SANJAY BAKSHI presents a yearly roundup on Europe fashion amidst challenging covid-19 times and shares how Europe embraced new behaviour

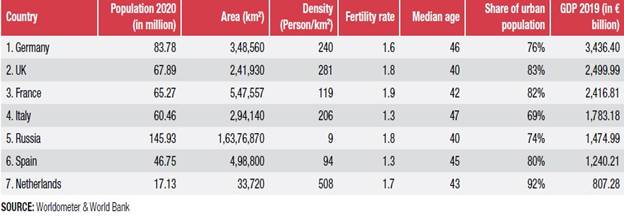

Europe is known to be world's colonial power, but its present identity is the European Union (EU)-a shared economy of 27 of 44 countries in the continent. The EU contributes 70 per cent of the continent's GDP which would have continued to be 83 per cent had Brexit not happened. Seventy per cent of the EU's GDP comes from only five countries of Western Europe-Germany, France, Italy, Spain and Netherlands, which when joined by the other two powerful nations-the UK and Russia, as second and fifth largest economies respectively, contribute 69 per cent of Europe's aggregate GDP. Besides, being an economic powerhouse the EU is also world's influential fashion zone and retail hub, emanating fashion trend and gifting many global retailers to the world.

Fashion industry

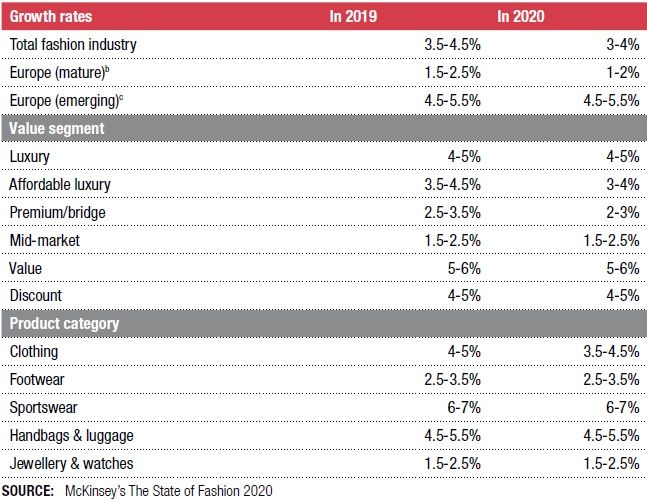

The McKinsey Global Fashion Index (MGFI) had predicted global fashion to grow at 3-4 per cent in 2020, slightly below than the growth for 2019. It envisaged fashion players to turn digital-first and fully leveraging new technologies. However, no one ever imagined 2020 to have a crisis like covid-19 which would convert even small notional growth rates into shocking negative growth rates as the year moved from quarter to quarter. The fashion sales plummeted world over as the discretionary spending saw enforced cut due to lockdown, income being temporary cut off and business closures.

For Europe specifically, McKinsey had separate predictions for mature and emerging markets. Mature markets, the major contributor to fashion retail business, were to grow around 1-2 per cent while emerging markets were to grow at the previous rate. The covid-19 pandemic impacted mature markets drastically with most of the fashion retailers having significant presence there. Had it not been for their online presence, the realised numbers in 2020 would have been even more embarrassing.

Though all fashion segments were affected anything above mid-market pricing was doomed as the consumer confidence and spending power were at the lowest. Among fashion product categories, clothing still continued to sell but mostly as a utility item; high-ticket fashion such as jewellery and watches, tourism-influenced luggage, party accessories like handbags and outdoor wearables like sportswear could not contribute much in sales. Demand for these items remained almost non-existent during entire mid-2020 -the main lockdown period with almost no outing.

Table 1 Demographics of Europe’s top 7 economies

Apparel trade

Europe's apparel market figures have always been robust with 2019 registering import of €177.30 billion and export of €126 billion. Respective average growth rates in apparel import and export between 2014 and 2019 have been 5 per cent and 5.9 per cent. China, the biggest importer for the EU, began started showing signs of decline in 2019 opening future opportunities for other countries to step in as alternatives. All such performances and plans were disrupted with the coronavirus pandemic by the end Q1, 2020.

International trade encountered a bumpy road with discontinuation of transportation, disturbed shipments, closure of numerous key production facilities and restriction on human interaction. Europe witnessed a 3 per cent drop in global trade values in Q1, 2020 along with 11.5 per cent drop in EU imports. The production in clothing sector also saw a 28.1 per cent drop during same quarter.

