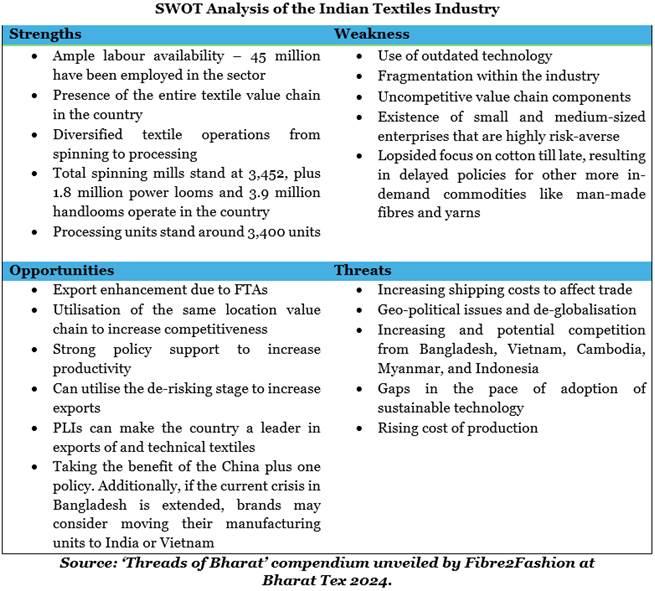

The Indian textile industry is one of the oldest in the world. Though being the second largest textile manufacturer right after China, the country’s export share globally stays restricted to around 2.5 per cent.

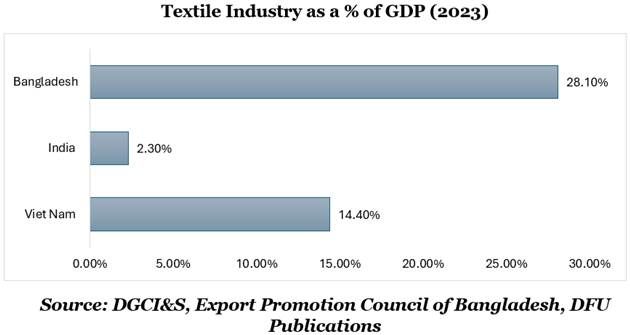

The Indian textile industry is one of the few vertically integrated, where industries and mills integrate all textile manufacturing processes. Along with being the largest producer of textiles, it is also the fifth largest producer of technical textiles; with the industry projected to grow at a CAGR of 8 per cent. With value addition missing in the Indian textile industry, there is an increasing need to initiate policies that can ensure the development of the industry. Being the largest cotton producer and also the second largest producer, 60 per cent of the Indian textile industry is cotton-based.

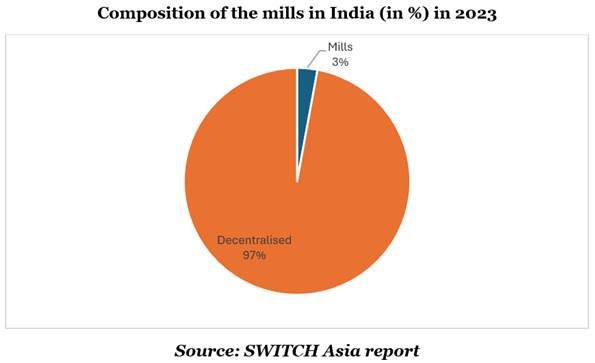

Handlooms dominate the country’s textile industry, employing millions of people. The country so far has more than 3,400 textile mills with 48 million spindle capacity. However, the decentralised power looms form a larger portion of the Indian textile industry. This is one of the major reasons for the slow adoption of technological advancements in textiles. However, the recent adoption of robotics, automation, and blockchain in the textile stages of spinning, weaving, and processing is slowly yet steadily leading to growth in the textile sector.

The Indian textile industry produces diverse textiles, from fibre, yarn, and fabrics to readymade garments. The country has the second largest vertically integrated production base. There are a lot of potential factors that can be the reason for the industry’s success. These include availability of low-cost labour followed by an abundance of naturally available cotton. Moreover, the locations of the textile mills give the nation immense, natural, cost, and geographical economies of scale. Those benefits however stand to be hampered by the complex policies, much tighter labour laws, a complex taxation system, and some import and export duties. This has resulted in the inability of the country to achieve economies of scale. The recent measures by the government may nonetheless help the country to achieve economies of scale in the medium to long term.

