Brits spend almost £45 billion on clothing and textiles annually, making United Kingdom the third largest apparel and footwear market worldwide after China and the United States. This feature delves into what makes the UK an interesting retail market, especially in the present scenario marked by continued inflation on essentials, particularly energy, and rising mortgage costs.

UK’s 2021 GDP at $3.13 trillion formed a 3.2 per cent share of world’s economy. According to Trading Economics – a global data information portal, its GDP per capita stood at $46,209 the same year. Currently, its world rank competes with India for the fifth position.

In more recent timeframe of quarter ending in October 2022, UK’s GDP fell by 0.3 per cent over the previous quarter ending in July 2022. Looking specifically into the month of October, the 0.5 per cent growth was largely driven by Services sector which grew 0.6 per cent after falling 0.8 per cent in September. The largest contributor to this growth were wholesale and retail trade which, excluding motor vehicles and motorcycles, respectively rose by 1.9 per cent and 0.6 per cent after seeing a fall in September. There was a growth of 1.2 per cent in consumer-facing services in October after a 1.7 per cent fall in previous month. Again, the largest contributor in this growth remained the wholesale and retail trade sector, growing by 6.5 per cent in October against a fall of 3.3 per cent in September. Consumer-facing services in UK collectively refer to retail trade, accommodation, food & beverage serving activities, travel and transport, and entertainment and recreation.

Economic Outlook

In one report, PwC reported that UK economy shrank by 0.6 per cent in June 2022 with polarised growth recorded at regional levels. While economic output stood at 0.9 per cent above its pre-pandemic level in February 2020, some regions struggled to breakthrough beyond the pre-pandemic levels, deepening the regional growth imbalance. London grew at the fastest rate in Q3, 2021 and remained around 3.3 per cent smaller than pre-pandemic levels, while other regions such as the North East, Midlands and Wales experienced a contraction between 1.2 per cent and 0.3 per cent. The report classified UK growth as ‘deteriorating’, estimating UK GDP growth in 2022 to average in the range of 3.1-3.6 per cent, followed by two years of slow or even negative GDP growth.

The UK inflation outlook is also highly uncertain. PwC’s analysis predicts inflation could peak at 17 per cent in the first half of 2023, highest ever since 1980. However, should government choose to freeze household energy bills then inflation could peak at 10-13 per cent.

Retail Overview

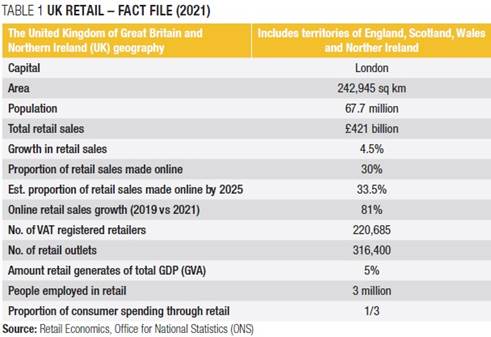

With over 2 lakh registered retailers and more than 3 lakh retail outlets, UK’s retail contributes 5 per cent to its economy. The sector employs around 3 million people, making it UK’s largest private sector employer, which attracts one-third of consumer spending.

UK’s 2021 retail sales at £421 billion registered a growth of 4.5 per cent over the previous year. In this, the online share was 30 per cent, which is expected to reach 33.5 per cent in the next 3 years. Owing to pandemic spread and lockdowns, and growing organic shift to digital shopping during the period, the online retail in UK has grown 81 per cent between 2019 and 2021.

E-Commerce

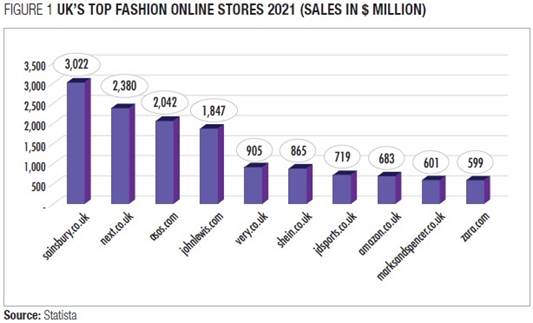

Internet shopping is very popular in the UK with 67.61 million mobile phone connections. There are 65.32 million internet users, 81 per cent of which are active on social media. An estimated 82 per cent of UK population bought at least one product online in 2021. The biggest players among UK e-commerce market are amazon.co.uk and argos.co.uk with revenues of $9.5 billion and $6.3 billion respectively. Together, the top three e-commerce stores account for 30 per cent of online revenue in the United Kingdom. E-commerce purchases made over smartphones have overtaken those made over tablets, with former representing well over two-thirds of all e-commerce sales. The online players that prominently shape UK’s e-retail are Amazon, Ao.com, ASOS, Boohoo, eBay, Missguided, N Brown Group through its Jacamo, JD Williams and Simply Be brands, Net-a-Porter, and Very Group (formerly Shop Direct) including its fashion site Littlewoods.com.

