With brick-and-mortar stores, the consumer can feel and actually try-on the garment, but it reduces design to the lowest common denominator. On the other hand, the goal of the e-commerce retailer is to differentiate themselves from everyone else. However, the problem occurs when they move into the bigtime. So, we are moving into a new model which is the fusion of brick-and-mortar and e-commerce.

We tend to divide garment retail into two distinct sectors: E-commerce and Brick-and- Mortar (B&M). According to Daniela Coppola, a senior researcher at Statista, e-commerce is moving ahead and will continue to do so in the future while B&M is in secular decline.

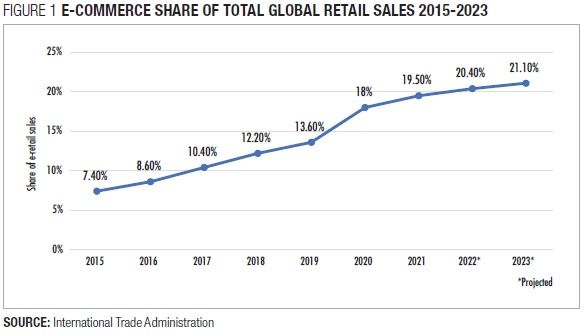

From its share of 8.6 per cent in total global retail in 2015, e-commerce’s share is expected to reach 24.5 per cent in 2025. I have no reason to doubt these figures. Statista is a reliable operation. However, while the data may well be accurate, the conclusions we draw are almost certainly incorrect because we are confusing process with structure. The e-commerce process is definitely rising but not the e-commerce sector because there is no distinct e-commerce sector. Today, every B&M store operates its own e-commerce website, while an increasing number of what we once termed pure-play e-commerce providers have opened their own B&M stores.

At the same time, some B&M stores are doing well. Finally, while many traditional B&M stores are being pushed to the wall, so too are pure-play e-commerce operations.

So, it would be better if we stop thinking of e-commerce and B&M as company types and start thinking of them as models which often co-exist within a single company.

To understand the nature of each, we should look at the advantages and disadvantages of each.

Brick-And-Mortar: The Advantage

• The consumer has an opportunity to actually look and feel the garment, rather than seeing just a picture of the garment.

• The consumer can actually try-on the garment rather than relying on a size number or letter. In a world where every label has its own sizing this is an important factor. Some B&M retailers, particularly those in better quality fashion, now offer alterations too.

Brick-And-Mortar: The Downside: Lowest Common Denominator Design and Markdowns

Today most B&M retailers follow the something-for-everybody model. This is simply a question of geography. The retail store by definition has a fixed location. Its potential customer base is limited to the distance a customer will travel to get to the store. A customer might travel 50 miles but not 500 miles.

Success is based entirely on increased market share — the ability to draw the potential customer away from other B&M competitors. To maximise its customer base, the store must sell fashion that appeals to the greatest number of potential customers and at prices that will further attract those customers.

But reality is different. In fact, the something-for-everybody model defined as fashion-for-everybody strategy has put the major retailers in a hole for two reasons:

• To succeed, the retailer must reduce design to the lowest common denominator boring designs because the more individualised the design, the smaller the potential customer base. The market for edgy designs is limited. Indeed, the edgier the design the smaller the market. Most consumers do not want edgy design. Those that do, will often turn away from the style. For example, “I love that jacket. It is new, interesting and at the cutting edge. It is great, but not for me.”

• To succeed, the retailer must have sufficient stock of every style, in every colour and every size to meet potential consumer demand. The retailer cannot afford to sell out of any style because every lost sale reduces market share. The result is a plethora of unsold garments which must be sold at reduced prices. Currently for fashion goods, the markdown rate (the difference between the price shown on the hangtag and the average price received after all sales and discounts) is over 35 per cent of the original retail price.

In this regard, markdowns are not evidence of a failure of design, merchandising or sourcing skills, but rather the necessary result of the never-ending fight for lower costs. This in turn limits the ability of the designers to create the best designs, the sourcing specialists to work with the best factories, and the merchandising executives to select the best style rather those with the lowest cost.

However, markdowns will continue to grow, resulting in ever-increasing retail prices until M&B retailers either change their business model or are replaced by other retailers with a more rational business model.

E-Commerce: The Upside

E-commerce is the opposite of B&M. The B&M store’s market is relatively small, based entirely on the number of potential consumers willing and able to travel to the store — about 10 million. On the other hand, the e-commerce retailer’s market is the entire world — 7.9 billion. Their potential customer base is 800 times the B&M store. The goal of the e-commerce retailer is to differentiate themselves from everyone else. The most successful e-commerce player is a small niche retailer.

