On September 8, 2021, the government of India approved a Production Linked Incentive (PLI) scheme of ₹10,683-crore for textiles, specifically aimed at boosting the production of man-made fibre (MMF) fabric, MMF apparel and technical textiles, products in the country to enable textile industry to achieve size and scale; to become globally competitive and a creator of employment opportunities for people. We examine the details of the scheme which is set to provide incentives from FY25 to FY29.

Duration of the scheme

The scheme is operational from September 29, 2021 to March 31, 2030 and the incentive under the scheme will be payable for a period of 5 years only.

Part-1 of the scheme:

Any person including company/firm/LLP/trust willing to create a separate manufacturing company under Companies Act 2013, can invest minimum ₹300 crore (excluding land and administrative building cost) to manufacture notified products. Such company will be eligible to get incentive when they achieve a minimum of ₹600 crore turnover by manufacturing and selling the notified products by the first performance year.

Part-2 of the scheme:

Any person including company/firm/LLP/trust willing to create separate manufacturing company under Companies Act 2013, can invest minimum ₹100 Crore (excluding land and administrative building cost) to manufacture notified products. Such company will be eligible to get incentive when they achieve a minimum of ₹200 crore turnover by manufacturing and selling the notified products by the first performance year.

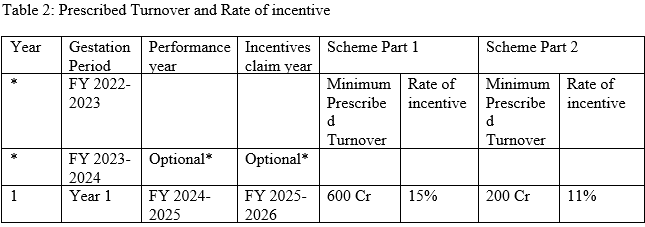

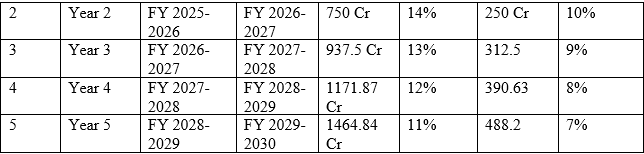

Turnover and incentives

Incentives in a particular year will be provided on achieving turnover as prescribed in Table 2 below for that year and, 25 per cent additional incremental turnover over the immediate preceding year’s turnover, subject to a cap of maximum 35 per cent admissible incremental turnover. In case the participant company fails to achieve the prescribed turnover or 25 per cent increase in turnover over immediate preceding year’s turnover, they will not get any incentive under this scheme for that year. Such participants will get incentive only when they achieve both, i.e the prescribed turnover target for the year and 25 per cent increase in turnover over immediate preceding year’s turnover, in subsequent year for reduced number of years.

Turnover cap

There will be a provision of cap of 10 per cent over and above the prescribed minimum incremental turnover growth of 25 per cent for the purpose of calculation of incentives from year 2 onward. Turnover achieved beyond that cap will not be taken into account for calculation of incentive. However, for year 1 the cap of 10 per cent will be applied over and above turnover of two times of the investment made under the scheme up to 2024-25. Turnover achieved beyond two times of investment per cent shall not be accounted for calculation of incentives in year 1. This shall apply to both schemes Part 1 & 2.

Selection criteria

Ministry of Textiles (MoT) shall invite applications from industry for selecting participants for the scheme. After screening of the applications, MoT shall publish the list of selected entities on the basis of recommendation of a Selection Committee under the chairmanship of secretary textiles.

Condition of Investment

a.Plant, Machinery and Equipment: Investment in plant, machinery and equipment under these guidelines shall include investment on new plant, machinery, equipment and associated utilities as well as tools, dies, moulds, jigs, fixtures (including parts, accessories, components, and spares thereof) of the same, used in the design, manufacturing, assembly, testing, packaging or processing of any of the manufactured notified product(s). It shall also include expenditure on packaging, freight / transport, insurance, and erection and commissioning of plant, machinery, equipment, and associated utilities. Associated utilities would include captive power and effluent treatment plants, essential equipment required in operations areas such as water & power supply and control systems. Associated utilities would also include Information Technology (IT) and Information Technology enabled Services (ITeS) infrastructure related to manufacturing including servers, software and ERP solutions. Such investments shall be used for determining eligibility under the scheme.

b.The plant, machinery and equipment should be purchased or leased in the name of the participant. In cases where these are being leased, the lease should be in the nature of a financial lease within the meaning of Accounting Standard 19 - Leases or Indian Accounting Standard (lnd-AS)- 116 Leases, as may be applicable to the participant, as Notified by Ministry of Corporate Affairs or any other appropriate authority from time to time.

c.The plant, machinery and equipment should be procured or leased through legally valid documents after payment of applicable taxes and duties.

d.The plant, machinery and equipment of the project approved under the scheme shall be used in regular course for manufacturing of the notified product(s) that are approved in the “Letter of Approval” issued by MoT. This does not preclude the usage of such machinery for manufacturing of other goods.

e.Building and Civil Construction: Investment made in construction of factory building (except administrative building and residential building) connecting road inside factory etc shall be considered for calculation of investment threshold.

f. Participant company can set up more than one manufacturing unit for production of notified products under this scheme. They will have to declare intent in the application.

g.Investment in R&D and Testing Laboratory: Investment upto 10 per cent of total project cost in R&D and Testing laboratory for development of notified products and maintaining quality shall be allowed and accounted for threshold investment. The software associated with R&D should have been procured or licensed through legally valid document after payment of applicable taxes and duties.

