Egyptian cotton production in MY 2019-20 may drop over an expected reduction in the harvested area. Moreover, the cotton prices of MY 2018-19 could also discourage farmers from planting cotton in MY 2019-20. Yet, cotton exports jumped by 57.1 per cent in MY 2018-19 over MY 2017-18; the trend is expected to continue. A Market Intelligence (MI) report from Fibre2Fashion looks at the cotton production, export numbers and the global demand for Giza Cotton.

Egypt, one of the leading cotton producers and exporters, supplies cotton of long and extra-long staple length. Giza, one of the finest varieties of Egypt, is grown exclusively in that country and manually harvested. The use of defoliants and chemical products are avoided during the production.

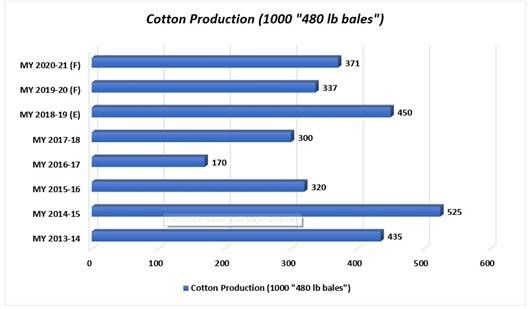

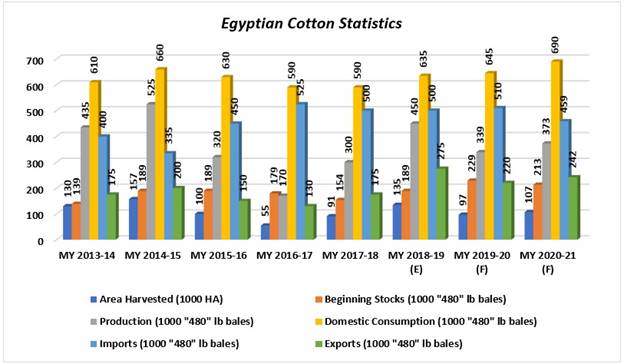

In marketing year (MY) 2018-19 (August to July), cotton area harvested grew by 48.4 per cent to 1,35,000 hector (ha) from 91,000 ha in MY 2017-18. The increase in area harvested in the MY 2018-19 boosted the total production to 4,50,000 bales (each 480 lb in weight) with a growth of 50 per cent over the previous MY. The Egyptian cotton production in MY 2019-20 is expected to drop over an expected reduction in the cotton harvested area. The cotton prices of MY 2018-19 could discourage farmers from planting cotton in MY 2019-20.

Cotton production and price turbulence

The cotton harvested area and cotton production in the country from MY 2013-14 has fluctuated year on year. According to the Office of Agriculture Affairs, cotton production in 2018-19 remained at a higher level with an increased cotton harvested area. Improved cottonseed varieties with higher yields also supported the production in MY 2018-19.

The cotton harvested area and the cotton production are expected to plunge in the coming years as farmers have received comparatively less amount per bale in MY 2018-19. In MY 2013-14, the cotton harvested area and cotton production was 1,30,000 ha and 4,35,000 bales. In 2018-19, the respective figures were estimated at 1,35,000 ha and 4,50,000 bales with a growth rate of 3.9 and 3.4 per cent over 2013-14. The cotton harvested area and cotton production in Egypt are forecast to plummet by 20.7 and 17.11 per cent at 1,07,000 ha and 3,73,000 bales in MY 2020-21.

GRAPH 01: Cotton Production (1000 "480 LB BALES")

Source: USDA & TexPro

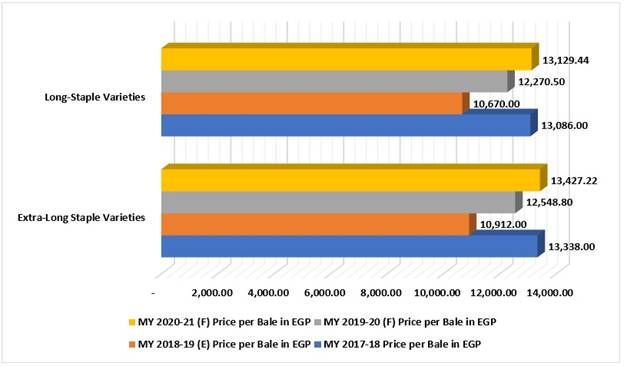

he improved cottonseed varieties were capable of producing an extra two quintar (quintar equals 50kg of lint cotton) per feddan, or 0.17 bales per hectare. As a result, Egypt's cotton supply has outrun the demand and prices have dropped. The prices of cotton with long staple and extra-long staple lengths dropped by 18.5 and 18.2 per cent to EGP 10,670.0 per bale and EGP 10,912.0 per bale in MY 2018-19 from EGP 13,086.0 per bale and EGP 13,338 per bale respectively in MY 2017-18.