The cumulative effect stretched in the second quarter too. The period of February-June 2020 saw a 22.4 per cent drop in sales volume of textiles, clothes and footwear in specialised shops of the EU but in parallel, a 17.4 per cent simultaneous sales increase was also seen over the internet as the consumer shifted to online purchases. Cautious unlocking in the third quarter indicated that knitwear will remain the biggest product segment in Europe in 2021 too while fashion and active sportswear will be the fastest growing product segment.

Leather trade

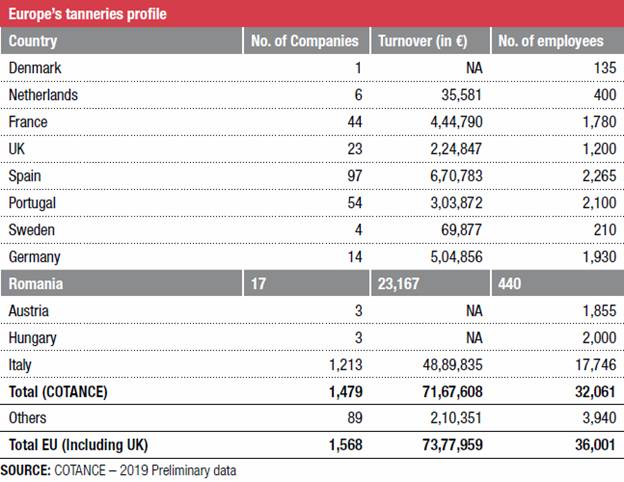

The Confederation of National Associations of Tanners and Dressers of the European Community (COTANCE) does a combined turnover of €7.4 million through more than 1,500 companies spread across various European nations. The industry has ably complemented fashion apparel and clothing segment since long besides providing raw material to other industries.

Table 2

Table 3 Europe’s tanneries profile

Table 4 Global retail trend

Table 5.1 Europe’s top retailers by revenue

Table 5.2 Europe’s top retailers by revenue

According to a forecast estimate by a panel of experts the global footwear consumption in 2020 was to fall by 22.5 per cent due to the covid-19 pandemic, representing a shortfall of estimated 5.1 billion pairs. The consumption fall included a decline by 27 per cent or 908 million pairs in Europe. A separate survey carried out by the Italian retailers' association, Confcommercio, found that sales of footwear and clothing fell to zero for stores not equipped with appropriate e-commerce platform after Italy entered a nationwide lockdown on March 11. For the whole month of March, sales of footwear and clothing through all channels fell by 67.4 per cent.

Global retail

The global retail market, distributed among six of seven continents on earth, is estimated at €23.20 trillion ($26.07 trillion) for 2020. The market has grown at a CAGR of 4.8 per cent since 2016 and was expected to reach €26.49 trillion by 2023, growing at a CAGR of 4.5 per cent. Share of e-commerce in global retail averaged at 12.3 per cent between 2016 and 2020 growing at a CAGR of 22.6 per cent. Expected to grow at 15.7 per cent between 2020 and 2023, the continuously ascending share was predicted to attain an average of 20 per cent, before covid-19 hit at the global stage quashing all predictions.

As of 2019, four European countries rank among top 10 nations with retail e-commerce sales. Three nations of UK (€126.32 billion), Germany (€72.85 billion) and France (€61.79 billion) belonging to Western Europe and the fourth, Russia (€23.96 billion) from Eastern Europe, ranked third, sixth, seventh and tenth, respectively. First three have also been large and flourishing economies with immense contribution to the retail consumption at world stage.

