Viscose rayon is a versatile material that has multiple applications in textiles, apparel, nonwovens and industrial sectors. Its demand is expected to see a rise in India as well as globally in the coming years. Fibre2Fashion Market Intelligence sheds some light on the viscose market of India.

Viscose fibre, a regenerated cellulosic fibre and a type of rayon, is the most popular among all types of rayon. The name 'viscose' is derived from viscous solution for spinning. Viscose rayon is produced from cellulosic materials such as wood pulp, bamboo and cotton linters. Wood pulp is generally used as a raw material, but the end product depends on the type of manufacturing process. Different production methods can result in rayon, viscose, modal, lyocell or bamboo rayon.

Applications of viscose rayon

Viscose is called artificial silk because of its lustre, excellent drape and retainability of bright colours. Some of its properties include good breathability, high moisture absorbency, comfortable wear and better dyeability, just like cotton. As this material is soft to touch and biodegradable, it is suitable to be used in medical textiles as well.

Viscose rayon is broadly used in the form of yarn, fabric, apparel and nonwoven.

Textiles and apparel: Novelty yarns, embroidery yarns, laces, chenille, cords, suiting, outerwear, crepe, gabardine, lining of coats, dresses, sarees, jackets, lingerie, sportswear, ties, slacks, bedsheets, curtains, blankets, draperies, etc.

Nonwoven: In medical textiles for surgical caps, surgical masks, wipes, hygiene products, etc.

Industrial use: Tire cords, tapes, conveyer belts, carbon fibres, graphite, etc.

Global market of viscose

The viscose fibre sector is expected to be the fastest growing sector among all manmade fibres as it possesses characteristics similar to cotton apart from being biodegradable. Consumption of viscose fibre among all manmade fibres is 6 per cent. About 45 per cent of the material is used in industries, and the same amount goes into making apparel. Home textiles contribute nearly 10 per cent.

Viscose market in India

India is the fastest growing economy in the world, and lower commodity prices have proved beneficial for the manmade fibre industry in India. Petroleum-based manmade fibre prices have also declined, which is giving tough competition to viscose. Growth in viscose fibre is expected with improved GDP per capita and subdued cotton demand in India. Cotton production is also expected to be lower than the expected consumption in the next five years due to reducing acreage and unsuitable climate for cotton crop. As a result, the demand of viscose will increase in India and globally. Lower pulp prices are also expected in the coming year, which can reduce operating costs and increase profit margins.

3.1 Viscose fibre supply demand scenario in India

3.1.1 Export import of viscose fibre

Fig.1: Export Import scenario of viscose staple fibre (VSF) in India

Source: Ministry of Textiles (Textile Commissioner, Mumbai)

There has been a rise in exports during FY2012-2016 due to an increasing demand from the international market. Export of viscose rayon has been declining in FY2017. Exports have decreased from 154 million kg in FY2016 to 107.83 million kg in FY2017. The import of VSF increased in FY2012 to FY16 and then declined in FY2017 at 26.74 million kg.

3.1.2 Consumption of viscose fibre

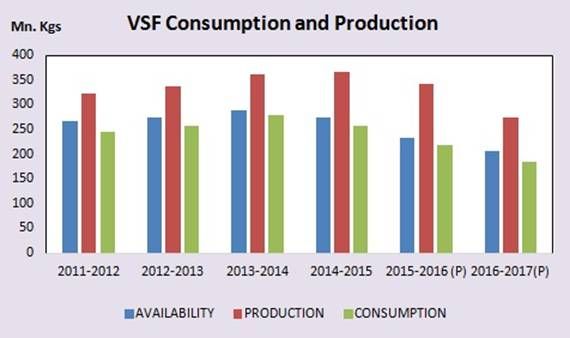

Fig. 2: Consumption and production scenario of VSF in India

Source: Ministry of Textiles (Textile Commissioner, Mumbai)

Availability = Opening Stock Production Import - Export

China, Indonesia, India, Taiwan, Thailand, Japan and Germany are the major countries for viscose rayon production. In India, production is higher than consumption. The overall production of VSF in India has declined in 2016-17 compared to the previous year and assessed at 273.15 million kg. The consumption in domestic market also declined during the same period. However, production of VSF has fluctuated in the post quota period. There has been a rise in production during 2013 to 2015 with the increasing demand from the domestic market. At present, Grasim is the only major producer of VSF in India.

3.2 Viscose Fibre Supply Demand scenario in India

3.2.1 Export Import of Viscose Filament Yarn (VFY)

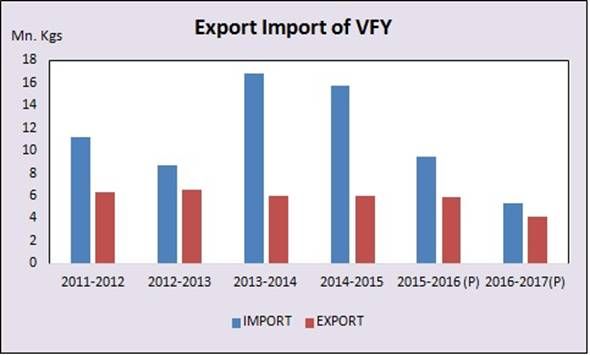

Fig. 3 Export Import scenario of VFY in India

Source: Ministry of Textiles (Textile Commissioner, Mumbai)

The import of VFY is higher than export. Import of VFY plunged from 16.8 million kg in FY2014 to 5.3 million kg in FY2017. Good quality wood pulp is not available in India despite high production capacity. For premium quality of VFY, India depends on imports from other countries.

3.2.2 Consumption of viscose yarn

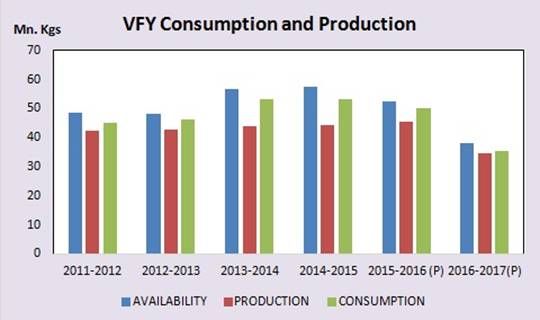

Fig.4: Consumption and production scenario of VFY in India

Source: Ministry of Textiles (Textile Commissioner, Mumbai)

Availability = Opening Stock Production Import - Export

In India, there has been a sharp fall in consumption and production of VFY in 2016-17. The production of VFY is lower than consumption, even though fibre production is higher than yarn. Consumption of VFY has declined since 2014-2015, from 53.15 million kg in FY2014 to 35.43 million kg in FY2017.

Major manufacturers of viscose rayon

Grasim Industries is the main player for VSF in India as well as globally. The installed capacity of viscose fibre in India is 416.68 million kg. There are seven manufacturers of VFY with an installed capacity of 81.27 million kg in FY2017:

-

Century Rayon

-

Aditya Birla Nuvo (Indian Rayon Corporation)

-

Kesoram Rayon

-

National Rayon corporation

-

Others

More than 80 per cent of the production is done by Aditya Birla Nuvo (Indian Rayon) and Century Rayon. Kesoram Rayon contributes around 18 per cent to rayon production and only 2 per cent of viscose rayon is produced by other companies.

Comments