As a result of the low prices, farmers and industry are expected to reduce cotton production in a desperate bid to raise country's cotton prices. The prices of the cotton of long staple and extra-long staple lengths are expected to increase in MY 2020-21 by approximately 23.1 per cent each to EGP 13,129.4 per bale and EGP 13,427.2 per bale respectively.

GRAPH 02: PRICE PER COTTON BALE IN EGP

Source: USDA & TexPro

The government of Egypt initially provided cash payments to the textiles industry which allowed them to pay a government-announced price for Egyptian cotton. Now, the government has declared an indicative price prior to the commencement of the planting season. The indicative price is a fine and precise attempt to encourage the textiles industry to buy cotton from farmers, but it is not a price support or commitment from the government to buy the crop.

In MY 2018-19, the government announced an indicative price for Giza 86 and 94, but prices dropped sharply when farmers began to market their product after the harvest.

Egyptian cotton varieties

The extra-long staple (ELS) type of cotton accounts for 3 per cent of the total world cotton production. Egypt, the United States, Israel and Turkmenistan are the only countries that produce this type of cotton. Egypt can produce both extra-long staple and long staple cotton.

FIG 01: Egyptian Cotton Varieties

In all, ten varieties of cotton have been identified under these two categories by the Cotton Arbitration and Testing General Organization (CATGO). Long staple cotton is further divided into lower-long staple variety that grows in the Delta region and upper-long staple variety that grows in Upper Egypt area. Traders and industry identify and market the upper-long staple cotton as medium staple cotton.

The plantation of cotton in the country is well organised and planned by the ministry of agriculture. Every year, the ministry issues a decree (two months before the onset of the planting season) that identifies the cotton varieties allowed for planting and segregated by region. According to this decree, each variety must be grown only in the specified areas. The cotton varieties such as Giza 45, 87, 88, 92, 96 and 93 are included in the extra-long staple cotton category and Giza 86, 94, 90 and 95 are long staple cotton. The long staple varieties such as Giza 86 and 94 are grown in the Delta region and Giza 90 and 95 are the upper-long staple varieties which are cultivated in Upper Egypt.

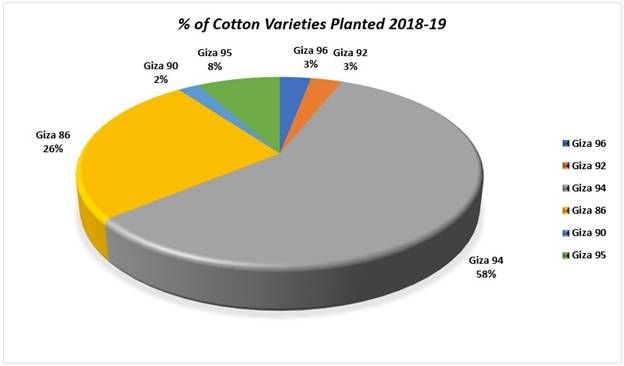

In MY 2018-19, the cotton varieties planted in Egypt were Giza 86, 90, 92, 94, 95 and 96. The major varieties of cotton planted domestically were Giza 94, 86 and 95. The Giza 94, 86 and 95 accounted for 58 per cent, 26 per cent and 8 per cent out of the total cotton planted varieties in the country.

GRAPH 03: % OF COTTON VARIETIES PLANTED 2018-19

Source: USDA & TexPro

Government's action to revamp cotton quality

In the last three years, the Egyptian government has been controlling the production and distribution of cottonseed which was previously handled by the private sector. This change was made in order to restore seed purity and cotton quality. The government was urged to take the control over the production and distribution of cottonseed as the quality of seeds had deteriorated significantly due to seed companies' lack of effective quality assurance systems.

According to an analysis released by the CATGO on the physical fibre properties of Egyptian cotton varieties, the quality and the physical properties of the cotton harvest improved significantly in MY 2018-19 and is expected to still improve in MY 2019-20. The various characteristics such as staple length, fibre strength, firmness, colour, trash count and maturity improved in MY 2018-19. This development may boost the demand for Egyptian cotton in the domestic and international markets.

