The global demand for textile fibres is expected to witness a growth of 2.5-2.7 per cent between 2016 and 2021, primarily driven by increasing consumption of MMF due to limited cotton production and supply coupled with other factors such as lower prices of MMF. A Fibre2Fashion Market Intelligence report.

The global demand for textile fibres consumption has witnessed a significant growth in the past three decades, especially that of man-made fibres (MMF) which grew from 19,000 kilo tonnes (KT) in 1990 to 60,762 KT in 2015, thereby contributing more than 90 per cent of the growth in the consumption of textile fibres during the period.

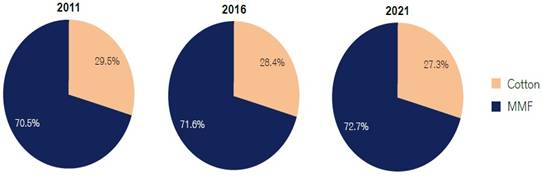

In the past three decades, when global population grew by 35-37 per cent to reach 7.3 billion, consumption of fibres reached 84,870 KT by registering a growth of almost 140 per cent. While the global increase in population is one of the basic drivers for increased consumption of textile fibres, there are other factors such as rising incomes, more affordable fibres, textiles and apparel products as well as changing attitudes to traditional textile products - used increasingly as disposable fashion, that have also played an important role in the growth of the global textile fibres demand all these years. Population growth and growing food products demand have completely changed the textile fibres consumption scenario with MMF dominating the market with more than one-third of the overall consumption in 2011.

Global cotton vs. man-made fibre market share (2011-2021)

Source: Secondary Research, Experts Opinion, Fibre2Fashion Analysis

Further, according to the United Nations, the global population is estimated to reach 8.1 billion by 2025 and is moving up the food chain creating nearly 35 per cent of the additional demand for food products, resulting in fierce competition against other crops for arable land. This increase in population, on the other hand, is expected to shrink the limited availability of arable and cropland by creating a food crisis and hence limiting the availability of the arable land and stagnating cotton production.

On the other hand, increasing population is also expected to increase the demand for textile fibres-both natural and man-made-by nearly 60 per cent, resulting in more consumption of MMF. This would be so since availability of raw materials for the production of MMF is expected to be available virtually on an unlimited basis for the next few decades and will cost significantly less than natural fibres. Apart from this, one more factor which ensures this unlimited availability is the recycling of MMF as against that of natural fibres, and the freedom of using these fibres in research and production to alter properties to make it suitable for newer applications. These factors are expected to be a major demand driver for MMF in the near future as well as in the long term.

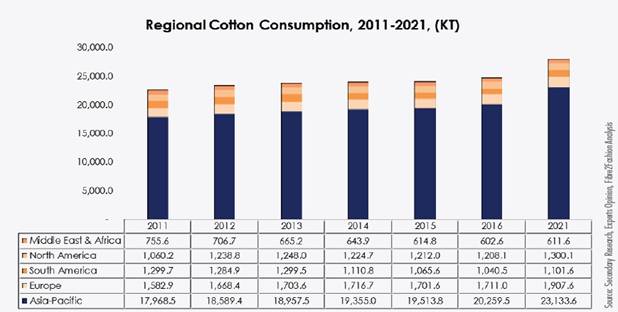

Regional cotton consumption, 2011-2021 (kt)

The global demand for cotton fibres was estimated to be 24,107.9 KT in 2015 as against the production of 21,719.5 KT in the same year. The demand for cotton fibres is expected to reach 28,054 KT by 2021 growing at a CAGR of 2.5 per cent during the period of study. The demand for cotton in Asia-Pacific is expected to be driven by increasing domestic consumption in India, China, and other Southeast Asian countries, coupled with increasing textiles exports to Europe and North America. Europe is expected to follow Asia-Pacific in terms of demand due to the expanding textiles industry in Turkey.

The global demand for cotton fibres was estimated to be 24,107.9 KT in 2015 as against the production of 21,719.5 KT in the same year. The demand for cotton fibres is expected to reach 28,054 KT by 2021 growing at a CAGR of 2.5 per cent during the period of study. The demand for cotton in Asia-Pacific is expected to be driven by increasing domestic consumption in India, China, and other Southeast Asian countries, coupled with increasing textiles exports to Europe and North America. Europe is expected to follow Asia-Pacific in terms of demand due to the expanding textiles industry in Turkey.

Globally, prices for cotton fibres are expected to remain stable due to the clearing of stocks by China, and lower prices of MMF due to weak crude oil prices. Demand for cotton fibres is expected to grow at a slower rate than MMF as the growth of textile fibres in turn is driven by emerging economies where synthetic fibres are gaining more penetration in textiles fabrics, as well as due to increasing consumption of synthetic fibres in industrial applications.

Regional MMF consumption market share, 2015 (%)

Meanwhile, synthetic fibres are expected to outpace cotton fibres in demand during the next decade. Globally, the demand for synthetic fibres is expected to grow at a CAGR of 3.8 per cent as against 2.5 per cent CAGR of cotton till 2021. The growth in demand for MMF is driven by factors such as limited cotton production, increasing demand for textiles products due to increasing population, relatively high cotton prices and increasing applications of synthetic fibres into industrial applications.

The demand for synthetic fibres in the Middle East and Africa is expected to grow at the fastest rate due to the growing textiles industry there along with the large presence of industrial bases in the region, followed by Asia-Pacific which currently accounts for roughly 69 per cent of the global synthetic fibre demand. The demand for synthetic fibres in the region is expected to increase at a CAGR of 4.1 per cent between 2015 and 2025 to reach 52,015.0 KT by 2021 primarily driven by growth in domestic consumption, increased adoption of synthetic fibres in the domestic textiles industry and increasing demand for synthetic fibres for the industrial applications in the region.

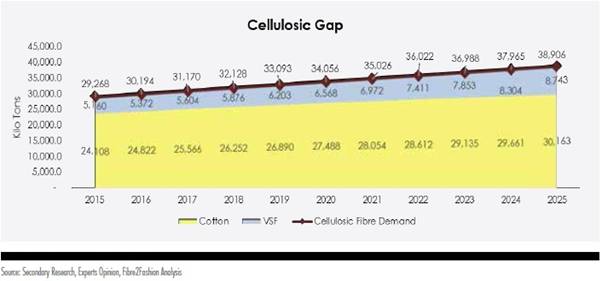

Both increasing population and increasing consumption of textiles, coupled with limited production of cotton is expected to widen the cellulosic gap further with each passing year. The only substitute available to cotton due to its favourable properties is viscose staple fibre (VSF) and it is estimated that cellulosic fibres will still account for 33-37 per cent of the total fibre as certain properties of cellulosic fibres, especially their physiological performance, makes it difficult to be substituted by petroleum-based synthetic fibres. Hence, viscose staple fibres being both an ideal substitute for cotton and being sustainable, are expected to fill this cellulosic gap providing a great opportunity for VSF manufacturers.

Overall, the global demand for textile fibres is expected to witness a growth of 2.5-2.7 per cent between 2016 and 2021, primarily driven by increasing consumption of MMF due to limited cotton production and supply coupled with other factors such as lower prices of MMF and increasing consumption of MMF into other applications such as home textiles and industrial products. Also, another major driving factor would be the product and process innovation in both traditional and non- traditional textile product areas using MMF.

Comments