The textile and apparel industry in Africa has grown rapidly in the past couple of years, and is estimated to grow at a compounded annual growth rate of around 5 per cent over the next five years. Even faster growth is possible if the countries pay attention to grey areas like infrastructure, strategic supply chain and skill management. Fibre2Fashion takes a look at some individual nations in the continent.

The US African Growth and Opportunity Act (AGOA) is a key driver for boosting the textile-garment industry in Africa as it allows 39 sub-Saharan African nations to export goods, which includes textiles and garments, to the United States free of duty. Countries like Kenya and Ethiopia are turning garment manufacturing hubs in the continent, followed by Rwanda, Uganda and Tanzania to a great extent.

Kenya led the East African Community (EAC) members in its use of the AGOA, scoring 98 per cent. However, it came second to Ghana which recorded 99.1 per cent with Madagascar coming third at 93.7 per cent. According to US government data, Ethiopia at 81.9 per cent and the Democratic Republic of Congo (DRC) at 68.2 per cent are the other east African countries that have also taken advantage of the treaty to increase exports to the United States, mainly of products like textile and apparels, metals, agricultural products and artefacts.

Kenya, Tanzania and Rwanda are the only EAC countries that have complete AGOA utilisation strategies in certain industries, including textile, apparel and handicrafts.

As African countries gradually shift to ratify the African Continental Free Trade Area (AfCTA), merging the continent's markets into a single market of more than 1.2 billion people and a GDP of over $2.5 trillion will be a challenge.

With 21 members, a population of around 560 million and a combined GDP of $769 billion, the Common Market for Eastern and Southern Africa (COMESA) is one of Africa's biggest regional economic communities and has made significant progress in many areas of integration. Growth of trade among COMESA members, however, remains low compared to the region's trade with the rest of the world, both in exports and imports.

Millions of dollars have been invested in east Africa's garment industry. The number of nations growing genetically-modified (GM) cotton in Africa has doubled since 2018. Ethiopia, Kenya, Malawi and Nigeria have joined South Africa, Sudan and Eswatini in adopting GM crops.

The Parsons School of Design in New York is working with the African Development Bank (AfDB) to leverage digital tools to support the African textile and fashion industry. The goal of the bank's Fashionomics Africa initiative is to enable African entrepreneurs operating in the textile, apparel and accessories industry to create and grow their businesses. It aims to create jobs, stimulate regional integration, intra-African trade and entrepreneurship development.

Through the Fashionomics Africa Digital Marketplace-which targets Cote d'Ivoire, Nigeria, Kenya, Ethiopia and South Africa-and mobile app, the bank is also analysing the impact of the textile sector on climate change and environment to deploy climate-friendly solutions.

German fashion house Hugo Boss in November launched a sustainable collection in support of Cotton made in Africa (CmiA), an internationally recognised standard for sustainably-produced cotton from the continent.

Sales of Moroccan textiles and clothing in the EU and US import markets were down sharply during the first half of 2020 as was production by Tunisian textile, clothing and fur manufacturers. The textile and apparel industry in Africa has grown rapidly in the past couple of years, and is estimated to grow at a compounded annual growth rate of around 5 per cent over the next five years. Even faster growth is possible if the countries pay attention to grey areas like infrastructure, strategic supply chain and skill management.

Let us take a look at some individual nations in the continent.

Ethiopia Attracts Investors With Prc Knowhow, Low Labour Costs

Ethiopia is the fifth-largest recipient of foreign direct investment (FDI) in Africa, along with Egypt, South Africa, the Congo and Morocco. Apart from the AGOA benefit, Ethiopia has duty-free access to the EU under GSP. The government expects textile exports to reach $300 billion by 2025. IMF has slashed the country's GDP growth forecast for 2020 down to 3.2 per cent from 6.2 per cent. It was 9 per cent in 2018-19.

The east African country has now positioned itself as one of the most attractive hubs for global fashion brands interested to shift production out of China. Chinese know how and investment, low labour cost and government commitment to infrastructure are the main incentives there. Worker wages are much lower compared to those in China and Bangladesh.

Ethiopian workers are the lowest paid in the global garment supply chain. According to a report by the NYU Stern Center for Business and Human Rights, the minimum wage for Ethiopian garment workers is $26 a month. Campaigners and unions have been highlighting the need for a statutory minimum wage to help protect workers from abuses, but the government's reported reluctance and the pandemic's fallout seemed to have halted any move in that direction.

