In H1 FY 21, sales and EBIDTA of the Indian textiles and apparel industry saw a drastic drop. With Q2 FY21, however, there have been signs of a remarkable recovery.

The covid-19 pandemic had its adverse effect on the sales and profits in the textiles sector. The Wazir Textile Index (WTI) saw a drastic drop in sales and EBIDTA in H1 FY21 owing to the pandemic.

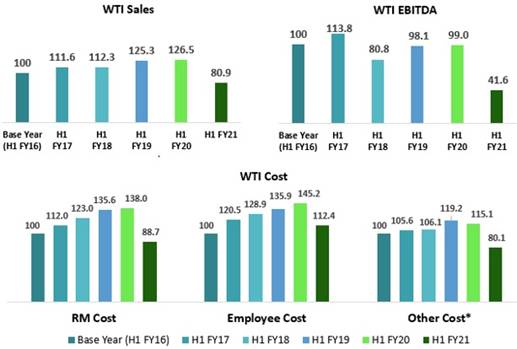

In H1 FY21, overall sales dropped by 36 per cent as compared to that in H1 FY20. The overall EBIDTA showed a decline of 58 per cent in H1 FY21 as compared to H1 FY20. Raw material (RM) cost and manpower cost also decreased by 36 per cent and 23 per cent, respectively during the same period.

The latest edition of the WTI, which encompasses the highlights of the cumulative financial performance of the top Indian textile companies with respect to the market performance of the Indian textiles sector, has just been released for H1 FY21.

According to the WTI, the consolidated sales of the selected top 10 companies were ₹12,934 crore in H1 FY21 as compared to ₹20,235 crore in H1 FY20 and showed a decline of 36 per cent as compared to the previous year. As compared to H1 FY20, the average EBITDA margin has also declined by 4.5 percentage points in H1 FY21 for the selected top companies. Average RM cost decreased by 0.3 percentage points, while the average employee cost increased by 2.3 percentage points in H1 FY21 as compared to the same period during the previous financial year.

Figure 1: WTI Sales, WTI EBIDTA, WTI Cost

Trend Analysis of the overall financial performance of the textile sector

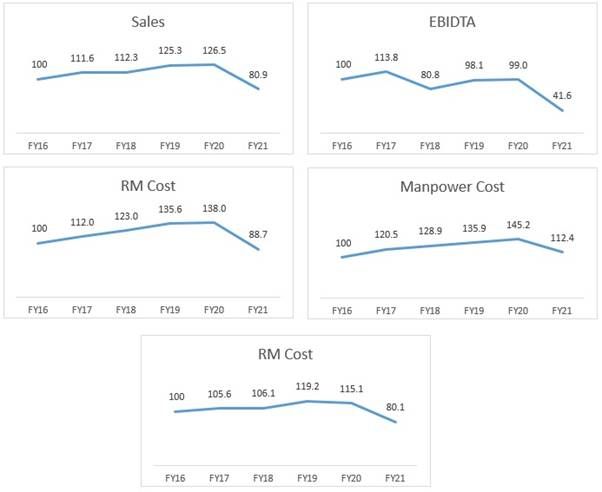

Due to the impact of worldwide lockdown induced by covid-19, there has been a major decline in trend across all the indices. Fig 2 is a graphical depiction of the same.

Figure 2: H1 FY21 Index Trend Analysis

India's GDP shrinks by 15.8% in H1 FY21 as compared to previous year

India's GDP stood at ₹60 lakh crore in H1 FY21, as against ₹71.3 lakh crore in H1 FY20, witnessing a record shrink of 15.8 per cent.

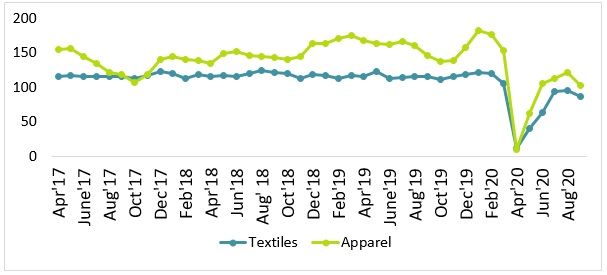

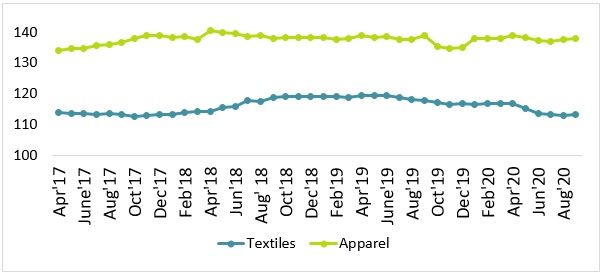

The average Index of Industrial Production (IIP) for apparel decreased by 47 per cent in H1 FY21 as compared to H1 FY20, while that of textiles showed a major decline of 44 per cent. In H1 FY21, the Wholesale Price Index (WPI) for textiles decreased by 4 per cent in H1 FY21 as compared to H1 FY20, while that of apparel declined by 0.4 per cent.

