European Central Bank's rate hike to impact global textile sector

Given the projected persistence of high inflation, the Governing Council has raised the three key ECB interest rates by 50 basis points, bringing the main rate to 3 per cent. Prior to July of last year, this rate had been in negative territory. Additionally, the ECB has revised its inflation expectations, now projecting an average of 5.3 per cent for this year and 2.9 per cent for 2024. In comparison, December projections showed a 6.3 per cent inflation figure for 2023 and a 3.4 per cent rate for 2024.

ECB has made the commitment to reducing inflation and announced plans for further rate hikes of 25 basis points in May and June. The prevailing consensus is that interest rates will indeed increase, which may have a negative impact on textile and apparel manufacturers' income. This is due to the current state of the retail market, which does not suggest a significant turnaround in the near future.

A prevailing trend in the retail industry is the reduction in the number of stores, resulting in fewer opportunities for manufacturers. This development could worsen the situation as retailers are hesitant to raise prices to cover increased interest rates, fearing consumer resistance. As a result, manufacturers may face tighter cash-flow positions, further compounded by continual hikes in the minimum wage. This may force companies to operate on a smaller scale to meet their heightened operating expenses.

Furthermore, a surge in borrowing costs due to an increase in interest rates could have a significant impact on employment levels. This situation is likely to cause considerable concern for textile and apparel manufacturers, given the additional challenges posed by the prevailing retail environment.

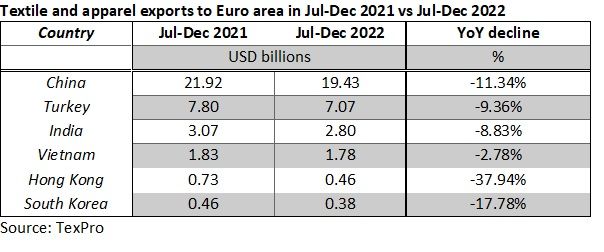

Countries such as India, China, and Vietnam have already experienced a fall in their textile and apparel exports to the euro area due to reduced demand as consumers have cut back on their expenditures. Since textiles are considered non-high priority items, any upsurge in the prices of goods is making consumers prioritise their spending towards necessities such as food, energy, and housing. Generally, when interest rates rise, demand weakens, which can lead to a downturn in the global textile industry.

Fibre2Fashion News Desk (WE SR)

-Ltd..jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)