The global viscose trade market involves intricate networks of export and import relationships between countries, reflecting the dynamic nature of the textile industry. Here, we analyse the viscose trade dynamics of several key players, including Indonesia, China, Singapore, Thailand, Germany, India, Taiwan, Japan, Malaysia, and Italy. By examining the top trade partners and the flow of viscose products, we gain insights into the regional and global dynamics shaping this industry. Understanding these trade relationships is crucial for stakeholders to navigate opportunities and challenges in the viscose trade market effectively.

Indonesia

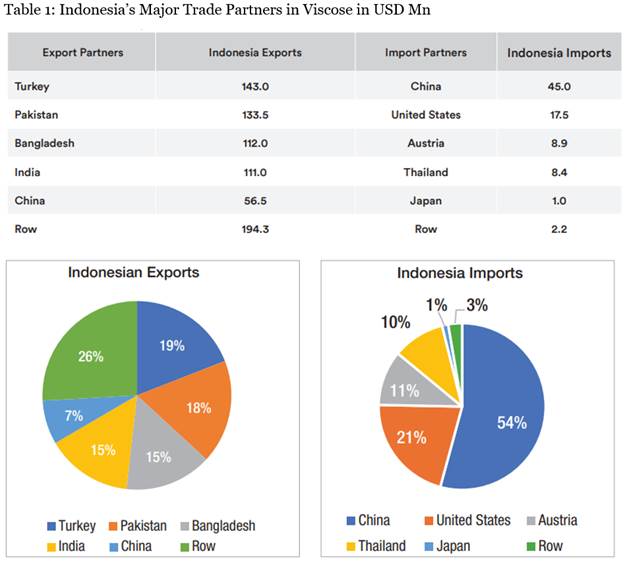

Export Partners:

Export Partners:

Turkey: Indonesia exports viscose worth $143.0 million to Turkey, indicating a significant trade relationship in the viscose market.

Pakistan: With exports valued at $133.5 million, Pakistan stands as another prominent destination for Indonesian viscose exports.

Bangladesh: Indonesia's exports to Bangladesh total $112.0 million, highlighting the substantial volume of viscose trade between the two countries.

India: Indonesian exports to India amount to $111.0 million, indicating a robust trade flow in the viscose sector between these two nations.

China: Although China is a significant player in the global viscose market, Indonesian exports to China are comparatively lower at $56.5 million.

Import Partners:

China: While Indonesia exports to China, it also imports viscose worth $45.0 million from China, suggesting a two-way trade relationship in the viscose sector between these countries.

United States: Imports from the United States stand at $17.5 million, indicating a notable flow of viscose products into Indonesia from this country.

Austria: Indonesia imports $8.9 million worth of viscose from Austria, contributing to the diversification of its import sources.

Thailand: With imports valued at $8.4 million, Thailand represents another significant source of viscose products for Indonesia.

Japan: While the volume is relatively low at $1.0 million, Indonesia also imports viscose from Japan, showcasing a diverse range of import origins.

China

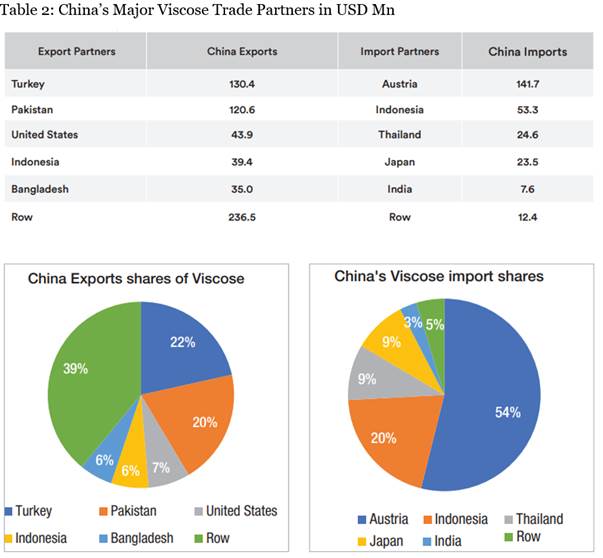

China, as a major player in the global viscose trade market, engages in significant export and import activities with various countries worldwide. Analysing China's top trade partners in terms of both exports and imports provides insights into the dynamics of the viscose industry.

