Since the turn of the millennium, investments in new textile machinery have significantly impacted the global textile industry. Advances in technology and the growing demand for high-quality have resulted in the introduction of high-speed spinning and weaving machines, along with the adoption of energy-efficient and environmentally friendly equipment. As a result, investments in new textile machinery since 2000 have been crucial in shaping the future of the textile industry and ensuring its continued competitiveness on the global stage.

When ITMA 2023 will open its doors in Milan, Italy, in June, many textile, textile machinery, chemical, and other companies, institutes, and organisations that are otherwise affiliated with the textile industry from around the world will enter the fully packed exhibition halls with a lot of expectations. Just like four years ago, ITMA will be held in a moment when the global textile industry is undergoing a very difficult time with many unknowns.

In this article we will have a look at how the investments in new textile machinery has evolved since the end of the quota system at the end of 2004 with regard to volumes as well as with regard to destinations. For that we will have a look at ITMF’s International Machinery Shipment Statistics. Furthermore, we will also look at how the textile machinery companies have performed since May 2021, when the worst part of the COVID 19-pandemic was already overcome. For this analysis, we will have a closer look at ITMF Global Textile Industry Survey.

Before And After 2005

With the end of the Agreement on Textiles and Clothing (ATC) on the December 31, 2004, the system of bilateral quota restraints on textiles and clothing negotiated by the US and European Union was dismantled. The ATC, which was negotiated during the Uruguay Round, mandated the phase-out of quotas on apparel and textiles over a 10-year period, beginning in January 1995. It replaced the Multi-Fibre Arrangement (MFA), which entered into force in 1974. The MFA enabled bilateral agreements between trading nations that would regulate trade in apparel and textiles. It allowed the imposition of import limits in the case of market disruption. Between 1974 and 1991, the MFA was renegotiated four times. The purpose of the MFA was to constrain exports of certain product categories from certain countries. Therefore, production costs of these product categories were higher than they would have been without restricting quotas. Once exporting countries had reached their quotas on specific products, production had moved to countries with less quota restrictions, often lesser developed countries. To a certain extent, the MFA helped such lesser developed countries to create a textile and apparel industry, of course at higher costs. However, the main objective of the MFA has always been to protect jobs in high-cost countries.

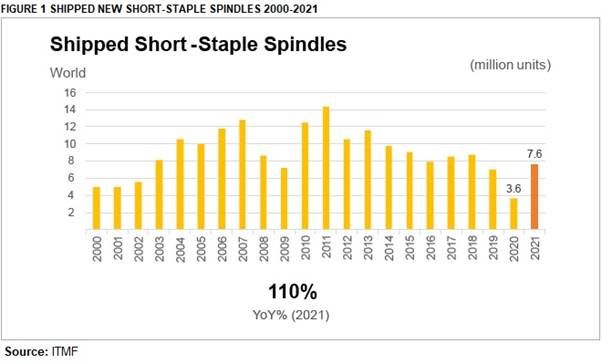

Shipments of New Short-Staple Spindles – A Long Term Perspective

While the MFA has mostly targeted the apparel trade, it also had an impact on the entire textile value chain. It is assumed that countries with quota-restricted product categories did not invest in the respective upstream textile segments as they probably would have done in a quota-free trade environment. And many of these countries started investing in new textile machinery ahead of the end of the ATC in order to be prepared to supply their respective downstream segments.

Since 1970, the International Textile Manufacturers Federation (ITMF) is compiling every year, in close cooperation with all major textile machinery producers from around the world, the number of new textile machines shipped during a year. The numbers are then published in the so called “International Textile Machinery Shipment Statistics (ITMSS)”. While in the 1970s the focus was only on spinning and weaving machinery, the ITMSS is now covering also texturing, circular knitting, flat knitting, and finishing machinery.

Before the ATC expired at the end of 2004, global shipments of short-staple spindles amounted to only 5 million in the year 2000 (see Figure 1). Until the year 2002, these shipments increased very slowly to 5.3 million. Afterwards global shipments picked up and soared to 8.1 million in 2003 and further to 10.6 million in 2004. It seems that around the world companies had invested in new capacities in anticipation of the expiration of the ATC.

After the expiration of the ATC, shipments in short-staple spindles continued rising significantly. Until 2007, shipments soared to 12.8 million spindles. Especially countries with a lot of potential to benefit from this new trade environment started investing. The best example is certainly China. The country could only fully benefit from the end of the ATC because it had joined the World Trade Organisation (WTO) in 2001. Joining the WTO was a kind of culmination point in the integration process of the Chinese economy into the global trading system which started only in the late 1970s.