The online retailing growth is driving a relentless pursuit of value for money. People look online for the best deals and prices, driving the proportion of money being spent online which has increased in recent years. Internet has become the natural place for shoppers to look for fashion, health and beauty, home and garden, consumer electronics and travel services. Shopping is happening both ways with shoppers trying products in-store and buying it at better price online or via smartphone or tablet as well as ‘clicking’ orders and collecting in-store. Continued rise of social networking and mobile internet access have made social media marketing a key channel in which e-commerce firms are boosting their investment. The online sales growth has seen a spike with gloom in bricks-and- mortar retailing.

Recent Performance

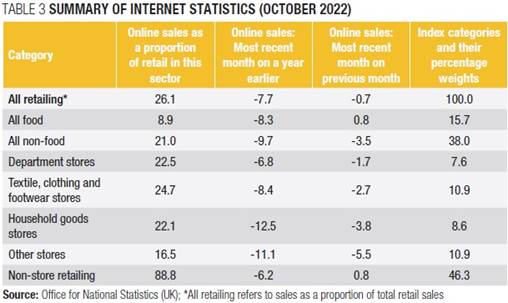

In 2022, October retail sales volumes rose by 0.6 per cent against a 1.5 per cent drop in September which was affected by the additional bank holiday for the State Funeral of The Queen. On comparing quarters ending in October on yearly basis, sales volumes in 2022 fell be 2.4 per cent, continuing the downward trend seen since summer (March) 2021 when restrictions were in place. Increase in October sales over September, was seen across all main sectors apart from food stores where volumes fell by 1 per cent (4.1 per cent below their pre-COVID levels in February 2020). In recent months, supermarkets have witnessed a decline in volumes sold due to increased cost of living and food prices. In non-food store retailing, volumes rose by 1.1 per cent – marking a 1.7 per cent drop from February 2020 levels. The sub-sectors of non-food stores reported a monthly rise in sales volumes of 3.6 per cent; clothing stores volumes rose by 2.5 per cent (3.7 per cent below February 2020); department stores fell by 0.3 per cent; and household goods such as furniture stores fell by 4 per cent (11.8 per cent below February 2020).

On the other hand, non-store retailing (predominantly online retailers) sales volumes rose by 1.8 per cent during October 2022 following a fall of 2.5 per cent in September, registering a growth of 21.2 per cent over February 2020 levels. The share of online sales in October to total retail sales was 26.1 per cent, remaining broadly consistent since May 2022.

Festive Season

UK experienced a festive season with mixed results in 2022. The sales were troubled due to train strike allowing a limited shopping time to shoppers. Due to various industrial action, there were reduced train services across the rail network from December 13, 2022, to January 8, 2023, causing significant obstruction to shoppers to reach stores for shopping. Trains became busier as they began starting later and finish earlier, providing no services at all in some places. Bricks-and-mortar stores of many retailers felt the major brunt of these strikes, which reportedly failed the segment to hit the billion-pound sales mark.

The footfall in the run-up to the Christmas ended 12 per cent lower than 2019 levels. Instead of the normally reduced rail service on Boxing Day, the network was closed after RMT (National Union of Rail, Maritime and Transport) rail workers walked out for the festive period from Christmas Eve. Some retailers began their Christmas sales earlier like fashion & lifestyle player John Lewis which began offering discounts online from 5 p.m. on Christmas Eve. However, the company decided to keep its stores closed on Boxing Day, in part, to give employees time off during the festive season. Overall, retail sales slumped to estimated 23 per cent during 2022 Christmas eve.

New Year 2023

Entering into the new year, the impact of rising cost of living and inflationary pressures was paramount. A survey by Barclaycard Payments found that shoppers intended to spend £229 in the post- Christmas sales – a reduction of £18 from a year ago.

