The US senate has passed a legislation which bans import of cotton and cotton products to the US specially those coming from the Xinjiang region of China to stand against forced labour condition of the Uyghur muslims. This is significantly going to impact the trade of cotton and cotton products between China and the US in future. A report.

The US textiles and apparel imports from China is expected to move down as the US senate has recently passed a legislation to ban import of products from China's Xinjiang region. This move by the US senate is supposed to stand against the forced labour situation of Uyghurs and other muslim groups in China’s Xinjiang region.

According to the Uyghur Forced Labor Prevention Act, the goods manufactured, especially cotton, in Xinjiang of China with forced labour are banned under the 1930 Tariff Act, unless certified by US authorities. This will significantly impact the trade of cotton and cotton products between China and the US.

The US imports of textiles and apparels from China has shown a strong growth as demand from retailers and brands are rising in the US. The US customers are ready to purchase from the stores with a reduction of restrictions imposed due to the COVID-19 pandemic. The situation is soon going to be normal like pre-pandemic situation. The purchasing power of the US population is rising with recovery of the pandemic situation and growth of business activities.

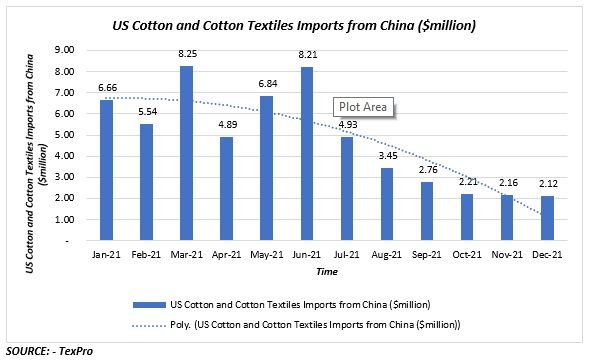

US Cotton and Cotton Textiles (chapter 52) Imports from China ($million)

The US cotton and cotton textiles (chapter 52) import from China was $6.66 million in January 2021. It substantially increased to $8.25 million in Q1 2021 with a rise of 23.83 per cent over the import in January 2021. It is estimated to show a slight drop in Q2 2021 with a rapid increase in corona cases in China.

Now it is expected to move down in the upcoming period with a legislation passed in the US to ban import of cotton and cotton products from the Xinjiang region which accounts for more than 80 per cent of total cotton production in the country. Hence the ban imposed may impact the major cotton and cotton products import in the US from China. The import may move down to $2.12 million in December 2021 with a drop of 74.18 per cent over import of $8.21 million in June 2021 as only the imported cotton and cotton products produced in other regions can be exported to US.

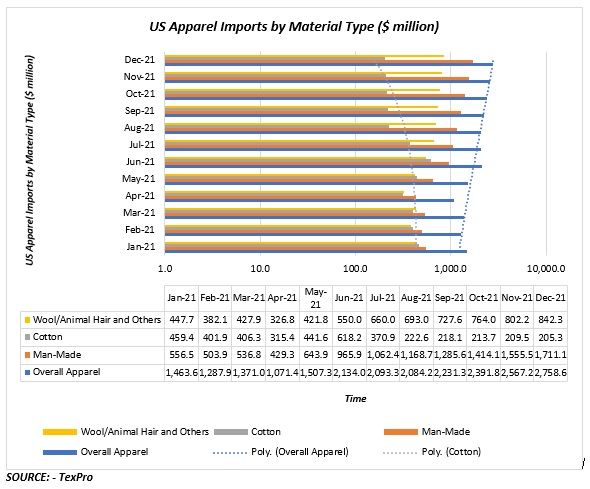

US Apparel Imports by Material Type ($ million)

The total US apparel imports from China is expected to move up in the upcoming period though cotton apparel import is anticipated to drop. An overall apparel import to US from China was $1,463.6 million in January 2021. It dropped to $1,371.0 million in March 2021 with a slight decline of 6.33 per cent. But it showed a gain of 55.65 per cent in June 2021 over the import of March 2021 and reached $2,134.0 million.

Now it is expected to move up further and reach $2,758.6 million in December 2021 with a surge of 29.27 per cent over the import of June 2021.

The US apparel imports of man-made fibre from China is expected to increase in the upcoming period. The man-made fibre apparel import of the US from China was $556.5 million in January 2021. It dropped to $536.8 million in March 2021 with a slight decline of 3.54 per cent. But grew by 79.92 per cent in June 2021 over the import of March 2021 and reached $965.9 million.

Now it is expected to move up further and reach $1711.1 million in December 2021 with a surge of 29.27 per cent over the import of June 2021.

The cotton apparel import to the US from China was $459.4 million in January 2021. It dropped to $406.3 million in March 2021 with a moderate decline of 11.55 per cent. But showed a gain of 52.14 per cent in June 2021 over the import of March 2021 and reached $618.2 million.

Now it is expected to move down and reach $205.3 million in December 2021 with a drop of 66.79 per cent over the import of June 2021.

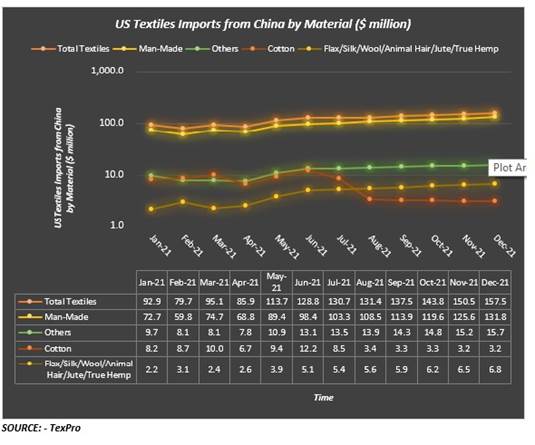

US Textiles Imports from China by Material ($ million)

The total textile import to the US from China was $92.9 million in January 2021. It increased to $95.1 million in March 2021 with a rise of 2.36 per cent over the import in January 2021. It moved up further in June 2021 with a surge of 35.49 per cent over the import in March 2021 and reached to $128.8 million.

Now it is expected to increase to $157.5 million in December 2021 with a boost of 22.27 per cent over the import of June 2021.

The man-made fibre textile import to the US from China was $72.7 million in January 2021. It increased to $74.7 million in March 2021 with a rise of 2.67 per cent over the import in January 2021. It moved up further in June 2021 with a surge of 38.35 per cent over the import in March 2021 and reached $98.4 million.

Now it is expected to increase to $131.8 million in December 2021 with a boost of 43.01 per cent over the import of June 2021.

The total cotton textile import to the US from China was $8.2 million in January 2021. It increased to $10.0 million in March 2021 with a rise of 21.10 per cent over the import in January 2021. It moved up further in June 2021 with a surge of 22.64 per cent over the import in March 2021 and reached $13.5 million.

Now it is expected to decrease to $3.2 million in December 2021 with a decrease of 74.17 per cent over the import of June 2021.

Comments