Time schedule for application for selection procedure

Application window for registration under the scheme shall be opened for the period from January 1, 2022 to January 31, 2022 (inclusive) on on-line portal. No application shall be accepted after the closure of the application window. However, in case of insufficient number of eligible applications, application window for selecting new applicants will be re-opened.

The applicant, in its application, shall declare and inform the PMA/MoT regarding their annual investment plan, expected sales turnover and expected employment generation and exports during the tenure of the scheme. A non-refundable application processing fee of ₹50,000/- shall be paid electronically by the applicant. Upon successful submission of an application, acknowledgement with a unique Application ID number shall be communicated to the applicant over email as well as through SMS. This acknowledgement shall not be construed as approval under the scheme. In case documents are found to be incomplete or deficient, MoT/PMA will issue query letter within 10 days from the date of online application and the applicant must submit required information/documents within 10 days from the date of receipt of such queries. In case the applicant fails to provide such information/documents in time, the application may be liable to be treated as rejected.

Procedure for selection under the scheme

The applications will be appraised as per the provisions of the scheme guidelines. The Selection Committee constituted by MoT for this purpose will consider applications for approval as per the criteria and budgetary limitations. Selection of applicants will be finalised within 60 days from the date of closure of application window. After receiving approval, MoT will issue communication with necessary details to the selected and waitlisted applicants within 5 working days from the date of finalisation of the list of selected applicants. Only the selected participants will be issued a “Letter of Approval” and other eligible applicants will be waitlisted. If a selected applicant is found to be ineligible at any stage, or if it has not complied with provisions of notifications, orders, guidelines or their own commitments made during application process of the scheme or declines the offer under the scheme at any stage for any reason, the envisaged incentive claim of such selected applicant shall be withdrawn, and the approval issued to the applicant shall be liable to be cancelled. In such a case, the offer may be extended to the waitlisted applicants

Eligibility criteria and conditions for claiming incentive

Selected participants meeting the criteria of threshold investment and threshold/ incremental turnover, shall be eligible to claim incentive. The participant shall also furnish all prescribed information. In case any participant fails to achieve threshold incremental turnover for any given year, the participant shall not be eligible for claiming incentive for that particular financial year. However, the participant will not be restricted from claiming incentive for subsequent years up to Performance Year 5 and for performance up to FY: 2028-29, provided prescribed and incremental turnover targets are achieved in subsequent financial years. The incremental turnover of notified product(s) should be commensurate with created production capacity under the scheme.

Criteria for calculation of incentive

Net incremental sales within cap of notified product(s) excluding taxes x Rate of Incentive in percentage for the performance year where,

(i)Notified Product(s) shall be as defined in this scheme and stated in the “Letter of Approval” issued to the selected participant.

(ii)Net Incremental Sales shall be turnover of the participant in the notified product(s) manufactured by the participant company minus the turnover for notified products of the participant in the immediately preceding year during scheme period.

(iii)In case of captive consumption of notified product(s) or sale of notified product (s) by the applicant to group companies, the gross turnover of notified product(s) shall be computed as under: (a) Notified Products invoiced as per GST rules for sale shall only be considered for incremental turnover. In case of captive consumption of upstream products manufactured by the Participant, no incentive will be payable. (b) In case a participant is selling the notified products to a group company and also to a non-group company, sale price offered to group or non-group company, whichever is lower, shall be considered for determining total value of transaction between the related parties.

(iv)Invoices generated from April 1 to March 31 of performance years shall be considered for the calculation of incentives for that financial year

(v)The onus of realisation of sales’ proceeds through normal banking channels shall be with the participant. Ministry of Textiles reserves the right to verify the documents evidencing realisation of sale proceeds which will be counted for computing participant’s turnover and incentives and take suitable recovery and penal action in case of any default on realisation of sale proceeds.

Disbursement of Incentives

An application for claiming incentives complete in all respect shall be filed online by the applicant by December 31 of immediate subsequent financial year of the performance year. The participant shall file its claim along with account details audited by statutory auditor of the company. He shall also submit a claim for disbursement of incentive on annual basis for the sales made in a performing financial year along with its audited financial statements. The PMA shall process claim for disbursement of incentive within 45 days from the date of receipt of such claim along with all supporting documents and will make appropriate recommendations to MoT. Upon approval of claims by Sanctioning Authority, the disbursement of incentive shall be done by way of Direct Bank Transfer through PFMS or through any other mechanism of adjustment in the account of participant company only by Pay and Account Officer (PAO) within 15 days from the date of approval of the competent authority. In case of excess claims disbursed inadvertently, the applicant shall suo-moto refund the same to MoT immediately. In case the participant fails to refund the excess amount then he will be liable for refund along with 15 per cent simple interest per annum to be calculated from the date of disbursement of incentive and up to actual date of refund by the participant. The payment shall be made in the head of account of MoT. The details of bank account shall be provided on the PLI portal. The company shall furnish the Output-Outcome details as per prescribed format on the PLI portal.

Conclusion:

Thus, the PLI scheme is all set to provide an immense boost to domestic manufacturing, and prepare the country’s textile and apparel industry for making a big impact in global markets. It will also help attract more investment into this sector.

Click here to find the HS-code list of items eligible for benefit under PLI scheme.

Comments