, supply chain or logistics)? All departments should focus on sustainability: design, sourcing, planning, supply chain, logistics, retail, etc. Do we have a reliable way to analyse sustainability or determine a statement is true or false?

Today, sustainability is unfortunately more cool than real. A few interesting start-ups are defining eco-friendly measures and explain the sustainability performance of retail products.

This article has not been edited by Fibre2Fashion staff and is re-published with permission from fashionretail.com

Comments