The Goods and Services Tax (GST) comes into effect from July 1, 2017. The textiles and apparel industry, by and large, has welcomed the tax rates that were announced by the GST Council on June 3, but opinions differ on how things will play out on the ground, Subir Ghosh reports.

The Goods and Services Tax (GST) is at long last all set to be rolled out from July 1, 2017. What was once much-awaited will now be a financial reality, and GST will be the way forward. There is almost near-unanimity among various sectors of the Indian textiles and apparel industry that GST will be beneficial in the long run, though there are differences of opinion and uncertainty over finer points.

The Goods and Services Tax (GST) is at long last all set to be rolled out from July 1, 2017. What was once much-awaited will now be a financial reality, and GST will be the way forward. There is almost near-unanimity among various sectors of the Indian textiles and apparel industry that GST will be beneficial in the long run, though there are differences of opinion and uncertainty over finer points.

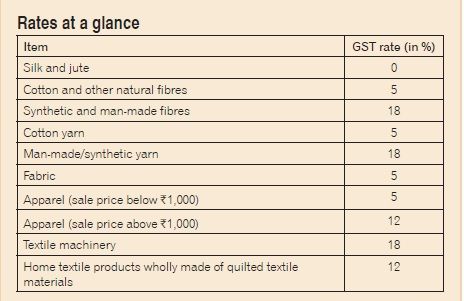

The textiles and apparel industry had to wait for close to two weeks after the GST Council on May 28 announced the first round of rates for most goods and services. Many in the industry had expected, or at least wanted, a uniform tax structure across the value chain. The council, chaired by finance minister Arun Jaitley and comprising his state counterparts, made a distinction between various items which would attract different rates-four slabs in all (see box: Rates at a glance).

Readymade apparel priced below ₹1,000 would attract GST at 5 per cent, while apparel above that mark would be taxed at 12 per cent. No tax would be levied on silk and jute fibres, while cotton and natural fibres would be taxed at 5 five per cent. Man-made fibre and yarn will be taxed at 18 per cent, while all other fibres and yarn would have a uniform 5 per cent rate. Fabric, irrespective of the fibre used, would be taxed at 5 per cent. In case of textile job work, the tax slab was initially 18 per cent, but was subsequently brought down to 5 per cent. This would be applicable to the work done by powerloom weavers, handloom weavers, knitters, processing units, and dyeing units. The job work carried out by garment and made-up manufacturers, however, would be subject to 18 per cent GST.

The GST Council has also increased the upper limit for the 'composition scheme' to ₹75 lakh from the earlier ₹50 lakh. Now, traders and manufacturers with an annual turnover of ₹20 lakh to ₹75 lakh can opt for the scheme and pay tax at 1 per cent and 2 per cent respectively. This scheme exempts tax payers with an aggregate turnover in a financial year up to ₹20 lakh-₹10 lakh in the Northeast and special category states-from GST. An entity whose aggregate turnover in the preceding financial year is less than ₹75 lakh-earlier ₹50 lakh-can opt for a simplified 'composition scheme' where tax will be payable at a concessional rate on the turnover in a state.

GST for the industry as a whole

The majority view among industry experts and players is that the GST rates would be beneficial. Vinod Wadhwani, deputy manager (merchandising & marketing) at the Raymond Group, declares, "The consensus across the board is that GST is not only a tax reform ushering in an era of a common tax code, but in fact a business reform bringing about a paradigm shift at a time when the textiles industry is facing challenges across the globe."

The CEO of Anil International / Anil Associates, Saorabh Saaboo, is expecting hiccups in the immediate future. "GST is important and in the long run will surely benefit the industry, but if it's made too difficult for people to handle, then it will meet with resistance from businesses, specially medium, small and micro enterprises (MSMEs). Immediately after implementation of GST, businesses overall are likely to become much slower due to not only the procedural difficulties, but also the fact that people will reduce working for some time so as to understand the effects." He also believes that the government might bring in amendments within 2-3 months of implementation. "Overall, it is beneficial for the industry, but in the short term, it could be a thumbs down."

Siddharth Bindra, managing director of Biba, sees the government's decision to put the overall textile chain in the tax bracket of 5 per cent as a bold and historic move. "The second phase of taxing branded garments below ₹1,000 at 5 per cent and garments above ₹1,000 at 12 per cent is also a balanced view keeping in mind the revenue constraints the government had. I am sure companies will absorb the increase in the upper bracket and not let it impact the consumer."