Export Partners:

Turkey: China's largest export partner for viscose, accounting for $130.4 million in exports. Turkey's demand for viscose signifies its importance as a textile manufacturing hub.

Pakistan: Following closely behind, Pakistan stands as a significant export destination for Chinese viscose, totalling $120.6 million. This reflects the strong ties between the two countries in the textile industry.

United States: Despite being a distant third, the United States still represents a notable market for Chinese viscose exports, amounting to $43.9 million. This highlights China's presence in the American textile market.

Indonesia: With $39.4 million in exports, Indonesia emerges as another important destination for Chinese viscose. This indicates the regional trade relationships within Asia.

Bangladesh: China's viscose exports to Bangladesh stood at $35.0 million, emphasising the significance of the textile industry in their bilateral trade relations.

Import Partners:

Austria: Leading in imports, Austria supplies $141.7 million worth of viscose to China. This suggests Austria's strong position in the global viscose market.

Indonesia: Despite being a major export destination, Indonesia also serves as a significant source of viscose imports for China, amounting to $53.3 million. This highlights the mutual trade relationship between the two countries.

Thailand: Thailand's contribution to China's viscose imports totals $24.6 million, indicating the diversity of China's import sources within the Southeast Asian region.

Japan: With $23.5 million in imports, Japan plays a notable role in supplying viscose to China, reflecting the longstanding trade ties between the two Asian nations.

India: Although relatively smaller compared to other partners, India still provides $7.6 million worth of viscose to China, showcasing the trade relations between these two major textile-producing countries.

This analysis underscores the intricate network of trade relationships that China maintains in the global viscose market, with various countries playing pivotal roles both as suppliers and buyers. Understanding these trade dynamics is essential for stakeholders in the textile industry to navigate and capitalise on opportunities in the viscose trade market.

Singapore

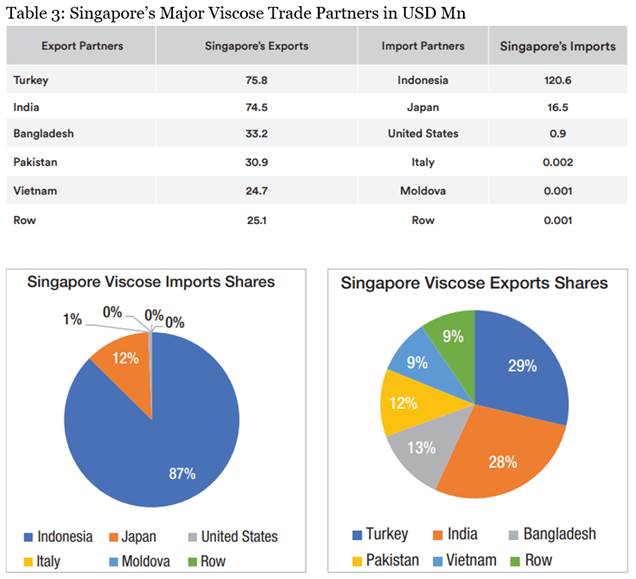

Singapore, despite its relatively small size, plays a significant role in the global viscose trade market. Analysing Singapore's top trade partners in terms of both exports and imports provides valuable insights into the dynamics of the viscose industry within the region.

Export Partners:

Turkey: Leading the list of export partners, Turkey accounts for $75.8 million of Singapore's viscose exports. This indicates Singapore's strong trade relationship with Turkey in the viscose sector, potentially driven by Singapore's position as a trading hub in the region.

India: Following closely behind, India stands as a significant export destination for Singapore's viscose, totalling $74.5 million. This reflects the importance of India as a major textile-producing country and Singapore's role in facilitating trade within the textile industry.

