Cellulosic feedstocks are non-food based and include crop residues, wood residues, and dedicated energy crops, besides industrial and other wastes. These feedstocks are composed of cellulose, hemicellulose, and lignin.

Cellulosic feedstocks refer to biomass materials that are primarily composed of cellulose, hemicellulose, and lignin and are utilised for various purposes, notably in the production of biofuels, biochemicals, and other bioproducts. These feedstocks are distinct from food-based crops like corn or sugarcane, as they are derived from non-food sources. Here is an elaboration on the components of cellulosic feedstocks and examples of the sources:

Cellulose: Cellulose is a polysaccharide consisting of long chains of glucose molecules and is the most abundant organic polymer on Earth. It serves as a structural component in plant cell walls, providing rigidity and strength. Cellulose is a crucial component of cellulosic feedstocks and serves as the primary source of fermentable sugars for biofuel production. Examples of cellulose-rich materials in cellulosic feedstocks include agricultural residues (such as corn stover, and wheat straw), forestry residues (like sawdust, and wood chips), energy crops (such as switchgrass, miscanthus), and certain industrial wastes (like paper pulp).

Hemicellulose: Hemicellulose is another type of polysaccharide found in plant cell walls, alongside cellulose. It is a heterogeneous polymer composed of various sugars, including xylose, mannose, galactose, and arabinose. Unlike cellulose, hemicellulose has a more branched structure and is more easily hydrolysed into fermentable sugars. Hemicellulose contributes to the overall carbohydrate content of cellulosic feedstocks and serves as an additional source of sugars for bioconversion processes. Examples of hemicellulose-rich materials include agricultural residues, wood residues, and energy crops.

Lignin: Lignin is a complex phenolic polymer that provides structural support to plant cell walls, alongside cellulose and hemicellulose. It is highly abundant in woody biomass and certain agricultural residues. Lignin acts as a binding agent in cellulosic materials, imparting rigidity and resistance to microbial degradation. However, lignin also poses challenges in the conversion of cellulosic biomass into biofuels and biochemicals, as it can inhibit enzymatic hydrolysis and fermentation processes. Various strategies are employed to overcome lignin-related challenges, including pretreatment methods and lignin valorisation technologies.

Examples of Cellulosic Feedstocks and Their Sources Include:

Crop residues: Agricultural residues left behind after harvesting crops, such as corn stover, wheat straw, rice husks, and sugarcane bagasse.

Wood residues: By-products of forestry and wood processing industries, including sawdust, wood chips, and wood shavings.

Dedicated energy crops: Specifically cultivated crops grown for their high biomass yield and suitability for bioenergy production, such as switchgrass, miscanthus, and willow.

Industrial and other wastes: Various industrial by-products and waste materials that contain cellulose, hemicellulose, and lignin, such as paper pulp, cardboard, and certain organic wastes from food processing industries.

Overall, cellulosic feedstocks play a significant role in the development of sustainable bio-based economies by providing renewable sources of energy, chemicals, and materials while mitigating the environmental impacts associated with fossil fuels and conventional agriculture.

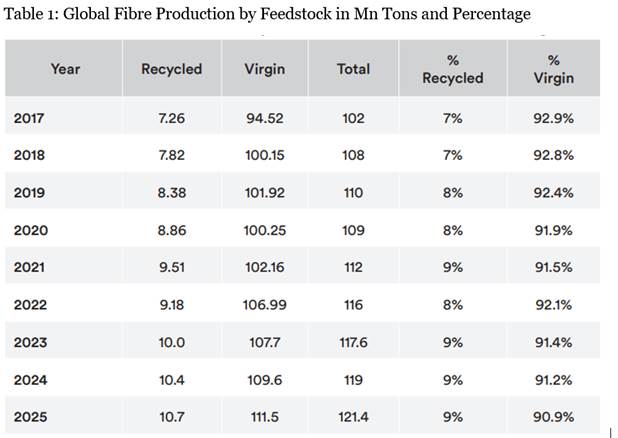

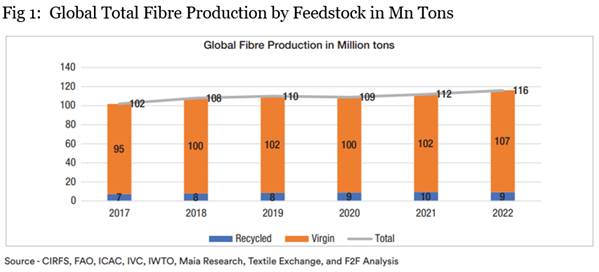

The table provided displays data on the recycling rates of materials over the years 2017 to 2025. The data includes the amount of recycled material (in million tons), the amount of virgin material (in million tons), the total material consumption (in million tons), and the percentage of recycled and virgin materials out of the total.

