Global trade dynamics are undergoing profound transformations driven by various factors such as consumer preferences, technological advancements, sustainability concerns, trade agreements, geopolitical tensions, and the impacts of the COVID-19 pandemic. These changes significantly influence apparel sourcing strategies. Consumer preferences continuously evolve, accelerated by e-commerce and digital platforms, necessitating agility from businesses to meet shifting demands. Technological advances like automation and AI have revolutionised manufacturing processes, prompting companies to reassess traditional sourcing strategies. Sustainability is increasingly central, with demand rising for ethically sourced products. Apparel companies are adjusting their supply chains to incorporate sustainable practices and meet stringent environmental standards. Trade agreements play a crucial role, in impacting the feasibility and efficiency of sourcing strategies. Geopolitical tensions can disrupt trade routes, while the COVID-19 pandemic has forced businesses to prioritise resilience and diversification.

Staying adaptive to evolving global trade dynamics is imperative for textiles and apparel businesses. Those who proactively respond to these changes thrive in the ever-changing marketplace. In this context, textiles and apparel (T & A) sourcing dynamics have been changing significantly. The Asia Pacific region has remained the dominant marketplace for sourcing textiles and apparel for years. The region, comprising countries like China, Bangladesh, Vietnam, India, and others, has emerged as a key hub for apparel production and sourcing for various reasons.

Recent Trends: The Global T&A Trade vs Asia Pacific Trade

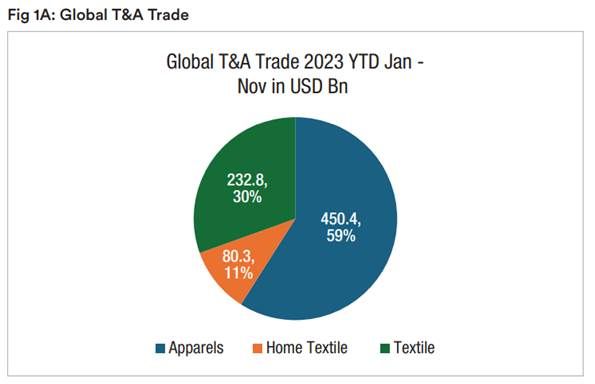

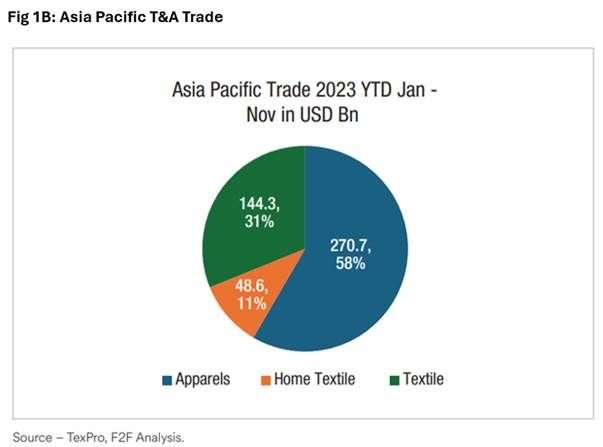

The global textile and apparel trade witnessed robust economic activity from January to November 2023, with the cumulative value reaching USD 763.5 billion. An insightful analysis of this trade landscape unveils distinct contributions from various segments. Notably, the apparel segment emerged as the frontrunner, commanding the largest share at 59 per cent. followed closely by raw textiles at 30.5 per cent, and home textiles at 10.5 per cent.

The dominance of the apparel category on the global stage signifies a strong demand for finished clothing products, underscoring the dynamism of the fashion industry in the international market. The significant contribution of raw textiles emphasises a substantial exchange of materials crucial for textile manufacturing, portraying the intricate global supply chain at play. Meanwhile, the home textiles segment, though holding a smaller share, indicates a discernible market for household textile products.