A key attraction for investment in the country is the lack of minimum wage and poor labour regulations, combined with the government's prioritisation of economic growth over rights-based development.

Four out of ten garment workers on Ethiopia's flagship industrial park lost their jobs after the onset of the pandemic, according to a study published in Word Development Journal. A five-month state of emergency was declared by the government in April to

fight the pandemic and mitigate its impact, prohibiting companies, including clothing factories, from laying off workers despite significant sales and order reductions.

At the start of the pandemic, textile and garment factories in Ethiopia's industrial parks employed 95,000 people, with women accounting for 70 per cent of these. The country's Jobs Creation Commission estimates that between 1.4 and 2.5 million jobs could be lost nationwide in the three months beginning November if safety nets are not put in place.

Factories produce wool, cotton and nylon fabrics, acrylic and cotton threads, sewing thread and garments. Some major players that already source from there include Inditex, H&M, PVH, Decathlon or Primark. The Ethiopian Textile Industry Development Institute (ETIDI) claimed the pandemic's impact on the country's textile-garment sector was not as sluggish as imagined earlier.

The Children's Place, the largest childrenswear retailer in the US, reportedly cancelled orders from Ethiopia in March and delayed payments by six months for orders completed in January and February.

According to Anurag Srivastava, ambassador of India to Ethiopia, India is a frontrunner for investment in the country's textile and garment sector as there is tremendous untapped potential for export of readymade garments from the country to the West. India is Ethiopia's second-largest investment partner after China with an approved investment of over $4 billion.

Indian firm Raymond in early 2020 signed an agreement with the Ethiopian government to set up a garment facility. Another Indian firm, KPR Mill Ltd, opened a factory in Mekelle Industrial Park under a collaborative partnership with the

International Trade Centre's Supporting Indian Trade and Investment for Africa (SITA) programme.

At the ITME Africa 2020 Exhibition held in February at Addis Ababa, Gujarat-based Laxmi Shuttleless Looms Private Limited gifted a Laxmi CM-R shuttleless flexible rapier loom to the Ethiopian Institute of Textile and Fashion Technology (EiTEX) under the Bahir Dar University for teaching and training.

Industrial

Ethiopia produced 76,000 tonnes of cotton in the last fiscal, which ended on July 7, according to ETIDI, which is preparing a five year strategic plan in addition to its 10-year master plan to improve textile and garment sector production and productivity.

Prime Minister Abiy Ahmed in October inaugurated the Bahir Dar Industrial Park, expected to boost the expansion of the textile industry in the capital of Amhara state. The first phase of the park, constructed by the China Civil Engineering Construction Company, has eight factory sheds.

Despite the uncertainties related to the pandemic, the Industrial Parks Development Corporation (IPDC) has planned to generate $400 million from foreign trade in this fiscal by involving 36 domestic investors and generating 45,000 jobs. Several textile and garment companies are also part of the IPDC parks.

The Semera Industrial Park will be completed and operations will start there this fiscal. The Mekelle Industrial Park is a major fully-operational park that has three textile and garment units. Two of these companies are owned by Chinese investors.

China's SINOMA Engineering in September started building a new garment industrial park in Hawassa, the capital of Sidama state. The construction of the 14-shed park is expected to be completed in less than a year. Ninety per cent of the products manufactured in this park will be exported and it will create 30,000 jobs.

Nasa Garment Plc, which started production in January 2020, became the first Ethiopian company from the Hawassa Industrial Park to export products to Canada. The company plans to earn $1.5 million this year and $7 million next year from exports. Nasa is preparing to venture into the second phase of investment at Bole Lemi Industrial Park. Expected to cost $11 million, the plant is planned to be fully operational in 2022. The second plant will manufacture denim with 7,000 employees.

External assistance

Germany in April announced a support package of €120 million to help the country address the negative economic impact of the pandemic. In late 2020, the United Kingdom, Germany and Ethiopia established a fund to provide subsidies to companies in Ethiopia's textile and garment industry. An initial 6.5 million was announced at the launch on October 29, and will be apportioned to applicants. The fund will protect jobs, enable textile factories to keep running and support factories to build back better. The UK Aid-funded FSD Africa will implement the project in partnership with First Consult, a leading Ethiopian consulting firm.