Bangladesh: With $33.2 million in exports, Bangladesh emerges as another notable market for Singaporean viscose. This highlights the close trade ties between Singapore and Bangladesh, particularly in the textile sector.

Pakistan: Singapore's viscose exports to Pakistan amount to $30.9 million, underscoring the importance of this bilateral trade relationship within the textile industry.

Vietnam: Singapore's viscose exports to Vietnam stand at $24.7 million, indicating the growing trade relations between the two countries in the textile sector.

Import Partners:

Indonesia: Leading in imports, Indonesia supplies $120.6 million worth of viscose to Singapore. This reflects Indonesia's significant role as a source of viscose for Singapore's textile industry.

Japan: Despite being a major exporter, Japan also serves as a significant source of viscose imports for Singapore, totalling $16.5 million. This highlights the diversity of Singapore's import sources within Asia.

United States: Singapore's viscose imports from the United States amount to $0.9 million, indicating a smaller but still notable trade relationship between the two countries in this sector.

Italy: Although relatively small compared to other partners, Italy provides $0.002 million worth of viscose to Singapore, showcasing the global nature of Singapore's viscose supply chain.

Moldova: With $0.001 million in imports, Moldova represents a minor but existing trade relationship with Singapore in the viscose sector.

This analysis underscores Singapore's role as a key player in the global viscose trade market, with diverse trade relationships with various countries worldwide. Understanding these trade dynamics is crucial for stakeholders in the textile industry to capitalise on opportunities and navigate challenges in the viscose trade market.

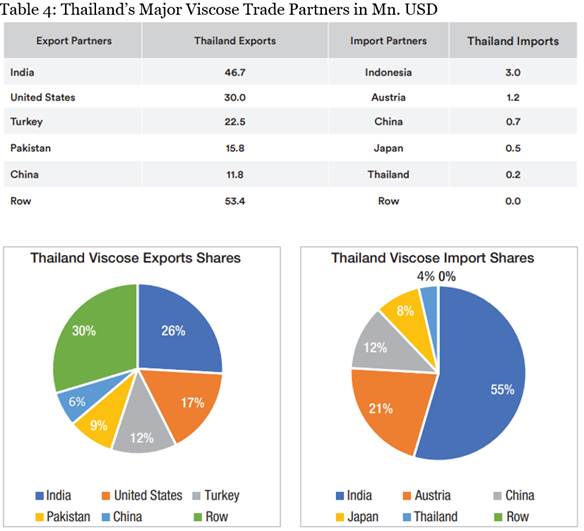

Thailand

Table 4 illustrates the major trade partners of Thailand in the viscose market, presenting both export and import data in USD million.

Export Partners: These are the countries from which Thailand exports viscose. The table lists the corresponding export values in USD million.

Thailand Exports: This column displays the total value of viscose exports from Thailand to each respective export partner.

Import Partners:

These are the countries from which Thailand imports viscose. The table lists the corresponding import values in USD million.

Thailand Imports: This column displays the total value of viscose imports into Thailand from each respective import partner.

Table 12 aids in understanding Thailand's trade relationships in the viscose industry, highlighting key partners both in terms of exports and imports, and indicating the flow of viscose trade between Thailand and other nations.