Footfall on Britain’s high streets and shopping centres plunged by more than a quarter in the week after Christmas compared with the week before. According to Springboard – a retail data analytics provider, since shoppers opted to stay at home during the year’s last week, footfall was 27.7 per cent lower than the week before and 19.7 per cent down on the same week in 2019. It could, however, be 7.2 per cent higher than the same week in 2021 owing to the fact that shoppers had stayed away from high streets due to the spread of the Omicron variant of COVID-19. Experts attributed footfall reduction in 2022 to the last week beginning on Christmas Day – a Sunday, when footfall is typically at its lowest, while the year before it began on the Boxing Day. This was evidently supported by the fact that there was a surge in shoppers on Boxing Day 2022 when footfall rose 38.8 per cent higher than 2021.

One analysis from the Centre for Retail Research (CRR) revealed that 17,145 shops closed in 2022 which is a jump of almost 50 per cent on the 11,449 shops closing in 2021.

Not All Was Bad

Although Christmas was challenging for some retailers, there were still fortunate few like Next Plc that even raised its profit for the year by £20 million, encouraged by the better-than-expected sales in the run-up to Christmas. Sales in Next stores were particularly strong – up 12.5 per cent in the three months to December 30 – while online sales were virtually flat y-o-y. The company now expects to make £860 million in profits for the financial year ending in January 2023, up by 4.5 per cent on the previous 12 months. The fashion and home retailer’s sales of full-price items had risen by 4.8 per cent in the nine weeks to December 30 which was well above the 2 per cent fall predicted and delivered £66 million more sales than expected. Sales numbers were also helped by inflation, with prices for Next’s clothing up by 8 per cent during spring and summer, and prices expected to rise by a further 6 per cent in the autumn. Next sales had boomed with arrival of cold in mid-December as people stocked up on winter clothing. To the retailer, it appears that the shoppers had not been as hard hit by higher energy bills as feared and had continued to buy more formal outfits for work and events.

Another fashion and lifestyle retailer Boots’ sales were also up by about 15 per cent in December with festive favourites such as beauty, fragrance and gifts all performing well. That came after sales at established UK outlets rose by 8.7 per cent in the three months to the end of November helped by a return to high street stores.

Fashion Consumption

In 2022, the average budget of UK household with average size of 2.4 people was £671 per week, £2,907 a month and £34,886 a year, according to an analysis of ONS Family Spending data by Nimblefins. About 4 per cent of average household budget is spent on clothing and footwear that translates into £25 per week, £109 per month, £1,308 annually. It is believed that UK is the third largest apparel and footwear market worldwide after China and the United States. As per estimates by UK Fashion & Textile Association, Brits spend almost £45 billion on clothing and textiles, a number that has steadily increased over the past decade and despite the pandemic wiping £10 billion off the figure, its growth is expected to continue over the coming years. During the pandemic year 2020, sales of clothing and footwear among online retailers increased by 31 per cent to reach an all-time high.

Changing Consumer Habits

With social media and smartphones feeding the demand for instant gratification, the retail industry has seen a shift in shopping habits. Rather than spending their money in bricks-and-mortar shops, consumers are now shopping online with ‘clicks’. As a result of this increased online demand, retail organisations are looking to recruit fresh digital talent. UK retail is reflecting a similar trend.

The retail manufacturing, especially in fashion segment, is one of the most polluting industries on the planet and an increasing awareness of environmental issues and the retail industry’s contribution to these concerns has created more conscious consumers. This has made UK customers to increasingly ask if products have been responsibly sourced, if they are ‘fairtraded’, and if they can be recycled, before they shop. Sustainability is important to young consumers and moving forward UK’s fashion retailers are willing to take responsibility for the waste they produce.

Employment Market

According to Jobfeed analysis 2021 reported by Textkernel – a job market watchportal, there were 355,000 retail job openings in the fourth quarter of 2021, which was a 90 per cent increase compared to the same quarter in 2020. However, the report observed UK retail experiencing a high level of turnover with employment rates decreasing while the number of job postings increasing quickly. According to a 2021 survey, quit rates were highest heading into the holiday season with over 720,000 retail workers quitting their jobs in the month of August. Later on, a 2022 survey found that 28 per cent of all retail employees in the UK want to quit their jobs. It was also found that 46 per cent of shift workers surveyed have had to work additional shifts owing to their company’s inability to hire new workers. This creates a loop wherein company’s failure to hire more workers is putting additional pressure on its existing employees who, in turn, are more likely to quit as a result.

With more than 66,000 in 355,000 job openings, sales and trading personnel remained in the highest demand. Next in order, the demand was high for administration and customer service positions with 23,000 openings. In contrast, hospitality sector registered 3X open positions it did previous year showing the tendency of UK consumers to spend savings they amassed during the pandemic on big-ticket items like international travel.