In the beginning of 2017, the government had announced a new policy in order to restore the strength of the Egyptian cotton industry. The ministry of agriculture had put a 19-step plan into effect close to the 2017 planting season.

The government's action plan includes following tasks:

1. Supply of high-quality seeds to increase yields and quality.

2. Development of local spinning and weaving industries.

a. The expertise of a foreign consulting agency was requisitioned to conduct a feasibility study and provide recommendations on the means to develop spinning and weaving facilities.

b. Recommendations of vertical integration of spinning and weaving.

c. Update of existing equipment.

3. Encouragement of good agricultural practices.

4. Preparation of annual economic studies that can determine the production area needed based on demand.

5. Development of new varieties to increase the yields.

a. The new variety developed most recently is Giza 97 which will be distributed for commercial use.

Domestic consumption and trade

In MY 2018-19, domestic consumption in the country was estimated at 635,000 bales with a growth of 7.6 per cent over the previous year. Domestic consumption increased due to high production, low prices and the ability of spinners to run plants at full capacity supported by low input costs. Domestic consumption is forecast to reach at 690,000 bales in MY 2020-21 with a CAGR of 4.2 per cent. The growth rate forecast for domestic consumption decreased with an expected decline in demand from local spinners over higher prices. Usually, long staple varieties are consumed locally in Egypt.

GRAPH 04: EGYPTIAN COTTON STATISTICS SOURCE: USDA & TEXPRO

Source: USDA & TexPro

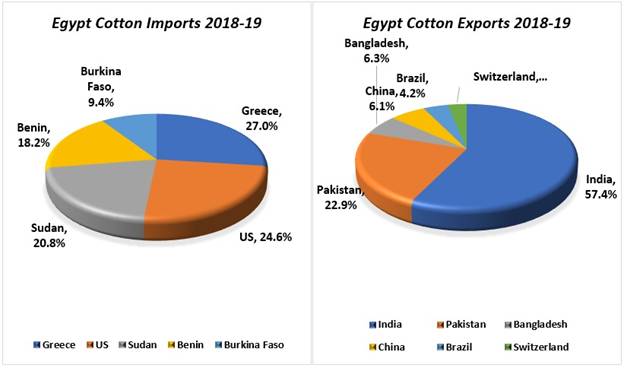

Exports

In MY 2018-19, Egyptian cotton exports increased by 57.1 per cent to 275,000 bales from 175,000 bales in MY 2017-18. This increase was attributed to the improved quality and low prices of Egyptian cotton in the given period. India, Pakistan, Bangladesh, China, Brazil and Switzerland were the major importers of Egyptian cotton in MY 2018-19 and the trend is expected to continue in MY 2019-20. India was the main importer of Egyptian cotton varieties in MY 2018-19 with a share of 57.4 per cent of Egypt's total lint cotton exports. Egypt has meanwhile started exporting short and medium staple varieties grown in Upper Egypt since MY 2018-19.

Cotton exports in MY 2019-20 is expected to drop by 20 per cent to reach 2,20,000 bales with a drop in domestic cotton production compared to the previous year. International demand is may go down over increased prices in the coming years. However, in MY 2020-21, exports are expected to increase with production of improved quality varieties supported by strong government initiatives.

GRAPH 05: EGYPTIAN COTTON TRADE, 2018-2019

Source: USDA & TexPro

Among industry players is the Cotton Egypt Association (CEA) which was formed by the Egyptian ministry of industry and trade (MoIT) and the Alexandria Cotton Exporters' Association (ALCOTEXA), owners of the trademarked Egyptian cotton logo. The CEA is tasked to improve the marketing and image of Egyptian cotton through the licensing of its logo. The licence is intended to certify the authenticity of Egyptian cotton through DNA analysis and prevent fraud.

The CEA has established a monitoring system covering the entire supply chain of its licensees. The organisation monitors the quantities purchased and sold by each licensee, mapping their sales and establishing a traceability system. They verify and ensure that quality and standards in using the logo are met, conducting random audits to licensee premises. The contract signed by MoIT and ALCOTEXA with CEA that gave the latter the sole rights to market with the Egyptian cotton logo ended in June 2017. ALCOTEXA have expressed concerns over renewing the same.