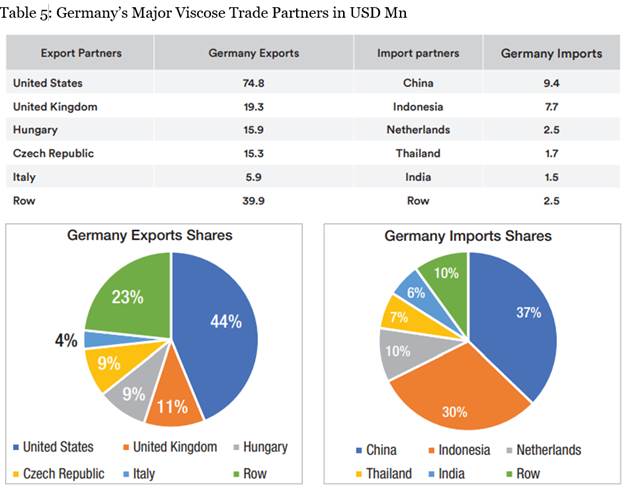

Germany

Germany's viscose trade demonstrates a significant export presence, with the United States emerging as the primary export partner, accounting for $74.8 million in exports. The United Kingdom follows with $19.3 million, and Hungary and the Czech Republic also contribute notably with $15.9 million and $15.3 million respectively. Italy, though to a lesser extent, remains a significant export partner with $5.9 million. In terms of imports, China leads the way with $9.4 million worth of viscose imports into Germany, trailed by Indonesia with $7.7 million. Netherlands and Thailand stand as notable import partners with $2.5 million and $1.7 million respectively. India also contributes with $1.5 million in imports. The data indicates a diverse set of trading partners for Germany in the viscose market, with varying degrees of import and export intensity.

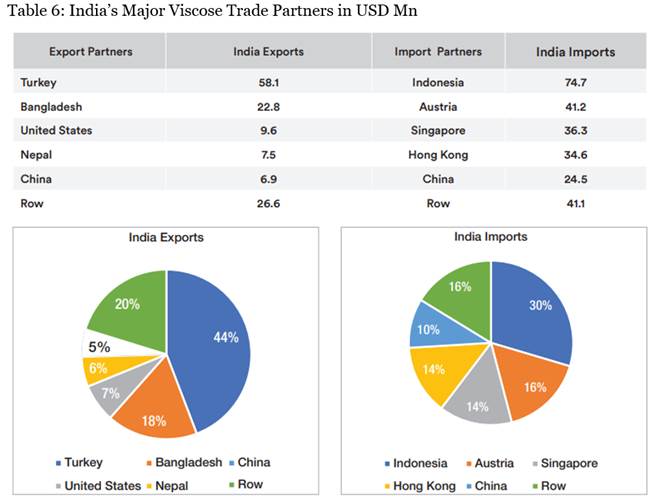

India

India’s viscose trade landscape highlights a robust export profile, with Turkey emerging as the top export partner, accounting for $58.1 million in exports. Bangladesh follows closely with $22.8 million, while the United States, Nepal, and China also make significant contributions, amounting to $9.6 million, $7.5 million, and $6.9 million respectively. In terms of imports, Indonesia leads with a substantial $74.7 million worth of viscose imports into India, followed by Austria with $41.2 million. Singapore, Hong Kong, and China also stand out as notable import partners, contributing $36.3 million, $34.6 million, and $24.5 million respectively. The data illustrates India’s diverse set of trading partners in the viscose market, with substantial flows both in terms of exports and imports, indicating a dynamic trade ecosystem in this sector.

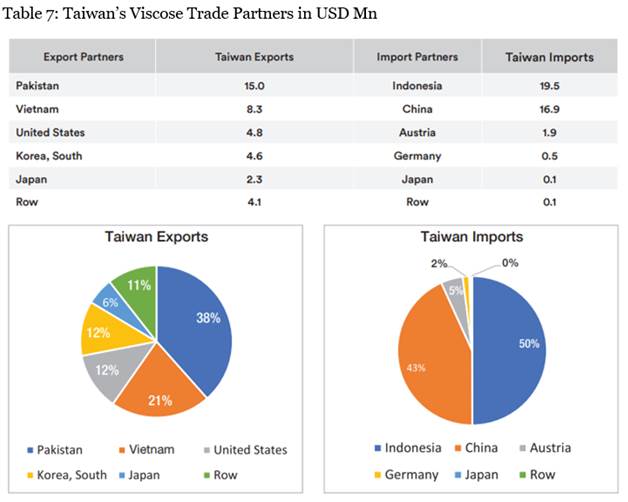

Taiwan

Taiwan’s viscose trade reveals a diverse set of export and import partners. Among export partners, Pakistan leads with $15.0 million in exports, followed by Vietnam with $8.3 million, and the United States with $4.8 million. South Korea and Japan also make notable contributions, totalling $4.6 million and $2.3 million respectively. In terms of imports, Indonesia stands out as the primary source with $19.5 million worth of viscose imports into Taiwan, followed by China with $16.9 million. Austria, Germany, and Japan also play a role in Taiwan’s viscose imports, though to a lesser extent. The data indicates Taiwan’s reliance on a diverse set of trading partners for its viscose trade, with significant flows both in terms of exports and imports, contributing to a dynamic market landscape.

