Asia houses some of the strongest potential countries in the world. Countries like China, India, Vietnam, and Bangladesh – the textile powerhouses of the textile and apparel industry are in this continent, which exports textile and apparel to the world.

Asia as a continent has a lot of advantages

-

Lower labour cost

-

Low water Cost

-

Industrial Energy cost

-

Knowledge endowment

-

Harmonising Tradition with Innovation

-

Optimising Textile Value Chains

-

Market Access through trade agreements

-

Fibre market advantage

-

Policy support for the T &A sector

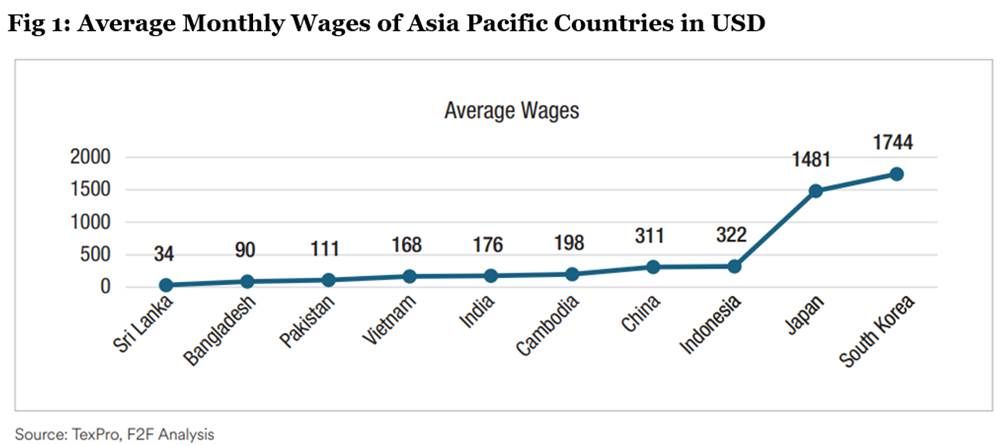

Low Cost of Labour

Asia stands out as a key hub for textile and apparel manufacturing, primarily due to its advantageous position in terms of labour costs. As illustrated in the diagram below, the region boasts significantly lower wages compared to the global average of $200 per month. Notably, countries such as Sri Lanka, Bangladesh, Pakistan, and Vietnam have emerged as leaders in this aspect, offering exceptionally low labour costs. This disparity in wages between Asian countries and other regions, particularly Europe, underscores the attractiveness of Asia as a preferred destination for textile industry investments. The accessibility to cost-effective labour serves as a pivotal factor driving the concentration of textile manufacturing within the continent.

Countries such as Bangladesh and Vietnam have effectively leveraged their low-cost labour advantage to emerge as significant players in the global garment industry. Their success stems not only from inexpensive labour but also from supportive policies and a favourable business environment. By fostering conditions conducive to commerce, these nations have attracted investments and positioned themselves as major textile export hubs.

The underlying principle driving this phenomenon is rooted in basic economics: the abundance of labour leads to a greater labour supply, resulting in reduced costs. Bangladesh, Vietnam, and similarly positioned countries like Cambodia and Myanmar stand poised to capitalise on their vast labour pools to emulate the success of established export hubs.

Conversely, Sri Lanka possesses a comparable advantage in terms of affordable labour. However, despite this asset, the country has struggled to capitalise on its potential due to prevailing economic conditions and other internal constraints.

Policy Benefit of Low Labour Cost

Although this is going to have its repercussions, a lot of Asian economies have this factor as their Unique Selling point (USP). Apart from this, these countries have the textile sector as the largest employer in these nations. Being highly labour intensive, it is but natural; the more the availability of labour; the lower will be labour costs. The countries in Asia benefit from the population factor which makes them attractive more from the perspective of the wages and the cheaper greenfield and brownfield investments. The countries still must explore the benefits of the economies of scale.

Some nations on the other hand also have seen a boost in labour productivity which is also linked with higher production and higher exports as the delays are reduced. Therefore, a lot of Asian nations like Bangladesh and Vietnam have seen their garment exports increase in the last decade due to cheap labour, higher productivity, and higher investments- which also increased the exports ultimately.

Let’s take the example of Bangladesh. It is one of the largest garment exporter nations and it employs around 40 per cent of the labour force of the economy. The country also promotes the industry heavily with the provision of cash incentives and tax holidays for the investors along with duty-free imports of the textile inputs. The same is the case for the country of Vietnam, as the nation is now aiming not only to increase the exports of apparel and footwear but also to enhance its existing linkages in the textile industry through the promotion of investments in the production of man-made fibres. There have been heavy investments in the development of yarns and fibres domestically to reduce the reliance on imported raw materials. A large consumer base is also leading different brands like Louis Viton and Dior to enter the country.