The Confederation of Indian Textile Industry (CITI) is happy with the government for keeping the rates at a low level so that textile sector, especially cotton-based products, can grow faster. Its chairman, J Thulasidharan, points out that the "new rates will help us to prepare ourselves for the newer regime as rates for cotton and natural fibres are in sync with our expectations."

However, KB Agarwala, president of the Federation of Hosiery Manufacturers' Association of India (FOHMA), Kolkata, finds the 18 per cent GST on segments such as embroidery, stitching and printing to be unacceptable. His argument: "These are unorganised sectors and high rates will affect their working. We have made representation to the government to revoke the rate."

He points out to some practical problems, "Before GST, there was no tax on fabric and yarn. Certainly, it will take some time to adjust to the new structure. The introduction of GST will help in maintaining transparency and accountability in the industry. We have already been facing the brunt of GST for the last two months as hosiery dealers are not willing to keep any stock in their godowns."

A new level-playing field is what matters to Prabhu Damodaran, secretary of the Indian Texpreneurs Federation (ITF), who points out, "The 'one nation one tax' policy will promote a level-playing field, with a scope of growth for efficient players. A uniform duty structure will help in the development of business. Further, the input tax credit will also help manufacturers reduce costs. Manufacturers will have to pay tax only on the value addition done by them and not on the entire value of the product."

GST for the apparel sector

It is apparel which has two tax slabs, and it is this segment that is expected to see some turbulence, particularly on the retail front. The assessments clearly depend on who is talking.

Arun Ganapathy, chief financial officer of Spykar Lifestyle Pvt Ltd, says, "GST for branded readymade garments has been fixed at 12 per cent. This is higher by about 2-3 per cent over the current tax. For readymade apparel lower than ₹1,000, the rate of 5 per cent is welcome. This will help in reducing the overall impact, though we have a small percentage of products in that category. There would be a one-time impact when we transition to GST. We are in the process of getting further clarity on this."

There are technicalities that are

open to interpretation. For instance, how will it be decided whether a garment

is above or below ₹1,000₹ Will it be based on the maximum retail price (MRP), the cost price,

or the post-discount price₹ Sachin Singhal, head of finance for Asmara

Apparels India Pvt Ltd, is categorical: "The above or below ₹1000 issue will be

decided based on the transaction price i.e. sale price, and not MRP. In case of

a discount, if the discount is given at the time of sale, then it will be

discounted price." Singhal also expects prices to both fall and rise.

"For under-₹1,000 sale value garments the prices will come down, but on over-₹1,000 sale value

garments it will increase."

Rahul Mehta, president of the

Clothing Manufacturers' Association of India (CMAI), foresees some price

changes, but not any on how sales will materialise. "The GST rate of 5 per

cent on garments below ₹1,000 will render them cheaper, while those above ₹1,000 will increase the

price of garments by 1-2 per cent. However, this will not affect the selling of

garments in the market."

Some calculations come from Raman Kumar, vice-president (retail) at Red Chief: "Currently, all government taxes are as follows: (4 1) per cent VAT on MRP, 2 per cent central excise duty on buying value and 2 per cent excise duty on the 60 per cent value of the MRP that has been taken by the government. As per the current scenario of GST, any product or service above MRP ₹1,000 will be calculated under the 12 per cent GST rate. So, the difference is approximately 5-6 per cent, which will definitely impact the current scenario of our business.

"Second, GST has a positive effect in the textiles sector which will now be online as it was not previously, and this will be a rebate in the product value. However, it will increase the funding for vendors. For example, previously, if a vendor bought 100 per cent cotton fabric with 0 per cent taxation at the rate of ₹100/metre, after the implementation of GST s/he will have to pay 5 per cent GST on the same, i.e. pay ₹105/metre. This will increase the cost of the product."

On the other hand, Raja Shanmugham, president of the Tiruppur Exporters' Association (TEA), argues, "GST on apparel is a very good initiative. Now, the manufacturers will have to pay tax only on the value addition done by them and not on the entire value of the product. The advantage will be passed on to the consumers. Earlier, in the multi-tax structure, a cost was added at every level. GST has eliminated that possibility, which has automatically reduced the cost of apparel."

