The recent Economic Survey 2016-17 of the ministry of finance analyses the growth of the apparel sector, and reveals that there is ample scope for development. The Indian apparel industry can grow considering that China is losing ground due to various factors including a rise in labour wages. However, there are certain factors that are hindering the growth of the sector, which need to be tackled to ensure its unprecedented growth. A Market Intelligence-Fibre2Fashion report.

The Economic Survey, the flagship annual document of the ministry of finance, represents the annual economic performance of the Indian economy. It is presented every year in Parliament by the ministry a day before the presentation of the Union Budget. It reviews the performance of key development programmes the policy initiatives of the government, and forecasts the effect of different government initiatives from short term to long term.

Last year, two major decisions had been taken by the Indian government-the implementation of the goods and services tax (GST) and demonetisation of currency notes in the denominations of Rs500 and Rs1,000. These actions led to a temporary decline in the growth trend, but will help boost the growth of the Indian economy, according to the Survey.

The apparel sector is growing in India as people are more concerned about their lifestyle and thus, the demand for branded and quality clothes across the country as well as across the globe has gone up. During 2015-16, the apparel sector contributed 42 per cent of the total share in textiles and apparel exports of India. The apparel sector has a huge potential for employment generation especially for women.

The apparel sector is the second largest labour intensive sector after footwear. It is dominated by female workers, driving the cause of women empowerment. Women empowerment leads to the development of the country with the growth of the apparel sector.

Opportunities and challenges

The current and expected global market conditions are ideal for growth of the Indian apparel sector as China is losing market share. Because labour wages have been increasing in China, the country's stability in the global market has been affected.

Table 1: Minimum wages of workers for apparel sector

Source: ILO, State Labour Department

In Table 1, the wages of leading apparel manufacturing countries are shown. India and Bangladesh have the lowest wages among all. India has a huge potential to take the position of China due to cheap, skilled and abundant labour force for the apparel sector. It can take advantage of the situation, but Bangladesh and Vietnam give tough competition to India with their lower wage rates and other favourable policies.

The apparel sector is growing in

India, but some constraints still hinder its growth. The challenges faced by

the apparel sector include labour regulations, trade policies, tax and tariff

policies, logistics, and the international trading environment as compared to

other countries. Moreover, the time and cost involved for the transport of

goods from factories to destinations are higher than its competitor countries.

The labour regulations have

nullified the benefits of low labour wages with regulations on minimum overtime

pay, tax regulations for low-paid workers, less flexibility for part time workers

and higher minimum wages in some conditions. Indian apparel firms are smaller

in size and capacity than those in other countries. Around 78 per cent

companies have 50 or less workers, while only 10 per cent employ over 500

workers.

Tax and tariff policies are

different in India from competitor countries. The taxes and tariffs are

different for manmade textiles and cotton/natural textiles. The policy is in

the favour of cotton-based textiles than manmade textiles. This is a serious

issue because the export demand of manmade textile is more than cotton-based

textile globally. With the tax relation for the manmade textile, exports can be

increased.

India imposes 10 per cent tariffs

on manmade fibres, and 6 per cent on cotton fibres. The higher tariff on fibre

and yarn directly leads to higher cost of cloth and apparel products. The tax

and tariff policy needs to reform for the equality of all textile products.

Domestic taxes are also lower for cotton apparel than manmade apparel-7.5 per

cent vs 8.4 per cent respectively.

Competitor countries offer more

benefits for improved market access in the international market than India.

Competitor countries have zero tariffs in the two-leading apparel importing

markets i.e. European Union (EU) and US.

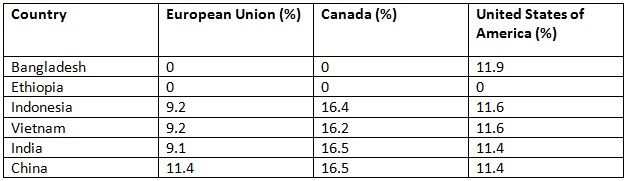

Table 2:

Tariff faced for export in major importing countries

Source:

World Bank Database

Table 2 shows the average tariffs

in different countries for the export of apparel. Bangladesh being a least

developed country (LDC), its exports to the EU are duty-free. Vietnam has also

enjoyed the benefits of zero tariffs once because of the EU-Vietnam free trade

agreement (FTA). Ethiopia enjoys duty-free exports to all major importing

countries and is an emerging competitor for India.

Policy response

To face the above challenges of the apparel sector, a special package was approved by the Indian government in June 2016. Apparel exporters will be allowed to offset the impression of state taxes imposed on exports, which could be as much as 5 per cent of exports.

-

Apparel sector will get a subsidy to boost the employment in the apparel sector. The government will provide benefits in the employees provident fund.

-

The government is serious about export policy discrimination from major importing countries. India will be very cautious while negotiating the FTA with the UK and EU.

-

According to a recent house analysis (2016), an FTA with the UK and EU can create 1,08,029 direct jobs per year in the apparel sector, besides indirect jobs.

-

GST will provide an opportunity to nullify domestic indirect taxes especially for manmade apparel production against cotton-based apparel.

-

Employment in the apparel sector can be created by the reformation of labour laws. Low wage employees get only 55 per cent of the salary since 45 per cent of it goes to various provident fund schemes and insurance. Low wage employees may not prefer 45 per cent savings as they need their salary at that time rather than in the future.

-

Employees should be given a choice in terms of savings. They should be free to decide among the different schemes for savings to encourage them to save. Various insurance policy companies also offer great options.

The apparel sector has a tremendous opportunity for growth and job creation, which directly leads to economic growth. The aim of all industrial policy promotion is to implement them without risk. But the apparel sector can boost exports, employment and social transformation by employing women. To conclude, many of the future policy responses like labour law reform, FTAs and tax rationalisation could give huge benefits to the Indian economy.

Comments