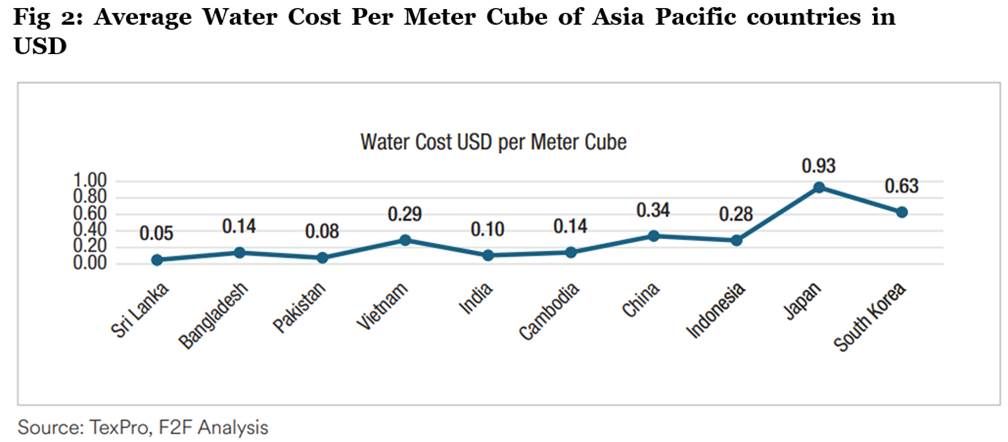

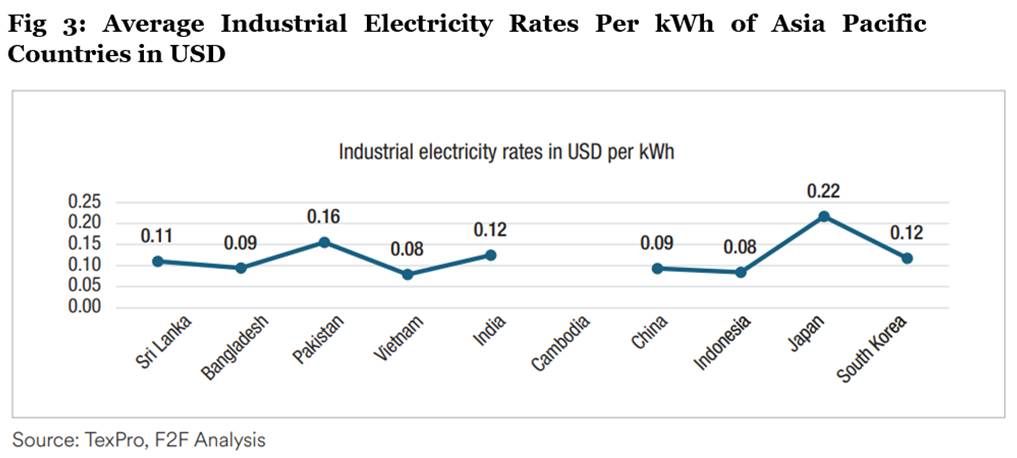

Low Water Cost

On the other hand, there are also resources available at a cheaper cost in these countries. The cost of water and energy is the lowest in these nations earmarked. Countries like India, Bangladesh, Sri Lanka, Pakistan, and Cambodia are lower due to the governments encouraging the growth of the textile industries in these regions. India for example is promoting the PM-MTRA parks for encouraging the growth of the textile industry. Bangladesh also has export promotion zones where the government is giving a lot of incentives to entrepreneurs who want to set up their industries in the same. Setting up of the Special Economic Zones and the further subsidies/incentives also involves the lowering of the water and energy usage costs.

Knowledge Endowment and Policy

Vietnam has extensively invested in research and development for raw materials and in technology in the country. The nation also has strong visibility across its major markets like the US and the EU. Apart from this, the country has a nine-year tax exemption for all investors and a 5-year import duty exemption for the import of raw materials, duty drawback on the import of the raw materials, and other machinery required to produce the final goods.

The same goes for China, one of the major textile prowess in Asia so far also has the same policy benefits for the textile industry. The nation has benefits like deductions of the advertising expenses of the apparel companies from the income tax, import tariffs deducted if the company exports the said commodities in the given period, and a preferential exemption in the taxes or preferential usage of land if the company has fixed assets above a certain period.

