South Africa's textiles and apparel industry is no longer as it was, but a new master plan could spark off a grand revival.

Signing of a retail, clothing, textile, footwear and leather (R-CTFL) master plan, government efforts to revive the declining domestic textiles industry through the 'Buy Local' campaign and preventing illegal imports, and a vow by big clothing retailers to buy an additional 85 million units of indigenously-manufactured clothes, shoes and leather goods over the next few years marked the textiles and garment sector in South Africa last year.

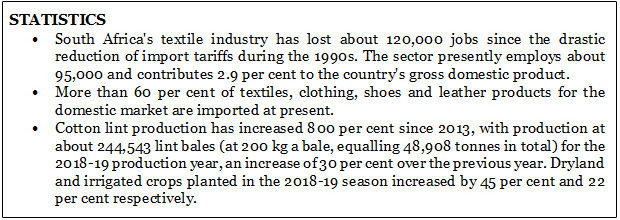

The country's once-mighty apparel and textiles sector employed 200,000 people in 1987, mostly in Cape and Natal provinces. But by 2006, dozens of factories had closed, the workforce halved, and manufacturers were struggling as the market was flooded with cheap Asian imports. South Africa is no longer a competitive producer of textiles but has potential in rebuilding it.

Great Revival Ahead

In his address to Parliament in September last, President Cyril Ramaphosa proudly announced that his splendid ready-to-wear suit was cent per cent indigenous. That signalled his government's intent to revive a part of the manufacturing sector devastated by the effects of trade liberalisation and global competition. Ramaphosa said the government would stimulate local demand and grow South African manufacturing by making sure the 'Buy Local' campaign was everywhere and ever present. He urged South Africans to deliberately and consistently buy locally-made goods.

A master plan was submitted to the department of trade and industry (DTI) in June to revive the ailing apparel and textiles industry, which had shed 140,000-160,000 jobs in recent years. Job losses, however, have stabilised over the last decade. The plan, aimed to stop the influx of illegal imports, is expected to create 60,000 new jobs by 2030.

According to National Clothing Retail Federation (NCRF), reviving the sector is not meant to find the cheapest labour, but drive an intelligent and sustainable agenda to make consumers aware.

At the South Africa Investment Conference in Sandton in November, the R-CTFL master plan was finally signed by, among other parties, the government, labour unions, the Foschini Group, Pepkor, Edcon, Mr Price and Woolworths. As per the master plan, the government has pledged to take a decisive action against illegal imports and unions have bound themselves to adjustments in the employment environment, which would hopefully increase competitiveness. Manufacturing companies promised R6.8 billion in investment over the next five years.

The Southern African Clothing & Textile Workers' Union (SACTWU) affiliated to the Congress of South African Trade Unions (COSATU) welcomed the master plan that aims to lay a firm basis for future growth and sustainability of the textiles and apparel industry.

At the same conference, the country's big clothing retailers vowed to buy an additional 85 million units of clothes, shoes and leather goods manufactured in the country over the next few years to boost the textiles industry. This step in the clothing retail sector is likely to boost the acquisition of domestic goods from its present level of 44 per cent to 65 per cent by 2030.

Earlier, the department of economic development and tourism Western Cape province allocated R132 million in April for boosting the industry. The province wants to rebuild the industry. South Africa imports too much apparel and textiles and produces too little, and its imports of clothing, textiles and leather goods have rocketed from just over R5 billion in 2000 to almost R60 billion now, according to Western Cape provincial minister for economic opportunities Beverley Sch�fer.

SACTWU's 'Wear SA' campaign is a partnership between a range of industry organisations and Cape Town universities. In September, the campaign launched an incubator store at the University of Western Cape's Faculty of Community and Health Sciences building in the Bellville CBD. Staffed by 18 students, the store provides experiential training in all facets of the industry, including garment design, manufacturing, buying, retail and marketing. The campaign also supported a six-week boot camp to develop student entrepreneurial and event management skills.

Investments Continue

The first phase of a R200-million DTI-funded programme, known as Sustainable Cotton Cluster (SCC), ended in March and successfully revived the country's cotton industry by unlocking private sector investments and buying power worth hundreds of millions. One such investment is the R72-million Loskop Cotton ginnery outside Marble Hall in Limpopo, which started operating and will enable further cotton production in the region and offer employment to local people. Further industry investments have been made in another ginnery as well as 11 cotton strippers and 24 cotton pickers. The programme was started five years ago with in-depth research to determine the demand, the state of each element in the whole supply chain and ways of optimising production.

The SCC programme plans to address several concerns, including traceability and benchmarking, raised by various downstream role-players in the second phase. The cluster also plans to tackle the prevalent silo mentality, which results in much duplication of work.

Clothing retailer Mr Price Group announced in November it would spend an additional R30 million on the development and support of small-scale cotton farmers.

A big investment came in the form of a multi-million-rand textiles, apparel and footwear manufacturing firm, Africa Bespoke Apparel (ABA), which was launched in January in Verulam in the KwaZulu-Natal province. ABA is a company fully owned by Blacks and is the first among the beneficiaries of the government's Black Industrialists Programme (BIP). ABA was approved a funding of R35.5 million from DTI's Black Industrial Scheme and the project is co-funded by KwaZulu-Natal government's Growth Fund.

Footgear, using funds from Old Mutual Private Equity, in July took over the Edgars Active and High Key chain stores, divisions of the Edcon Group, and leading retailers of branded sport and lifestyle footwear, clothing and accessories. Footgear was founded in 2001. Following the acquisition, Footgear planned to employ more than a thousand workers across its national store footprint.

Klopman, a leading European producer of fabrics for workwear, in September announced its entry into South Africa following a partnership with Servworx, the second largest workwear rental company in South Africa. Klopman is optimistic about the country's market potential, forecasting growth potential of millions of metres of fabric over the next few years.

The Mandela Bay Development Agency (MBDA) and Mandela Bay Composites Cluster (MBCC) signed a memorandum of understanding in April under which the former will prioritise the use of advanced materials including composites in selected products falling within its mandated area and to attempt to collaborate with the composites cluster.

Comments