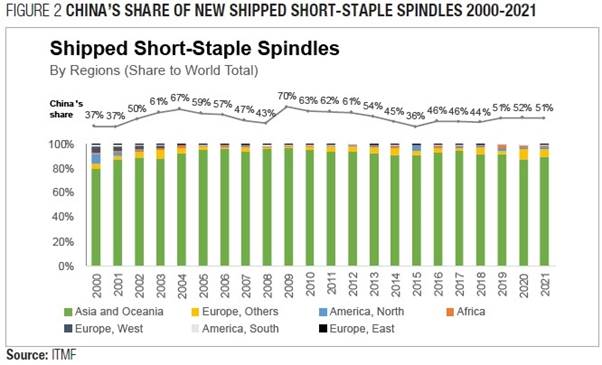

In 2000, China’s share of global shipments of short-staple spindles reached “only” 37 per cent (see Figure 2). Until 2004, this share jumped to 67 per cent. In the following years until 2008, the share fell again to still impressive 43 per cent. After the Global Financial Crisis of 2007/08 China’s share soared again to 70 per cent. It declined in the following years slowly but steadily to 36 per cent in the year 2015.

Of course, the share of China seems to be extremely high. But given the fact that the Chinese economy was growing in double-digit numbers of around 10-11 per cent between 1980 and 2010, these enormous investments in new textile machinery do not come as a surprise. Having grown for such a long time at such a speed, the Chinese economy slowed between 2010 and 2020 to a range of between 10 per cent and 6 per cent. This enormous economic growth was fuelled by an increase of the Chinese population which rose from around 982 million in 1980 to around 1,348 million in 2010. According to the UN, the population has peaked in 2022 with around 1,426 million people and will decrease in the coming years and decades. But this enormous economic growth was not just driven by a higher population. It materialised in a higher GDP per capita as well. Between 1980 and 2010, the GDP per capita skyrocketed from only $195 to impressive $4,550. Until 2022, the GDP per capita continued soaring to $10,409 (Sources: World Bank and UN). In other words, China had more people to cloth and a richer population with a higher income that could afford more clothing, home textiles and other types of textile products. As a result, the per capita consumption increased.

The investments in new textile machinery like short-staple spindles targeted not only the domestic Chinese market but also the international markets. China’s exports of textiles and clothing soared also after the opening up of the Chinese economy. Between 1992 and 2020, exports grew more than ten-fold from $25 billion to around $281 billion, according to the World Bank’s World Integrated Trade Solution (WITS).

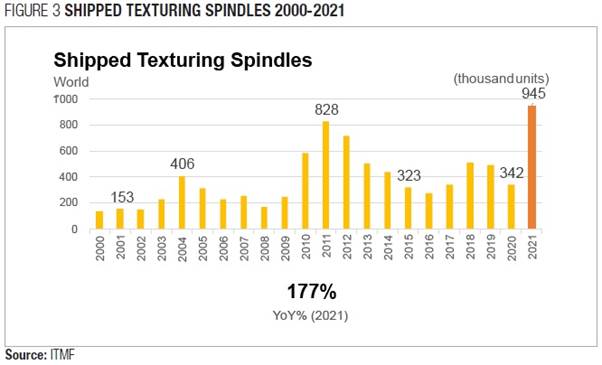

Shipments Of New Texturing Spindles – A Long Term Perspective

A closer look at investments in texturing spindles since the year 2000 provides the opportunity to analyse also the markets for synthetic fibres. As the name implies, short-staple spindles are used to spin staple fibres. Before the advent of man-made fibres, all fibres (with the exception of silk) were natural staple fibres and had to be spun. The emergence of filament fibres (cellulosic and synthetic) increased the portfolio of fibres significantly.

Texturing spindles are used to give synthetic filaments a different look and touch. They are therefore a good indicator to what extent the role of synthetic fibres has expanded in the past decades.

Figure 3 shows that with the end of the ATC, annual shipments of texturing spindles increased for the first time in the years 2004 and 2005. Between 2000 and 2003 shipments amounted to around 150,000. In the following years, they jumped with a peak in 2004 of around 406,000. But shipments of texturing spindles really exploded after the Global Financial Crisis in the years 2010 until 2012, when they reached 582,000 in 2010 and 828,000 in 2011 and 718,000 in 2012. Compared to the year 2000, shipments in 2011 were six times or 500 per cent higher. While shipments fell in the 10 years back to a range of between 510,00 and 278,000 per year, they reached a new all-time high in 2021 with 945,000.

This increase in annual shipments is a clear indicator of the growing importance during this period of man-made fibres in general, and synthetic fibres in particular, especially polyester.