Manikam Ramaswami, chairman and managing director of Loyal Textile Mills Ltd and former chairman of the Cotton Textiles Export Promotion Council (TEXPROCIL), finds the higher tax rate to be perfectly in order. He points out, "If someone is buying a garment for ₹1,000, paying ₹7 more will not hurt. Luxury goods need to suffer the higher GST in all categories."

The president of the Textile Association (India), Arvind Sinha, however, is a bit worried. He contends, "Garments are a very powerful lobby; we are expecting some modification in the sector. With a 5 per cent GST, fibre, yarn and fabric can settle down. The tax structure in garments will start a lot of malpractices, which is our worry. Before it gets implemented, we expect some solutions."

The hosiery segment may not feel the pinch. Says Agarwala, "We were expecting GST on hosiery to be around 12 per cent. However, the rates are 5 per cent and we are already paying value added tax (VAT)at around 5-6 per cent. Hence, there is no problem for the hosiery sector. We are an organised sector, and so we will not have problems. However, it will take time for things to settle down."

The tax slabs, according to Sanjay Kowarkar, vice-president (sales & marketing) at InspirOn Engineering Pvt Ltd, will not have any effect on his company. He says, "It will have no impact on us. The input costs have been increasing and the cost of branded garments too are increasing, but still we find demand for these products. However, the impulsive buying in retail malls may get affected.

GST on fibres, yarns and fabric

The GST Council has made a clear distinction for fibre/yarn while finalising the tax slabs, and it has decided to club all fabric under the lowest slab of 5 per cent. The question is how this will impact fabric manufacturing. Wadhwani has a very elaborate interpretation: "The textiles industry has urged the government to apply the lowest GST rate of 5 per cent across the value chain in the textiles and apparel sector which is still under final consideration. The rules currently propose four slabs i.e. 5, 8, 12 and 18 per cent of tax. Currently, fabrics are exempted from taxes, but applying a uniform tax will have an impact on the final cost of fabrics/apparel.

"This in turn would result in three distinct benefits: (i) Break in input credit: A significant portion of the textiles industry operates in the unorganised sector resulting in a gap of inflow of input tax credit. The input tax credit can now be claimed if raw materials are purchased from registered tax payers; (ii) Removal of fringe taxes: Reduction in the manufacturing cost by removal of other fringe taxes like entry tax, octroi and luxury tax will definitely give a shot in the arm to the textiles industry. (iii) Claiming input credit against input of machinery will largely benefit the textiles industry."

Taking a cautionary note, Thulasidharan observes that the 18 per cent GST rate levied on man-made fibres and synthetic yarn would have an inverted duty structure problem as the fabric would attract only 5 per cent GST rate. He also points out that the high rates announced for man-made fibres' fabric and yarn, dyeing and printing units, embroidery items at 18 per cent can lead to an increase in input costs and can adversely affect the entire textile value chain.

The 5 per cent GST on cotton and natural fibres/yarn does not make much difference to the existing tax structure. Mehta says, "I think it is more or less the same. The man-made fibres will be taxed at 18 per cent, which is similar to the existing tax structure." Sinha agrees, "There is not going to be much impact. The government has been very reasonable while introducing the taxation policy. However, we are hoping to see modifications in due course." Shanmugham, however, agrees only partly: "We welcome the 5 per cent GST rate for knitwear, but for other areas like embroidery, washing, and printing and in the garment stage activity, the tax rate is 18 per cent. We have raised this concern with the council. Our request is to keep the end-to-end tax charges at 5 per cent."

Various textiles associations had urged the GST Council to fix uniform rates for cotton and synthetic fibres. But now with different rates, Ramaswami feels there would be a case to reduce GST for polyester which has several non-textile applications. "However, at the garment stage the entire GST on the fibre can be fully absorbed. If there is a fibre-based GST at the fabric or garment stage, then there will be a huge mis-declaration. Rates will not make cotton textiles more expensive as all state taxes will get absorbed, and GST on dyes, chemicals and spares will get absorbed too."

The vice-president of the Gujarat Garment Manufacturers Association, Arpan Shah, has reasons to be worried about. He says, "We are concerned about the 18 per cent GST rate on man-made fibres, and also the tax slab on apparel. The taxing structure on rest of the textile items is acceptable. Our confusion is on the tax rate to be implemented on blended yarn."