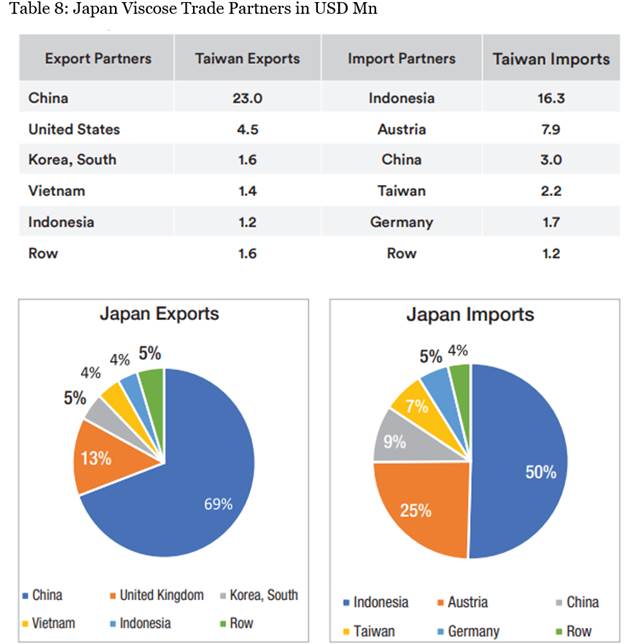

Japan

Japan’s viscose trade reflects a diversified set of partners for both exports and imports, with Taiwan maintaining significance in both aspects.

Export: Taiwan is Japan’s principal export destination for viscose, with exports valued at $1.6 million. This indicates a substantial portion of Japan's viscose exports are directed towards Taiwanese markets.

Other notable export destinations include China ($23.0 million), the United States ($4.5 million), South Korea ($1.6 million), Vietnam ($1.4 million), and Indonesia ($1.2 million).

Import: Japan sources viscose primarily from Indonesia, with imports valued at $16.3 million. This highlights a significant reliance on Indonesian viscose by Japan.

Austria emerges as the second-largest import partner, with imports valued at $7.9 million, indicating notable sourcing from Austrian markets.

Other import partners include China ($3.0 million), Taiwan ($2.2 million), and Germany ($1.7 million).

Miscellaneous sources contribute to imports termed as 'Rest of the World' (ROW), with imports valued at $1.2 million.

Overall, Taiwan maintains its importance as a key partner for Japan's viscose trade, while Indonesia plays a significant role as a major import partner. This trade dynamic underscores the importance of bilateral relationships and market dynamics in the viscose industry between Japan and its trading partners.