From 2017 to 2025, there is a consistent increase in both recycled and virgin materials, as well as in total material consumption. This indicates a growing demand for materials over the years. Despite the increase in total consumption, the percentage of recycled materials remains relatively stable around 7 per cent to 9 per cent, while the percentage of virgin materials fluctuates slightly but generally maintains a high proportion, ranging from around 90 per cent to 93 per cent.

This data suggests that while there is some progress in recycling efforts, the majority of materials consumed are still derived from virgin sources. It highlights the importance of continued efforts to improve recycling infrastructure, promote sustainable consumption patterns, and develop alternative materials to reduce reliance on virgin resources and mitigate environmental impacts such as deforestation, habitat destruction, and greenhouse gas emissions.

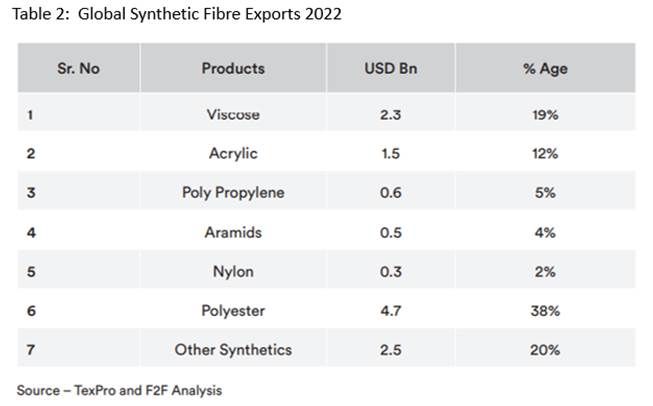

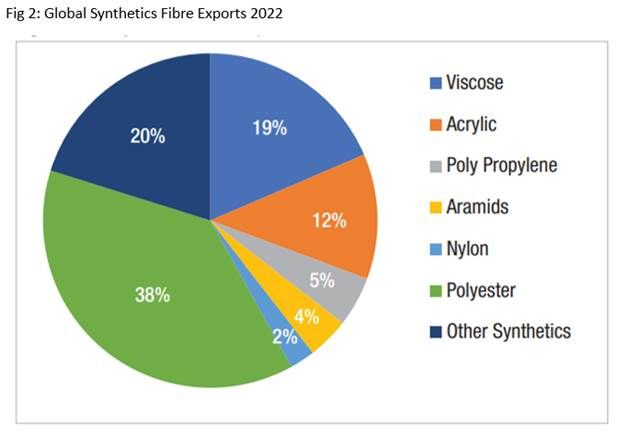

Global Synthetic Fibre Exports in 2022:

In 2022, the global synthetic fibre market witnessed significant exports across various product categories, contributing to the dynamics of the international textile industry. Here is a breakdown of the key products exported, their corresponding export values in USD billion, and their percentage shares (Table 2).

Viscose:

USD 2.3 Billion (19 per cent)

Viscose, known for its versatility and sustainability, accounted for a notable portion of the exports, showcasing its enduring popularity in textile manufacturing.

Acrylic:

USD 1.5 Billion (12 per cent)

Acrylic fibres, valued for their softness and warmth, constituted a substantial portion of the exports, catering to a range of applications including apparel and household textiles.

Poly Propylene:

USD 0.6 Billion (5 per cent)

Polypropylene fibres, prized for their strength and moisture resistance, represented a notable share of the exports, finding applications in diverse sectors such as automotive, medical, and geotextiles.

Aramids:

USD 0.5 Billion (4 per cent)

Aramid fibres, renowned for their exceptional strength and heat resistance, contributed significantly to the exports, catering primarily to specialised industries such as aerospace, defence, and industrial applications.

Nylon:

USD 0.3 Billion (2 per cent)

Nylon fibres, celebrated for their durability and elasticity, constituted a smaller yet significant portion of the exports, being utilised in a wide array of products ranging from apparel to industrial components.

Polyester:

USD 4.7 Billion (38 per cent)

Polyester fibres, prised for their affordability, durability, and ease of care, emerged as the leading contributor to exports, reflecting their widespread adoption across various textile segments globally.

