US apparel imports from China have moderated this year, which paired with the prevalent trade tensions, might give the impression that US apparel imports are shifting away from China. But the data is not clear on this as some categories see a secular fall across all partners. There are also data reporting issues which render any such conclusion very hasty.

US textile and apparel imports had begun to return to their usual trajectory lately, with home textile imports falling from their high last year and apparel imports inching back towards pre-Covid levels. Supply chain bottlenecks have now become the most pressing problem as shipments get lined on US ports, and delays mount to exorbitant levels. Delays are such, that Hapag Lloyd and CMA CGM have reportedly alerted their customers about cancelling calls to the Port of Savannah, one of the largest ports in the US recently.

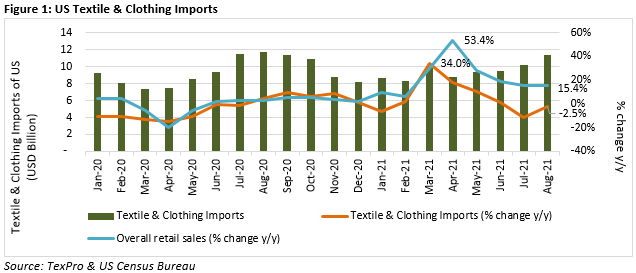

US imports had seen a tremendous jump in the first half of 2021, only to be caught in the logjam created by the demand itself. US textile and clothing imports, although continue to rise on a m-o-m basis in Aug-21, it registered a negative growth relative to the previous year. This is in contrast to the overall retail sales in the US, which continue to rise on both m-o-m and y-o-y basis. As figure 1 would suggest, domestic sales are booming in the US (even if the pace has reduced since Mar-21), while import demand for textiles and clothing have been impacted heavily due to the shipping bottlenecks and consistently rising logistics costs.

US imports back to usual trends

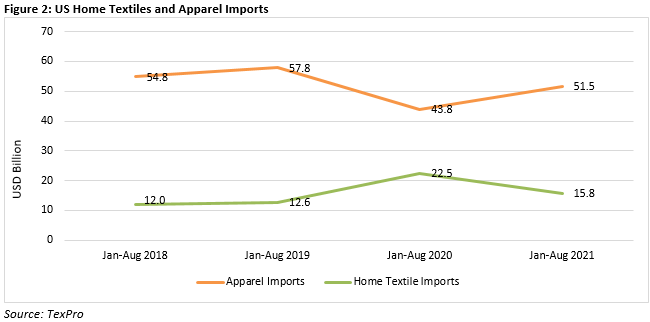

Since, apparel and home textiles are the two largest categories of textiles imports in the US, let us have a quick look into how these have performed. During the lockdown phase, demand for home textiles increased tremendously as consumers found renewed interest in maintaining health and hygiene and reinventing their personal space . US’ Home textiles imports touched USD 21.7 billion in 2020 compared to USD 9.4 billion in 2019 and USD 9.2 billion in 2018. On the other hand, US apparel imports saw a sharp drop last year. A large part of this impact on US imports was obviously on imports from China.

Both home textiles and apparel imports for US have returned to their usual trends this year, as evidenced from Figure 2. Year to date, while apparel imports have only started to recover fully to pre-pandemic levels, home textile imports remain higher than pre-Covid levels, highlighting a possible behavioral shift towards more hygiene.