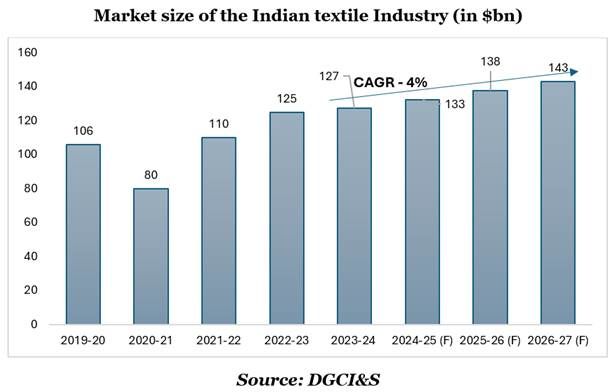

The market size of the Indian textile industry

The size of the Indian textile industry is about to increase to around $144 billion in FY 27, as compared to $127 billion in FY 24 at a CAGR of 4 per cent. There can be various factors that can lead to an increase in the market size. Government initiatives like Skill India, ‘Make in India’, and other recent measures can indirectly help in boosting the textile industry. The reversal of the inverse duty structure and the introduction of PM MITRA scheme will lead to an increase in the market size, which will be led by the easing of norms, improvement in infrastructure, and less bureaucracy.

Another reason for an increase in the market size of the Indian textile industry is the expanding middle class in India, which will result in higher demand for textile and apparel products. Indian middle class represents 31 per cent of the population and will account for 60 per cent by 2047. This major jump also means that the Indian textiles industry will have a lot of untapped new consumers to cater to. However, to cater to the rising population which is more value and price-sensitive, India needs to review its strengths and weaknesses to assess further opportunities, and where it can capitalise them.

Factor comparison for textile industries in India

Besides China, there are three major textile-exporting nations—Bangladesh, India and Vietnam—from Asia. All three countries have immense significance in the textile industry from an economic perspective. For India, the textile industry plays a major role as it employs around 100 million people. However, for Bangladesh, it plays a major role in terms of the economy and the GDP. The sector contributes over 80 per cent to the country’s foreign exchange earnings.

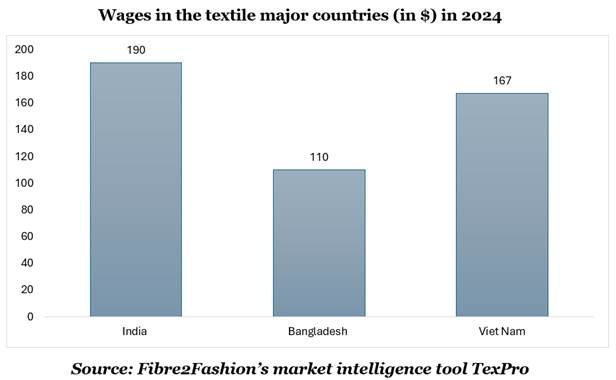

In terms of wages, India has one of the highest wages for labour among the three countries considered. However, the wages are flat in this sector for India, according to the Textiles Committee, which is creating worker scarcity. It is also observed that many brands and high-profile manufacturers are shifting their base to other countries with cheaper labour.

Looking at the current crisis in Bangladesh, India may benefit if the uncertain situation continues; however, stringent policies and inflexible labour laws can result in India not only losing out on the ‘China plus one’ opportunity, but also the upcoming potential opportunity.

Drivers of Exports for India

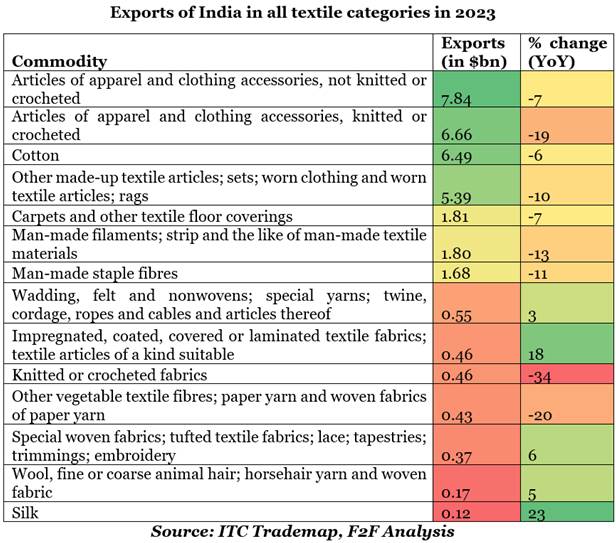

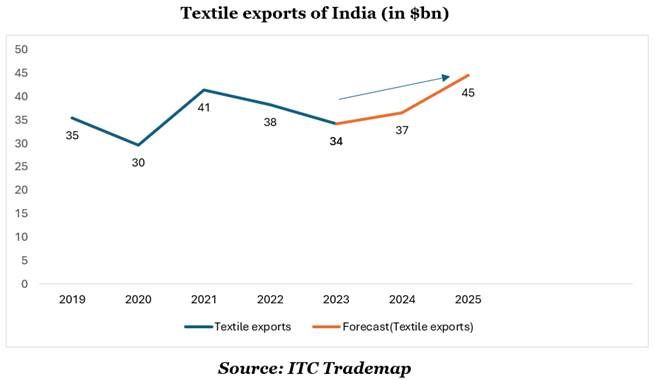

One of the most important factors driving the textile industry is exports. Indian apparel and textile exports contribute to around 12 per cent of total exports of the country, indicating the significance of the textile industry for the country’s exports. The need to improve the apparel sector will increase if the country wants to take the benefits of the expanding consumer base globally.