The ZDHC Foundation launched its first project in Africa aimed at strengthening capacity in Ethiopia's textile and apparel industry. As part of a private-public partnership between the German government and Dow Europe GmbH, the Foundation will lend its expertise to help ensure a safer and eco-friendlier textile and apparel industry in the country.

Future

But as a civil war erupted in the northern Tigray region in early November between the army and the Tigray People's Liberation Front loyal to Tigray's former ruling party, garment factories there have been severely hit. Investors are taken aback as it could lead to a period pf prolonged unrest. As the conflict arrived at the gates of Tigray's capital Mekelle, textile companies began shutting down and pulling out staff. Italian hosiery chain Calzedonia suspended operations. Bangladeshi textile company DBL flew its foreign staff out of the country. The course of the conflict will have a strong bearing on the industry in future.

Statistics

• In 2019, exported fashion goods to Europe worth €67.7 million, 49 per cent more than a year ago

• Textile-garment sector earned over $171.7 million during fiscal 2019-20, according to ETIDI

South Africa: Focus On Boosting Domestic Production

A strong focus of South Africa's clothing, footwear, textiles and leather (CFTL) sector in 2020 was domestic production boost. Cheaper Chinese imports have shrunk the country's once healthy textile and clothing industry. Retailers shunned local products to cut costs and boost profits.

Stakeholders across the value-chain in the CTFL industry in September vowed to work closely to identify and execute on opportunities to deepen localisation and bolster production. They did this at a virtual meeting of the executive oversight committee managing the implementation of the Retail-CTFL masterplan, signed by stakeholders in November 2019.

The masterplan has seven commitments, including growing the domestic market, driving domestic sourcing, ending illegal imports and value chain transformation. The government department of trade, industry and competition (DTIC) is focusing on its implementation. Sales in the this industry in the first half of 2020 fell by 20 per cent adjusted for inflation compared to the figures in the corresponding period in 2019, while production volumes declined by 30 per cent.

With pandemic restrictions interrupting global trade, South African retailers like Woolworths and The Foschini Group are looking to raise investment in local clothing manufacturers to reduce dependence on Chinese imports. While analysts praise the move, they feel it won't fully revive the ailing industry.

The companies have signed up to an industry plan that includes a target to source 65 per cent of their goods from local manufacturers within the next decade. But a big challenge is domestic companies cannot replace the full range of imported apparel products.

Workers in the CFTL sector resumed work in May as lockdowns were eased. The second national sectoral 'COVID-19 Lockdown National Collective Agreement' signed in March guaranteed full wage payment to textile workers during the six-week lockdown period.

In April, the country's National Bargaining Council for the Clothing Manufacturing Industry ratified the first ever COVID-19 PPE & Essential Products Collective Agreement, whose primary objective was to ensure that the apparel industry contributed constructively to combating the pandemic's spread by providing adequate PPE.

The agreement provides for workplaces to be re-purposed, and to provide protection for employees through anti-COVID-19 customised workplace plans, including appropriate social distancing during production and work hours restructuring.

The Southern African Clothing & Textile Workers' Union (SACTWU) completed its 2020 round of wage negotiations in the clothing industry in December. Nearly 70 000 clothing workers in the country are expected to benefit from a collective agreement ratified at a special meeting of National Bargaining Council for the Clothing Manufacturing Industry.

The agreement, concluded between SACTWU, the Apparel & Textile Association of South Africa, the South African Apparel Association and the Transvaal Clothing Manufacturers Association, provides for a wage increase of 3.7 per cent with effect from March 1, 2021, and a further 4.2 per cent increase with effect from September 1.

Statistics

CTFL sector accounts for about 2.5 per cent of manufacturing output

Apparel segment has a projected market volume of $661m in 2020 (Statista.com)

Egypt: Cotton Industry Hit Hard Amid Textile Sector Modernisation Efforts

Several Egyptian clothing units have halved production, while many others have stopped production altogether due to the pandemic's impact, according to the Readymade Garments Chamber, which said the dramatic slowdown is due to a projected decline in market demand for the Fall season. A massive overstock of summer clothing sat for months in factories. Egyptian factories hardly sold 30 per cent of their summer season stock between July and September.