Figure 3: Index of Industrial Production (IIP)

Data Source: Ministry of Statistics and Program Implementation (Base Year 2011-12)

Figure 4: Wholesale Price Index (WPI)

Data Source: Ministry of Statistics and Program Implementation (Base Year 2011-12)

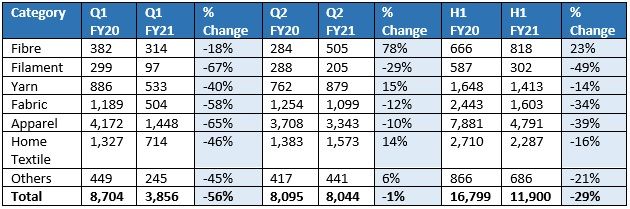

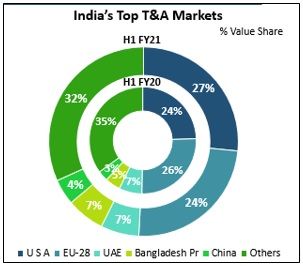

India shows 29% decline in exports in H1 FY21

The textiles & apparel (T&A) exports in H1 FY21 stood at $11.9 billion, showing a dip of 29 per cent from H1 FY20. The exports of filament and apparel witnessed the highest dip of 49 per cent and 39 per cent, respectively. The US, EU-28, and UAE remain the top export destinations for India's T&A products with a combined share of 57 per cent. In Q2 FY21, exports of fibre have shown a significant recovery of 78 per cent y-o-y due to the increase in cotton exports amid the US ban on the purchase of cotton products from China. On the home textiles front, exports witnessed a steady recovery in Q2, led by high hygiene and wellness consumption across the US and EU territories.

Table 1: India's Textile & Apparel Exports H1 FY21 (Values in US$ Million)

Data Source: DGCI&S

Figure 5: India's Top Textile & Apparel Export Markets H1 FY21

Data Source: DGCI&S

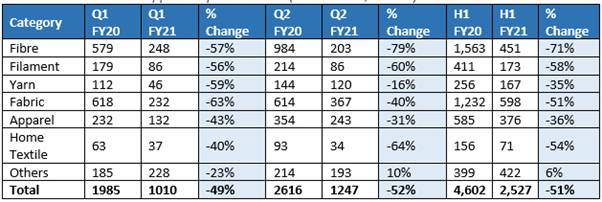

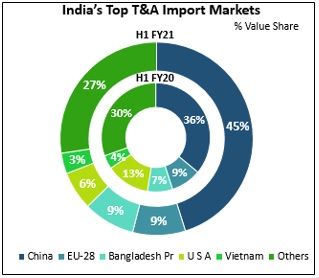

China continues to be the largest import partner of India

India's T&A imports stood at $2.25 billion in H1 FY21, recording a decline of 51 per cent over that in H1 FY20. The imports of fibre and filament experienced the highest decline of 71 per cent and 58 per cent, respectively. The imports of others have shown a slight growth of 6 per cent in H1 FY21 as compared to H1 FY20 due to the heavy imports of PPE kits in Q1 which then reduced in Q2 as India excelled in in-house manufacturing of the same. China continues to be the largest import partner for India with a share of 45 per cent in H1 FY21 which has increased by 9 per cent as compared to H1 FY20.

Table 2: India's Textile & Apparel Imports H1 FY21 (Values in US$ Million)