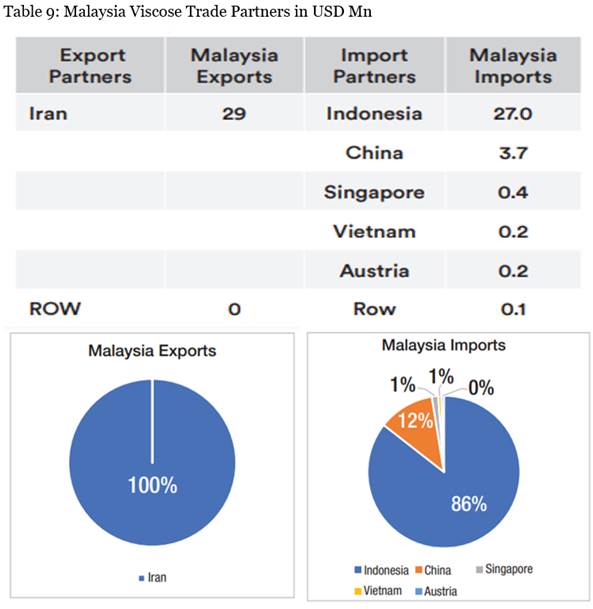

Malaysia

In terms of viscose trade, Malaysia primarily engages with Taiwan as both an export and import partner. Export: Malaysia’s main export partner for viscose is Taiwan, with exports valued at $29 million. This indicates a significant portion of Malaysia’s viscose exports are destined for Taiwanese markets. Import: In terms of imports, Malaysia mainly sources viscose from Indonesia, followed by smaller quantities from China, Singapore, Vietnam, and Austria.Indonesia stands out as the largest import partner, with imports valued at $27 million, indicating a substantial reliance on Indonesian viscose by Malaysia.

Additionally, smaller imports are recorded from China ($3.7 million), Singapore ($0.4 million), Vietnam ($0.2 million), and Austria ($0.2 million).

Other miscellaneous sources contribute minimally, termed as 'Rest of the World' (ROW), with imports valued at $0.1 million.

Overall, Taiwan emerges as the central partner for Malaysia's viscose trade, while Indonesia plays a significant role as a major import partner. This trade relationship signifies the importance of bilateral ties and market dynamics in the viscose industry between these countries.

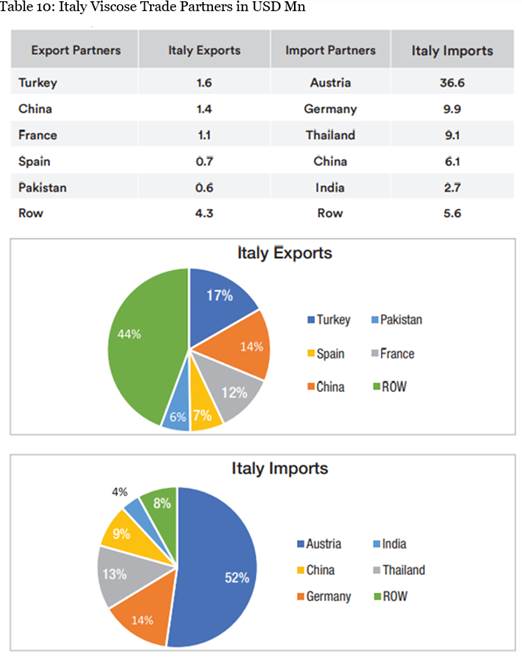

Italy

Italy’s viscose trade reveals a diverse range of partners for both exports and imports, with Taiwan emerging as a significant player. Export: Italy’s primary export partner for viscose is Taiwan, with exports valued at $4.3 million. This suggests a notable portion of Italy’s viscose exports are directed towards Taiwanese markets. Other export destinations include Turkey ($1.6 million), China ($1.4 million), France ($1.1 million), Spain ($0.7 million), and Pakistan ($0.6 million). Import: Italy imports viscose predominantly from Austria, indicating a strong reliance on Austrian viscose with imports valued at $36.6 million. Other major import partners include Germany ($9.9 million) and Thailand ($9.1 million), highlighting significant sourcing from these countries.

Additionally, Italy imports from China ($6.1 million) and India ($2.7 million).

Miscellaneous sources contribute to imports termed as 'Rest of the World' (ROW), with imports valued at $5.6 million.

Overall, Taiwan stands out as a key partner for Italy's viscose trade, both in terms of exports and imports. This trade pattern underscores the importance of bilateral relationships and market dynamics in the viscose industry between Italy and its trading partners.

Conclusion

The global viscose trade market demonstrates intricate relationships among key players, with Turkey, Indonesia, and Pakistan emerging as significant export destinations. China maintains a robust presence both as a major exporter and importer, while Singapore and Malaysia showcase dynamic trade dynamics within the region. Overall, bilateral relationships and market dynamics play a pivotal role in shaping the viscose trade landscape across various countries worldwide.

Comments