The Apparel Export Council of Egypt said textile exports dropped by 29 per cent in the first semester of the year and a 40 per cent decline in production is imminent.

The country's RMG exports declined by nearly a fifth in the first nine months of the year, but in September, exports were up by 21 per cent on the month before. RMG exports were worth $377 million, $239 million and $393 million in the first, second and third quarters of 2020 respectively. Exports to Europe were down by 14 per cent between January and September.

The cotton industry was particularly hit hard by the pandemic as the government had just invested $1.25 billion to modernise spinning, weaving, knitting, dyeing, finishing, printing and cut-and-sew manufacturing of the state-owned textile industry. The first machinery and foreign trainers were scheduled to arrive in April 2020, but the pandemic halted all those plans. Another problem of the cotton sector is farmers shifting to more food crops as the country remains a major foot importer.

President Abdel-Fattah El-Sisi inaugurated in July the first stage of a new industrial complex built by the Egyptian National Company for Industrial Development in Sharqiya governorate. A cotton textile complex comprising six factories in Robeiki industrial city was opened.

In the same month, the Holding Company for Cotton, Spinning, Weaving, and Clothes signed a contract to set up a new spinning factory at the Misr Spinning and Weaving Company in al-Mahalla al-Kubra. The factory will have more than 182,000 spinning wheels with an average production capacity of 30 tonnes per day.

During the Swiss-Egyptian Investment Forum in Cairo in February, Switzerland-based Rieter, which supplies systems for short-staple fibre spinning, and the Holding company signed additional contracts related to the modernisation programme of the textile industry.

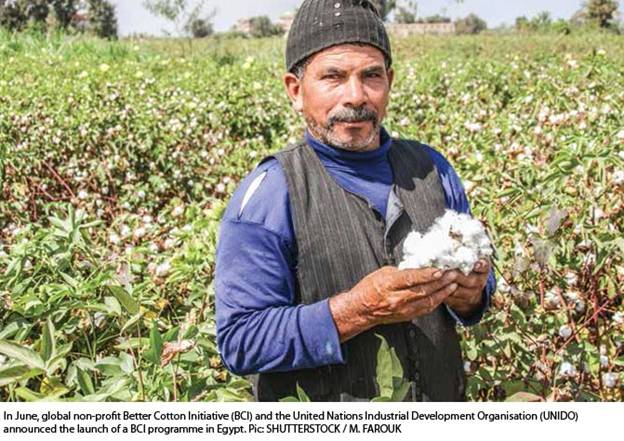

In June, global non-profit Better Cotton Initiative (BCI) and the United Nations Industrial Development Organisation (UNIDO) announced the launch of a BCI programme in Egypt. The participating farmers will receive training on the Better Cotton principles.

Five Egyptian researchers claimed to have developed the world's first high performance fibres and reinforcements from by-products of date palm pruning like frond and fruit stalks, also called PalmFil. The sustainable and economical fibre is compatible with textile and composite processing and offers the properties needed for future lightweight cars. The fibre is cent per cent biodegradable and compostable and has a specific tensile strength five times higher than structural steel, and equal to those of flax, hemp and sisal. Its vibration damping and acoustical insulation is higher than those of glass and carbon and thermal insulation higher than carbon.

In December, UNESCO included the Egyptian manual textile industry of the Upper Egypt region in the list of intangible cultural heritage sites in need of urgent preservation. The year ended with the government denying reports on social media about privatising spinning and weaving factories.

Statistics

Textile industry contributes around 3 per cent of the country's GDP, employs 2.25 million, or a third of its industrial labour force, to meet its annual demand of 180,000 tonnes

Kenya Allows Commercial Growing Of Bt Cotton

More than 100 Kenyan apparel manufacturers temporarily closed due to the pandemic, sending hundreds of workers home because of a decline in demand in export markets, primarily in the United States. The affected units were mostly from the export processing zones in Nairobi, Mombasa, Kisumu and Machakos. At least 30,000 direct jobs had been lost in the sector by June, data by the Kenya Private Sector Alliance indicates.

After banning the import of used garments and footwear on March 31 as the pandemic spread, the government lifted the ban in August.