Mehta, on the other hand, maintains, "There will be a certain amount of inconvenience. However, the tax rate on man-made fibre is same as earlier with 12.5 excise duty and 5 per cent VAT. On the contrary, now there will be tax credit of 5 per cent which will benefit the manufacturers."

Saaboo goes on to caution: "Yarn prices are expected to reduce and the overall slower demand will push it down even further. Even in the international markets, the demands are slow at present. The bigger spinners might start holding the yarn to get the desired prices, but the small and medium spinners might do panic selling starting around third week of July."

GST on machinery

According to Smarth Bansal, brand manager at the Colorjet Group, "The 18 per cent GST is too high on textile machines, and since we manufacture in India and sell across the world, a lower GST rate would encourage Indian manufacturers like us to invest more in ramping up the production facilities and support the Make In India initiative by Prime Minister Narendra Modi."

CB Chandrashekar, CFO of Lakshmi Machine Works Limited, sees no drastic difference in the existing purchase and sales of machineries. "Earlier, the rate for machinery was 12.5 per cent with 5 per cent VAT, which totalled to 17.5 per cent. With an 18 per cent GST on machinery, there is neither loss nor gain. But, it is too early to say anything as we are yet to have the rates for services and textiles."

Managing director and executive board member of the Embee Group, Harsh Shah, too thinks it is too early to comment. "As far as our company is concerned, we manufacture capital machinery. When it comes to textile machinery, the most important things are innovation and efficiency as it is a long-term investment. The cost of the machinery is considered, but it's a secondary matter. Hence, we don't see a much impact on textile machinery."

Working out the new cost structure

It is definitely not going to be a smooth run from Day One, and this has been pointed out by most experts and analysts across the board. Kumar, in fact, delves slightly deeper as he says, "Solutions to maximum challenges have been provided by the government coordinators. However, there are still some challenges which we are facing in the implementation of the same which are as follows:

"First, as per the previous taxation structure, fabric and external processing like colour dyeing, embroidery, etc, were not liable for any taxes, but after the implementation of GST, fabric has been adjoined in tax calculation. So, product costing will become broader including all tax calculations before finalising the cost. Second, the HSN (harmonized system of nomenclature) code is another confusing part of GST. Currently, we are using tariff heading for excise-related products which is based on category-wise sections. But the HSN code is based on product specification. Third, if any retailer or trader earlier had their own excise unit and were paying the excise at their end, they would be the manufacturers of that product. But a huge confusion remains as to what procedure will be followed from now on. We are contacting the best consultancy teams in the field of GST who will be providing us with expert solutions."

Kumar is also sure that compliance compulsions would be good for retail. "Digital payment is good for the retail sector. In many inferior sectors, cashflow from the banks' end is very low because the cash transactions are very costly for banks (due to the logistics involved). This was affecting the organisation of retailers who were trying to enter interior sectors of retail. However, the digital payment has proved to be very beneficial for organising such retailers. For the unorganised retail sector, the government has already announced that the minimum turnover limit that is ₹20 lakh. Under this turnover limit, any retailer is not bound under GST. However, s/he would also not be a beneficiary of the rebate of taxes either. So, the product cost will reduce and maximum products will fall in the under-₹1,000 section on which only 5 per cent tax will be calculated. Those unorganised retailers whose turnover limit is above ₹20 lakh will have to implement GST at their end."

India on the world stage

There are varying opinions about the overall effect that GST might have on the Indian textiles industry vis-a-vis its competitiveness in both domestic and global markets.

Mehta is flat in his assertion: "There will be no change." Sinha too does not think the global market will be affected, "because GST does not have any impact on exports. In India, we have to build volumes in textiles and apparel. We are struggling with the export market because of insufficient volume. GST will help in improving the volume as it will help in streamlining the entire value chain.

Wadhwani, nevertheless, believes that the impact of GST would be substantial, involving a lot of transitional issues, and also that industry will need to gear up for implementation of the new tax regime after understanding the (potential) impact. "A uniform code of taxation will not only bring about an ease in operational issues, but also an overall cost benefit across the value chain of the industry. GST should instill confidence in foreign players, in turn leading to fresh infusion into the textiles industry across the board," he asserts. Kowarkar prefers to be circumspect: "The policies are not yet crystallised as there are many gaps. It is rather early to comment on this aspect."