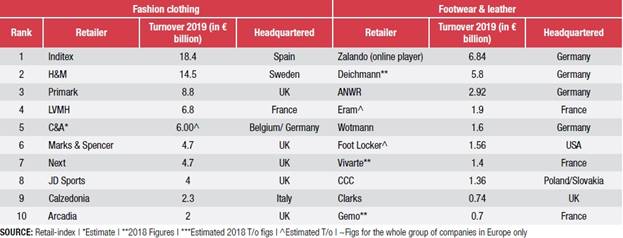

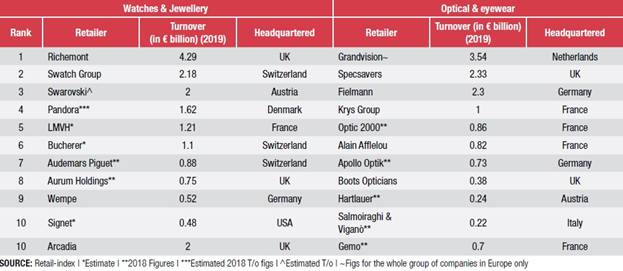

European retail

Netherlands-based retail-index.com, an industry research portal, estimates about 7,000 European and non-European retail chains with minimum of five stores or minimal €3 million turnover, are operating across 41 countries in Europe. Around 3,100 among them are fashion retailers led by fashion & clothing (57%), followed by footwear & leather (22%), jewellery & watches (12%) and optical or eyewear retailers (9%). Germany, France, Spain and UK together have 30 per cent of all these fashion retailers.

Despite being a mature market, European retail faced many challenges and setbacks in 2020. The pandemic-affected year tested many influential and powerful retailers. Performance of some of Europe’s top fashion retailers is being shared in Table 5.1.

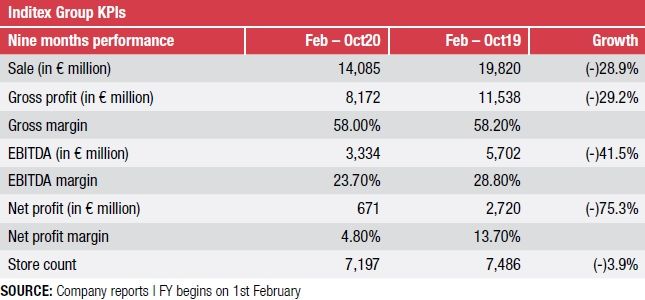

Inditex Group, Spain

Fibre2Fashion reviewed the Group's half-year performance in its October story "Tackling Covid19 - The Zara strategy". The new business update for the Group over nine months period includes an overall sales decline of 29 per cent and net profit decline of 75 per cent. However, Group's online sales continued to grow at 75 per cent with 44 per cent increase in online visits reaching a count of 3.4 billion.

Table 6 Inditex Group, Spain

The company termed 97 per cent of its online growth as organic. The Group credited sales turnaround and positive profits to the effective management in every area of the company, with a seamless coordination between each link in the business model: design, product, manufacturing, logistics, stores and online. Inditex also opened stores in 25 markets during these nine months including China, Mexico, Russia, Germany, the Netherlands, Spain and Saudi Arabia. At the end of the period Inditex operated a total of 7,197 stores. Though most of Group's stores reopened by the end of July, 88 per cent of its stores had to operate with limited capacity and opening hour restrictions. From 19 October 2020, a new phase of closures and restrictions began in various markets1.

H&M, Sweden

The H&M Group review up to August 2020 was published by Fibre2Fashion in the month of November. The fashion Group started the year strongly and with a positive momentum until the first wave of covid-19 had an impact. Extensive social restrictions involving temporary store closures and large drops in customer footfall to physical stores led to a substantial decrease in sales, particularly in Q2, 2020.

A strong recovery in the Q3, 2020 continued for much of the Q4, 2020 (September 1, 2020-November 30, 2020). Despite the recovery the Group's Q4 net sales, amounting to SEK 52,543 million, decreased by 10 per cent in local currencies compared with Q4, 2019. Within Q4, 2020 sales for the periods September 1 to October 21 and October 22 to November 30 in local currencies terms, decreased by 3 per cent and 22 per cent, respectively, compared with the same periods last year. For FY20, net sales decreased by 18 per cent in local currencies. For full-year 2020, net sales amounted to SEK 187,025 million. However, the recovery again transitioned into a new slowdown as a result of the pandemic's second wave1. The company will share its full-year (December 19-November 20) performance by end- 2021.

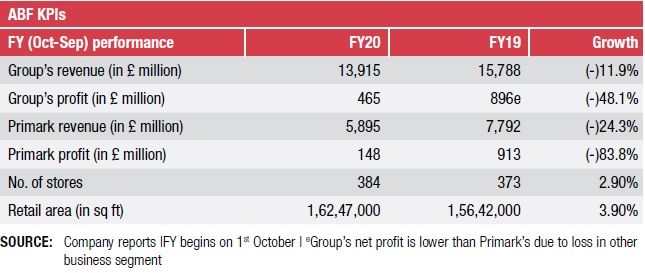

Associated British Food plc (Primark), UK

Primark, the retail business owned by Associated British Food plc, is one of the largest fashion retailers in Europe and the largest clothing, footwear and accessories retailer by volume in the UK. As of September 2020, it has 384 stores with retail area of 16.25 million sq ft across 13 countries, including the US. ABF's FY20 revenue was £13,915 million, 12 per cent down from previous year. This was primarily due to third quarter performance in which Primark's stores were closed.