Allowing commercial growing of transgenic Bt cotton was the highlight of Kenya's textile sector in 2020. The government gave 16.3 metric tonnes of Bt cotton seeds to farmers in the eastern and western regions. The government will distribute such seeds and pesticides to 23 counties suitable for cotton production during fiscal 2020-21.

Data from the county's department of agriculture indicate the farm-gate price for conventional cotton has been about Sh 52 per kilogram with the price of Bt cotton having a potential to fetch up to Sh100 per kilogram.

The government will build a Sh70-million ginnery in the Kinondo area of Msambweni sub-county in Kwale. Kwale is among the five counties where ginneries will be built as part of a programme to revive the sector. Kwale-based Australian mining firm Base Titanium has agreed to construct the ginnery at the PAVI Business Park in Kinondo. Kirinyaga county is planning to revive the Mwea Cotton Ginnery to support cotton farmers.

Garment manufacturer Rift Valley Textile Ltd (Rivatex) will open a branch in Boya in Kisumu county as part of its expansion plans and wants to employ at least 3,000 to boost the revival of cotton farming after decades of decline. The garment factory will procure raw materials from 24 cotton-growing counties, most of them in the Lake Region Economic Bloc.

Kitui County Textile Centre (KICOTEC) rolled out a skills transfer programme aimed at training tailors in industrial garment production. The project will enable community tailors to acquire professional skills and produce quality and affordable PPE, hospital linen and school uniforms.

Apparel company Nguo Yetu is planning to engage Kenyans working abroad, including in the United States, in expanding its distribution footprint. The company also plans to get into partnerships with foreign companies in certain strategic markets. According to the Economic Survey, Kenyan firms exporting textiles and apparels to the United States under AGOA earned a combined Sh46 billion in 2019.

Nigeria: Cotton Seems Primary Focus

The government's aim is to change the textile chain and increase the percentage of manufacturing in the GDP from 9 per cent to more than 15 per cent under the Pamba na Viazi (PAVI) cotton radicalisation programme and increase cotton production from 29,000 to 65,000 bales annually. The domestic demand for cotton is now met through local production, the Central Bank of Nigeria (CBN) claimed.

Kwajaffa Hamma, director-general of the Nigerian Textile Employers Association of Nigeria, however, feels stakeholders are worried about the government putting more money into cotton production than the moribund textile industries they were supposed to revive. None have been revived since 2017, according to him.

One media outlet also reported quoting cotton farmers that government interventions, which usually come through CBN's Anchor Borrowers Programmme, were always late.

The government has conceived an integrated textile and garment park in Katsina state to end the annual loss worth $6 billion due to import of garment and textile goods. A partnership between the Nigeria Correctional Service and local company Erojim Investments Limited and its technical partner, China's Poly Technologies Inc., will establish a factory to produce high quality shoes, garments and leather products.

Meanwhile, the country's traditional, hand-made fabrics are being hit hard by cheap Chinese imports, often smuggled.

Rwanda: Sector Grows 83% In 2 Years Despite Agoa Withdrawal

The withdrawal of AGOA trade benefits by the United States for Rwanda in 2018 makes the country less attractive as a manufacturing base for international garment producers. But the government recently claimed its textile and garment sector grew by 83 per cent in value between 2018 and 2020.

The country's efforts to boost its garment industry have seen it fight a secluded trade battle with the United States. The AGOA benefit withdrawal followed Rwanda's decision not to back out when six members of the East Africa Community (EAC) block-Burundi, Kenya, Rwanda, South-Sudan, Tanzania, and Uganda-first announced they would all put in place high tariffs on imported second-hand clothing from the United States, and then five of the countries retracted following a US threat to remove all EAC nations from the AGOA list of beneficiaries.

Government statistics indicate Rwanda exported $5.9 million worth of textile and garment products in 2018. By 2020, that value increased to $34.6 million, implying raised volume of garment exports to markets like the Democratic Republic of Congo, Belgium, Germany and Hong Kong.

To help the country's clothing manufacturers, the Rwandan government has removed import taxes on raw materials like cotton. New factories get grants and loans.

Some experts, however, suspect Rwanda's capability to build a competitive clothing industry. While other EAC members are cotton-producing nations, Rwanda needs to import this raw material as the densely populated and mountainous country is unsuitable for major cotton production.

This article was first published in the January 2021 edition of the print magazine.

Comments