Interestingly, mirroring the global pattern, the Asia Pacific region demonstrates a parallel distribution in trade contributions across these categories. In the Asia Pacific trade landscape, apparels stand out as the primary driver, reinforcing the region's pivotal role in manufacturing and exporting finished clothing items globally. The substantial share of raw textiles in Asia Pacific trade further accentuates the region's influence on the global supply chain for essential textile materials. While the home textiles category contributes proportionally less, it signifies a notable presence of Asia Pacific in the trade of household textile goods.

The consistency in ratios between global and Asia Pacific trade underscores the region's alignment with broader global trends, emphasising its integral role in shaping the international dynamics of the textile and apparel industry. This analysis not only provides a snapshot of the trade distribution within the industry but also offers valuable insights into the regional and global implications, aiding stakeholders in making informed decisions and strategies.

In the global textile trade scenario- in this case, the Asia Pacific region dominates the global textile trade scenario. An approximate 60 per cent of the global trade is dominated by the APAC region. This is because most of the textile producers and exporters are in the Asian region. Trade in the apparel sector is dominant in the global as well as in the APAC region followed by the home textiles and the textiles. There is a chunk of Asian countries which specialise in the production of apparel along with other textile products like home textiles.

Segmental Analysis of the Global Trade Data

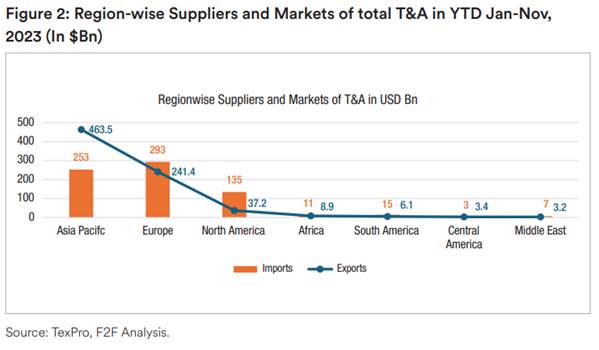

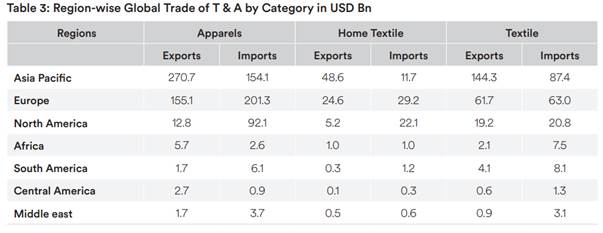

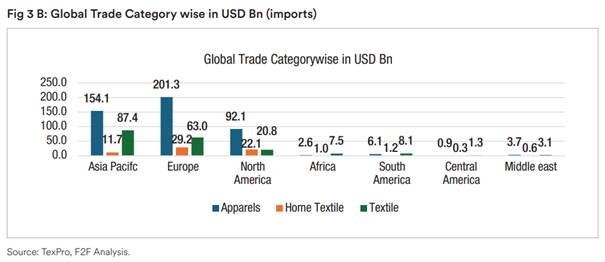

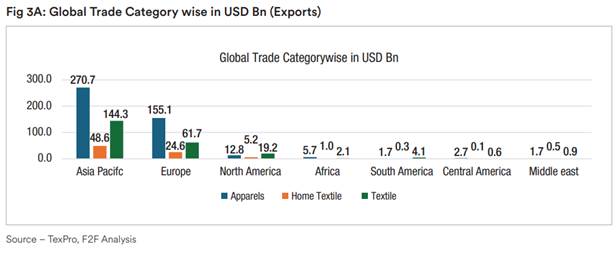

The segmental analysis of the global trade of T & A data reveals that the Asia and Pacific region is the largest contributor in supplying textile and apparel-based goods and not only a supplier but also one of the biggest markets after Europe for textile and apparel-based commodities. It contributes to a cluster share of 60.7 per cent in the overall textile and apparel segment and as an individual region, it contributes 60.1 per cent in the apparel segment, 60.5 per cent in the Home Textile segment, and 62 per cent in the global exports of the raw textile segment.