The top 10 retail organisations in the UK when it comes to open positions are together responsible for 15 per cent of all demand in the industry. Among them, Amazon leads with more than 10,000 open positions, followed by Tesco (8,700 positions) and Sainsbury’s (7,300 positions). To attract more workers, such large organisations are increasingly offering better benefits packages with paid time off. Compared with the US, where 70 per cent of the demand for retail labour is accounted for by mid-size to smaller organisations, 85 per cent of the retail job openings in the UK come from 36,000 smaller companies. The Greater London area with 55,000 open positions accounting for 15 per cent of all retail job openings in the country, and Manchester with 14,000 openings and the West Midlands with 11,500 openings happen to be the country’s most populous regions; suggesting that the larger is employment base of the region, the higher is the demand for retail workers.

Fashion Retail – Key Updates

Although UK retail is dominated by the likes of Tesco, Sainsbury’s, Walmart (Asda) and Morrisons – all supermarkets, there are some fashion retailers such as H&M, John Lewis, Marks & Spencer, New Look, Primark, River Island, TK Maxx, Zara etc that majorly contribute to UK retail. Following are the developments with few of them:

Primark

UK’s leading fashion retailer Primark is expanding with purpose. At home, it plans to invest £140 million over the next two years in UK real estate that would include opening of at least four new stores in Bury St Edmunds, Craigavon, Salisbury and Teesside Park. The investment is estimated to create at least 850 new jobs and increase selling space by more than 160,000 sq ft in a boost to local areas. Alongside, Primark will relocate its stores in Bradford and High Wycombe to higher profile locations. In a response to growing popularity of its home range, a second Primark Home Space will be opened in Liverpool store (store at Merry Hill, West Midlands being the first one). The domestic investment builds on the launch of Primark’s Click Collect trial in mid-November which was on in 25 stores across the North of England and Wales on an extended range of kids’ clothing, accessories and nursery products. The company will also refurbish and upgrade stores on high streets, shopping centres and retail parks. It will further continue with roll-out of LED lighting across UK stores as part of its ambition to halve its carbon footprint across its value chain by 2030.

The brand opened its first store in 1973 in Derby and is scheduled to complete half century of its operation this year. Today, it runs 190 stores in the UK and employs more than 30,000 people. Outside of UK it has presence in 13 other countries and is expanding internationally with opening of 27 new stores and an additional 1 million sq ft of new selling space, in line with its aim of reaching 530 stores by 2026. The markets for expansion include the US, France, Italy and Spain, as it grows in Central and Eastern Europe via Romania and Slovakia. In November, it announced to invest €100 million each in France and Spain to open new stores and extend select ones. While €80 million will be utilised to open eight new stores and extend one store in Spain, the balance €20 million will be utilised to upgrade and refurbish existing stores. For France, the investment will open seven new stores and expand the store at Lyon La Part Dieu between December 2022 and the end of 2023. The Spanish investment will create over 1,000 jobs over next two years, while in France this figure will be 800. Primark entered Spain in 2006 and France in 2013 where it currently operates 56 and 20 stores respectively. Stores in France span a selling area of 100,000 sq m and employ 5,820 people.

Marks & Spencer

In November end, Marks & Spencer acquired the intellectual property including the source code and algorithms developed by personalised fashion marketplace, Thread. This acquisition provides M&S with the opportunity to integrate the cutting edge, proprietary tech into the M&S.com platform, and accelerate personalisation to deliver a unique customer experience. The personalisation capabilities will stretch across all clothing products available on M&S.com including the retailers third-party brand partners which complement and enhance the core offer at M&S. The retailer has been generating substantial value through its customer data over the past few years, personalising offers and language and providing repeat purchase and product recommendations that has resulted in 20- 25 per cent of all digital interactions. Outfit recommendations proved particularly valuable; the ‘frequently bought together’ recommendations are estimated to be worth an incremental £20 million of revenue over the 2022 – a 12-month period. M&S now anticipates that personalisation will generate more than £100 million of annualised incremental revenue for the business. With this anticipation, the acquisition reflects a ‘buy not build’ approach that will enable the retailer to move quicker in its personalisation strategy, integrating the tech in under 12 months versus a likely three-year build timeframe. Following the administration of Thread, M&S is now hiring 30 of its former data scientists, software engineers and styling and creative teams within its data and digital function including Kieran O’Neil and Ben Phillips, who founded Thread in 2012.