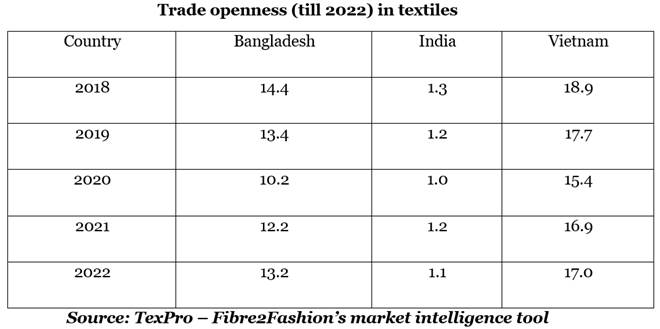

If we compare the trade openness of India with Bangladesh and Vietnam, there is a significant stagnation in the indicator as compared to the other two countries. The reason for the same are significant barriers in terms of the quality control measures, a duty structure that is slowly moving towards protectionism in a bid to punish the geopolitical rivals of India, to encourage domestic manufacturing and exports, and to curb inflation in the country in the times of crisis. So, there is a need to guard that the current policies do not turn out to have a counter-productive effect on India. The Government of India needs to ensure that the policies that are implemented are more in favour of increasing trade competitiveness and openness of India for textile exports.

India’s exports for the year 2023 have fallen by 11 per cent YoY. This is influenced by a lot of different factors like the crisis in the EU and the US; the Russia-Ukraine war; the Hamas-Israel war and the risk of the war spreading to the Middle East which has made all the countries more cautious in their expenditure. In addition, the Red Sea crisis is resulting in a continuous increase in freight prices, which is harming Indian exporters. Apart from this, the Indian textile MSMEs are under immense stress due to the losses and the debt pressure, which is leading to industry-wide demands for a moratorium on debt repayment.

However, there are other issues that have led to stress in the sector. The issues are:

-

Slower rate of technological adoption

-

Lack of adoption of digital infrastructure for the Indian textile industry

-

Higher fragmentation

-

Incompetent value chain

There are efforts made by the Government of India to boost Research and Development (R&D) in the value chain through the Technology Upgradation Fund Scheme (TUFS) and Amended Technology Upgradation Fund Scheme (ATUFS). Further, to ensure that the industry adopts globally acceptable sustainability standards, there have been some developments regarding the zero liquid discharge (ZLD) mechanism in a lot of textile intensive states of the country.

Road Ahead

The Union Budget for 2024-25 proposed to take the country’s textile exports to $600 billion by 2047 which is a humongous task for the Indian government. Although India has all the potential, the country is unable to achieve economies of scale and mass production like Bangladesh, Vietnam, and China—even though it has a full value chain present in the country.

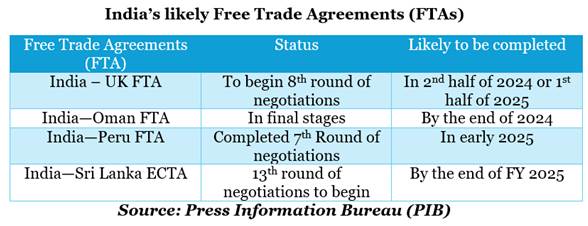

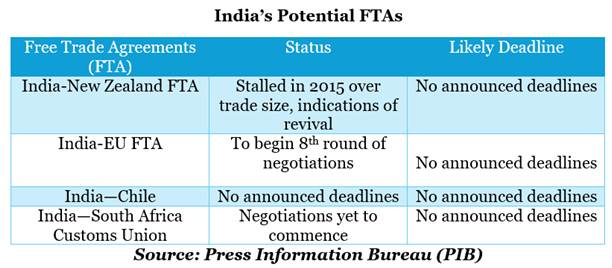

The country needs to ink more FTAs with other countries taking advantage of the de-risking trend which is taking all the countries by storm. The Government of India is anticipating early completion of its FTA negotiations with the UK, Oman, Peru and Sri Lanka. In addition, it is looking forward to signing FTAs with the EU, New Zealand, Chile and South Africa Customs Union.

India already has 15 FTAs in force. The textile sector needs to utilise these existing FTAs, whose utilisation rates is far below 25 per cent. In comparison, other countries on average have utilisation rates of above 50 per cent. Adoption of sustainable practices in line with consumer demands and global trends is also required. With this, there needs to be some relaxation in the tariffs for the importation of the textile raw materials which is harming the ability of the industry to be in line with the trends of man-made fibres. However, the extension of the Rebate of State and Central Taxes and Levies (RoSCTL) Scheme till 2026 will help the industry to be in alignment with the global standards and make the Indian exports competitive.

Innovations like 3D printing, the use of organic material for manufacturing apparel using nanotechnology, and laser printing to produce apparel and design is the need of the hour. If India can use these technologies, not only can it gain huge in terms of cost savings in the long run; but also, can be a step towards mass production and achievement of economies of scale.

20240830145908.gif)

20240924091633.png)

20240924111837.jpg)

Comments