Table 7 Associated British Food plc (Primark), UK

First half-year sales grew by 4 per cent at constant currency driven by increase in retail area and improved like-for-like sales in Europe business. Primark managed low level of markdown when all stores reopened by mid-July. Sales at Primark stores in retail parks remained higher than previous year while stores at shopping centres and regional high streets stayed somewhat same. The stores at large destination city centres, heavily dependent on tourism, contributed 8per cent to total sales as against 13 per cent of last year. As of October-end, Primark stores in Ireland, France, Belgium, Wales, Catalonia and Slovenia, representing 19 per cent of total retail area, were temporarily closed.

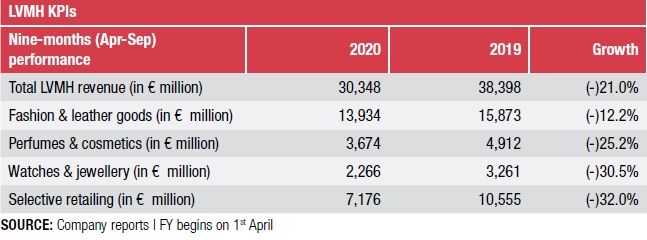

Louis Vuitton Moet Hennessy (LVMH), France

LVMH, one of the world's leading luxury products group, recorded revenue of €30.3 billion in the first nine months of 2020, registering a decline of 21 per cent compared to the same period in 2019. Since the start of 2020, LVMH demonstrated good resilience in an economic environment severely disrupted by the serious health crisis that led to the suspension of international travel and the closure of the Group's stores and manufacturing sites in most countries over a period of several months.

Table 8 Louis Vuitton Moet Hennessy (LVMH), France

Basis the Q3 comparison of 2020 and 2019, revenue was down by 7 per cent. The third quarter saw a strong rebound in fashion & leather segment as Louis Vuitton continued to display momentum and creativity, in all areas, from products to shows and customer events. It strengthened its production with the opening of a new workshop in France. Online sales for perfumes & cosmetics grew steadily in the third quarter and there was a significant improvement in trends in stores as well. Sales of watches & jewellery dropped 14 per cent in the third quarter of 2020 against Q3, 2019. In selective retailing segment, Sephora gained market share in its main countries particularly because of strong growth in online sales.

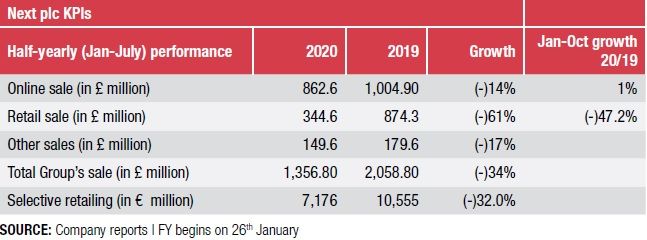

Next, UK

Next plc is a British fashion & home retailer headquartered at Enderby, England. It retails clothing, footwear and home products. With operations in 38 countries, the retailer runs more than 600 stores. For the first half of 2020, Next's combined full-price brand sale composed of online, retail and finance sales, was down by 33 per cent and 34 per cent including markdown, against previous year.

Table 9 Next, UK

A nine-month period from January to October 2020 resulted in a 1 per cent growth in online sales and 47 per cent drop in retail sale compared to nine-month period of 2019. The sales performance by product category remained very similar to the second quarter, with home and childrenswear over-performing while demand for men's and women's formal and occasion clothing remained weak.

Online sales continued to be strong, both in the UK and overseas markets. In retail, out of town retail parks also continued to perform better than high streets and shopping centres. In the third quarter, markdown sales were down by 12.3 per cent against last year, mainly driven by lower footfalls and capacity constraints in online warehouses as full price sales were prioritised over clearance sales.