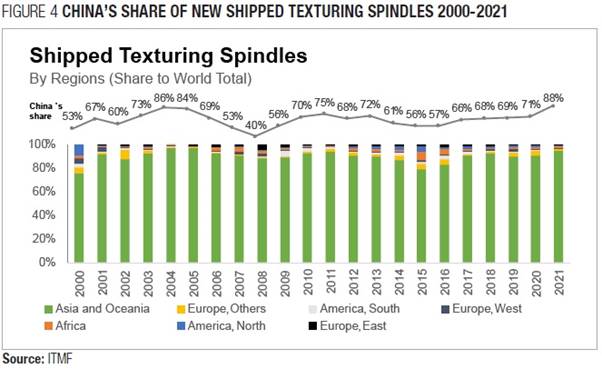

Figure 4 shows the share of shipped texturing spindles by regions as well as by China. Asia was a dominant investor already in 2000 but has increased its dominance in the following two decades. The main investor in texturing spindles was again China. While China’s global share reached “only” 53 per cent in 2000, this share rose to 86 per cent by 2004. Afterwards, China’s share dropped to 40 per cent during the Global Financial Crisis but then increased again to between 56 per cent and 75 per cent. In 2021, this jumped to an unprecedented level of 88 per cent, highlighting that China is by far the most important processor of man-made fibre in the world.

If more short-staple fibres are spun to yarns and if more filaments are texturised it is to be expected that more machinery is necessary to further process these yarns and filaments to fabrics. ITMF is also compiling data of the shipment of different types of weaving and knitting machines. Since shipments of both types of machinery show a very similar pattern, only the evolution of shipments of large circular knitting machines will be looked at.

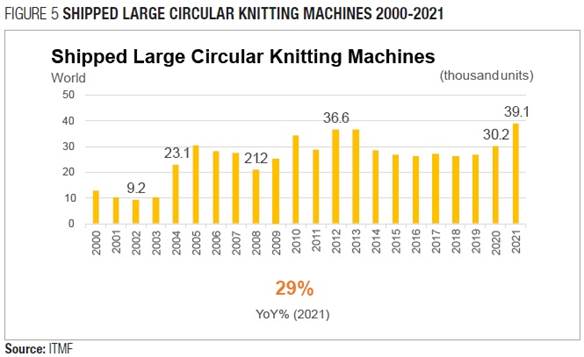

Shipments Of Large Circular Knitting Machines – A Long Term Perspective

Similar to the evolution of shipments of short-staple spindles and texturing spindles, shipments of large circular knitting machines took off in 2004 (see Figure 5). Until the end of the ATC, annual shipments hovered around 10,000 units. But in 2004, shipments soared to around 23,100 units. Even during the Global Financial Crisis, shipments did not fall back to levels before 2004. After the Global Financial Crisis, shipments continued growing and reached a peak of around 36,600 units in 2012 and 2013. In the following years, shipments remained elevated and reached a new all-time high in 2021 with shipments of 39,100 large circular knitting machines.

The elevated annual shipments of large circular knitting machines is a logical consequence of an increased level of spun yarns and filaments. It also is a result of higher growth rate in the consumption of knitted products compared to woven products in the last 20 years.

The elevated annual shipments of large circular knitting machines is a logical consequence of an increased level of spun yarns and filaments. It also is a result of higher growth rate in the consumption of knitted products compared to woven products in the last 20 years.

Until the end of the ATC in 2004, the share of Asia of shipped large circular knitting machines reached around 60 per cent. In 2004, this number jumped to almost 90 per cent. The main investor in new large circular knitting machines was – once more – China whose share of globally shipped machines exploded from 33 per cent in 2003 to 72 per cent in 2004. Until 2013, China’s share remained at an elevated level of between 65 per cent and 77 per cent. In the following years, its level dropped to 40 per cent in 2017, but increased again to around 56 per cent in 2021.

Summing UP

Before the end of the quota system, global shipments of short-staple spindles were low but picked up significantly in anticipation of the expiration of the agreement. After the expiration, shipments continued to rise, especially in countries like China, which had joined the World Trade Organization in 2001. Texturing spindles saw a similar increase in investments, indicating the growing importance of synthetic fibres, particularly polyester. Shipments of large circular knitting machines also increased significantly, reflecting an increased level of spun yarns and filaments and higher growth rates in the consumption of knitted products compared to woven products. Asia, and specifically China, was the dominant investor in all three types of machinery—short-staple spindles, texturing spindles, and large circular knitting machines. These trends demonstrate the changing landscape of the global textile industry since the end of the quota system.

Comments