Considering the following

***************

Fable: The Origin of E-Commerce Start Ups

E-commerce began with one person: Tom with the big head.

Tom wore a size 72 hat, or would have, if there had been a size 72 hat. The problem is that only one man in a million has Tom’s size head. If a store is located in a large urban area with a potential consumer base of 10,000,000, of which half 5,000,000 are men, a store selling size 72 hats would have 5 potential customers. We can understand why Tom went hatless.

Until the day Tom discovered the internet and went into business. With internet, Tom’s customer base was not a circle with a 50-mile radius. It was a circle with a radius of 12,500 miles. His customer base was not 50 per cent of 10,000,000, but 50 per cent of 8,000,000,000. And rather than only five potential customers, Tom now had 4,000 potential customers, every one of which would be willing to pay a premium for a hat that actually fit their head.

Tom set up a website, went to a hat factory where he placed orders for size 72 hats in four styles, 500 pieces each.

30 days later the hats arrived at Tom’s house. He put his stock in his garage, his guest room. In fact, everywhere.

He posted the stuff on his website and sat back and waited. The first day he sold 3 hats. By the end of the first month, he had sold 43 hats. This was a little depressing until one of the social media superstars posted 2 sentences on Instagram:

TOM WITH THE BIG HEAD SELLS SIZE 72 MEN’S HATS

GO TO TOMWITHTHEBIGHEAD.COM

The good news was that Tom’s business dramatically increased.

The bad news was that Tom’s stock sold out in 34 minutes.

Tom’s business plan was different. Rather than measuring success in terms of rising market share, Tom was happy with a market share of 0.00005 per cent. In Tom’s new market, success is based entirely on the product that is new, exciting and above all different. Tom’s business model could be summed up in one very strange sentence: The smaller your customer base, the more successful your operation.

This is the fundamental problem facing the something-for-everybody crowd. The big stores all have e-commerce websites, but what they are selling is by definition cookie-cutter boring. Tom’s customers shun them. In fact, their only customers are the people who already shop at those brick-and-mortar stores.

Think of the garment retail as a three-tiered market. At the top we have the designer labels. At the bottom we have the mass market Walmarts, Targets, etc. Both have secure customer bases. The big B&M stores are in the middle. They not only have to compete against the top and the bottom tiers, but also against Tom-with-the-big-head and his thousands of friends.

Where once retail was blah, suddenly the design cutting edge now extends out to infinity. Today, anybody with an idea can actually go into business. Of course, 90 per cent go broke in the first year, but the new generation something-for-somebody began to understand their competition.

Tom’s something-for-somebody idea led to ‘the smaller you are, the more successful you are’ which caught on. Dick, Harry, Selma, Ethel and their 10,000 friends joined in.

***************

E-Commerce: The Downside

The small niche e-commerce model is almost unbeatable. However, the problem occurs when they move into the bigtime, where marketshare becomes a factor. Many, particularly those operating in the fast-fashion market, fail to realise that their customer base is inherently unstable, looking for instant gratification. It is like: “We want the newest, latest, the edgiest and we want it NOW!”

In these difficult times, when disposable income is reduced, those addicted to instant gratification can still meet their needs, only at the expense of their suppliers. The process is simple

• Buy Now

• Wear once

• Return to the supplier

With returns reaching 30 per cent, yesterday’s winners such as Boohoo and Missguided are fast becoming today’s losers.

E-Commerce: The Future

The e-commerce model will continue to grow because it best meets the needs of our times. We live in an era of populism, when ordinary people previously trapped in a system where they had little or no control over their lives, have broken free.

Almost everybody dreams of going into business for themselves. Clothing retail is usually high on the list. Everybody wears clothes. Almost everybody at one time or another has been unable to buy what they wanted because it was not available in the market. If only I could bring that to market….

This has always been a dream because you do not have the capital and without that there can be no store.

E-commerce has changed all that. Now you require little capital and no store.

As we see from Figure 1, e-commerce will continue to grow because ordinary people now have a chance.

The traditional B&M store will continue to lose market share because their target consumers are those of who grew up in the pre-internet age. Within a decade these people will be gone and so too will the stores that currently rely on them.

However, there is a new model: The Fusion of B&M with E-commerce. We are moving into the period when the physical store will become only a shell — a showroom where consumers can visit, see and try-on the actual clothing, and where a tailor can take measurements for alterations. This new model store will have no inventory, no backroom staff, and no sewers to make alterations. All that will be at a central location, where the consumers’ garments will be selected, altered, and sent directly to the consumers’ homes. Each branch store in this hybrid operation will be smaller, with reduced staff and lower overheads. Markdowns will be reduced because branch stores do not need the inventory of all colours and all sizes for every style.

This is the future, and that future is already here.

Comments