Interviews

Circular economy drives superior risk-adjusted returns: Research

28 Jul '21

3 min read

Pic: Shutterstock

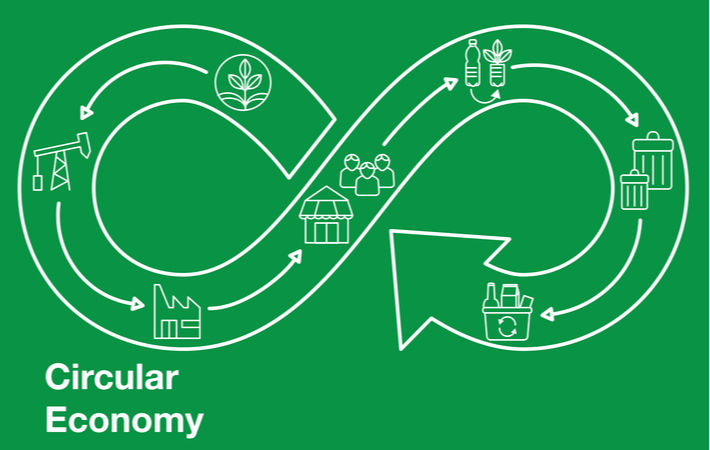

UK-based Ellen MacArthur Foundation recently published a white paper in collaboration with Milan-based Bocconi University and Italian international banking group Intesa Sanpaolo that showcases new evidence demonstrating how circular economy strategies can de-risk investments and drive superior risk-adjusted returns for investors and financial institutions.

The university’s analysis of over 200 European, publicly listed companies across 14 industries shows that the higher the circularity of a company, the lower its risk of defaulting on debt, and the higher the risk-adjusted returns on its stock.

The paper reveals how circular economy strategies can reduce investment risk by decoupling economic growth from resource consumption, diversifying business models and allowing businesses to better anticipate stricter regulation and changing customer preferences, the foundation said in a release.

Embedding circular economy principles also reduces exposure to supply chain disruptions and volatility of resource prices, the analysis showed.

Circular economy is increasingly recognised by the financial sector as a value creation opportunity that delivers on goals related to climate and other global challenges.

The financial sector is increasingly seizing the circular economy opportunity, with dedicated financing activity growing steeply. The last two years have seen a steep increase in the creation of debt and equity instruments related to the circular economy, including public equity funds, corporate and sovereign bonds, venture capital, private equity and private debt, as well as bank lending, project finance, and insurance.

For example, assets under management in public equity funds focussed on the circular economy have grown from $0.3 billion in December 2019 to over $8 billion at the end of the first half of 2021.

Recognising the circular economy as an innovative and strategic challenge, Intesa Sanpaolo has embedded circular economy in the group’s business planning since 2018. In this paper, Intesa Sanpaolo, with expertise provided by Intesa Sanpaolo Innovation Centre, offers a case study on how financial institutions can seize the circular economy opportunity.

To take advantage of this de-risking effect and better risk-adjusted performance, Intesa Sanpaolo has integrated circular economy approaches into its strategic plan and adopted proactive circular economy credit policies and lending strategies, including the launch of a dedicated €6 billion credit Plafond, and is actively engaging with international institutions, businesses and academia to support the development of the circular economy market.

It is also exploring how to integrate the circular economy framework into its credit risk assessment process.

The university’s analysis of over 200 European, publicly listed companies across 14 industries shows that the higher the circularity of a company, the lower its risk of defaulting on debt, and the higher the risk-adjusted returns on its stock.

The paper reveals how circular economy strategies can reduce investment risk by decoupling economic growth from resource consumption, diversifying business models and allowing businesses to better anticipate stricter regulation and changing customer preferences, the foundation said in a release.

Embedding circular economy principles also reduces exposure to supply chain disruptions and volatility of resource prices, the analysis showed.

Circular economy is increasingly recognised by the financial sector as a value creation opportunity that delivers on goals related to climate and other global challenges.

The financial sector is increasingly seizing the circular economy opportunity, with dedicated financing activity growing steeply. The last two years have seen a steep increase in the creation of debt and equity instruments related to the circular economy, including public equity funds, corporate and sovereign bonds, venture capital, private equity and private debt, as well as bank lending, project finance, and insurance.

For example, assets under management in public equity funds focussed on the circular economy have grown from $0.3 billion in December 2019 to over $8 billion at the end of the first half of 2021.

Recognising the circular economy as an innovative and strategic challenge, Intesa Sanpaolo has embedded circular economy in the group’s business planning since 2018. In this paper, Intesa Sanpaolo, with expertise provided by Intesa Sanpaolo Innovation Centre, offers a case study on how financial institutions can seize the circular economy opportunity.

To take advantage of this de-risking effect and better risk-adjusted performance, Intesa Sanpaolo has integrated circular economy approaches into its strategic plan and adopted proactive circular economy credit policies and lending strategies, including the launch of a dedicated €6 billion credit Plafond, and is actively engaging with international institutions, businesses and academia to support the development of the circular economy market.

It is also exploring how to integrate the circular economy framework into its credit risk assessment process.

Fibre2Fashion News Desk (DS)

Popular News

Leave your Comments

Editor’s Pick

-Ltd..jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)

.jpg?tr=w-120,h-60,c-at_max,cm-pad_resize,bg-ffffff)