All these capacities are absent from other countries like Europe and the US. Land is pretty much costlier and there is a minimal government interference model in the developed countries.

Harmonising Tradition with Innovation in Asia Pacific Countries

The textile industry in Asia blends traditional knowledge with modern requirements. Vietnam, for instance, has a rich heritage of silk weaving and embroidery, utilising different ethnic groups' skills to produce a variety of traditional and modern products. Similarly, India boasts a vast handloom industry spread across rural areas, with initiatives like the Handloom Export Promotion Council aimed at boosting exports to global markets. China also has a history of traditional textiles. This rich heritage contributes to Asia's textile sector being one of the oldest and most adaptable to economic changes, explaining why it thrives in the region.

Optimising Textile Value Chains

Export-oriented nations like Bangladesh, China, India, and Vietnam have established connected textile value chains with dedicated textile parks, attracting higher FDI and generating employment. Of course, countries like India and China boast entire textile value chains within their borders, from raw materials to finished products, facilitating efficiency, and making them global leaders in textile exports. Vietnam's national policies aim to enhance the domestic textile value chain, reducing reliance on imports. Overall, Asian nations excel in establishing and efficiently running textile value chains.

The convergence of factors such as low-cost labour, supportive policies for the textile industry, favourable geographical advantages, and efficient logistics has propelled the textile industry in the continent to unprecedented heights. This synergy of elements has not only enabled the efficient operation of the textile sector but also fostered its remarkable growth, making Asia a powerhouse in the global textile market.

Expanding Horizons: Leveraging Free Trade Agreements for Market Access

Major garment manufacturing nations have established free trade agreements (FTAs) with key global markets such as the European Union (EU) and the United States (US). For instance, the EU has FTAs with ASEAN nations like Vietnam and Singapore, offering preferential access to countries like Bangladesh. Vietnam also enjoys preferential access to the US through bilateral trade agreements and participation in initiatives like the Trans-Pacific Partnership.

Additionally, various ongoing negotiations within Asia, such as the Vietnam-Bangladesh FTA and the India-ASEAN agreement, contribute to the creation of an extensive and interconnected textile supply chain across the region. Agreements like India's FTA with the EU and Bangladesh's preferential access to the US market have the potential to reshape the textile export landscape in Asia.

Despite the existence of these FTAs, reports suggest underutilisation, particularly in the US and EU markets. Improving utilisation rates, as highlighted in a study by a US fashion organisation, is crucial. Enhanced utilisation not only benefits both trading partners but also reduces associated trade costs.