Next Plc

Despite good Christmas sales, Next remains cautious about the year ahead and warned of more price rises coming. The company finds inflation easing as the price of important commodities such as cotton is falling back. Nevertheless, price rise is being led by the fall in the value of the pound against the dollar, which is used for freight and fuel bills and to buy clothing in the Asia-Pacific region. If it was not for the weakening of the pound, prices would be flat or down. This suggests that the cost-of-living pressures will begin to ease as UK moves into the second half of this year and into the following year, though the year to January 2024 would be tougher. Its guiding for pre-tax profits predicted a 7.6 per cent fall to £795 million on 1.5 per cent lower sales. Additionally, Next announced that it would continue to look at buying or investing in brands, as it has done with Made.com and Joules. This approach of Next is being seen as opportunistic as it is based on the ‘the right price, management and brand’ that must fit the company’s ‘total platform’ online services that was launched in April 2020.

Brexit Fallout

It has been three years since UK opted for Brexit, the after-effects of which are now coming to the fore. Even prior to the Ukraine war, UK businesses reported of competitive disadvantage due to Brexit deal that has increased costs, paperwork and delays. According to The British Chambers of Commerce’s (BCC) survey of 1,000 businesses, 71 per cent admitted to having been affected by the European Union trade deal that is not allowing them to grow or increase sales with only 12 per cent agreeing to have benefitted from the Trade and Co-operation Agreement (TCA).

One of the ways in which the Brexit has impacted UK retailers is evidently in the form of price rise. Food retailers blame Brexit as the main cause for rise in food prices, especially in a situation when more than 40 per cent of UK’s food comes from Europe. Likewise, the fashion & lifestyle retail segment is also suffering from issue of price rise. Zara is reportedly charging shoppers in the UK as much as 50 per cent more than in Spain, with French sporting goods retailer Decathlon also compelled to hike price of its e-bikes for the Brits. A research conducted by Guardian Money looked at the prices of popular items at Pan-European retailers including IKEA, Apple, JD Sports and H&M, as well as Zara and Decathlon. It compared prices in the UK, Germany, France, Spain, Italy and Ireland, and found that while at some retailers such as JD Sports, prices are broadly similar across Britain and the EU countries, at others the prices in UK are markedly higher. None of the retailers have generally lower prices in the UK, Zara particularly having biggest percentage price differentials between the UK and rest of Europe. British shoppers were found paying €58.70 for a linen blend tunic dress at one of Zara’s stores in the UK while at stores in Germany, France, Italy and Ireland the price of the same dress was €49.95, and in Spain it was €39.95. Similarly, Decathlon is charging a Riverside electric bike in UK at €1,525 and in France, Spain and Italy at €1,199. The retailer says that the UK’s exit from the EU has made it more expensive to import stock. In such case, Decathlon UK had to expand the size of the supply team in order to deal with the additional administration, costs and duties associated with Britain’s exit from the customs union. In the UK specifically, Decathlon has to deal with constantly changing exchange rates, coupled with the post-Brexit burden of having to pay import duties twice on a number of products – once when goods enter the EU, and again once when they enter the UK.

Supply Chain

In 2022 beginning, M&S complained of facing issues at Northern Ireland border with its supplies into the region. The retailer wrote to the UK Prime Minister urging the government to find a long-term solution for moving goods into Northern Ireland which, according to the retailer, must result in products from Great Britain staying in Northern Ireland without the need for certification. According to the retailer, the use of technology can make the border frictionless with no material detriment to customs controls or food safety. The company’s managing director Stuart Machin pushed forward a ‘Facilitated Movement Scheme’ whereby approved and accredited firms can move from every product being checked to a risk-based approach underpinned by auditing and penalties for failure. M&S has experienced disruption in Northern Ireland since the UK left Europe compelling the retailer to halt ordering for Christmas in the country even at the cost of letting customers down. The decision was taken in the wake of perceived risk.

Looking Ahead

Going forward, there is a set of retailers in the UK that do not anticipate a collapse in demand but are expecting continued inflation on essentials, particularly energy, and rising mortgage costs as well as further rises in the prices of their own products. At the same time, the encouraging festive sales among some retailers come as a positive sign and more impressive given the harsh squeeze on household finances. Store sales emerged to be particularly strong with shoppers opting to head back into physical locations to seek out the best deals and keep a tighter grip on their budgets. Despite these silver linings, the overall outlook remains challenging. The combination of rising mortgage costs, spiralling energy bills and ongoing inflation are expected to hit discretionary spending in UK throughout 2023. This recessionary backdrop set against rising operating and input costs for retailers is going to hit profits hard for large swathes of the industry. Let us wait and watch.

Comments