The man-made fibre issue recurs in Shanmugham's assessment. "For man-made fibres, we have to compete with international competitors, for which we have requested the government to bring down the rate to 12 per cent. As it is, we are not competitive in the international market because of the pricing differences. We have to reduce the yarn price in the Indian context so as to bring it to a level-playing field in the international market. If this happens we can improvise our growth percentage in the international market by providing those garment ranges."

The cascading effect on exports

Most GST-related discussions have hovered around the likely impact on exports. Mehta thinks making predictions would be jumping the gun. He reasons, "It will be too early to comment on the exports of textiles as the duty drawback rates are yet to be announced."

Most GST-related discussions have hovered around the likely impact on exports. Mehta thinks making predictions would be jumping the gun. He reasons, "It will be too early to comment on the exports of textiles as the duty drawback rates are yet to be announced."

Wadhwani's explanation is different: "GST will not only eliminate tax evasion, but also remove inefficiencies associated with exemptions cascading in the sector. The increase in revenue is expected to go up threefold estimated at ₹10,850 crore annually after GST implementation. The proposed tax reforms would help in achieving the target of generating 25 million jobs and attracting investments worth $200 billion by 2025 as mentioned in the representation by the Clothing Manufacturers Association of India to the ministry of textiles."

Another angle is provided by Singhal: "The effect should be nil except for a cash-flow issue because under GST an exporter will be paying the tax on procurement and will be subsequently claiming a refund as export sale is still zero rated. Still, clarity on the duty drawback and ROSL (rebate on state levies scheme) kind of export benefit schemes have to come through because at present an exporter gets an export benefit of 10 per cent on their FOB (free on board)."

Ramaswami goes on to add, "If GST is given back immediately and the drawback / MEIS is given as per the extra costs incurred by exporters, then it would not impact exports negatively. In fact, it could help as certain states do not refund Form W refunds for very long time. Tamil Nadu is typical."

E-commerce under scanner; digital's the way

E-commerce companies are regarded as shops and not as platforms under the new GST regime. And now, portals will be responsible for collecting tax at source. E-commerce companies will therefore have more work cut out for them. Harsh Shah, co-founder of Fynd, points out, "This change has increased a compliance burden on e-commerce companies, but it is for the betterment of the whole unorganised ecosystem. Being regarded as a shop is, though, a wrong perspective from which to look at e-commerce companies; they could have better regarded as a service provider."

E-commerce companies are regarded as shops and not as platforms under the new GST regime. And now, portals will be responsible for collecting tax at source. E-commerce companies will therefore have more work cut out for them. Harsh Shah, co-founder of Fynd, points out, "This change has increased a compliance burden on e-commerce companies, but it is for the betterment of the whole unorganised ecosystem. Being regarded as a shop is, though, a wrong perspective from which to look at e-commerce companies; they could have better regarded as a service provider."

Moreover, the mandatory registration is expected to discourage small merchants and traders from selling through e-commerce platforms. With the textiles industry constituting such a huge chunk of MSMEs, it would be interesting to see how the turf changes, and whether smaller players will be gobbled up by the bigger ones. Says Shah, "E-commerce is clocking a sale of minimum ₹1-2 lakh per month with payouts every 15-21 days for any registered seller on a platform; letting go of such sales would burn a hole in the vendors' pockets. As of now, textile is one of top contributor to exports and GDP, and the same industry has the most number of unregistered dealers paying minimal or no taxes. Getting them to register will surely have a positive impact in the long run. Smaller players will see an increase in compliance and maintain records whereas it would be easier for big players since they have an existing setup. In market share, there may not be a much of a change."

Another angle being probed by many is whether multiple registrations, which are being seen by e-commerce companies as hasslesome and unfair, will have an adverse effect on the inventory practice that is followed by shopping portals. Shah explains, "E-commerce companies have moulded themselves to become compliant, and the inventory model is one of the examples. Getting multiple registrations is not only the case with e-commerce companies but also with other industries like retail chains having multiple stock points. It will surely block a huge chunk of working capital and this is not good for the e-commerce sector which is currently reporting losses. Sales or return policies of purchasing was a widely accepted practice which will be impacted by the change as e-commerce players may have to further shell out money for paying taxes on the inventory being stored in the warehouse. This will promote a marketplace model among e-commerce players and create an opportunity for smaller players as stocks will not be blocked by the major players in the market."

Comments