With higher demand for cotton yarn and fabric for exports, the trade of cotton and allied products is expected to increase in MY 2020/21. A report.

SOURCE: - TexPro & USDA

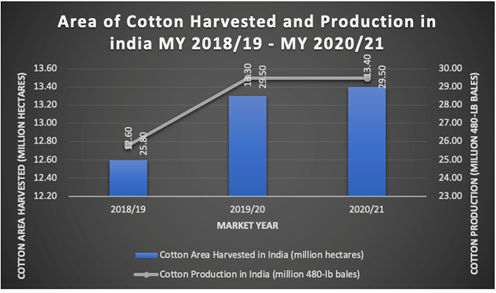

The cotton area harvested and the cotton production in India have shown a significant rise in the MY (market year) 2019/20 as compared to the area harvested in MY 2018/19. The cotton area harvested, and the cotton production has increased by 5.56 per cent and 14.34 per cent to 13.30 million hectares and 29.50 million 480-lb bales respectively in MY 2019/20 over MY 2018/19.

It is expected to increase in the upcoming MY 2020/21 with higher demand for cotton yarn and fabric for exports. It also triggered cotton fibre and yarn prices in the beginning of the year 2021. The purchase of cotton by the government of India under the MSP programme has been done in various states which has secured approximately more than 24.00 per cent of total production.

The area harvested and production is expected to move up to 13.40 million hectares and 29.50 million 480-lb bales in the MY 2020/21. The excess rains of northeast monsoon and rising pest infestation lowered the production of cotton in Telangana. But the cotton area harvested in Telangana soared by 15.00 per cent in MY 2020/21.

The domestic consumption of the country got subjugated as a majority of people worked from home. Also, the lockdown had limited the retail footfall with slower recovery. The customers became more cautious and they focused on the savings.

India cotton trade

The cotton exports of India have considerably moved up in the MY 2019/20. The country’s cotton export remained at 3.20 million 480-lb bales in the MY 2019/20 with the growth of 9.37 per cent over the previous MY 2018/19. The cotton exports got the boost with the ongoing Sino-US trade war. But this boost was offset by the impact felt due to the spread of the Covid-19 pandemic.

The impact of Covid-19 has been partly controlled with the help of lockdown and the release of vaccine. The shipments have been rising regularly with time. Also, certain governments have developed alternative ways to increase trade. India’s exports and imports moved up with strong overseas as well as domestic demand. India’s cotton imports increased by 26.67 per cent in the MY 2019/20 to 2.28 million 480-lb bales from 1.80 million 480-lb bales in MY 2018/19.

The cotton exports are expected to move in the MY 2020/21 to 5.00 million 480-lb bales from the 3.50 million 480-lb bales in MY 2019/20. The prices of the Indian cotton remained lower as compared to the overseas cotton prices. From October 2020 to January 2021, the Indian cotton prices surged by 16.00 per cent as compared to 23.00 per cent rise of the Cotlook A-Index. This price gap has given a competitive advantage to the Indian cotton players over the overseas players. The gap between Indian ex-gin and Cotlook A Index prices kept Indian raw cotton as a cost-effective alternative. According to FAS analysis, Bangladesh, China, and Vietnam remained at the top of the list of Indian cotton suppliers in 2020 and contributed for more than 90.00 per cent of total Indian cotton exports.

The Indian cotton exports are expected to increase in MY 2020/21 with a rate of 42.86 per cent to 5.00 million 480-lb bales from the 3.50 million 480-lb bales in MY 2019/20. But the imports are expected to move down by 56.14 per cent to 1.00 million 480-lb bales in MY 2020/21 from the 2.28 million 480-lb bales in MY 2019/20.