Imports

In 2018-19, the cotton import estimated at 500,000 bales was the same as in the previous year. Imports are expected to increase in MY 2019-20 to 510,000 bales and expected to drop to 459,000 bales in MY 2020-21. The expected rise in MY 2019-20 is attributed to the slight expansion in domestic processing capacity.

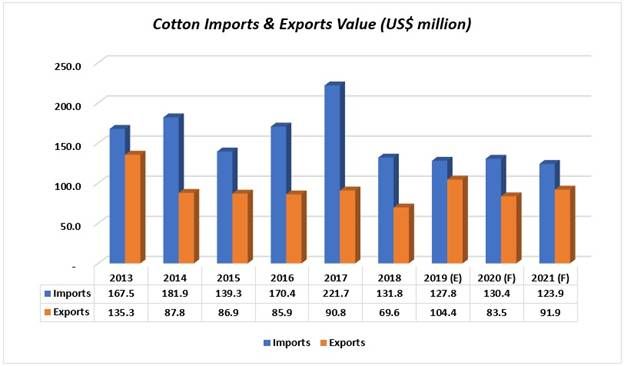

GRAPH 06: COTTON IMPORTS & EXPORTS VALUE IN US$ MILLION (2013-2021)

Source: USDA & TexPro

In MY 2019-20, domestic cotton production is expected to remain high with an expected reduction in the area harvested. This will ease domestic cotton prices and encourage traders and yarn manufacturers who source extra-long and long cotton varieties to do so locally. Yarn players dependent on medium staple varieties will maintain their import levels to meet domestic and international needs. They can use the Egyptian long staple cotton in lieu of imported short and medium staple cotton, if the prices of local cotton are more competitive than imported cotton. In MY 2018-19, the major cotton exporters to Egypt were Greece, the United States, Sudan, Benin, and Burkina Faso. This may continue in MY 2019-20.

Local traders and yarn manufacturers of Egypt prefer the quality of US Pima and upland cotton. According to one of the biggest yarn manufacturers, his yarn importers in Europe requested the yarn of pima cotton and were willing to pay the extra cost due to its high quality. The cotton varieties such as Giza 90 and 95 are produced locally or imported from Greece, Burkina Faso, Benin, and Sudan. Some spinners use Egyptian extra-long and long staple varieties, while others depend on imported US Pima cotton upon requests from international buyers.

EGYPTIAN COTTON TRADE POLICY:

-

Importers must apply for an import permit from the Ministry of Agriculture & Land Reclamation's (MALR's) Central Administration for Plant Quarantine (CAPQ),which is valid for one year.

-

Egypt imposes zero import tariffs on raw cotton or cotton lint (HS: 520100) and 5.0%import tariffs on carded or combed cotton (HS: 520300).

-

According to CAPQ regulations, importers should request import permits at least one month before importation, identifying the port of entry and date of arrival to reserve the equipment required for fumigation.

-

In addition, the shipment must be accompanied by a fumigation certificate from the quarantine authorities at the port of origin and less than three months should have elapsed from the date of issuance to the date of arrival.

-

If the three-month validity period is exceeded, the shipment must be returned to its origin, and the fumigation should be repeated, or the product may be re-exported to a third destination.

-

Egypt's cotton import regulations stipulate that imported cotton should be free from whole or broken seeds or foreign materials (Article 51 of the Egyptian Plant Quarantine Rules & Regulations: Ministerial Decree 3007/2001).

-

When a shipment is found to have whole or broken seeds, even if one seed is found in baled cotton, it will not be released. The importer can either destroy it under the supervision of CAPQ, re-export it to another destination, or return it to the country of origin. If the importer decides to re-export, CAPQ will issue are-export certificate stipulating the reason for its rejection.

-

Egypt also requires that cotton exported to Egypt be fumigated at the country of origin using methyl bromide, magtoxin or phostoxin at specified concentrations found in the import permit.

-

Fumigating the shipment at country of origin does not exclude it from being fumigated at Egyptian ports.

- The following statement must be in the certificate:

"The cotton is free from boll weevil - Anthonomus grandis".

Thegovernment also recommends an optional pre-shipment inspection at origin. Ifdone, two CAPQ inspectors travel and inspect the shipment prior to itsdeparture from the port of origin. Although pre-shipment inspection isoptional, some importers prefer to bear the cost, which serves as an insurancepolicy of sorts, to avoid delays at the port of entry.

SOURCE:USDA

Comments