Data Source: DGCI&S

Figure 6: India's Top Textile & Apparel Suppliers H1 FY21

Data Source: DGCI&S

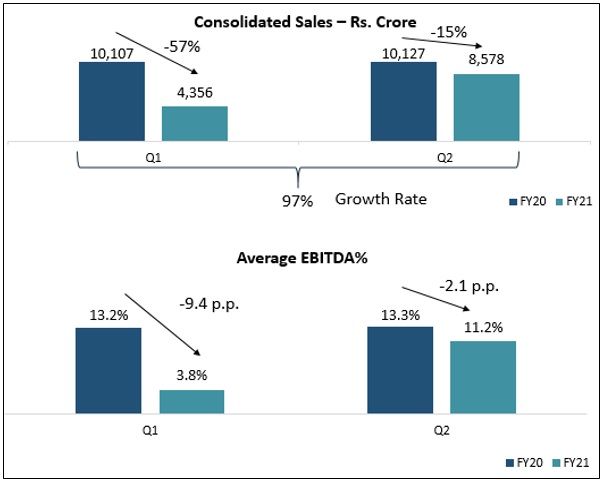

Consolidated sales rebounded by 97% in Q2 FY21 when compared to Q1 FY21

On a consolidated level, sales declined in Q1 FY21 due to the lockdown but showed a significant recovery in Q2 FY21 when compared to the same period the previous year. When compared to Q1 FY21, the sales in Q2 performed much better and rebounded by 97 per cent. Consolidated EBITDA margin also declined in Q2FY21 by 2.1 percentage points compared to the same period the previous year.

Figure 7: WTI Consolidated Sales, WTI Average EBIDTA%

Data Source: Money Control p.p. stands for Percentage Points

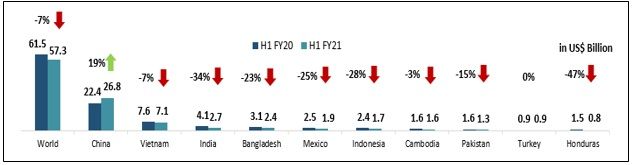

Textile & Apparel imports of USA declined by 36% in H1 FY21 (excluding PPE imports)

USA imported T&A products worth $57.3 billion in H1 FY21. The T&A imports of the US showed a decline of 7 per cent in H1 FY21 as compared to the previous year. The decline is lower than expected primarily due to the significant jump in the imports of PPE kits. Without PPE imports, there has been an overall decline of 36 per cent in US T&A imports in H1 FY21.

Figure 8: Overall Imports and Top Import Countries of USA H1 FY21 - (PPE included)

Data Source: OTEXA, UN Comrade

Figure 9: Overall Imports and Top Import Countries of USA H1 FY21 - (Without PPE)

Data Source: OTEXA, UN Comrade

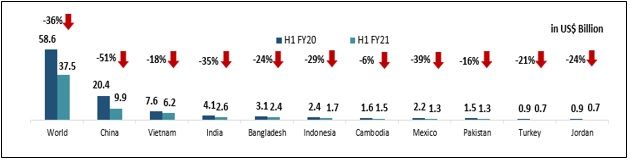

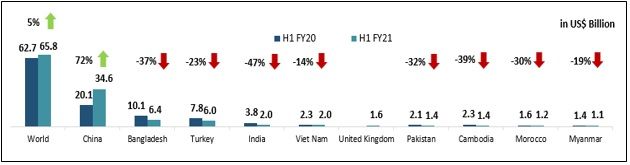

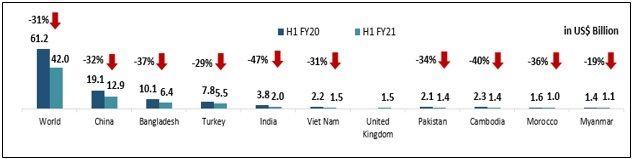

Textile and Apparel imports of EU have declined by 31% in H1 FY21 (excluding PPE imports)

With a value of $65.8 billion in H1 FY21, the EU's T&A imports increased by 5 per cent in H1 FY21 as compared to that in H1 FY20. This is primarily due to the significant jump in the import of PPE kits, mainly from China. This resulted in tremendous growth of 72 per cent in China's exports to the EU as well. Without PPE imports, there has been a decline of 31 per cent in EU's imports in H1 FY21.

China is the largest producer of PPE kits and other related products continue to be the largest exporter to both the US and EU.

Figure 10: Overall Imports and Top Import Countries of EU H1 FY21 (PPE Included)

Data Source: UN Comtrade

Figure 11: Overall Imports and Top Import countries of EU H1 FY21 (Without PPE)

Data Source: UN Comtrade

India's exports to the US stood at $2.7 billion in H1 FY21, showing a decline of 34 per cent as compared to the previous year. For the EU, India's exports stood at $2.0 billion in H1 FY21, showing a decrease of 47 per cent over the same period during the previous year.

The Indian T&A industry showed a significant recovery in overall sales and EBIDTA levels in Q2 FY21 as compared to Q1 FY21. The consolidated sales rebounded by 97 per cent from Q1 FY21 to Q2 FY21 and the average EBIDTA percentage recovered by 7.4 percentage points from Q1 FY21 to Q2 FY21. The performance of exports also showed recovery with only 1 per cent decline in Q2 FY21 as compared to 56 per cent decline in Q1 FY21. With these results and the beginning of the post-covid world, the T&A industry is anticipated to show positive results in the next quarter.

Comments