China’s recovery from the pandemic is running into many issues. From renewed COVID-19 infections to extreme weather conditions, and supply chain disruptions have stalled a smooth return to normal economic conditions. But other two major risks – rising debt and China’s power consumption cuts, could give bigger shocks to China’s as well as the global economy.

Economic recovery from the pandemic has not been smooth until now. From freight costs rising more than 300 per cent since last year to truck and truck driver shortages in EU and US and now rising food prices in many parts of the world, the highly connected world, a boon until recently, has now increasingly become a bane for the supply chains.

The centerpiece of this drama is once again the second largest economy in the world. Chinese ports and major economic hubs were recently hit with multiple typhoons disrupting activity. This combined with renewed surge in COVID-19 infections meant supply was affected even further. Average container freight rates for different routes on the Chinese ports have continued to rise since Mar ‘21, rising by 80.6 per cent between Sep ‘21 and Mar ’21, and more than 460 per cent since the lowest point in Apr ’20. In addition to higher costs, delays in supply have also created new shortages for consumer products in the markets importing heavily from China. Chinese producer prices have also been inching upwards consistently with 9.5 per cent y-o-y in Aug-21. But two other significant challenges in China pose high risk to global supply chains and economic stability – China’s high debt levels and recent curbs on power consumption.

China’s rising debt risk

The latest in the list of events, was the Chinese real-estate giant Evergrande announcing a liquidity crunch and likely inability to service its most recent due debts. This looks like the US real estate market before the Global Financial Crisis, with home buyers borrowing heavily, while non-performing loans for the real-estate sector have been rising.1 And Evergrande is not the first in line in the list of large real estate developers which defaulted on their debt service. Data from Bloomberg shows that net debt issuance (net of repayments) by developers in China was negative for all months in 2021.2 The report highlights that until now, Chinese developers have defaulted on $10 billion of bonds (onshore and offshore), and now not just real estate companies but energy producers might face severe financial stress as well.

For now, the Chinese Central Bank has injected liquidity in the system to reduce the impact and a possible contagion. Still, the debt levels in China pose heavy risk if the situation worsens from here. China’s debt pile, particularly the corporate debt has reached an all time high and at dangerous levels when compared historically with other countries. Where on the one hand, China’s Corporate Debt to GDP was 114.2 per cent at the start of 2009 relative to EU’s 160.4 per cent and US’ 168.1. It has now raced past both countries at 159.5 per cent by end of Q1 2021, compared with EU’s 115.6 per cent and US’ 85.4 per cent. Even worse, estimates suggest that the hidden or unaccounted debt of local governments was also another USD 2.3 trillion, further increasing the risk to its financial system.

Power shortages

Another major development that has hit Chinese industry recently is the power shortages due to rising coal and natural gas prices, along with policy curbs on consumption in order to reduce emissions. The situation has come to a point where factories have had to either curb activity or in some cases, shut altogether. Power shortages have largely hit the three largest industrial provinces Jiangsu, Zhejiang and Guangdong making almost one-third of China’s economy.

The current power crisis in China is because of policy prerogatives to reduce carbon emissions in the run up to Beijing Winter Olympics set to be held in March 2022. China’s carbon emissions have been on a consistent rise and eclipsed those of the OECD in 20193 in absolute terms and was fast catching up in per-capita terms. With the frenzy to control these emissions rapidly, Chinese policy makers are willing to forego economic growth in the process. This is reflected in the directives given to steel producers to put in place production curbs until March 2022.4 This could have further drastic impact on supply chains and lead to continued rise in costs. On the economy side, global agencies are already forecasting lower growth for China in 2021. For instance, Goldman Sachs recently reduced China’s growth forecast for 2021 from 8.2 per cent to 7.8 per cent.

Textile dyeing and chemical fibre factories will also see cuts in production as many enterprises in the Zhejiang province have been directed to do so. China’s industrial supply determines global prices to a large extent, and curbs on production will provide opportunities for competitors to gain market share, however with higher prices for industrial inputs. This will have multiplied impact on inflation in European countries and the US where supply delays have already created a shortage of products.

Potential impact on textile and clothing

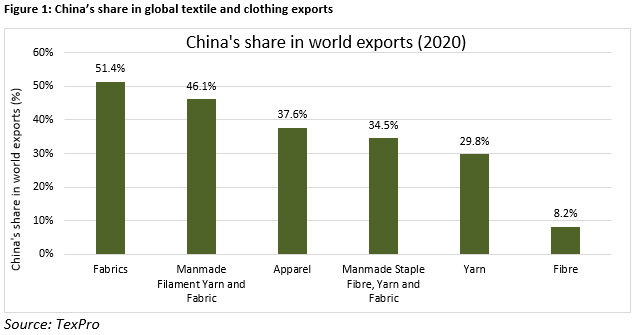

The 2019 report on Global Value Chains reflects how important China is for the global textile industry. Figure 1 shows China’s share in different categories of textile and apparel industry. China holds the largest share in fabrics, man-made filament staple fibre, filament yarns and fabric, which are also the likely sectors to be hit by the policy directions to cut emissions.

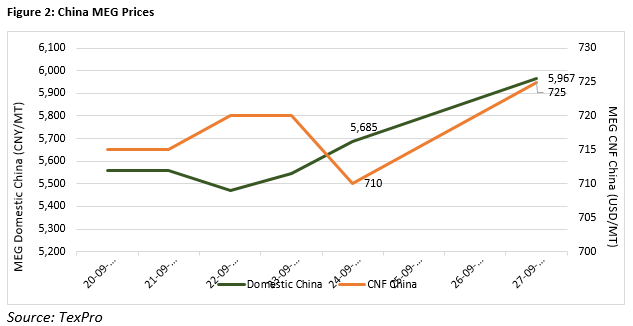

Polyester markets are likely to see supply demand pressures as mix of factors such as container shortages, high freight costs and policy curbs on power consumption. Prices of more energy intensive inputs in the textile supply chain are likely to be hit harder from this crisis as factories are made to run on reduced capacity. For instance, daily price updates from TexPro show that China domestic MEG prices increased by 282 CNY/mt and China CNF MEG prices rose by around 15 USD/mt between Sep 24 and Sep 27, owing to expectations of tight supply going further (Figure 2). Multiple MEG producers have been reported to have cut production or entirely shut operations recently with no hint of the timeline for resuming it. PX and PTA operating capacity in China has also reportedly reached its lowest this year due to the energy curbs and it is expected to put tremendous pressure on these markets.

1https://asia.nikkei.com/Business/Markets/China-debt-crunch/China-s-souring-developer-loans-raise-fear-of-financial-contagion

2https://www.bloombergquint.com/business/record-defaults-hit-china-s-weakest-firms-as-liquidity-tightens

3https://rhg.com/research/chinas-emissions-surpass-developed-countries/

4https://www.bloomberg.com/news/articles/2021-08-10/china-aims-for-olympic-blue-with-plans-to-extend-steel-curbs

Comments