Other Synthetics:

USD 2.5 Billion (20 per cent)

Other synthetic fibres encompassing a diverse range of materials such as polyethene, polyamide, and polyvinyl chloride (PVC), among others, collectively constituted a significant share of the exports, catering to specialised applications and niche markets.

The global synthetic fibre exports in 2022 underscored the industry's resilience and adaptability, with a diverse portfolio of products meeting the evolving demands of consumers and industries worldwide. As the textile landscape continues to evolve, these export figures provide valuable insights into the trends and preferences shaping the global synthetic fibre market.

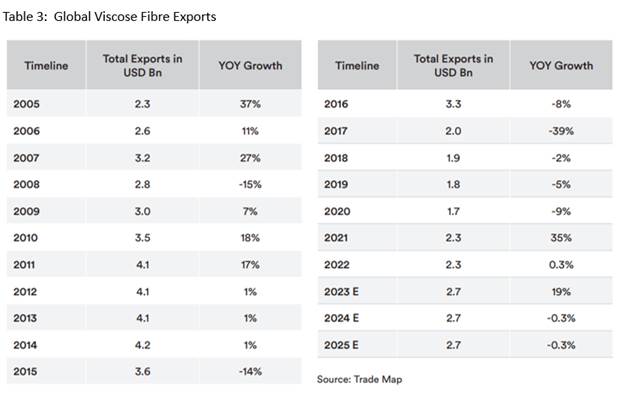

Viscose Export trends: A Perspective on Time Series

Viscose, also known as rayon, is a popular textile fibre produced from natural sources such as wood pulp, bamboo, or cotton lint. It is widely used in the textile industry for making clothing, upholstery, and other textiles. Analysing export trends for viscose involves examining various factors including production capacities, demand-supply dynamics, market trends, and trade policies. Here is an elaboration on viscose export trends:

Production Capacity and Geographic Distribution: Understanding the production capacity of viscose fibre globally is crucial. Countries like China, India, Indonesia, and Brazil have significant capacities for viscose production. China has historically been a major producer and exporter of viscose, with many viscose manufacturing facilities. However, shifts in production capacity due to factors like labour costs, environmental regulations, and technological advancements can impact export trends.

Market Demand and Consumer Preferences: Viscose exports are influenced by market demand, which, in turn, is affected by changing consumer preferences, fashion trends, and economic conditions. For example, there might be fluctuations in demand based on seasonal fashion trends or changes in consumer preferences towards sustainable and eco-friendly fabrics.

Trade Policies and Regulations: Trade policies and regulations, both domestic and international, play a significant role in shaping viscose export trends. Tariffs, duties, quotas, and trade agreements can affect the competitiveness of viscose exports from different countries. Changes in trade policies, such as the imposition of tariffs or trade restrictions, can impact the flow of viscose exports between countries.

Competitive Landscape and Price Dynamics: The global viscose market is competitive, with several key players vying for market share. Understanding the competitive landscape, including the pricing strategies adopted by manufacturers and exporters, is essential for analysing export trends. Price dynamics, including fluctuations in raw material prices (such as wood pulp or cotton), energy costs, and currency exchange rates, also influence export trends.

Sustainability and Environmental Concerns: Sustainability and environmental concerns are increasingly important factors shaping viscose export trends. Consumers are becoming more conscious of the environmental impact of textile production, leading to growing demand for sustainably produced viscose fibres. Exporters who can demonstrate a commitment to sustainability and transparency in their supply chain may gain a competitive advantage in certain markets.

Emerging Markets and Technological Innovations: Keep an eye on emerging markets where demand for viscose fibres may be growing due to economic development and changing consumer lifestyles. Additionally, technological innovations in viscose production, such as advancements in manufacturing processes or the development of new types of viscose fibres, can impact export trends by improving product quality, reducing costs, or enabling the production of specialised textiles.

By analysing these factors and keeping abreast of market developments, policymakers, industry stakeholders, and businesses involved in viscose production and trade can gain insights into export trends and make informed decisions to capitalise on opportunities and mitigate risks in the global viscose market.

Conclusion

The global synthetic fibre market is experiencing dynamic growth driven by diverse product offerings and evolving consumer preferences. Viscose, a versatile and sustainable fibre, continues to hold a significant share in textile exports, reflecting its enduring popularity across various applications. Understanding export trends requires consideration of factors such as production capacities, market demand, trade policies, competitive dynamics, sustainability concerns, and technological innovations. By analysing these factors, stakeholders can navigate the complex landscape of the viscose market, capitalise on emerging opportunities, and address challenges to ensure sustainable growth and competitiveness in the global textile industry.

Comments