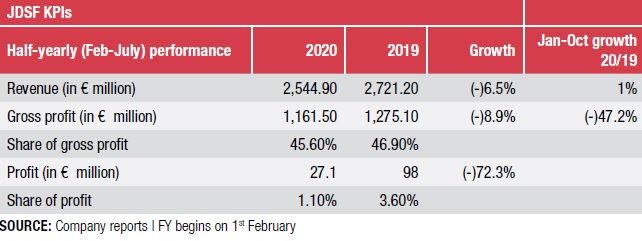

JD Sports Fashion (JDSF), UK

JDSF is a sports fashion, multichannel retailer of branded sports and casual wear, combining globally recognised brands such as Nike, adidas, Puma and The North Face, with strong own brand labels such as Pink Soda and Supply & Demand. The company has operations in 25 countries none of which, except UK and US, contributes more than 10 per cent of the Group's total revenue.

Table 9 JD Sports Fashion (JDSF), UK

The Group began fiscal with 2,203 stores and ended half-year with 2,210 stores with addition of 23 new and four acquired stores while 20 were closed down. Share of UK & Europe markets in total revenue reduced to 62 per cent in 2020 against 68 per cent in 2019 with revenue dropping by 14.2 per cent. In contrast its overseas revenue growth remained positive at 9.8 per cent.

In many territories, early weeks of pre-closure period continued to show positive trend. During the closure period, consumer switching to online channels were readily serviced by the Group's omni-channel offering. Across the countries where stores had to be temporarily closed, approximately 60 per cent of the combined store and online revenues from the previous year were retained. On reopening the initial pent-up demand was short lived with weaker footfalls, particularly across Europe. However, weakness in footfall was compensated by better conversion and higher ATV to an extent, thanks to the shoppers who visited stores willingly and with intent to shop.

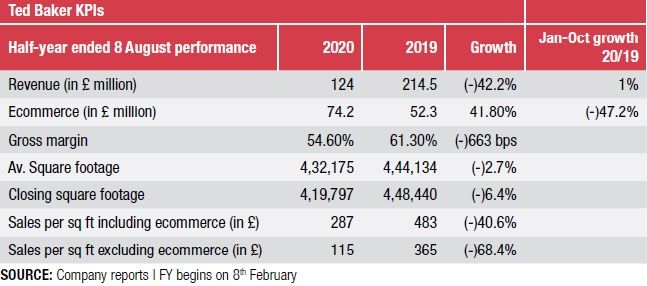

Ted Baker, UK

Ted Baker, a British luxury clothing company, operates wholesale, retail and e-commerce business. Its retail channel comprises stores & concessions across the UK, Europe, North America and South Africa and localized e-commerce sites in the UK, continental Europe, the US, Canada and Australia, providing an omni-channel experience. The company's retail performance was similar to many other retailers amid covid-19 with declining store figures and growing e-commerce.

Table 10 Ted Baker, UK

For the 28 weeks period ending on August 8, 2020, its worldwide retail sales decreased by 42.2 per cent to ٟ24 million while online sales grew by 41.8 per cent to £74.2 million, representing 59.8 per cent share of total retail sales against 24.4 per cent in 2019. Ted Baker's own directly operated e-commerce business grew by 56 per cent while store sales decreased by 69.3 per cent to 㿝.8 million.

The wholesale business revenue was also down by 55.7 per cent and gross margin dropped from 37.6 per cent in the previous year to 28.9 per cent in 2020. Ted Baker's revenue dropped 45.9 per cent to 𧵡.50 million for the same period. The fashion house reacted to the challenging times by reducing operational expenses, furloughing staff at stores and head office, utilising benefits of government's support schemes, initiating cost control and restructuring programmes.

Zalando, Germany

Zalando, founded in 2008, is a Berlin-based e-commerce platform that offers fashion and lifestyle products to online customers in 17 countries. It carries a wide fashion products assortment of over 3,000 brands. Expectedly, Zalando's performance registered positive growth on almost all KPIs with consumers switching to online shopping.

Table 11 Zalando, Germany

In Q2, 2020, sales and overall performance recovered strongly after the dip in the first quarter where a severe negative impact of the coronavirus pandemic on growth and performance was seen. In Q2 2020, GMV and revenue grew by 33.0 per cent and 27.4 per cent respectively. The exceptional growth was enabled by the company's focused execution of the platform strategy and decisive crisis response on the one hand and changing consumer behaviour-transition from offline to online, on the other. Together with the strong top line growth, Zalando achieved significant efficiency gains in fulfillment costs and reduced marketing investments.

Other tales of 2020

The covid-19 pandemic arrived in Europe almost with beginning of 2020. It put pressure on health services for unprecedented service delivery, shut down the non-essential businesses and held fashion industry captive for significant time throughout, the otherwise vibrant, Europe. Being among the influential and financially attractive industries of the world fashion's captivity resulted in furloughing and unemployment of millions of people.