Regarding the market perspective, it holds 35.3 per cent of the global textile and apparel imports. When further analysing raw textiles, imports are at 46 per cent followed by apparel imports are at 33 per cent and the remaining 18 per cent is covered by the Home Textiles segment.

Comparative Regional Trade Statistics

Asia, particularly countries like China, Bangladesh, Vietnam, and India, has been a major hub for apparel sourcing. However, there has been a gradual shift in recent years due to rising labour costs in China and geopolitical considerations. Some companies have been diversifying their sourcing to other Asian countries to manage the risks and costs of production.

The segmented analysis of global trade data underscores the Asia-Pacific region as a paramount contributor to the supply of textile and apparel-based goods. Beyond being a leading supplier, it also stands as one of the most significant markets for such commodities, ranking second only to Europe. This region commands a substantial share of 60.7 per cent in the overall textile and apparel segment, with a specific breakdown showcasing its dominance at 60.1 per cent in the apparel segment, 60.5 per cent in the Home Textile segment, and a remarkable 62 per cent in the global exports of raw textile materials.

Textile Trade Dynamics: A Regional Analysis of Imports and Exports

When we say we are analysing the exporters and the importers in the textile industry globally, we are talking here about the suppliers and the potential markets for the export of the same. The Asian countries no doubt dominate the textile export market and the other nations in Africa, the Middle East, North America, and Europe are the consumers or the markets for these textile exports.

Asian countries are largely dependent on the European and American markets for their exports, but these countries also have their intra-continent trade. Countries like China, Bangladesh, and Vietnam export apparel to the countries within Asia and export to the other major markets. Thus, the suppliers are in a much need to diversify by expanding the trade within the Asian continent and exploring countries in the African region.

From a market perspective, the Asia-Pacific region accounts for 35.3 per cent of global textile and apparel imports. A more granular examination reveals that raw textile imports constitute 46 per cent, while apparel imports and Home Textiles cover 33 per cent and 18 per cent, respectively.

This comprehensive analysis highlights the pivotal role played by the Asia-Pacific region in the global textile and apparel industry, both as a major supplier and a substantial market force.

Hence the regional breakdown underscores the diverse and interconnected nature of the global textile and apparel trade, with each region playing a unique role in the overall industry landscape. Even though apparel and finished textile products dominate the textile trade scenario, all the nations included in the region also have traded in the raw materials segment, which is also an important link of the textile value chain. China dominates the fibre and fabric segment in the region followed by India which also exports fibre, fabrics, and yarn products. Therefore, with the chain of the final products and trade established in the region, it has its huge chain of the textile value chain and the trade in the same.

Textile Trade Dynamics: A Regional Analysis of Imports and Exports by Categories

The region of Asia and the Pacific dominates the export of textile final products like apparel, home textiles, and raw textiles. However, if observed the same countries also import the same products. The reason is those countries either import it for value addition or import it for domestic use. Countries like India for example import Bangladesh-produced apparel due to the quality along with the price which is the primary reason for the large-scale import of the apparel. On the other hand, a large amount of import of fibre and fabrics happens from China and India to apparel-producing nations like Bangladesh, Vietnam; etc. Other regions like Indonesia are also involved in the textile trade in the region.

Conclusion:

The Asia-Pacific region, led by China, Bangladesh, Vietnam, and India, remains a powerhouse in global textile and apparel trade. Recent trends show strong demand for finished clothing products, with apparel dominating trade. Despite leading exports, the region also engages in significant imports, reflecting internal consumption and market demands. Intra-regional trade expansion within Asia is essential for risk mitigation and market exploration. Overall, the region's influence underscores the dynamic nature of the textile industry, requiring stakeholders to adapt to evolving trade dynamics effectively.

Comments