India Cotton Trade (2018/19 to 2020/21)

SOURCE: - TexPro & USDA

SOURCE: - TexPro & USDA

Indian cotton prices (State-wise)

SOURCE: - TexPro

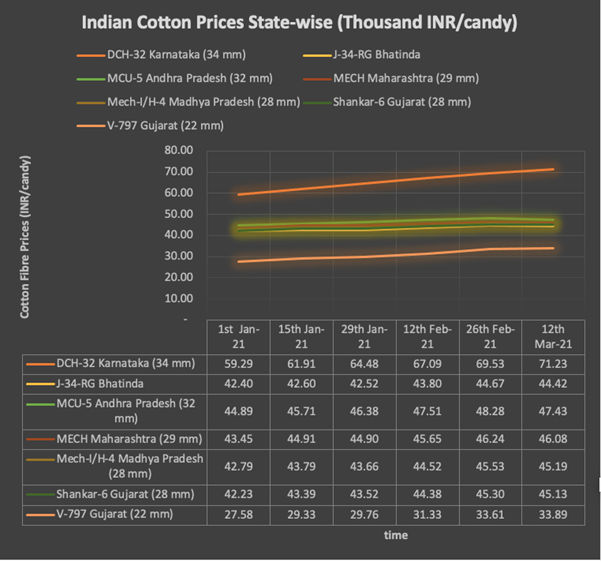

The prices of Indian cotton have shown considerable rise in first half of MY 2020/21, from August 2020 to January 2021. The prices are striking again from the beginning of 2021. The price rise has been observed in almost all cotton fibres in the country. Out of the major cotton fibres in India, the prices of DCH-32 from Karnataka and V-797 from Gujarat have shown a considerable price augmentation in the first quarter of 2021. DCH-32 and V-797 have shown a price rise of 20.14 per cent and 22.87 per cent to 71.23 INR/candy and 33.89 INR/candy in March 2021 from 59.29 INR/candy and 27.58 INR/candy in January 2021, respectively. The prices of other cotton varieties such as J-34-RG from Bhatinda, MCU-5 from Andhra Pradesh, MECH from Maharashtra, Mech-I/H-4 from Madhya Pradesh and Shankar-6 from Gujarat have also shown a rise, but the increase was negligible and remained between 4.00 to 7.00 per cent.

India cotton yarn and fabric exports

SOURCE: - TexPro, USDA & DGFT

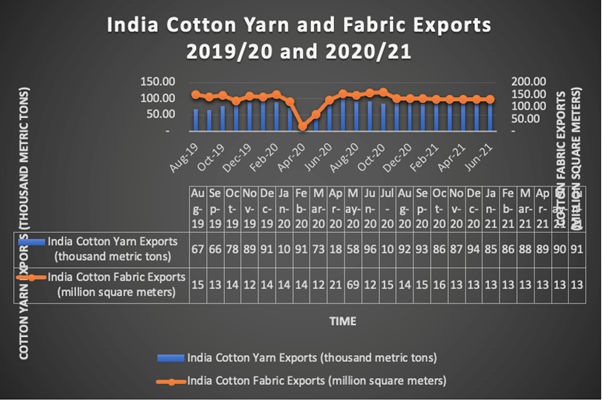

The demand of the cotton yarn in abroad countries has been increasing from the beginning of the MY 2020/21 with there is a surge in demand for value added cotton textiles. This also sustained the escalated prices of the Indian cotton textiles. The counties such as China, Bangladesh, and Vietnam have exponentially imported cotton from India in the second half of 2020. Exports of cotton fabrics also followed the same trend as cotton yarn. But the cotton imports remained low due to ample domestic crop in the country with relatively low buying from mills.

The yarn export of the country remained at 930.00 thousand metric tonnes in MY 2019/20 with a monthly average of 77.50 thousand metric tonnes. The monthly average of yarn exports in the first half of MY 2020/21 has prominently surged to 89.64 thousand metric tonnes from the monthly average exports of 77.50 thousand metric tonnes in MY 2019/20 with a growth of 15.67 per cent. It further expected to move up 6.64 per cent from January 2021 to July 2021.

The fabric exports of India were 1,489.15 thousand metric tonnes in MY 2019/20 with a monthly average of 124.10 thousand metric tonnes. The monthly average of fabric exports in the first half of MY 2020/21 has increased to 169.52 thousand metric tonnes from the monthly average exports of 124.10 thousand metric tonnes in the MY 2019/20 with a hike of 36.61 per cent. But it is expected to remain stable to a slightly lower value between January 2021 to July 2021.

20240830145908.gif)

Comments