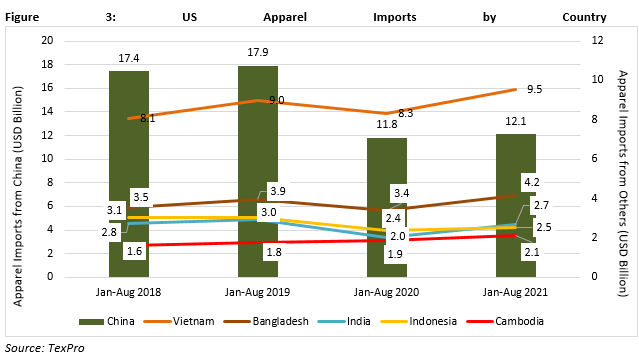

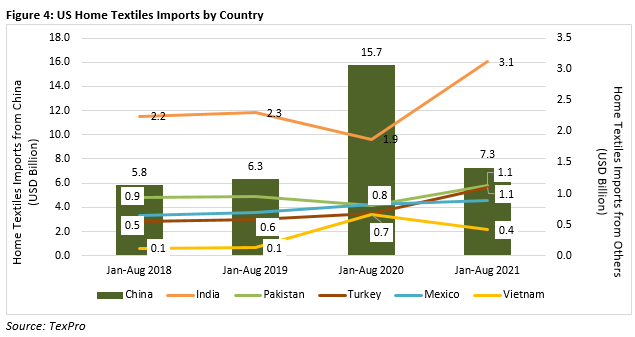

US imports appear to have shifted to other locations from China, as recent tensions between the two trade partners have only increased. For apparel imports, the large gainers as reported by the US, have been Vietnam, Bangladesh, India, Indonesia, and Cambodia (Figure 3). However, there is another angle to this apparent trend shift that we will discuss later. US home textiles imports from China have normalised from the levels reached last year but remain elevated than pre-Covid levels (Figure 4). However, home textiles imports from India and Turkey have risen tremendously, while only seeing marginal growth from other partners (Mexico and Pakistan).

Are other partners gaining share in US imports?

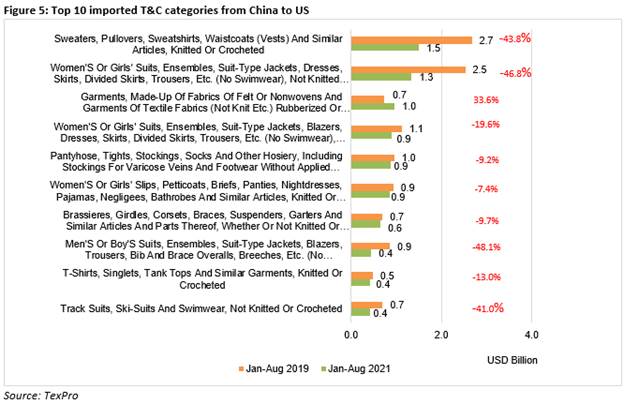

Commodity-wise, all major apparel categories have seen a decline in imports from China. A look at the top 10 categories in apparel, shows that there has been as much as 46 per cent decline in US imports from China. Figure 5 shows the top ten categories of apparel imports from China to the US and almost all have seen a fall in Jan-Aug 2021 compared to Jan-Aug 2019. The heaviest fall has been in men’s woven suits, ensembles & jackets (-48.1 per cent), women’s woven suits & ensembles (-46.8 per cent), knitted sweaters & pullovers (-43.8 per cent), woven track suits & swimwear (41.0 per cent) and women’s knitted suits & ensembles (-19.6 per cent). The HS Codes for these categories are 6203, 6204, 6110, 6211 and 6104 respectively. Not very surprisingly, imports of garments made of felt or nonwovens (primarily surgical gowns) from China saw a substantial increase in the period of our analysis.

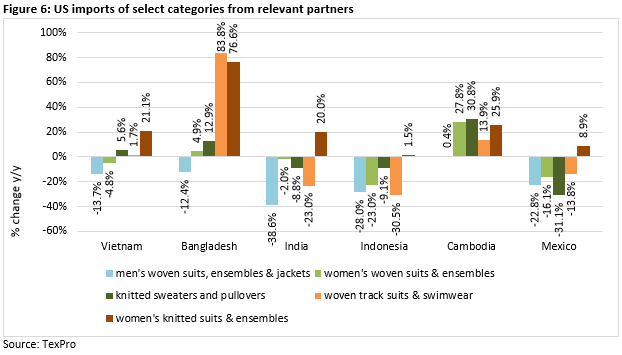

The very simplistic interpretation of US imports declining from China and deriving an obvious conclusion that it may be shifting to other locations is not uniformly true. For instance, the category with the largest decline in China imports as mentioned above, men’s woven suits, ensembles & jackets, has simultaneously seen a decline in imports from all other relevant partners. Bangladesh (-12.4 per cent), Vietnam (-13.7 per cent) and Mexico (-22.8 per cent) are amongst the largest importers of this category to US and have seen a drastic fall in demand. Not surprisingly, total US imports in this category have also declined between Jan-Aug 2019 and Jan-Aug 2021. This is depicted in Figure 5 along with four other product groups that we discussed above.