Order cancellations

Lockdowns marked by stores closures resulted in cancellation of orders worth billions of euros to Asian suppliers, particularly to Bangladesh factories. Consequently, an estimated 1.2 million Bangladeshi workers were impacted directly with thousands of factories and associate suppliers losing their contracts. They could neither provide income to furloughed employees nor compensate the dismissed ones due to sudden payment cuts from Europe-triggering a humanitarian crisis.

Luxury brands donated

Fashion leaders did their part to deal with the situation and donated suitably. LVMH initially donated ٟ.78 million to the Red Cross China followed by deputing its perfume and cosmetics units to manufacture large quantities of hydro alcoholic gel and pledged 40 million medical masks. Kering, the French luxury brand, donated to Hubei Red Cross Foundation in China and also extended donations to four major foundation hospitals in Italy, besides joining LVMH in providing medical masks. Prada's leadership donated intensive care and resuscitation units to three hospitals in Milan too. Dolce & Gabbana donated for a research project by Humanitas University. Another luxury brand of Italy,

Moncler, donated €10 million to construct 400 ICUs in the country. Versace promoters donated €200,000 to ICU of the San Raffaele Hospital in Milan. Giorgio Armani followed the suit by donating €1.25 million to numerous Italian hospitals and institutions. Lacoste factory workers volunteered in manufacturing 145,000 washable and reusable masks for protecting essential business workers from virus. Italian Maison Valentino's parent company donated €1 million to an emergency field hospital in Madrid, Spain. H&M, too, extended compensation for its suppliers.

Other also shared responsibility

Independent fashion players too shared responsibility to fight covid-19. Threegraceslondon.com gave 100 per cent of its three-week sales till April 8 to the Crisis Charity. UK's Paula Knorr donated 20 per cent of their profits to Sufra-a food bank and kitchen based in northern London, for providing food and basic supplies to the needy. Oslo-based fashion house Holzweiler collaborated with poet Alexander Fallo to raise awareness for those who suffered with loneliness during pandemic period, sold t-shirts printed with poet's work and donated 100 NOK of each purchase to a local non-profit charity.

Foundation fund created

The British Fashion Council (BFC) created a ٟ million BFC Foundation covid crisis fund to support creative fashion businesses and individuals to survive the crisis, a portion of which was also to safeguard and support students as future talent. The fund had support coming from Arch and Hook, British Vogue, Browns, Burberry, depop, GQ, JD.COM,INC, Label/Mix, Paul Smith, Rodial and Value Retail.

Fashion shows got cancelled

When the covid-19 heat shifted to Europe, fashion shows became the immediate casualty. Chinese brands unanimously cancelled their participation at the Milan Fashion Week, pioneered by Angel Chen and Ricostru. In Paris too, cancellations by six more Chinese brands namely Masha Ma, Shiatzy Chen, Uma Wang, Jarel Zhang, Calvin Luo and Maison Mai, followed. Reacting to the developments, Europe's fashion icon Chanel also announced in February the cancellation of staging its May-scheduled Mtiers d'Art collection in Beijing. Few days later, seeing the damage done by virus in northern Italy, Armani cancelled on his invitees too with less than a 24-hour notice and offered live streaming of the show instead. Shows at the Paris Fashion Week went on but with clinical execution. Chanel and LV banned US staff from attending the show and Belgian Dries van Noten and Spanish Paco Rabanne offered protective masks to their guests. The smaller independents Rosie Assoulin, Agn's B and APC did not show, and nor did the jewellery Maison Cartier, who stopped its Cartier Creations presentation. Gucci announced withdrawal of its San Francisco Cruise 2021 show to be held in May. Other cancellations included Chanel and Dior shows in Italy scheduled for May, Prada's in Japan, Max Mara's in St Petersburg, Hermes' in London and Armani's in Dubai.

Shuttering down

Among major fallouts of covid-19 was closure of physical stores across Europe as per the government guidelines. The crisis of the already fragile European store retailing and shaky high streets were further deepened with stores closure. Many top players like Primark, H&M, Inditex and Arcadia had already shut their shops before official lockdown and so did UK's famous department chains, including Harvey Nichols, Harrods, Selfridges, John Lewis and Liberty. However, their online stores remained functional with delayed deliveries and extended return periods.

Comments