Indian textiles and apparels (T&A) industry accounts for approximately 4 per cent of the global T&A market. Having blessed with large raw material availability—cotton, jute, silk and wool—supported by the world’s second largest spinning and weaving capacity, giving the industry an opportunity for a 95 per cent domestic value addition, India offers to the world a complete value chain solution from farm to fashion, which gives it a competitive edge by shortened lead times to reach its buyers.

Majority of India’s export are to the US and the EU, which together constitute approximately 60 per cent of total apparel exports from India in value terms. However, despite the unique production advantages it has, Indian apparel has been facing price competition in its traditional export destinations, primarily due to high tariffs both in the US and in the EU as against zero duty access available to competing nations like Bangladesh, Sri Lanka, Pakistan, and Turkey, which had been affecting India’s export performance.

Contrary to this, Indian apparel enjoys a competitive position in the UAE, which accounts for a decent 12 per cent share in total apparel exports from India. With India supplying $1,515 million of apparel to the UAE as against the total imports of $4,679 million, Indian apparel exports contribute to a decent share of approximately 32 per cent of the total apparel imports into the UAE. In terms of category, both woven and knitted garments hold a much better acceptance in the UAE. Both knitted as well as woven apparel are amongst the top 10 export items after mineral, gems and jewellery to the UAE. India holds position as major supplier in both HS61 and HS62.

Until recently, the share of both India as well as China has been witnessing a similar trend in the UAE apparel imports both facing an import duty of 5 per cent. The historic India-UAE Comprehensive Economic Partnership Agreement (CEPA) signed recently will give impetus to the trade between the two countries. India will improve its share in the UAE in the absence of 5 per cent import duty which was earlier levied by the Gulf nation. Appreciating the fact that currently India and China are the only two dominant players in the RMG sector of the UAE, the CEPA would result in a drop of 5 per cent import duty for Indian RMG as against 5 per cent duty maintained for China. It is quite likely that the gap of approximately $2,000 million currently filled predominantly by China and other smaller players, can suitably be catered by Indian apparel exporters, and India could become a dominant player of RMG in the UAE market.

However, not all products which are high on import demand in the UAE are the core export strengths of India. Therefore, the entire gap currently between UAE imports from India versus rest of the world is not expected to be in favour of India, post CEPA, which came into force from May 1, 2022. The actual advantage India could possibly take out of its CEPA with the UAE would depend on the following factors:

• Import demand of specific RMG products in UAE

• Production strength/export capability of Indian companies to export the products in demand in UAE

• Acceptance of these Indian products into UAE

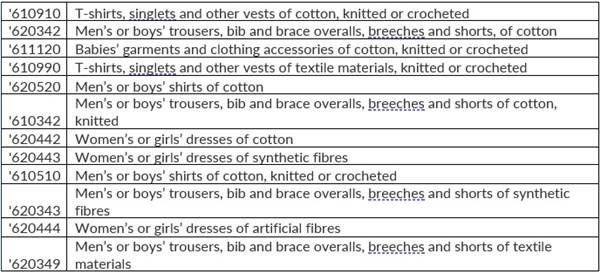

Based on the above criteria, following products seem to have high potential in the UAE:

Accordingly, the benefit is expected to be higher for knitted garments originating predominantly from Ludhiana in the north and Tiruppur textile cluster in the south of India.

Current government schemes are focusing on employment generation in the textile sector, which include Scheme for Integrated Textile Parks (SITP), Samarth scheme. In addition, a separate scheme for development of knitting and knitwear aims at boosting production in knitting and knitwear clusters which provide employment to nearly 24 lakh persons. The CEPA, which is expected to strengthen the presence of Indian RMG in the UAE, will be instrumental in absorbing the outcomes of these initiatives taken by the Indian government.

Considering that the COVID-19 pandemic has affected the majority of India’s traditional export markets where India faces tariff disadvantages against competing suppliers and huge logistics cost, it makes sense for Indian garment exporters to strengthen its focus on UAE post CEPA. The Indian government has been focusing on rigorous promotion of exports to UAE through World Expo Dubai 2020, Dubai, UAE which was held during October 2021 to March 2022 which focused apparel and textile sector during November-December 2021. The Apparel Export Promotion Council (AEPC) along with industry exhibitors are now participating in International Apparel and Textile Fair (IATF), Dubai this month. These efforts will give further impetus to Indian apparel exports to UAE.

Comments