The only product group amongst these 5 categories that has seen a rise YTD in overall US imports is women’s knitted suits & ensembles. US imports in this category grew by 8.5 per cent in Jan-Aug 2021 relative to Jan-Aug 2019. Here, all the six competitors to China that we have analysed, have seen a growth in imports. Bangladesh has seen the largest change in this category with a rise of 76.6 per cent, while Vietnam and India have seen moderate rise of 21.1 per cent and 20.0 per cent respectively. Bangladesh has also seen tremendous rise in US import demand for woven track suits & swimwear, with an increase in exports by 83.8 per cent in YTD 2021 against 2019.

Cambodia has seen significant gains in US import demand for 5 categories discussed. The largest growth registered in the knitted sweaters and pullovers segment (30.8 per cent), followed by women’s woven suits & ensembles (27.8 per cent) and women’s knitted suits & ensembles (25.9 per cent).

Misreporting in textile trade data

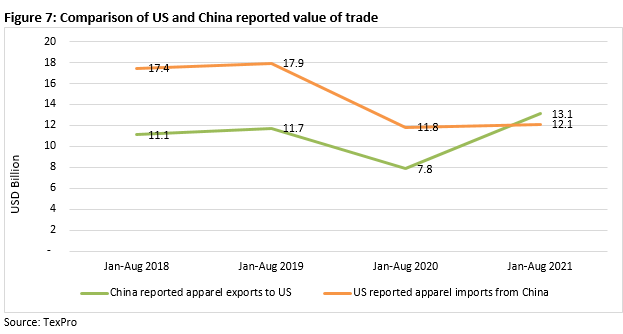

Analysing these trends assumes that US reported import numbers reflect the true picture. But as Figure 7 would suggest, reported numbers of US apparel imports from China and China exports of apparel exports have seen increasing divergence since last year. Or to be more precise, this divergence (or convergence) appears after the US announcement of increase in tariffs on imports from China. This divergence is also there for home textiles imports in the US, however not as stark as in apparel imports (Figure 8). The primary reason for this divergence, as also recorded earlier by the Federal Reserve , has arisen possibly because of two reasons – 1) higher tariffs by the US on Chinese imports and 2) China’s reduction in VAT rebate rates recently. These two changes have reportedly led to US importers underreporting the value of imports from China and presumably Chinese exporters overreporting their export value, leading to the convergence of the two numbers. Previously, US imports were always higher than Chinese export numbers by a certain (almost constant) factor due to the Customer Information File (CIF) difference. That difference has now disappeared and for the first time, US reported import value is lower than China’s reported exports value.

Conclusion

The impact of US imports from China is perhaps very unclear given the underreporting of numbers. Going with one of the two numbers – US imports from China or China exports to US – completely changes the possible impact on US-China textile and apparel trade that one would imply from the trade numbers. However, some other countries have evidently seen increasing import demand from the US and will probably continue to do so. Countries like Vietnam, Bangladesh, India, Indonesia, and Cambodia are expected to see much more demand from the US as we get fully back to pre-Covid growth trajectory. Since US-China trade tensions are far from over, the uncertainty around the impact on trade is also likely to persist.

1https://www.crisil.com/en/home/newsroom/press-releases/2020/12/stay-at-home-accelerates-recovery-for-home-textile-exporters.html

2https://www.federalreserve.gov/econres/notes/feds-notes/did-the-us-bilateral-goods-deficit-with-china-increase-or-decrease-during-the-us-china-trade-conflict-20210621.htm

Comments