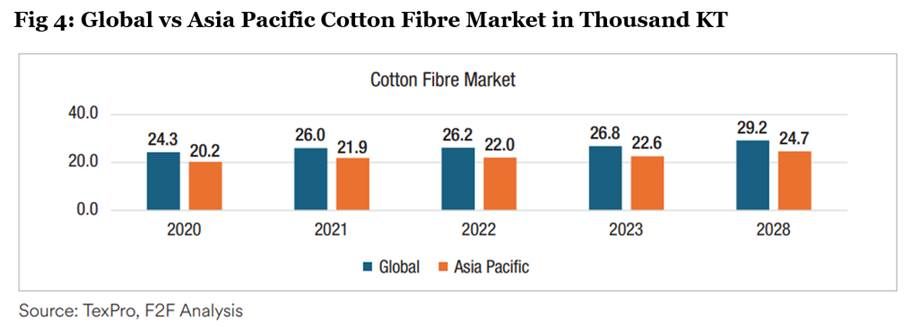

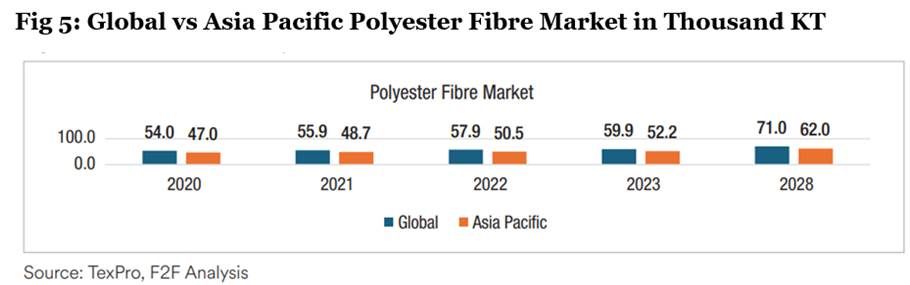

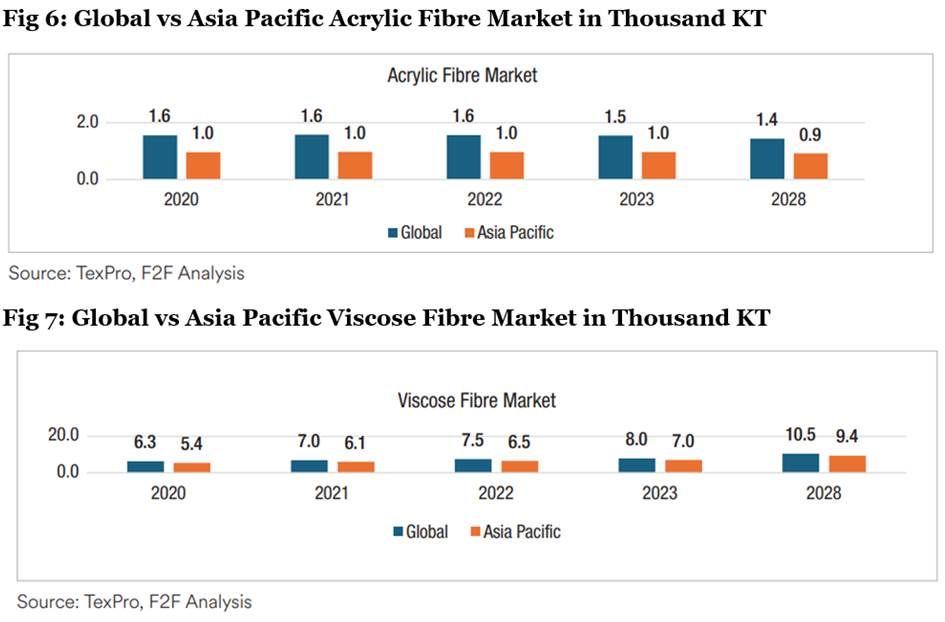

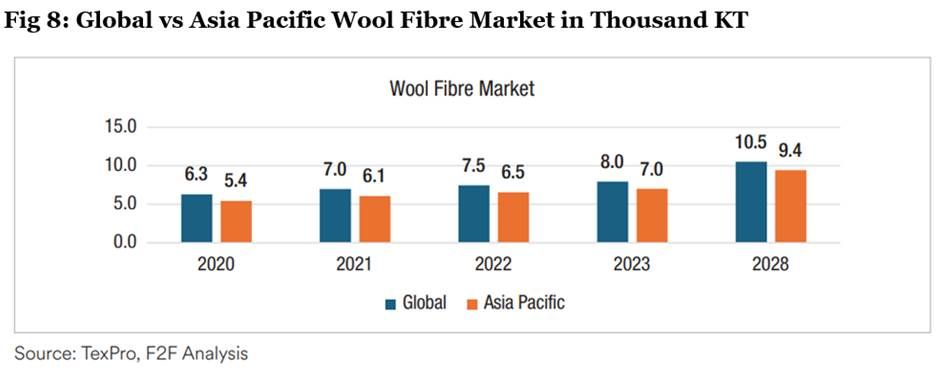

Fibre Market Advantage of Asia Pacific Countries

If seen in the table above properly, the Asia-Pacific region consumes 85 percent of the total fibres produced worldwide. The reason is that the region is the major producer of the final textile products and therefore, the fibre demand is set to increase in the coming years. According to the F2F analysis by the year 2028, fibre consumption is to increase by 1 per cent to 86 percent in the year 2028. With the increasing production of final products like Apparel and home Textiles and the concentration of textile production in the Asian Pacific region, fibre consumption is bound to increase in the coming years.

The share of cotton consumption in the Asian Pacific region is reducing steadily. The region produces apparel and other textile products with most of the cotton fibre used. However, there is also a gradual increase in the consumption of other fibres like polyester, nylon, viscose; etc. As the world moves towards being more aware of sustainability issues, the consumption of more recyclable fibres is bound to increase along with fibres like viscose and polyester.

Ending Note

Asia's textile dominance is driven by strategic advantages like low labour, water, and energy costs, alongside innovative policies. Countries such as Bangladesh and Vietnam leverage these advantages to emerge as major players in the global garment industry. Harmonising tradition with innovation and optimising textile value chains further enhances Asia's position. Despite underutilised free trade agreements, the region's textile industry continues to thrive, fuelled by increasing fibre consumption and sustainability trends, ensuring its ongoing dominance in the global market.

Comments