Interviews

Trade war pushes firms from PRC to GSP nations: statistics

18 May '19

3 min read

Pic: Coalition for GSP

Evidence continues to grow that the nearly year-long US-China trade war is pushing companies to source more from generalised system of preferences (GSP) countries like India, Thailand, Cambodia, Indonesia and Turkey, according to the Coalition for GSP, a group of US firms and trade and consumer bodies educating policymakers and others about GSP benefits.

The May 10 increase in tariffs on $200 billion in imports from China and the announcement that new tariffs on the remaining $300 billion worth imports could come soon will only accelerate the trends, the coalition said on a website that it runs.

Shifting trade from China to these countries does not appear to be a by-product of recent actions, but instead one of President Donald Trump’s explicit goals, and it is working.

GSP saved US companies $105 million in March, an increase of $28 million (36 per cent) from March 2018 and the second highest level on record. In the first quarter of 2019, GSP saved US companies $285 million. That is $63 million more than the first quarter of 2018.

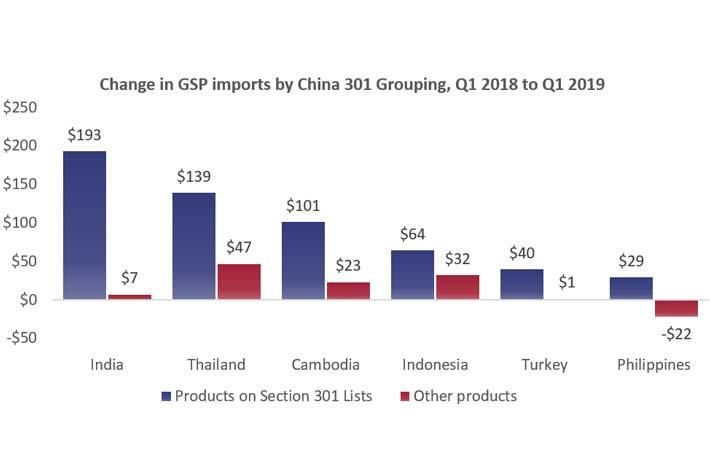

Products hit by Section 301 tariffs when imported from China account for 90 per cent of increased GSP imports in 2019. Overall, GSP imports rose by about $760 million, with $672 million coming on products on China Section 301 lists. GSP imports of products on those Section 301 lists increased by 19 per cent, while GSP imports of other products increased by just 5 per cent.

For India, 97 per cent of increased 2019 GSP imports are on the China Section 301 lists. GSP imports on Section 301 lists increased by $193 million (18 per cent), while imports of everything else increased by just $7 million (2 per cent).

Similarly for Turkey, 97 per cent of increased 2019 GSP imports are on the China Section 301 lists. GSP imports on Section 301 lists increased by $40 million (13 per cent), while imports of everything else increased by just $1.2 million (less than 1 per cent).

For the Philippines, GSP imports of products on China 301 lists growth helped offset declining GSP imports of all other products. South Africa, Brazil, and Egypt saw similar increases in Section 301-affected products offset losses of other products.

Not only would terminating GSP for India, Turkey, or others under review hurt many US companies and workers that have relied on GSP for years, it also would reduce viable sourcing options for companies looking to buy less from China in response to Section 301 tariffs, thereby undermining President Trump’s own objectives. (DS)

The May 10 increase in tariffs on $200 billion in imports from China and the announcement that new tariffs on the remaining $300 billion worth imports could come soon will only accelerate the trends, the coalition said on a website that it runs.

Shifting trade from China to these countries does not appear to be a by-product of recent actions, but instead one of President Donald Trump’s explicit goals, and it is working.

GSP saved US companies $105 million in March, an increase of $28 million (36 per cent) from March 2018 and the second highest level on record. In the first quarter of 2019, GSP saved US companies $285 million. That is $63 million more than the first quarter of 2018.

Products hit by Section 301 tariffs when imported from China account for 90 per cent of increased GSP imports in 2019. Overall, GSP imports rose by about $760 million, with $672 million coming on products on China Section 301 lists. GSP imports of products on those Section 301 lists increased by 19 per cent, while GSP imports of other products increased by just 5 per cent.

For India, 97 per cent of increased 2019 GSP imports are on the China Section 301 lists. GSP imports on Section 301 lists increased by $193 million (18 per cent), while imports of everything else increased by just $7 million (2 per cent).

Similarly for Turkey, 97 per cent of increased 2019 GSP imports are on the China Section 301 lists. GSP imports on Section 301 lists increased by $40 million (13 per cent), while imports of everything else increased by just $1.2 million (less than 1 per cent).

For the Philippines, GSP imports of products on China 301 lists growth helped offset declining GSP imports of all other products. South Africa, Brazil, and Egypt saw similar increases in Section 301-affected products offset losses of other products.

Not only would terminating GSP for India, Turkey, or others under review hurt many US companies and workers that have relied on GSP for years, it also would reduce viable sourcing options for companies looking to buy less from China in response to Section 301 tariffs, thereby undermining President Trump’s own objectives. (DS)

Fibre2Fashion News Desk – India

Popular News

Leave your Comments

Editor’s Pick

-Ltd..jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)