As global apparel consumption dipped by 22 per cent in 2020, India’s exports have taken a hit. The vaccine shot for Indian industry would be “manufacturing excellence”.

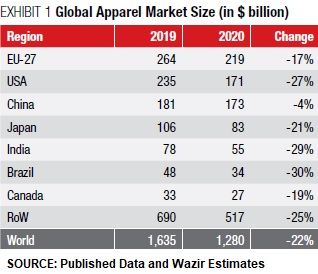

The coronavirus pandemic wreaked havoc on most consumer businesses all over the world in 2020. Textiles and apparel businesses were no exception. It is estimated that global apparel consumption, which was $1.6 trillion in 2019, declined by almost 22 per cent and became $1.2 trillion in 2020 (Exhibit 1).

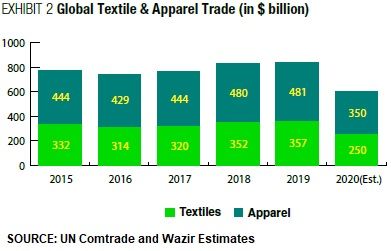

Additional lockdowns in 2021 due to the ongoing second wave of covid-19 in India and other key markets will lead to a further fall in production output and exports. Apparel retail was marred by global lockdowns for 3–5 months in all major markets. Several brands cancelled or delayed orders and many factories remained shut for days due to the looming uncertainty. Supply chains across the world were disrupted. As a result, the global trade in textile and apparel reduced by approximately 30 per cent; from $838 billion in 2019 to $600 billion in 2020 (Exhibit 2).

The pandemic caused acceleration of some key trends in the industry which will have a far-reaching impact in the next few years (Exhibit 3).

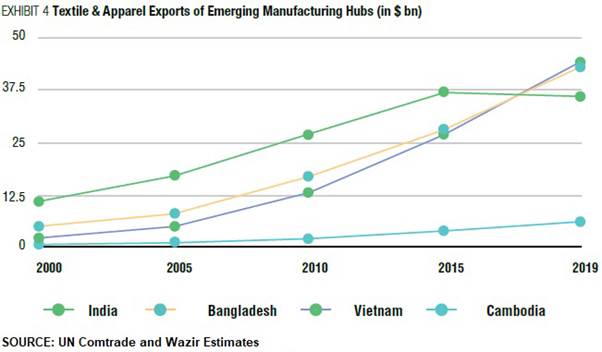

In the last few years, Indian industry’s performance has not been up to the mark, especially in exports. Even after having a large raw material base and manpower pool, the country’s exports have stagnated since 2015. But several smaller Asian exporting nations that are mostly dependent on imported raw material have surpassed India in exports (Exhibit 4).

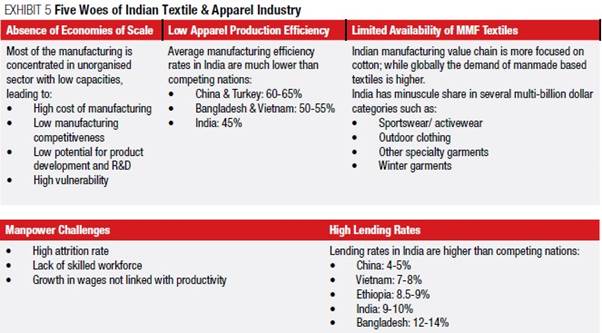

There are 5 key reasons behind India’s suboptimal performance in the textile and apparel sector (Exhibit 5).

At the company level, there are seven common mistakes that are prevalent in the Indian manufacturing units.

Way Forward for Indian Companies

There is a silver lining for the Indian industry in the fact that global buyers are looking to diversify out of China. The US-China trade war and US-EU sanctions on cotton produced in China’s XUAR region are the key reasons behind this trend. As a result, leading global investors will also invest in destinations other than China, either on their own or in JV with local investors. India can position itself as the most suitable alternative to China leveraging its inherent strengths. Recently announced schemes by the Government of India like Production Linked Incentives (PLI) and Mega Investment Textiles Parks (MITRA) are also poised to be gamechangers as they intend to support world class, mega capacities which is need of the hour for Indian industry.

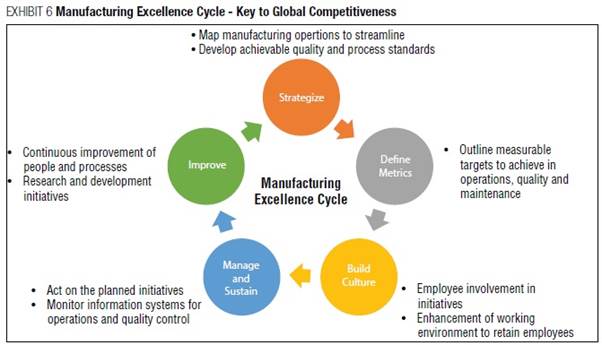

The answer to addressing various woes and tapping the emerging opportunities for Indian textile and apparel companies is to strive for Manufacturing Excellence (emphasis added) (Exhibit 6). The paradigm can help companies counter the input cost increase, improve overall performance and make it ready for the next level of growth. Such companies will be positioned best to attract large buyers and international JV partners.

Practical Approach to Achieving Manufacturing Excellence

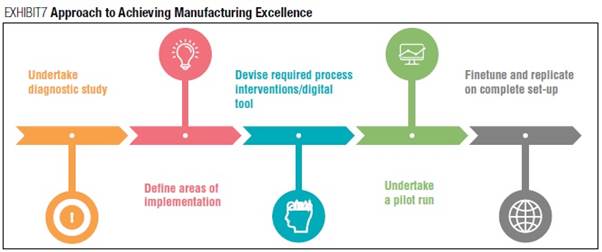

No two companies, their technology, management, manpower skillset, issues and challenges are the same. Hence, the interventions to achieve manufacturing excellence also are different. They need to be customised for each company based on an initial understanding of on-the-ground situation. Hence, the first step on the entire process (Exhibit 7) is conducting a diagnostic study of the unit covering products, processes, technology, infrastructure and manpower.

The diagnostic study helps answer the following questions:

•What is the current status of production, quality, KPIs and operations vis-a-vis industry benchmarks?

•What is the scope of improvement from the current status—with investment and without investment?

•What are the possible savings under different heads?

•What are the interventions required to be implemented for improvement?

•What will be the timeline and associated costs?

Once the complete action plan is mapped out, actual implementation work is undertaken—first as a pilot, which is then replicated on the complete set-up.

Manufacturing excellence is not a process extraordinaire, but a disciplined and scientific way of doing things. The production managers and heads often find little to no time to take a step back and review why are the things the way they are. Their day-to-day intense involvement in operations necessitate involvement of a third party—a manufacturing excellence consultant that brings a fresh pair of eyes to critically review the situation.

In today’s subdued economy, inefficiencies in operations are a recipe for disaster. Indian textiles and apparel companies that operate on waferthin margins need to realise the need to imbibe manufacturing excellence practices now more than ever. One time cost to improve the operations will far outweigh the returns that can be fetched by getting the right support at the right time. And the right time is right now.

This article was first published in the May 2021 edition of the print magazine.

Comments